Options Expiry Resurrection

We’ve reached a milestone with our 100th episode of “Your Next Trade.” Week after week, we’ve been guiding you through the stock market and various asset classes. 2025 has been particularly eventful, offering numerous opportunities for traders. Here’s a recap of the latest market movements and insights.

Market Recap: Post-Easter Movements

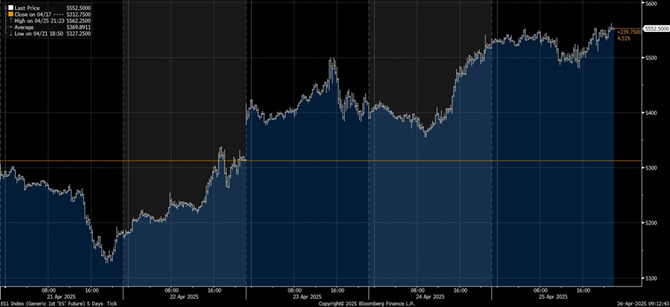

- Options Expiry Resurrection: The options expiry, which occurred on Thursday instead of the usual Friday due to Good Friday, led to a market reset. This reset triggered a rally starting Monday, despite initial sell-offs due to tariff concerns.

- Tariff Tensions: The market initially reacted negatively to tariff announcements, but a subsequent pullback by the Trump administration, influenced by pressure from the bond market and key financial figures, led to a recovery.

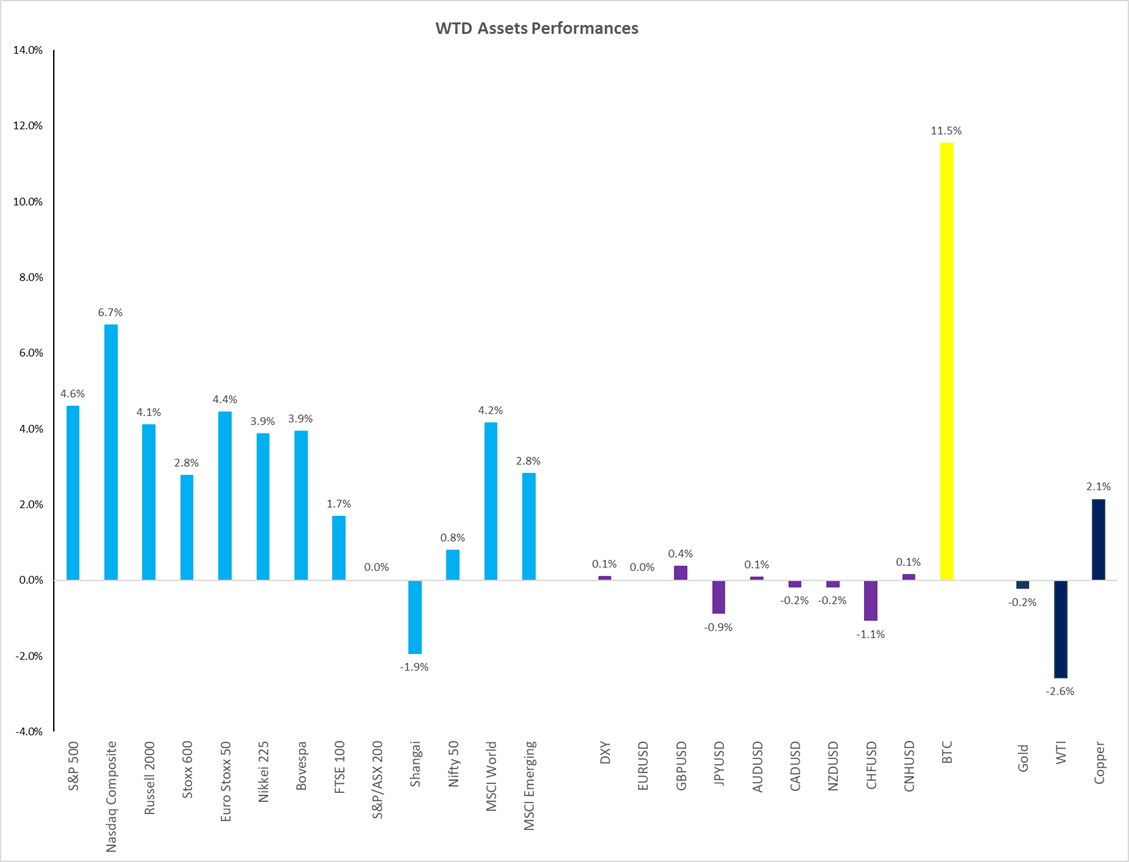

- Strong Week for Assets: The S&P 500 rose by 4.6%, NASDAQ by 7%, and Bitcoin by 11%. Despite some reversals, most asset classes showed strong performance.

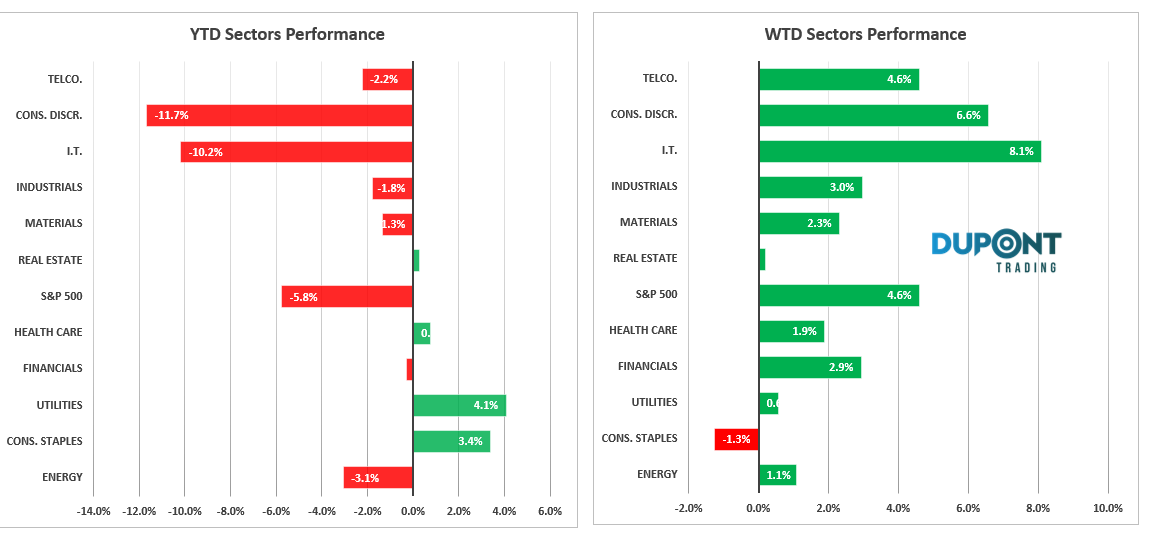

Sector Performance and Trends

- Tech and Retail Surge: Semiconductors, software, cloud, and internet technology sectors saw significant gains. Retail traders actively bought dips in major names like Tesla and Nvidia.

- Consumer Staples and Utilities: These sectors, typically seen as safe havens, underperformed during the risk-on week but remain strong year-to-date.

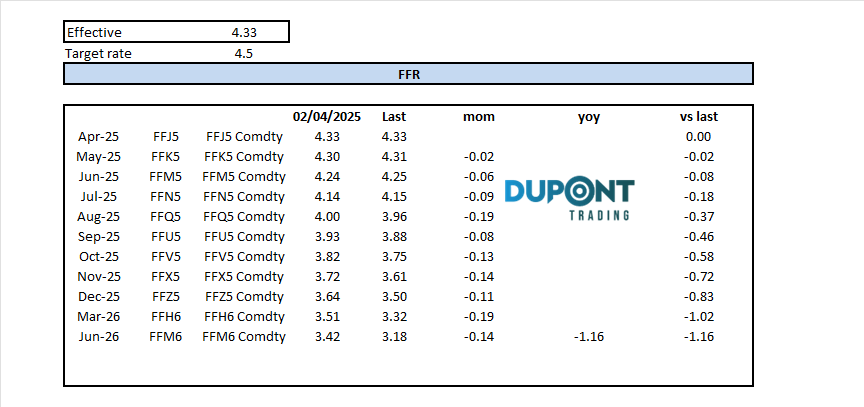

- Interest Rates and Bond Market: Rates are around 4.25%, with the bond market still digesting tariff-related news. The Fed is expected to implement three rate cuts by year-end.

Volatility and Technical Analysis

- VIX at 25%: Volatility remains high due to ongoing uncertainties. The S&P 500 and NASDAQ charts indicate a potential upward trend, driven by retail traders and options activity.

- Gold and Euro Movements: Gold saw a significant reversal, and the Euro-Dollar pair experienced fluctuations, reflecting broader market trends.

Gold Weekly Chart.

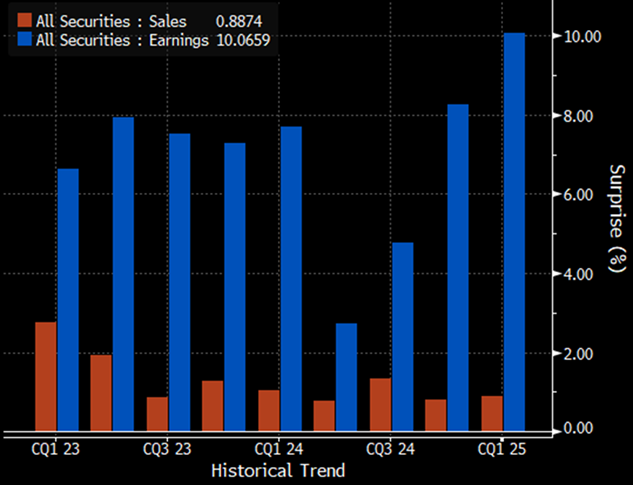

Earnings Season Insights

- Positive Earnings Reports: Out of 178 companies in the S&P 500, most have beaten expectations. However, future outlooks remain uncertain, with many companies downgrading forecasts.

- Impact of a Weaker Dollar: A weaker US dollar is expected to benefit exporters, providing a tailwind for future earnings.

Looking Ahead

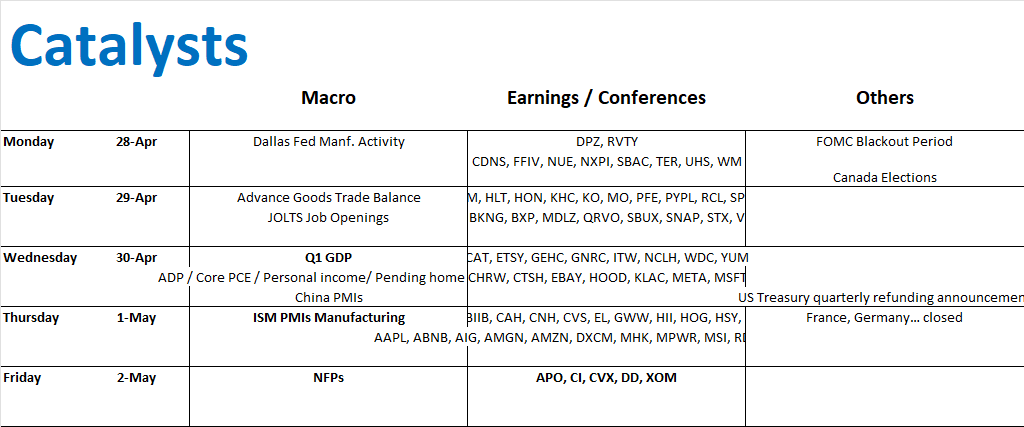

- Key Catalysts: Tariff announcements, macroeconomic data (GDP, PMIs, ISM), and major earnings reports (Amazon, Apple, Microsoft) will be crucial in the coming weeks.

- Market Expectations: The S&P 500 is expected to move within a 2.5% range this week. The bond market and Fed’s actions will also be closely watched.

Community and Mentoring

- Join Our Community: Our Discord community offers both free and advanced channels for in-depth discussions: https://discord.com/invite/Yf42SgAx7f

Access to 30 channels for just $75 per month. https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

- For personalized mentoring, reach out soon as slots are filling up quickly.

Happy a good Trading Week!

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions