Mighty Globalists

Market Recap: U.S. Struggles, Europe Strengthens

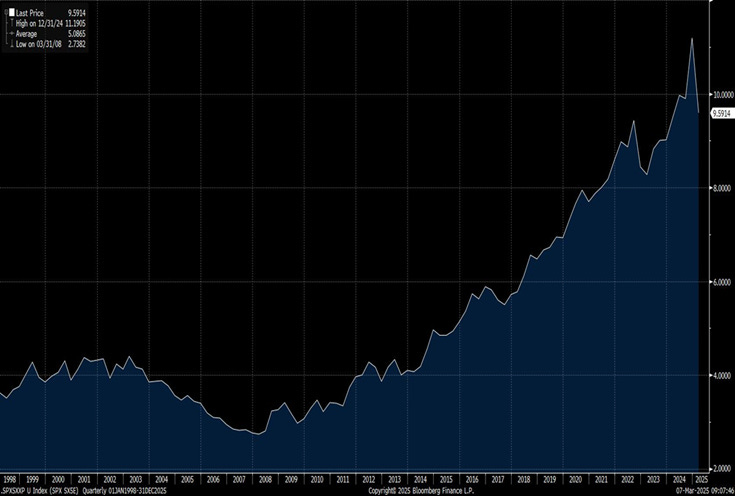

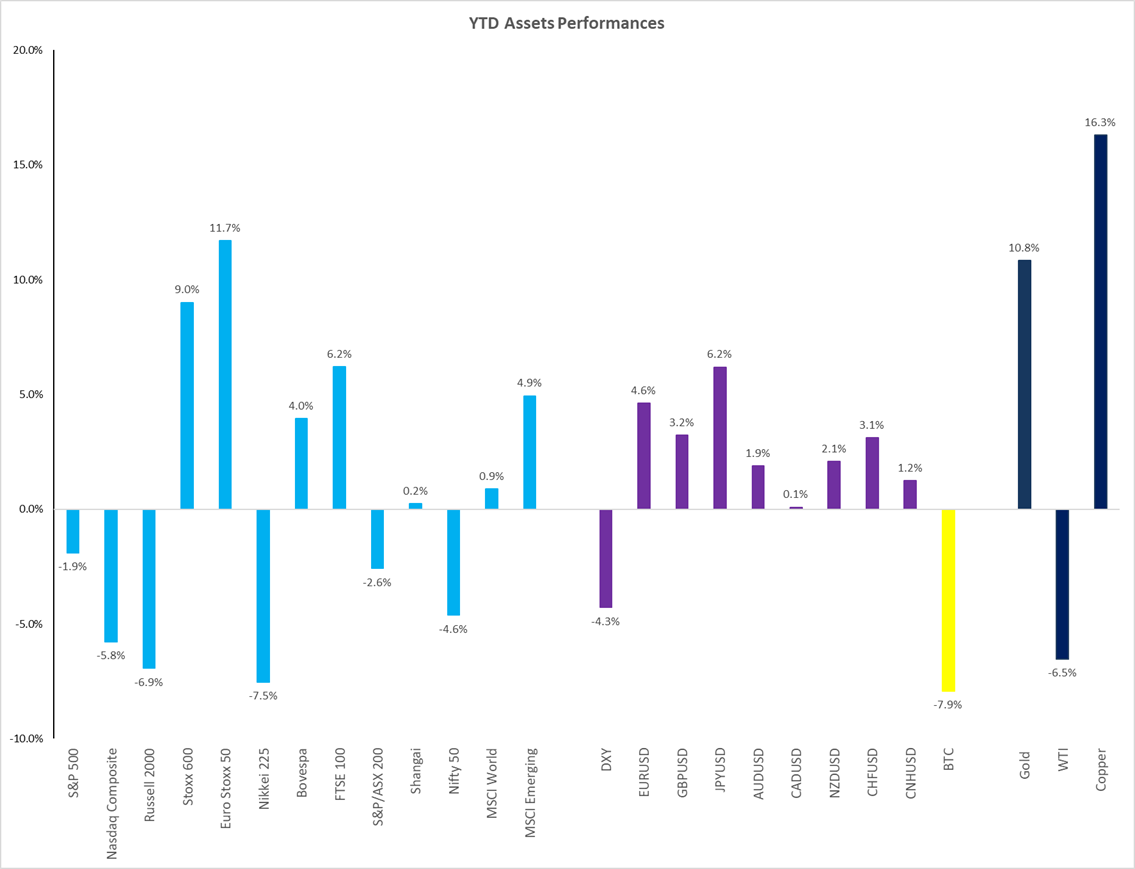

This past week brought significant shifts in global markets. The U.S. stock market continued to underperform, while Europe—especially Germany—showed signs of strength. A key takeaway: the S&P 500 has been the global outperformer over the past 25 years, but recent trends suggest that valuation concerns and geopolitical moves are weighing on U.S. stocks.

S&P 500 vs European STOXX 600

The U.S. dollar weakened by 4% year-to-date, a move in line with the Trump Administration’s past desire for a lower dollar to benefit exporters. Meanwhile, the recent equity sell-off is not only about globalization but about valuation and tariffs, as the S&P 500 continues to trade at historically high multiples.

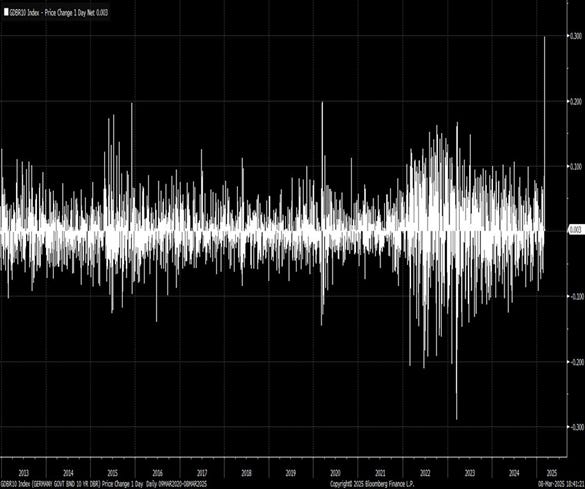

Big Developments: Germany’s $500 Billion Move

Germany announced a $500 billion fund for defense and infrastructure, marking a major shift in European fiscal policy. For years, Germany has advocated for strict budget rules, but now, faced with geopolitical tensions and economic challenges, the country is preparing to spend significantly. This announcement has led to increased bond yields across Europe and raised concerns about long-term financing.

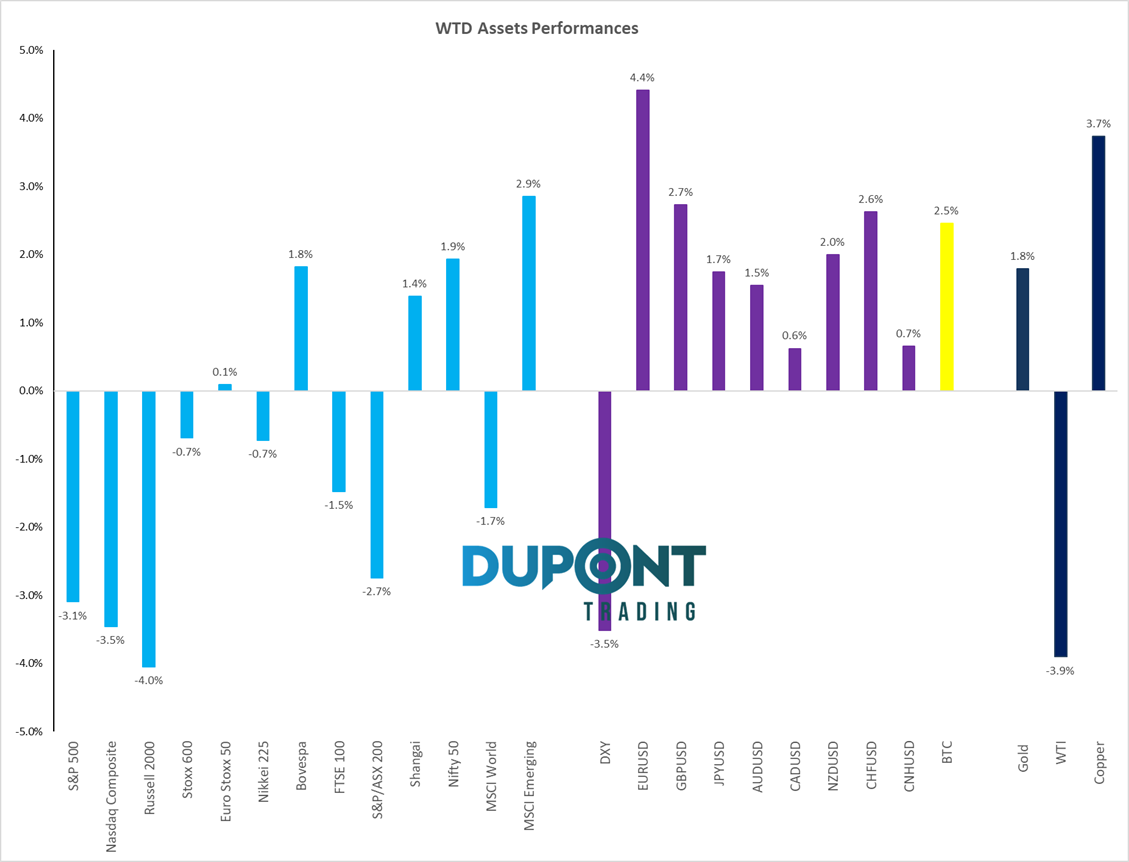

At the same time, the market remains volatile, with U.S. stocks continuing to experience sharp moves. The S&P 500, NASDAQ, and Russell indices were all down 3–4% for the week, while financials, cyclicals, and consumer discretionary stocks took the biggest hits. Gold and gold miners, however, stood out as safe-haven plays.

Sector Breakdown: Key Performers and Laggards

- Winners: Gold miners, gold, defensive sectors

- Losers: Regional banks, financials, tech stocks (especially high-beta names like Nvidia and Palantir)

- Noteworthy Moves: JP Morgan dropped from $280 to $240, reflecting market concerns about economic growth.

As the U.S. economy shows signs of slowing, the probability of a recession in Q1 is rising. Financials’ weakness signals that investors are worried about more than just valuations—consumer spending and overall economic activity are in focus.

Interest Rates & Bond Market Reaction

- U.S. 10-year yield: Hovering around 4.30%

- Germany’s 10-year yield: Up 50 basis points in a week, signaling a massive shift in expectations.

- Reactions across Europe and Japan: Bond yields rising across the board due to anticipated government spending

This increase in bond yields could pose long-term challenges as higher borrowing costs impact both governments and businesses.

Volatility Watch: Market Sentiment and Trading Insights

- The VIX (volatility index) hit 25%, indicating increased market stress and short-term panic.

- The S&P 500 has experienced an 8% correction—historically, non-recessionary corrections range from 5% to 12%, but a confirmed slowdown could deepen the decline.

- The NASDAQ has been more volatile than the S&P 500, with key support levels being tested.

Nasdaq 100 E-Mini futures testing trend.

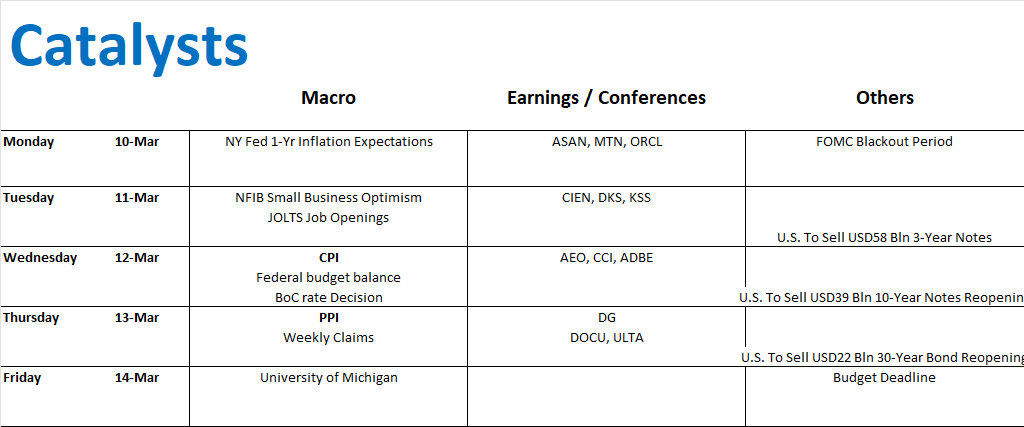

What’s Next? Key Catalysts to Watch

- Inflation Data: CPI and PPI reports could shape market expectations for Fed rate cuts.

- Federal Reserve Outlook: Market expectations are pricing in 2.5 rate cuts this year, with the first likely in July.

- Earnings Reports: Adobe, Oracle, and Ulta will be key names to watch.

- Political & Trade Developments: Tariff-related headlines will continue to create noise and impact market sentiment.

Final Thoughts: Stay Focused on Fundamentals

Market swings can be noisy, but it’s essential to focus on key economic indicators. While the market sentiment has shifted from optimism (3% GDP growth expectations in early 2024) to recession fears, it’s important not to overreact. Valuations remain stretched, particularly in the U.S., and rising bond yields pose challenges. Expect continued volatility, tariff-related headlines, and potential buying opportunities in oversold names.

For those looking to deepen their market knowledge, consider joining our 4×4 Video Series https://duponttrading.com/4×4-course/ or one-on-one mentoring sessions https://duponttrading.com/mentoring/ to build a professional trading process.

Join our Discord community for real-time insights, macro data, and sector-specific discussions. Subscribe for full access to our research and market commentary:

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

Stay informed, trade smart, and have a great trading week!

Greg

📩 Contact: greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions