The Final Countdown

We are on the edge of significant market-moving events with the U.S. elections, FOMC meeting, and a potential Chinese economic stimulus all set to unfold in just 10 days. Here’s a recap of the key takeaways and insights to help you navigate these turbulent times.

- U.S. Elections:

The U.S. election momentum is surging, with markets reacting to polls showing Trump narrowing the gap with Harris. In reality, Financials Markets are now pricing a Trump win. A notable $45 million bet on Trump’s victory by a French trader is stirring market waters, impacting stocks and various assets.

- Interest Rates & Bonds:

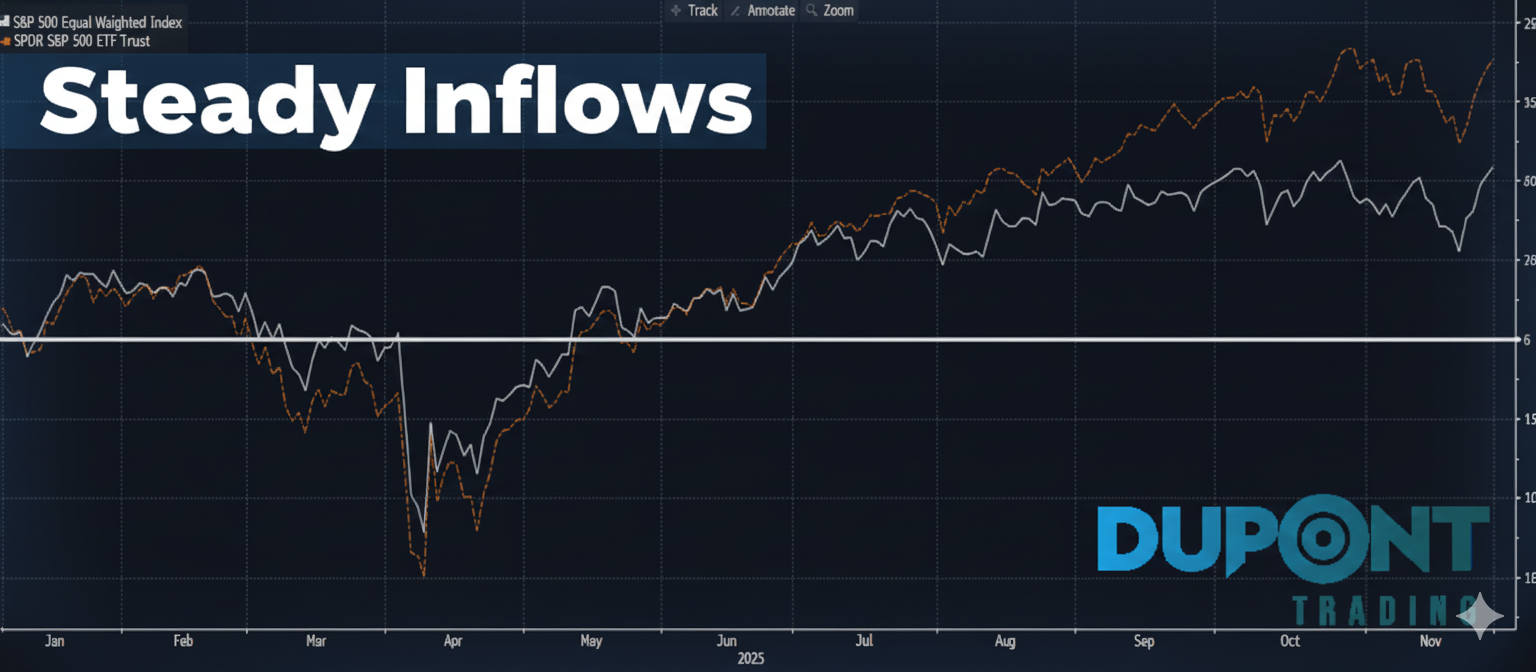

Yields are under pressure as bond supply increases to support high U.S. deficits, expected to hover around 5-7% of GDP. Rising yields have strengthened the dollar, up significantly for the year, with implications across asset classes. - Equity Markets Year-to-Date:S&P 500 & Nasdaq: Up approximately 22-23%

Europe & Japan: Europe showing 10% gains; Japan leading with a 133% surge

Commodities: Gold shines at 33%, while WTI remains stable around $70 amid Middle East tensions

- Weekly Performance:

The S&P dipped 1% last week, with cyclical sectors like Materials and Industrials underperforming, contrasting with a strong Consumer Discretionary sector, led by Tesla’s 20% rally.

Defensive and cyclical sectors have struggled, while tech and discretionary stocks like Tesla and Nvidia keep the Nasdaq buoyant.

Trading Insights:

- Lotto Ticket Trade: With potential gains tied to a Harris victory, a bullish solar sector trade could pay off despite low odds. This strategy employs a low-cost, high-reward structure ideal for speculative plays.

TAN Invesco Solar ETF 1/17/25 Call Spread 50/60

Cost = 40c

- Earnings Season Highlights: So far, U.S. companies beating estimates have seen significant gains, while in Europe, misses have led to steep declines. Expect this volatility to continue as major companies like Microsoft, Apple, and Amazon report this week.

Macro Events & Earnings Calendar

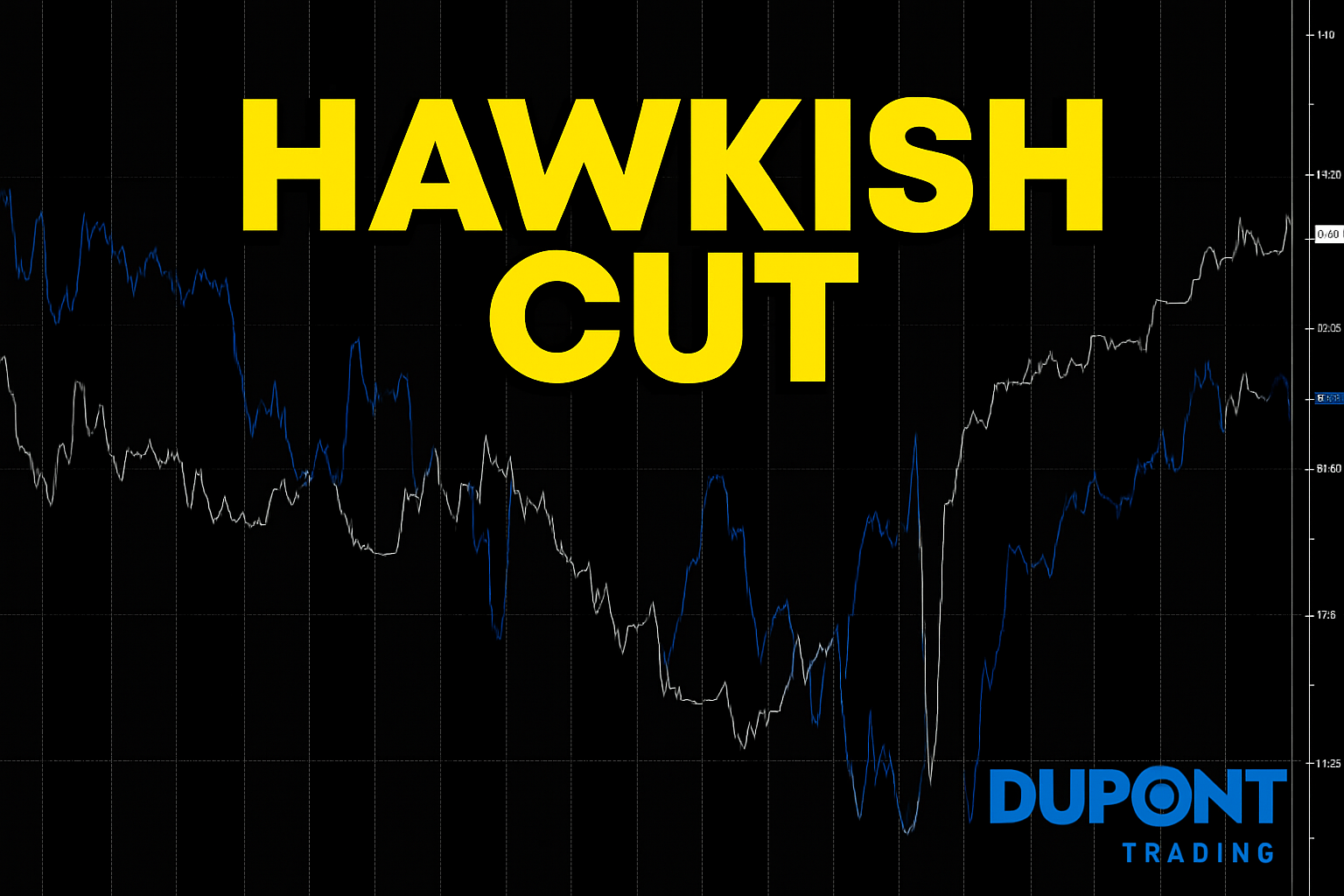

FOMC Meeting (Nov 7-8):

With election day preceding the meeting, markets currently anticipate the possibility of a rate cut but are unsure if the Fed will deliver two cuts by year-end. The VIX remains elevated, reflecting election uncertainties.

Macro Data Highlights:

- Wednesday: U.S. GDP

- Thursday: Core PCE, Personal Income, and Spending

- Friday: NFP, ISM Manufacturing—critical to market sentiment heading into year-end

Earnings Alert:

94 companies in the S&P 500 report this week, including top names such as AMD, Microsoft, Meta, and Amazon. These reports will set the tone for market sentiment into November.

Technical Overview & Trading Sentiment

- S&P 500 & Nasdaq: Both indices show signs of consolidation, with the S&P holding within a key range. High yield levels (4.20%-4.25%) are the next resistance, where further increases could weigh on equities.

- WTI Oil & Gold: WTI has remained stable despite geopolitical tensions, while gold continues its upward trend, reaching new highs, a reflection of inflationary concerns and safe-haven demand.

- Volatility: The VIX has picked up, driven by rising bond yields and market nervousness ahead of earnings. Implied volatility for Microsoft and other top tech stocks suggests an eventful earnings week.

Looking Ahead: The Final Countdown

With 10 days until the major events, here’s what to watch:

- U.S. Elections: Election results could shift the market outlook substantially, with expected volatility in equities and bonds.

- FOMC Decision: The Fed’s rate policy announcement, now shifted to Thursday, will be closely watched for signals on inflation management.

- Chinese Stimulus: Any announcement from China could impact global markets, especially commodity and export-dependent sectors.

- Earnings.

Want more insights?

Join our Discord community for in-depth discussions, access to premium content, and more! https://discord.gg/wrvGuF3M

And if you’re interested in personalized mentoring, be sure to reach out soon, as slots are filling up quickly: https://duponttrading.com/mentoring/

Have a great trading week!

Greg

greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions