Trump 2.0

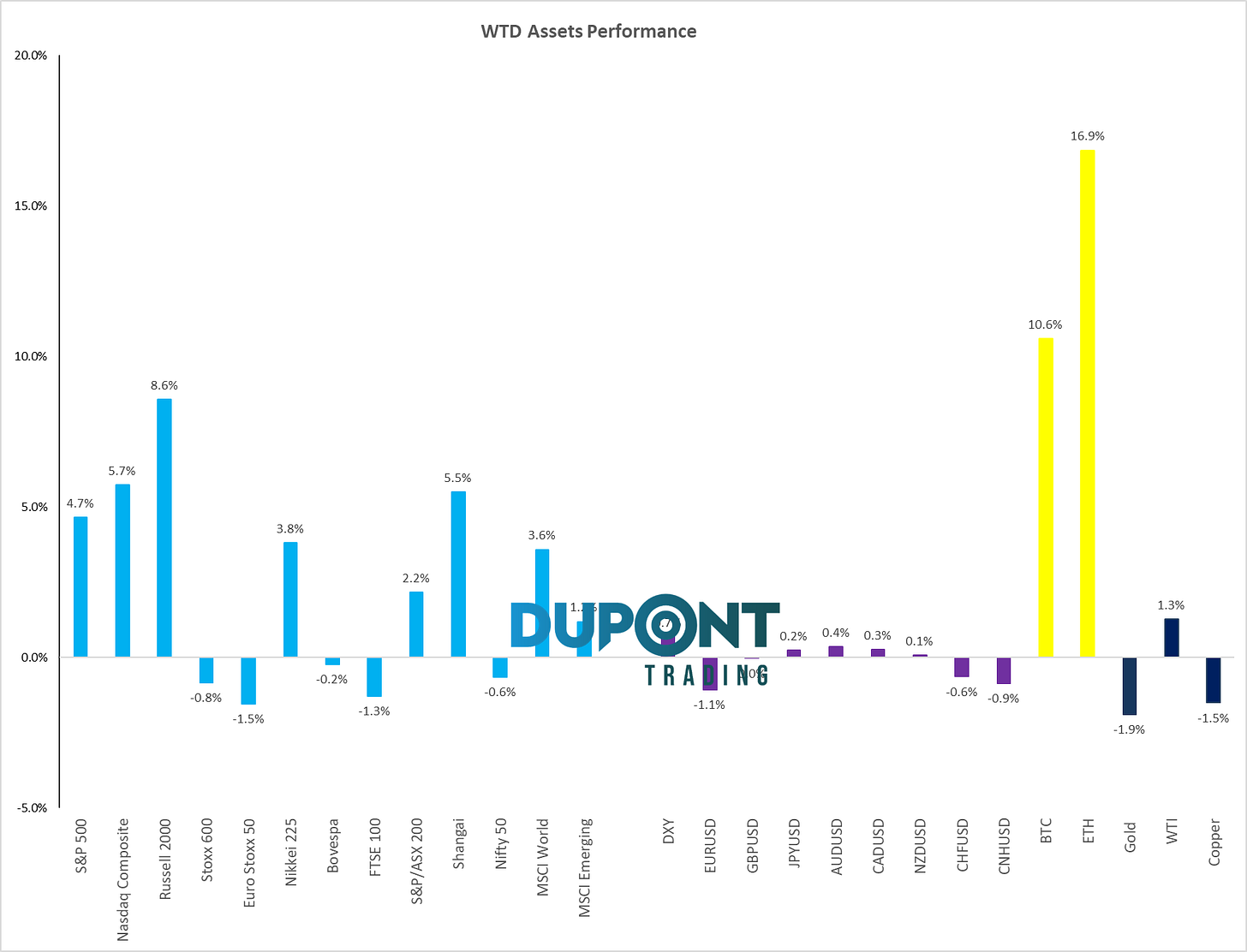

The U.S. markets had their best week of the year, with the S&P up 4.7% and the Russell 2000 soaring 8.6%. This rally mirrored trends seen in 2016, albeit with even larger moves across sectors. European markets were less enthusiastic, with Euro stocks down by 1.5% due to weaker currency performance. Meanwhile, Japan and the U.S. dollar showed strength, and cryptocurrencies, led by Bitcoin, surged on anticipated government support.

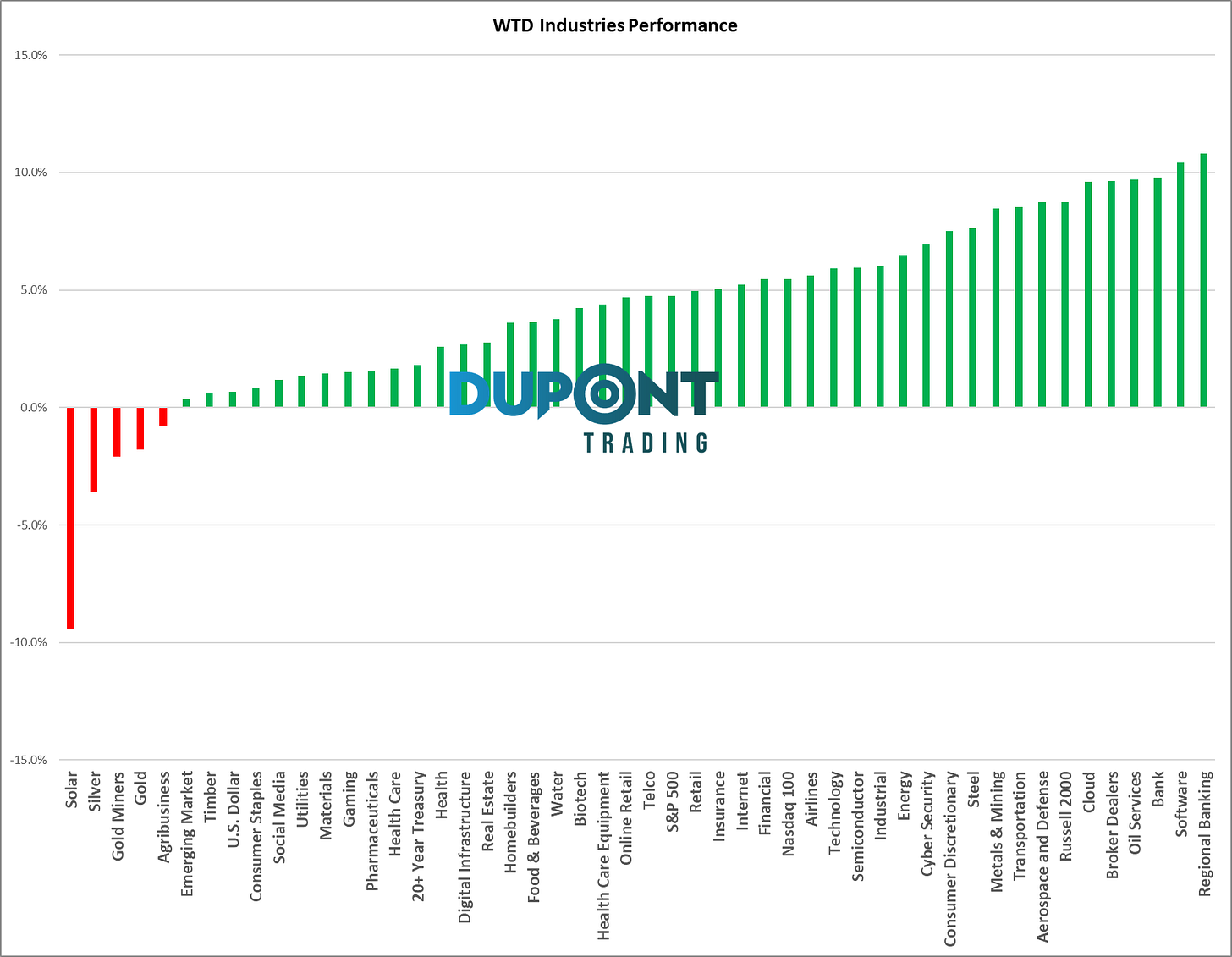

Sector Winners and Losers:

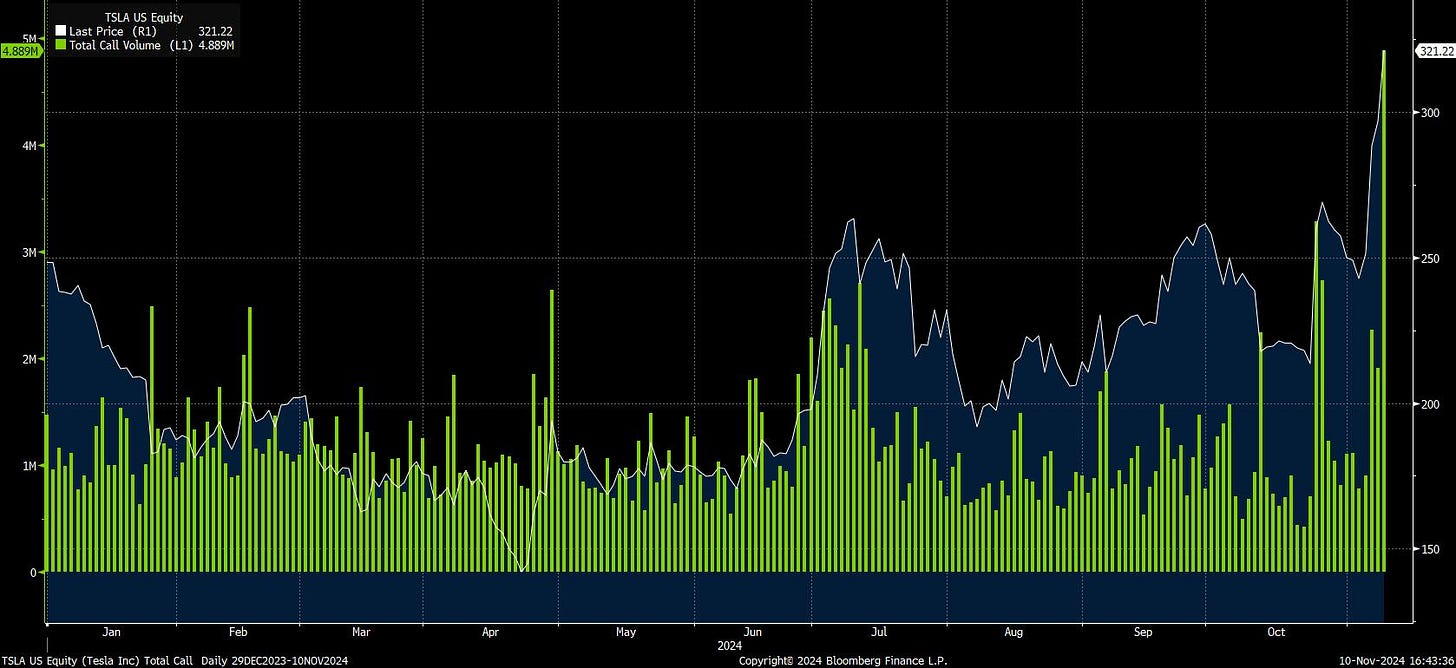

Banks, especially regional banks, saw double-digit growth as the market anticipated deregulation benefits. Consumer discretionary stocks, helped by Tesla’s rally, also shone, while materials and healthcare lagged. In other sectors, defensive stocks such as consumer staples underperformed as the market leaned toward high-growth areas.

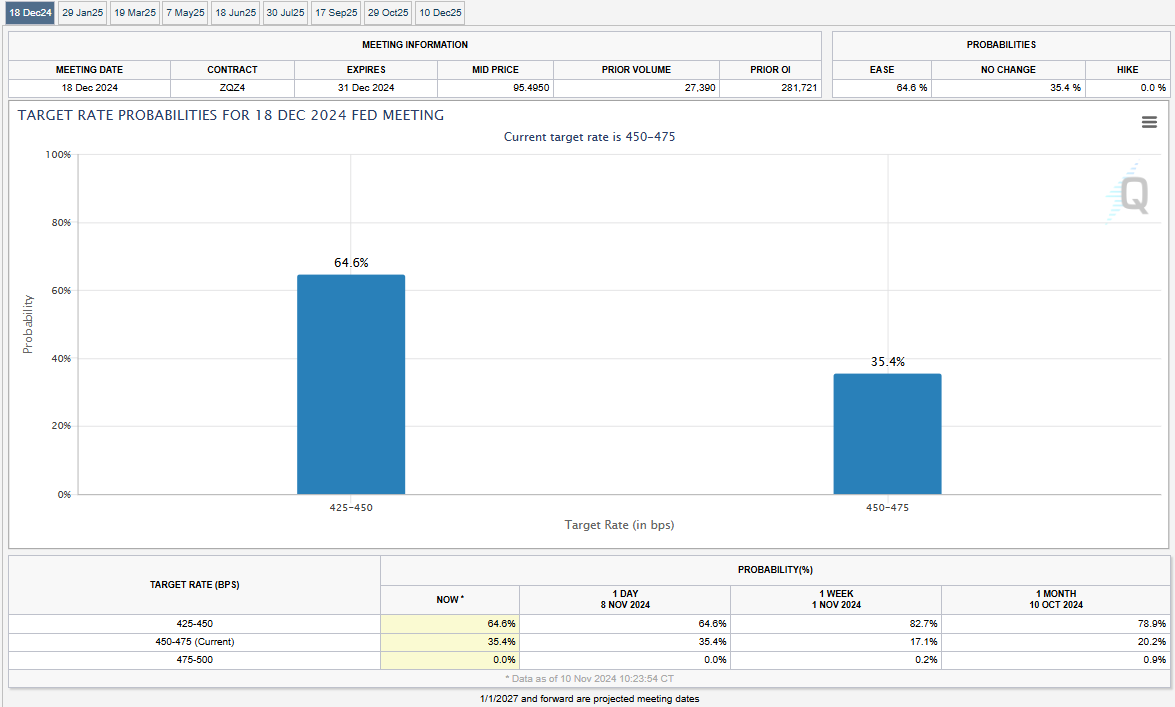

Interest Rates and Fed Outlook:

U.S. 10-year Treasury yields were down on the week but still hovering between 4.2% and 4.5% increased, signaling market expectations for increased government spending without immediate deficit reductions. The Fed is likely to cut rates in December due to a softening job market, with inflation on track to the 2% target. At the moment, markets are pricing a 2/3 chance of a -0.25% cut at the FOMC December meeting.

Strategic Analysis: Opportunities in Key Assets

Bond and Currency Market Insight:

The bond market’s response to deficit and growth expectations suggests it will remain crucial for investors. In currencies, the strong dollar trend may persist; however, any policy attempts to devalue could provide new opportunities, especially against currencies like the euro and yuan.

Crypto and Deregulation:

With the Trump administration’s positive stance toward crypto, Bitcoin is on track to reach new highs, potentially eyeing the $100,000 mark. This, along with anticipated deregulation, could bring momentum to other high-growth areas, including tech and banks.

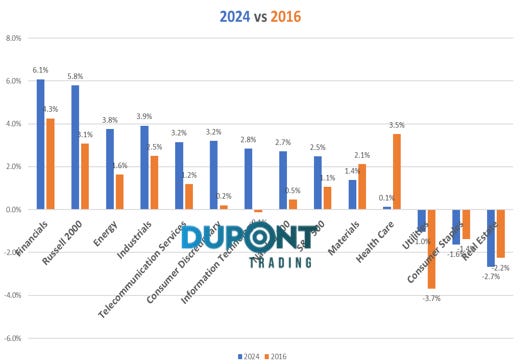

Election Impact: Repeating History with a Twist

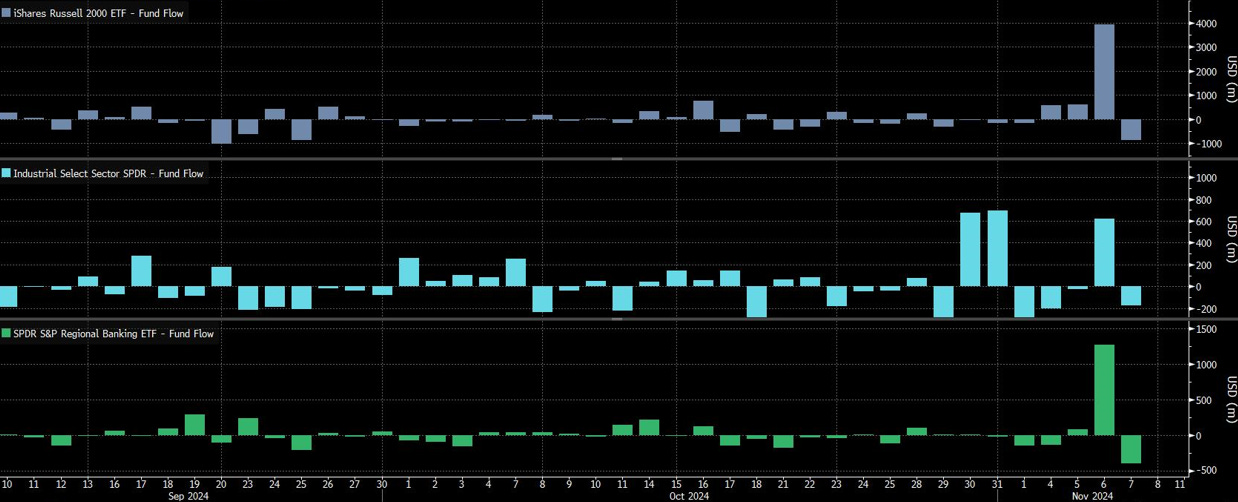

The post-election market playbook resembled the one from 2016. ETFs in financials, energy, real estate, and the Russell 2000 have been particularly strong.

2024 vs 2016 Election Day Sectors Performances.

After Wednesday’s initial rally, market momentum continued as institutional inflows increased.

ETFs inflows in IWM, XLI , KRE

The ongoing trend of buying calls and strategic options trading remains a significant driver.

Tesla (rhs) vs Tesla Total Calls Traded (lhs).

Weekly Catalysts to Watch

- Inflation and Retail Sales Data: CPI and PPI data on Thursday, plus retail sales on Friday, could provide clarity on the post-election economic environment.

- Key Earnings: Earnings season isn’t over, with major companies like Nvidia and Walmart on the horizon in 10 days. Expect these to add volatility and influence market direction.

- Deregulation and Policy Shifts: The administration’s plans for reduced regulation and reshoring may significantly affect U.S. industries, particularly manufacturing, semiconductors, and healthcare.

Technical Overview and Seasonality Trends

Market Trends:

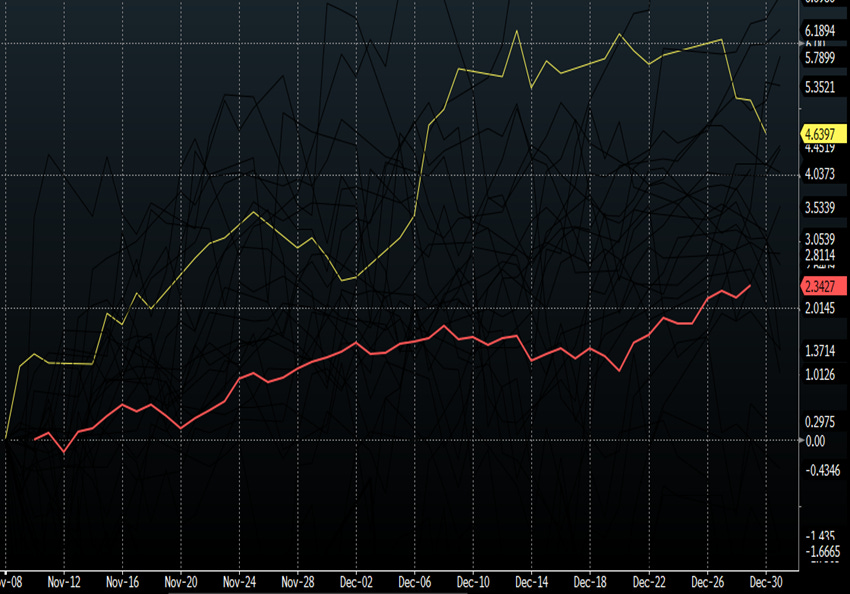

The S&P hit 6,000, with strong trends continuing in major indexes. Russell 2000 stocks, often favored during pro-growth, pro-U.S. policies, are poised to continue outperforming through year-end.

Seasonal Expectations:

Historically, markets gain between 2% to 5% from early November through December, suggesting a positive end-of-year outlook. However, with valuations high (22x 2025 earnings), strong earnings growth will be needed to sustain this trend.

S&P 500 Seasonality: 2016 (Yellow) – Avg. since 1995 (Pink)

Trading Reflections and Final Thoughts

Reflecting on the past week’s trades, this was a high-return week with large moves in European and U.S. assets, particularly in banks, renewable energy, and other high-potential sectors. Moving forward, expect more from deregulation-driven opportunities, especially in banks, crypto, and technology. Keep an eye on energy demand and the impacts of artificial intelligence on the sector, tariffs and reshoring.

Want more insights?

Join our Discord community for in-depth discussions, access to premium content, and more! https://discord.gg/wrvGuF3M

And if you’re interested in personalized mentoring: https://duponttrading.com/mentoring/

Have a great trading week!

Greg

greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions