Tulips Growing

Welcome to this week’s edition of our market insights! We have plenty to cover, from the stock market’s performance to cryptocurrency trends, macroeconomic forecasts, and more.

🌷 “Tulips Growing” – A Look at Market Trends

- High Short Interest vs. S&P 500: Since the stock market lows in early August, there’s been a remarkable trend. Stocks with high short interest have outperformed the S&P 500 by 25%, driven largely by retail investors. This echoes previous periods of market euphoria.

S&P 500 vs High Short Interest Index.

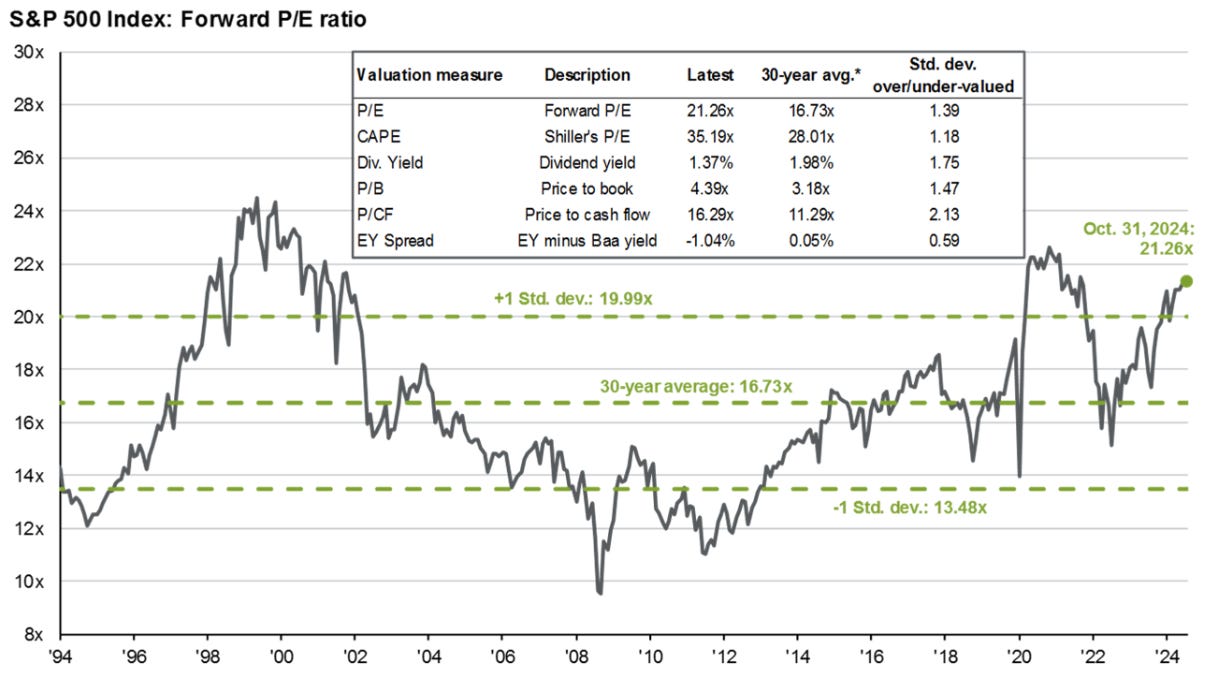

- Valuation Concerns: While some are excited by these high flyers, caution is warranted. History suggests that overextended stocks often face a correction.

S&P 500 Forward P/E ratio – Source: J.P. Morgan

🎄 Holiday Deal on the 4×4 Video Series

- As we approach the festive season, there’s a 25% discount on the 4×4 Video Series, offering a comprehensive guide to professional trading.Develop your trading skills with our up-to-date comprehensive education video series and a wealth of downloadable resources. From key concepts to advanced processes, get everything you need to become a successful trader.https://duponttrading.com/4×4-course/

Use coupon code “HOLIDAY25″—valid until December 31, 2024!

📅 Weekly Market Performance Highlights

- S&P 500 & NASDAQ: Both indexes rose by 1.7% this week, driven by seasonality and inflows into passive investments. The coming weeks traditionally favor a bullish trend as we approach the year-end.

- Cryptocurrency Surge: Bitcoin continues its parabolic rise, nearing the $100,000 mark. Similarly, gold has rebounded, and oil (WTI) trades above $70.

- Dollar Strength: The U.S. Dollar gained nearly 1% this week, partly due to weaker economic signals from Europe, highlighting a shift in global economic expectations.

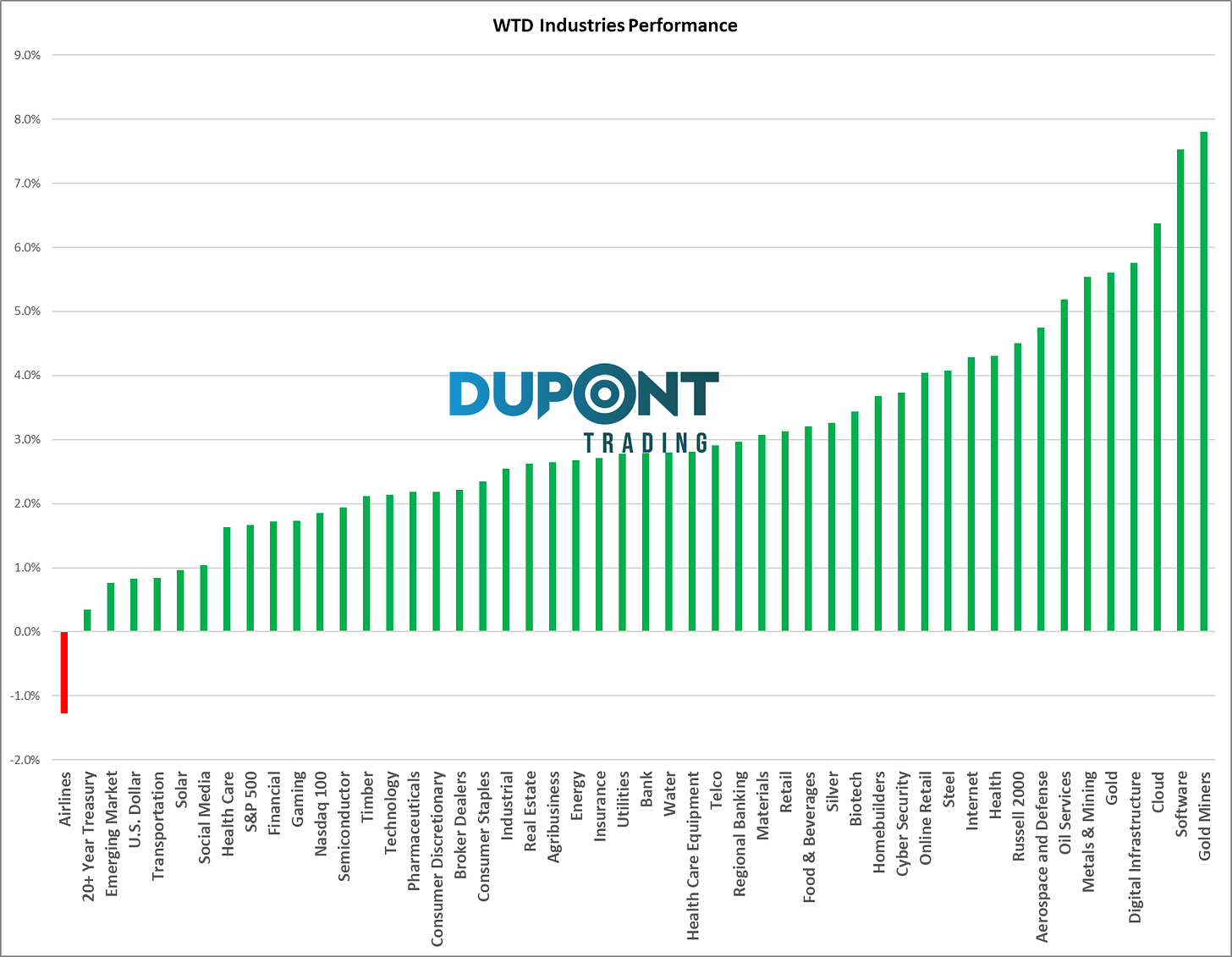

📉 Sector and Industry Movements

- Market Broadening: There’s an expansion beyond the tech-heavy “Fabulous Seven.” Industrials, materials, and other cyclical sectors have outperformed the broader market.

- Interest Rates & Fed Outlook: The U.S. 10-year Treasury yield remains around 4.42%. With inflation expectations stabilizing, the Federal Reserve is less likely to maintain aggressive rate hikes. The December meeting will be crucial, with a 50/50 chance of a 25 basis point adjustment.

📊 Key Charts & Analysis

- Euro vs. Dollar: The Euro dropped to 1.035 amid weaker European economic data, while the U.S. economy remains relatively strong. The yield differential between U.S. and European bonds underscores this divergence.

U.S. 2y – EUR 2y (lhs) vs EURUSD (rhs inverted)

- NVIDIA’s Earnings Surprise: Despite solid financials, NVIDIA’s stock saw mixed reactions post-earnings. This reflects broader market dynamics, with investor focus shifting from earnings to macro factors.

📆 Looking Ahead: Key Catalysts

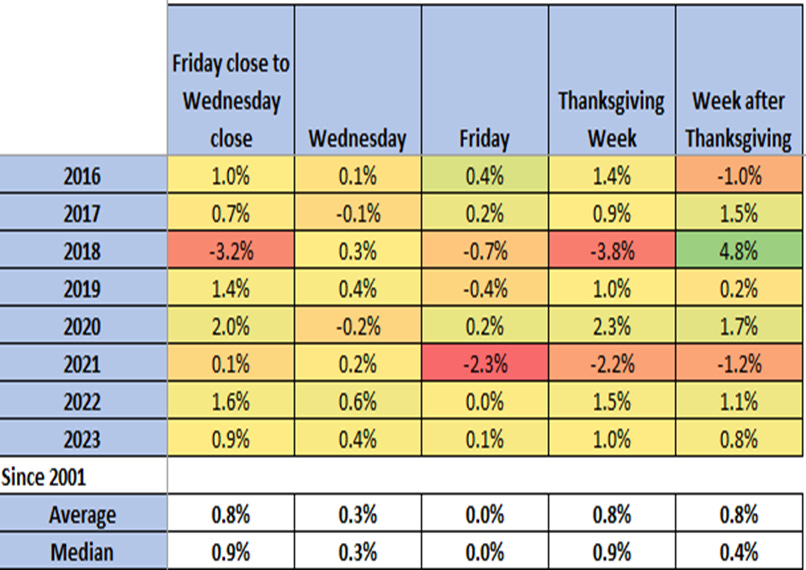

- Thanksgiving Week Trends: Historically, the Thanksgiving week is bullish, with the S&P 500 typically gaining about 0.8% to 0.9%. This seasonal pattern is expected to continue, although recent market strength may temper gains.

S&P 500 Thanksgiving week Performance.

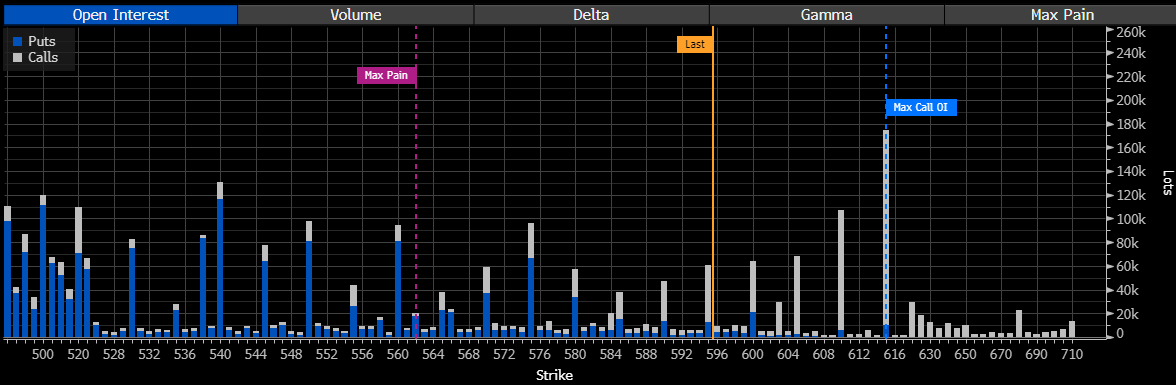

- December Options Expiry: There’s a significant options setup for mid-December, particularly around the 615 level on the SPY, suggesting potential for a 3-4% market move.

SPY 20 Dec 2024 Open Interests

- Macro Events & Earnings: Key economic data and earnings next week include U.S. GDP, PCE inflation, and regional PMI reports. Notable earnings to watch are Dell, Crowdstrike, and HP, particularly for insights into AI-driven trends.

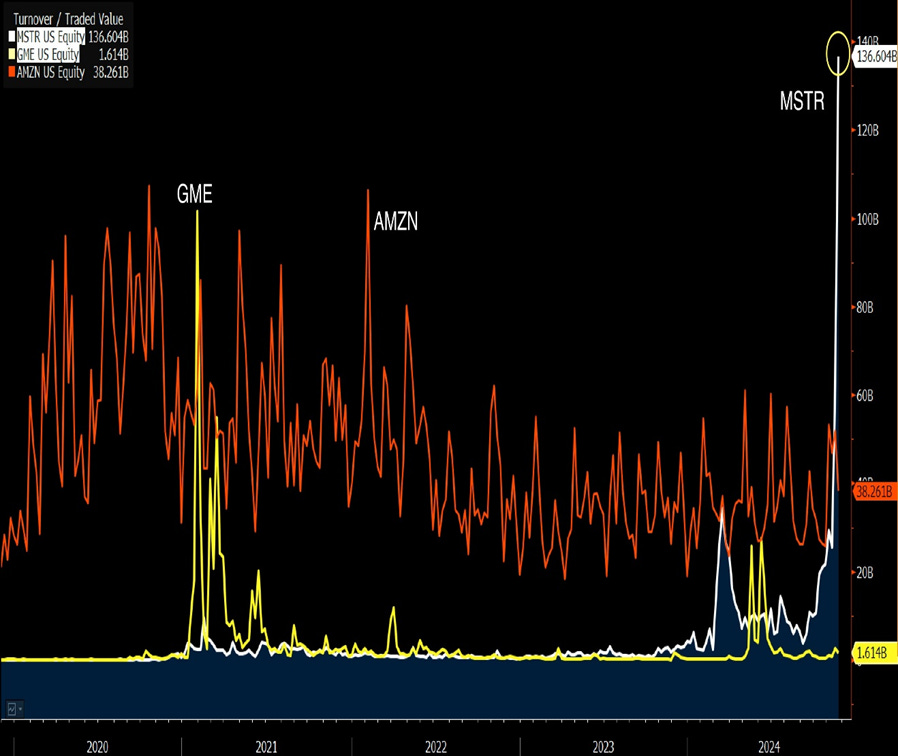

- MSTR MicroStrategy crazy week in one chart:

Weekly Volume in B $ – Source: Eric Balchunas.

📈 Passive Investing & Inflows

- The market’s recent rise is largely due to consistent daily inflows, suggesting a mechanical, rather than fundamentally driven, uptrend. Watch for shifts in ETF flows and options trading as a gauge of sentiment.

Want more insights?

Join our Discord community for in-depth discussions, access to premium content, and more! https://discord.gg/wrvGuF3M

In the near future, the most advanced channels will go beyond a paywall.

And if you’re interested in personalized mentoring, the 4×4 Video Series or the most advanced Discord channels please send us an email.

Have a great trading week!

Greg

greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions