Elections Hangover

From crypto surges to anticipated earnings, here’s a comprehensive overview to keep you informed and prepared for the week ahead.

Market Overview

- Post-Election Market Dynamics

- The S&P 500 experienced a post-election jump, moving from 5,850 to 6,000. This reaction was influenced by the election results and subsequent market sentiment.

- Options played a crucial role, with key levels at 6,000 affecting the market’s behavior.

- Thursday and Friday saw shifts due to the Fed’s recent statements on interest rate cuts being less aggressive than previously expected.

- The different nominations to the Trump Administration are having clear impact on assets and industries.

S&P 500 back to 6th of November Open level.

- Sector Highlights

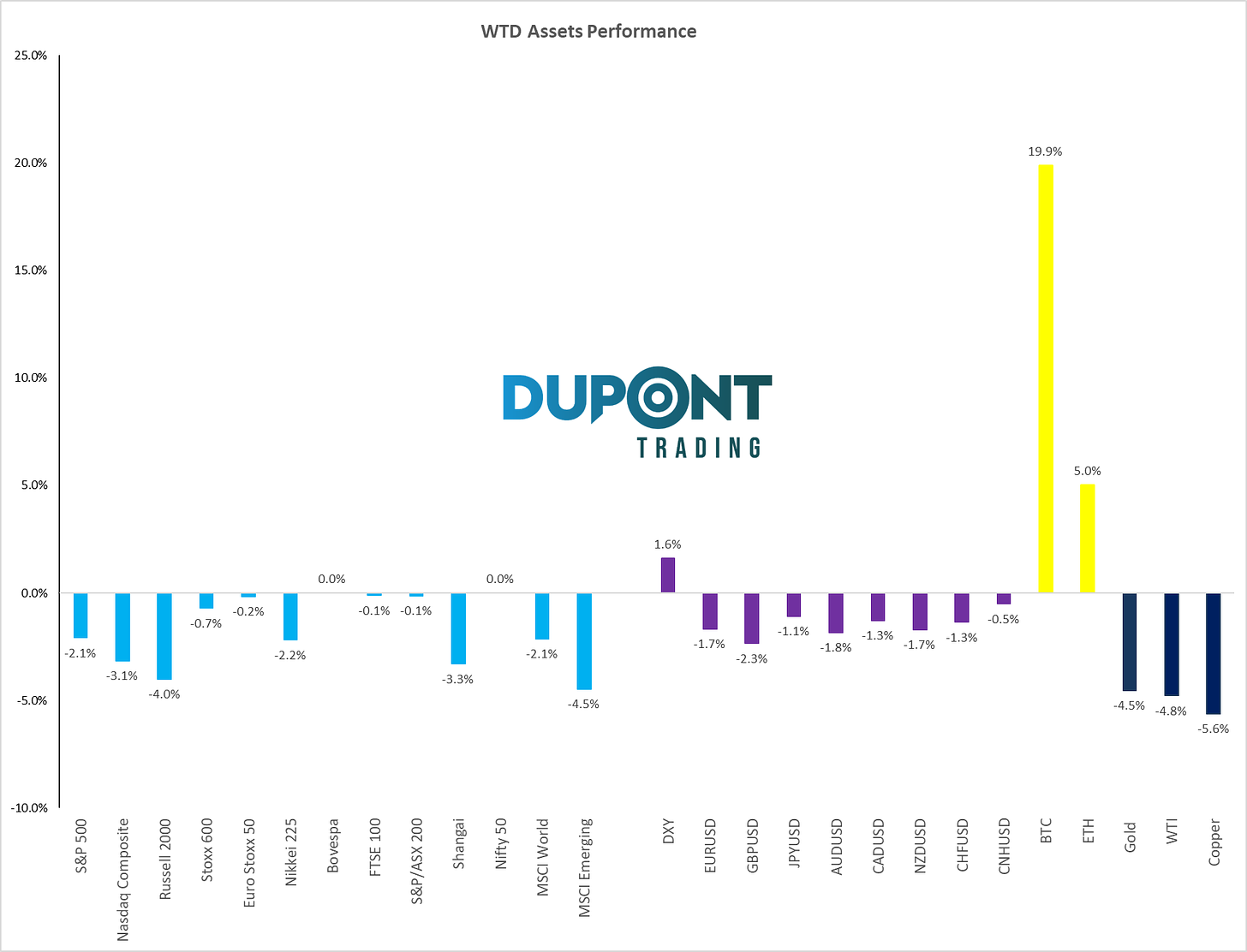

- Crypto: Bitcoin surged 20% last week, and now trading above the 90,000 mark. Predictions suggest the potential for reaching 100,000 by the end of the year.

- Stocks: Traditional equities faced challenges; the S&P was down 2%, and NASDAQ fell by 3% after a strong previous week.

- Commodities: Gold dropped below $2,600, and WTI crude is testing the $67 level. Copper remains sluggish due to underwhelming Chinese economic stimulus.

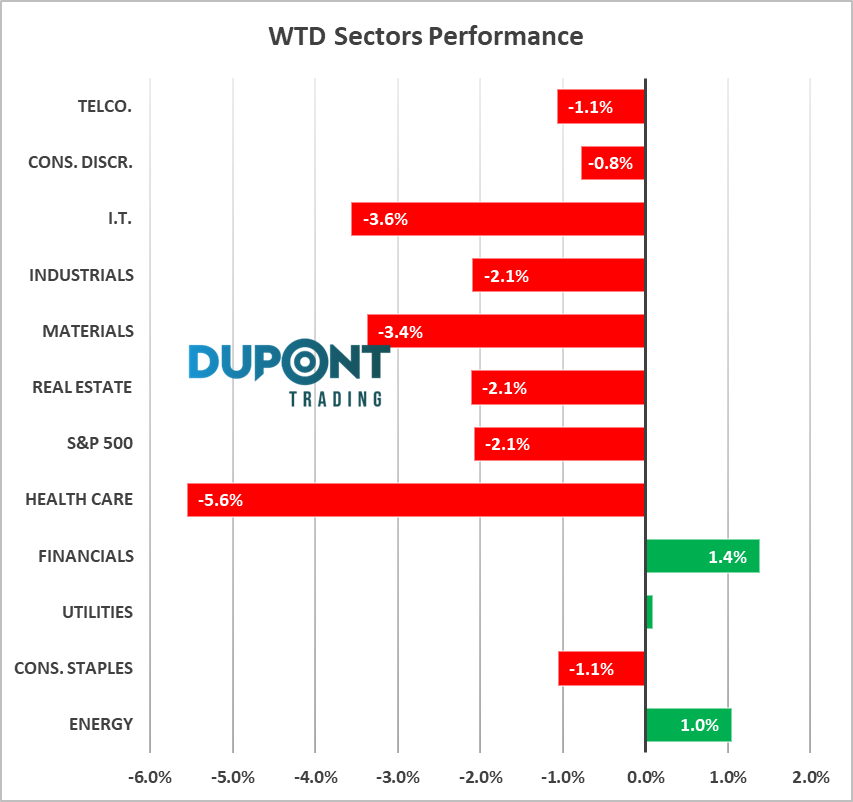

- Sector Winners & Losers

- Banks stood out positively, performing well across the board, especially names like JP Morgan and Wells Fargo.

- Healthcare struggled, primarily due to the nomination of new leaders expected to impact the sector. Vaccine-related stocks took a hit.

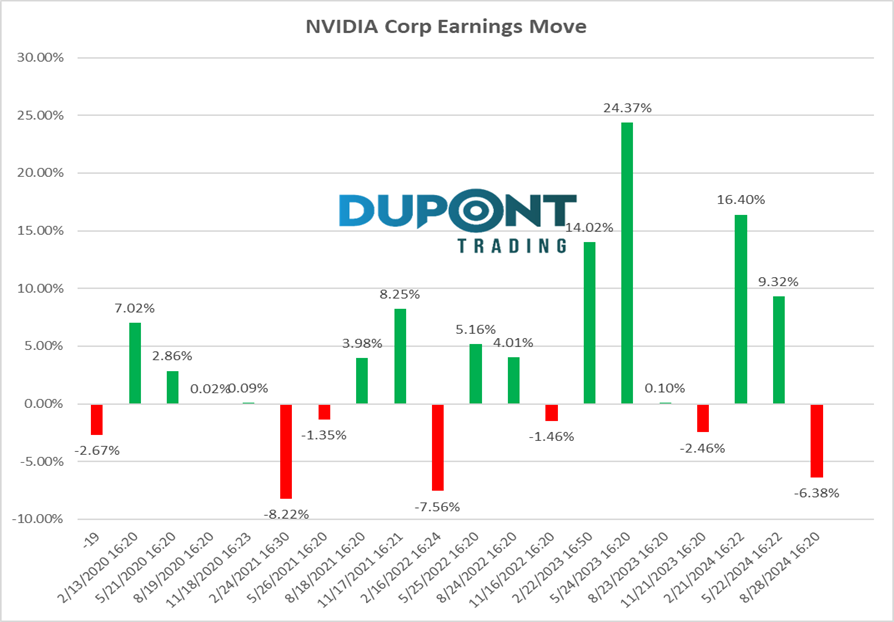

- Biotech & Semiconductors saw notable declines, with semiconductors dropping 7% ahead of Nvidia’s anticipated earnings.

Key Economic Indicators & Insights

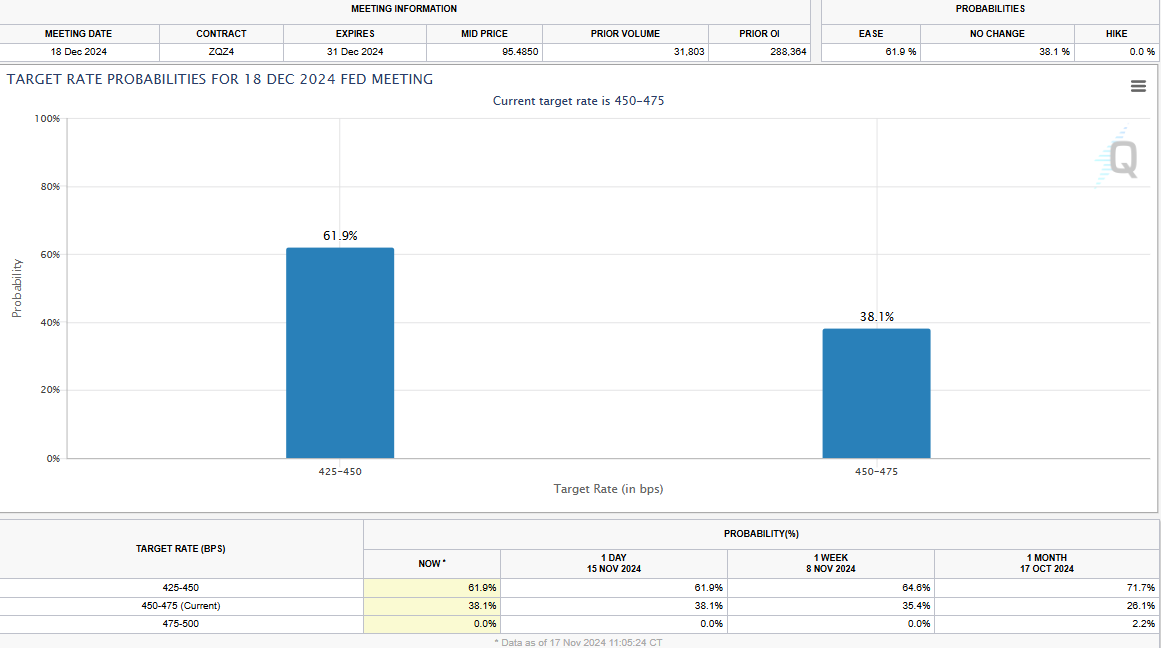

- Interest Rates & The Fed

- U.S. 10-year yields are hovering at 4.44%. A rise above 4.25% could spell challenges for stocks, signaling inflation concerns and potential Fed caution.

- Market expectations for December have adjusted, with a 60% chance of a 25 basis point cut, reflecting a less dovish outlook compared to earlier predictions.

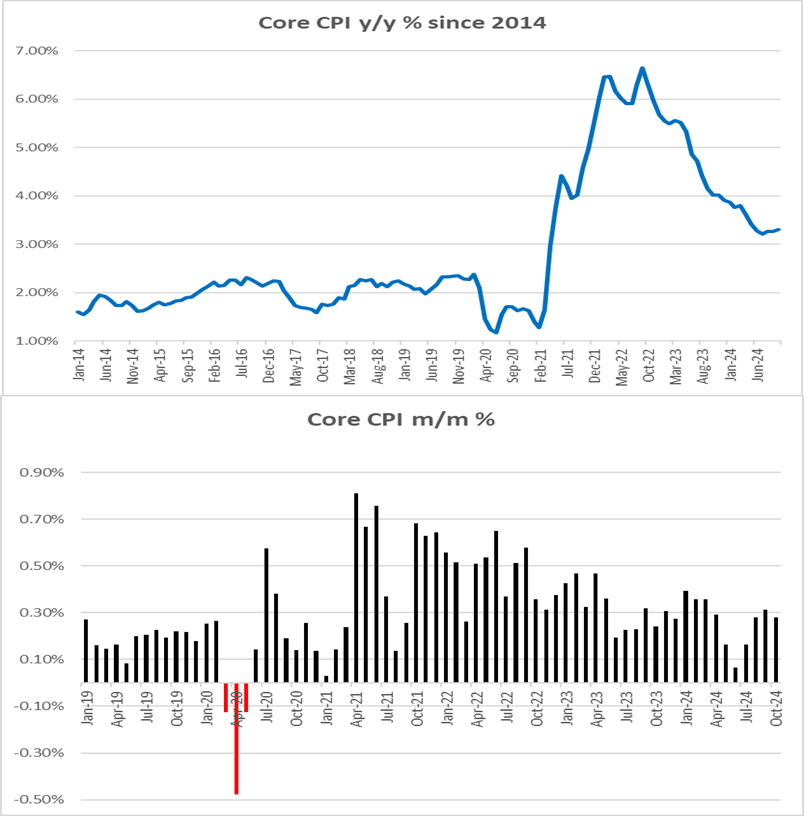

- Inflation & Employment

- Recent data hints at inflationary pressures resurfacing, aligning with discussions on the job market’s importance over traditional inflation metrics.

Macro Trends to Watch

Focus remains on rates, inflation indicators, and the broader economic environment as we head towards the end of the year. The market has pivoted, keeping a keen eye on Fed policies and macroeconomic shifts.

What’s Coming Up?

- Nvidia Earnings (Wednesday, Post-Close)

Expectations are high with an implied move of ±9%. Recent earnings have generally exceeded projections, and Nvidia’s new product announcements are closely watched.

- Retail & Macro Data

Retail giants like Walmart are reporting this week, giving insights into consumer sentiment. Watch out for housing data, PMI updates, and retail sales indicators.

- Global Events

The G20 summit in Brazil could generate geopolitical headlines, but the main market mover will remain Nvidia and retail data.

Tips & Observations

- Option Expiry Impact: The monthly options expiry has become a crucial driver, amplifying market moves. Keep an eye on these dates for potential shifts.

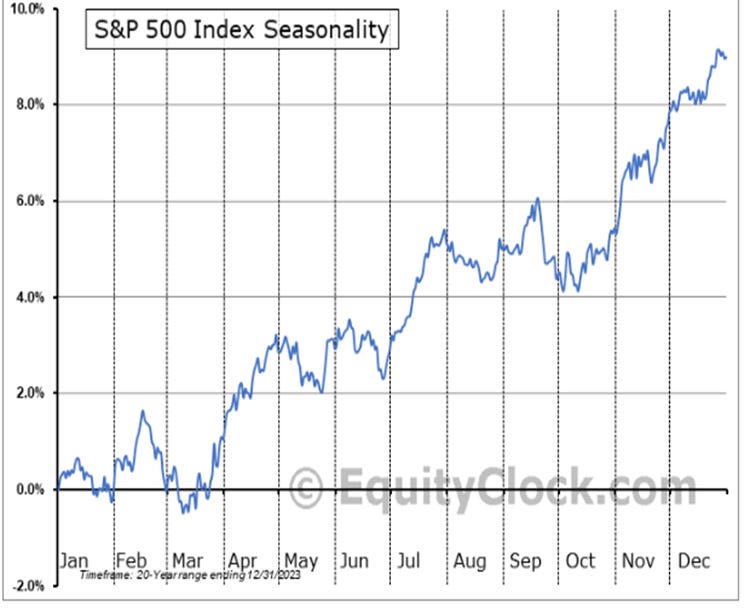

- Seasonal Patterns: Historically, mid-November to Thanksgiving shows market weakness before a year-end rally. Be cautious of short-term dips.

- Volatility: The VIX moved to 16%, signaling increased volatility. Traders should be prepared for sudden spikes amid market turbulence.

Want more insights?

Join our Discord community for in-depth discussions, access to premium content, and more! https://discord.gg/wrvGuF3M

In the near future, the most advanced channels will go beyond a paywall.

And if you’re interested in personalized mentoring, the 4×4 Video Series or the most advanced Discord channels please send us an email.

Have a great trading week!

Greg

greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions