Fed Asymmetry

This week, we dive into the concept of “Fed Asymmetry” and its implications for market performance. But before we get started, a quick story that highlights the reality of trading success:

I recently received a message from a former student who sold his business for millions and has since invested over $1 million in the market. He reminded me of the importance of setting realistic expectations. Many are drawn in by promises of huge returns, but this is misleading. Consistent gains of 8-12% annually, with disciplined trading, are more realistic and sustainable.

I quote:

“I will be happy with 8-12% annual returns and 2x return to max drawdown so I’m not a good advertisement for a lambo.”

Fed Asymmetry: What’s Happening Now?

This asymmetry is critical. The Fed is pushing the economy forward with aggressive rate cuts, and traders need to adapt to the reality of Fed policy rather than wishing for different outcomes. Understanding how the Fed moves—and when—can guide smarter trades.

Trade the Fed that you have not the Fed that you want.

Market Performance Recap

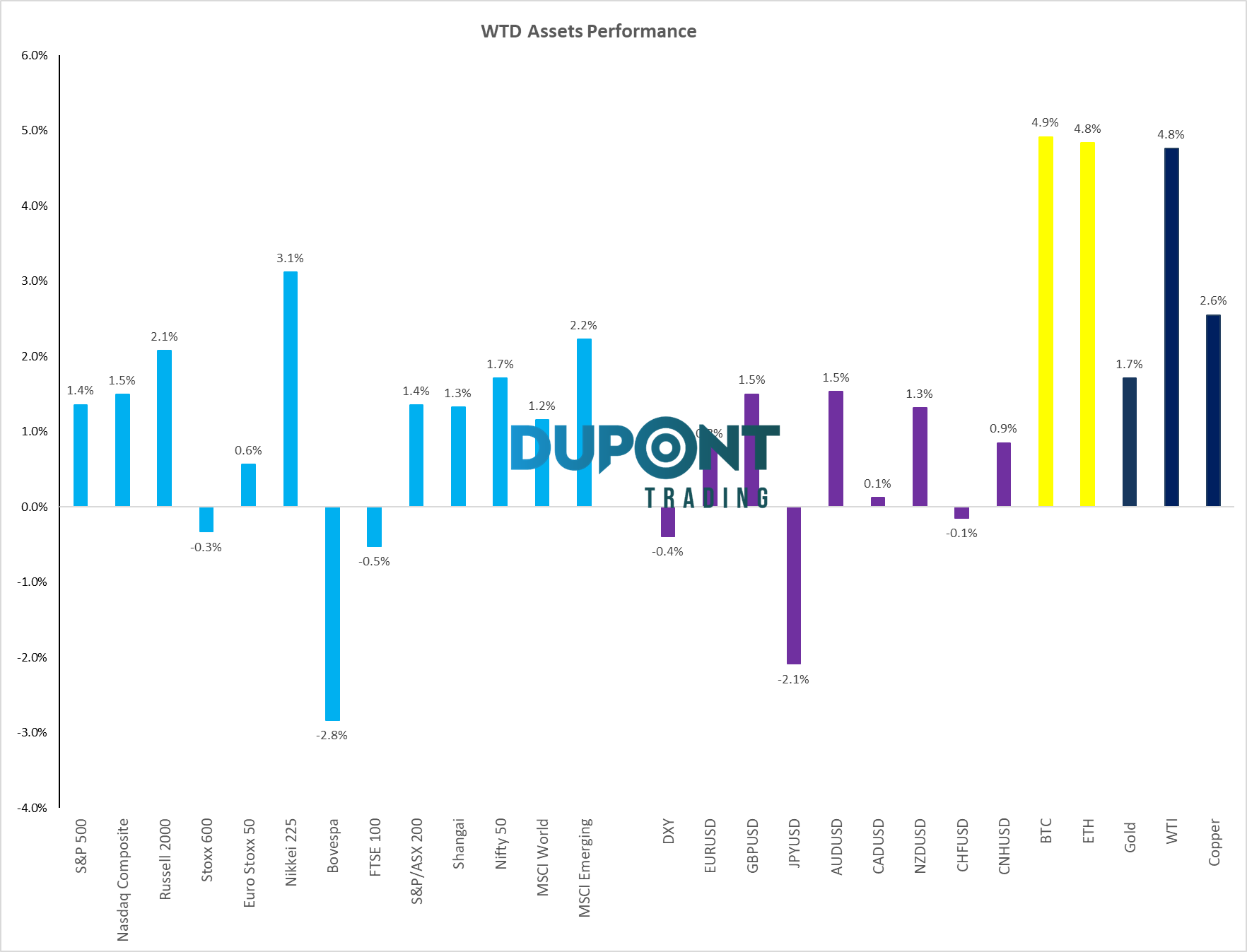

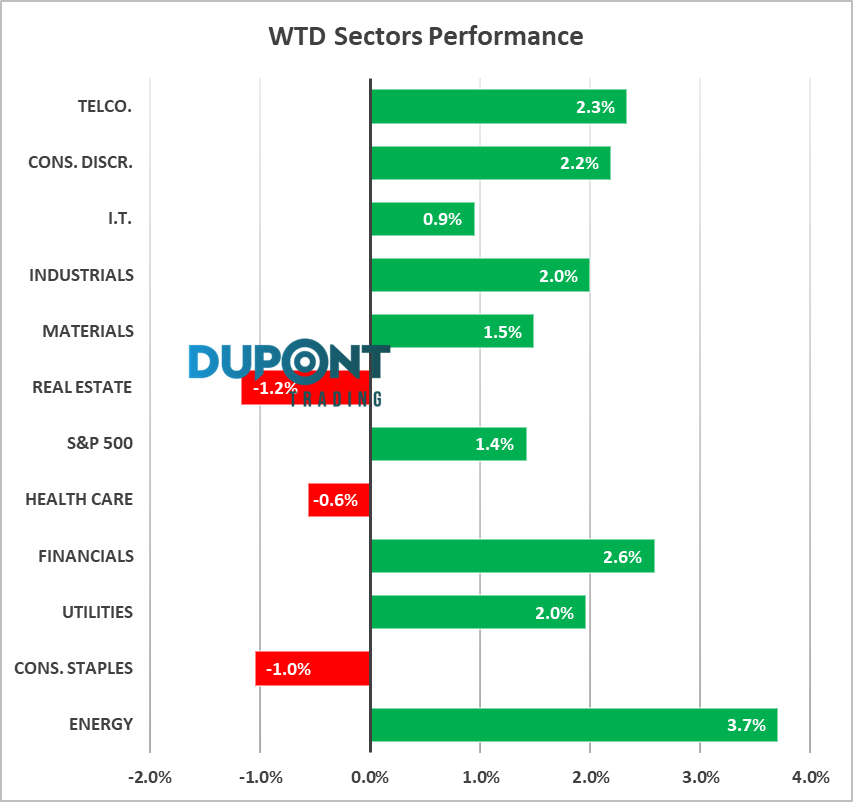

- Stocks: The S&P 500 and Nasdaq posted solid weekly gains of about 1.5%, while Euro stocks were flat. Technology and cyclical sectors like industrials and materials performed well, while defensive sectors underperformed.

- Crypto: The cryptocurrency market continues its strong performance.

- Commodities: Oil (WTI) rebounded to over $70 per barrel, and copper saw gains, despite broader concerns about global economic slowdowns.

- Dollar and Gold: The U.S. dollar showed slight weakness, while gold reached new highs.

Sector Highlights

Rate Cuts and What’s Next

The Fed has already cut rates by 100 basis points, with another 50 expected by year’s end. By December, we might see a neutral rate target around 2.9% to 3.5%. This aggressive monetary easing suggests further rate cuts in the coming months, with potential implications for equities and bond yields.

Technical Analysis

- S&P 500 & Nasdaq: Both indices continue to hit new highs, despite September’s typical seasonality headwinds. The Nasdaq broke its downtrend, signaling potential further gains.

- Russell 2000: This index is showing a sideways trend, making it harder to read.

- DAX (Germany): A clear uptrend remains in play, despite Europe’s economic challenges.

- Oil and Copper: Despite global uncertainty, both commodities performed well last week, possibly hinting at upcoming positive news from China.

Key Stocks to Watch

- Micron: Earnings are due, and the stock is on a critical support level. Bearish analysts’ comments make this one to watch closely.

- Costco: Trading at 50x earnings, it continues to defy market odds, but is near the top of its long-term trend.

- Nike: With a new CEO and activist involvement, this iconic brand is poised for changes that could lead to exciting developments.

Looking Ahead: Market Catalysts

Several key events are on the horizon that could shake up the markets:

- Fed Commentary: Fed Chair Powell is set to speak again, confirming or revising Wednesday’s rate cut message.

- Earnings Reports: Major companies like Micron and Costco are set to report earnings, providing further insights into the health of key sectors.

- PMI Data & GDP Revisions: Macroeconomic data will play a pivotal role in shaping the market’s trajectory.

- Inflation (PCE): Keep an eye on Personal Consumption Expenditures (PCE) inflation data from August, which has historically moved the market.

Seasonality and Risk

While September is typically a weak month for equities, the market could see further volatility post-options expiration. Historically, the week after the September expiry is down 0.8% on average, rising only 31% of the time.

Final Thoughts

As always, timing is critical in trading. The Fed’s aggressive rate cuts and the potential for more rate action could present opportunities, but it’s essential to remain realistic, adjust to market conditions, and stay informed about the bigger macroeconomic picture.

Subscribe to Substack: Gregoire Dupont | Substack

Have a great trading week!

Greg Dupont

greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions