This week, we dive into the latest market movements and the impact of recent geopolitical events on various asset classes. Market Overview: Tariffs and Market Reactions: The week started with concerns over new tariffs imposed on April 2nd. This decision led to significant market movements, with the US 10-year Treasury yield fluctuating between 4% and […]

Tariffs Crash

This week has been nothing short of dramatic, with markets across asset classes experiencing significant sell-offs due to tariff announcements and growing recession fears. Key Highlights: Tariff Impact: Trump’s Announcement: On Wednesday, Trump announced new tariffs, initially perceived as manageable at 10%. However, further details revealed much higher tariffs, leading to a market sell-off. Market […]

New Leaders

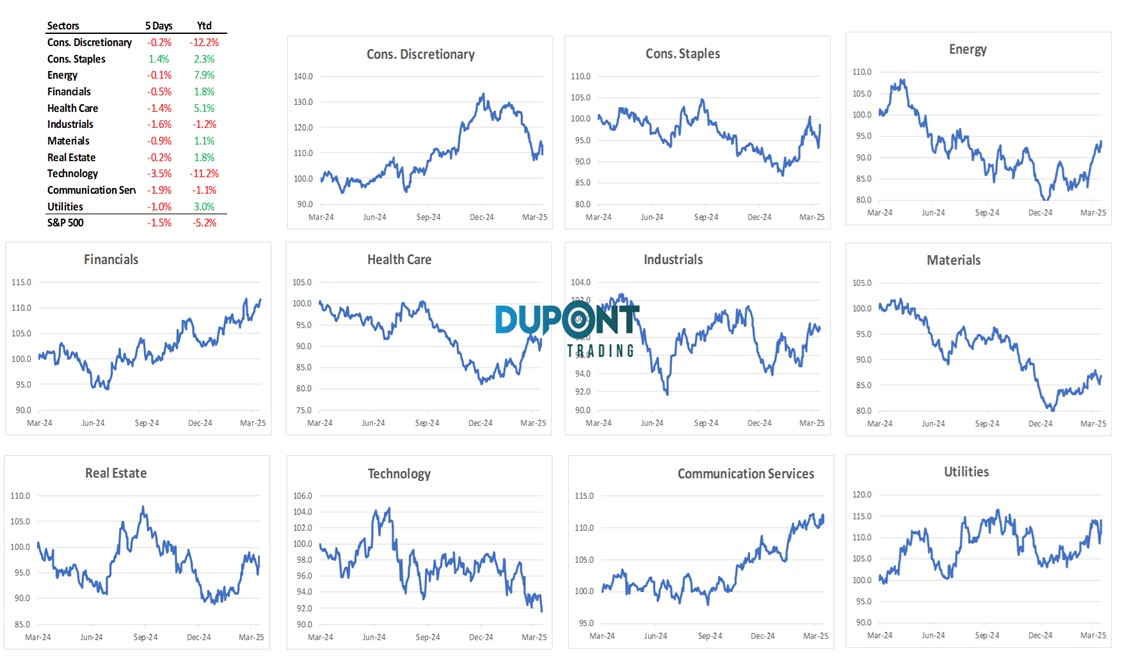

Market Overview: Searching for New Leaders The stock market has been struggling since the start of the year, with major indices showing downward trends. As traders and portfolio managers, identifying outperforming stocks (longs) and underperforming ones (shorts) is crucial. Looking at sector performance is a key strategy, and our weekly sector chart analysis has shown […]

Tesla Crashing

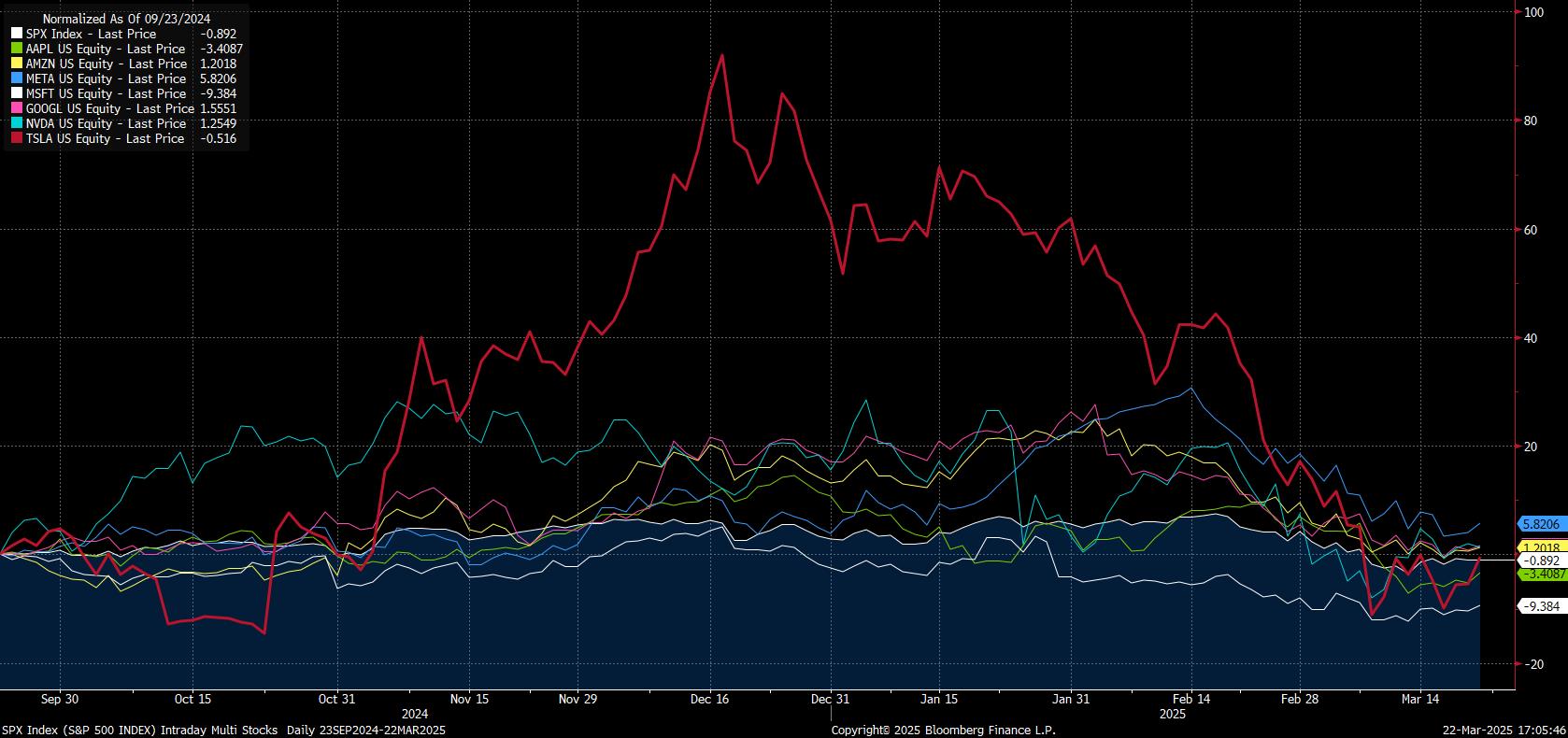

🚗 Tesla Under Pressure: Crash or Correction? Tesla has been underperforming since mid-December, despite having surged post-election. A key point? Musk’s support of the Trump Administration initially drove flows into the stock, but recent months have seen a retreat. Short-Term View: After spiking very hard after the elections, Tesla has tracked the “Fabulous 7” closely […]

Credit Next

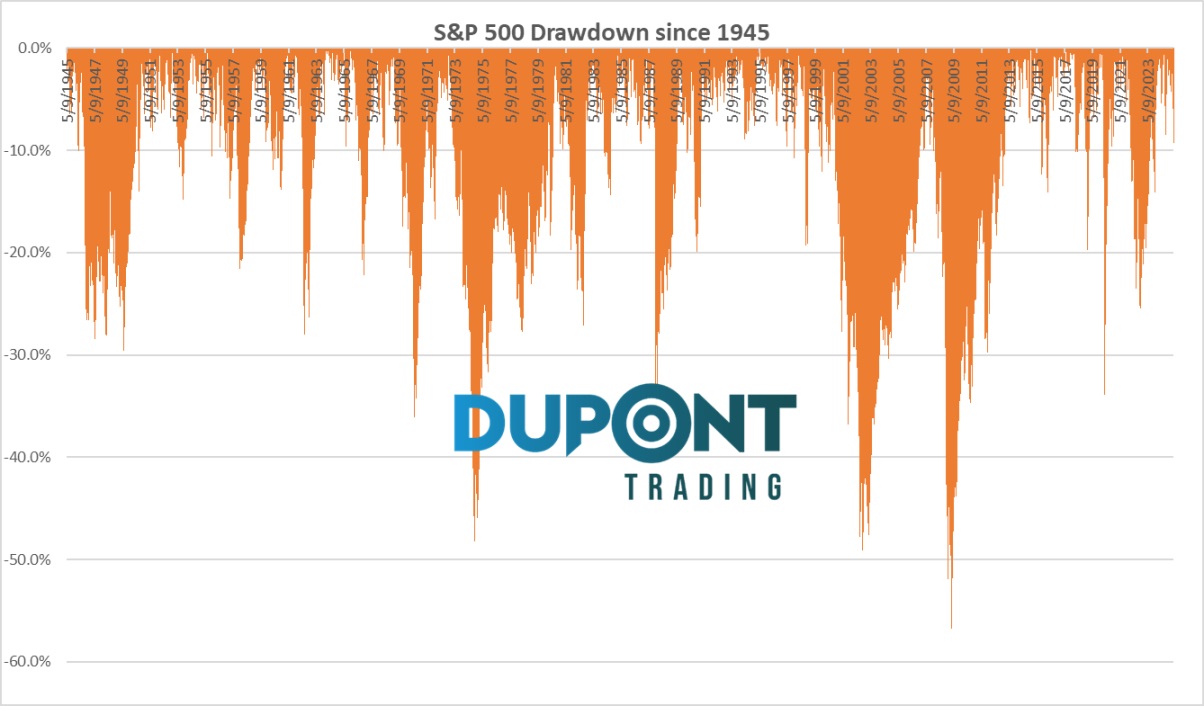

Equity Markets: Correction or Recession? Since mid-February, we’ve seen a 10% correction in the S&P 500, pushing U.S. equities into negative territory for the year. Historically, a 10% drop is normal in non-recessionary environments. But if you’re anticipating a recession, 30-50% drawdowns are historically more common. Key Takeaway: Credit markets are stable, suggesting no […]

Mighty Globalists

Market Recap: U.S. Struggles, Europe Strengthens This past week brought significant shifts in global markets. The U.S. stock market continued to underperform, while Europe—especially Germany—showed signs of strength. A key takeaway: the S&P 500 has been the global outperformer over the past 25 years, but recent trends suggest that valuation concerns and geopolitical moves are […]

Momentum Meltdown

Welcome to this edition of our newsletter, covering key market movements and insights from the past week. With a mix of geopolitical drama, economic slowdowns, and shifting investor sentiment, there’s plenty to unpack. Since last week’s option expiry, there’s been a notable shift. High-beta and high-momentum stocks, particularly retail favorites like Palantir ($PLTR) and Carvana […]

Friday Sadness

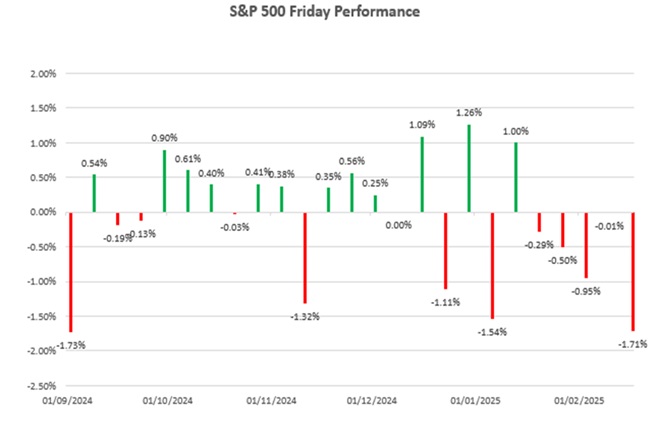

Market Recap: Another Rough Friday Fridays have continued to be a struggle for the markets, a pattern observed since mid-January. This past Friday, the S&P 500 dropped 1.7%, following similar struggles in the NASDAQ. The primary reasons? Expiring options, shifts in market positioning, and weak macroeconomic data. Recent S&P 500 Friday Performances. Zero-Day Expiry Options: […]

NO MAGA

This week, markets are hitting new highs, with the S&P 500 and NASDAQ performing well, alongside strong movements in European markets. However, there’s increasing debate over whether the era of U.S. market dominance is coming to an end. Let’s break it down. Global Market Trends: U.S. vs. The World The MSCI World ex-U.S. index has […]

Retail Traders Going All-In

Welcome to this week’s edition of Your Next Trade! We have plenty to discuss, including retail traders’ aggressive market participation, sector performances, key earnings reactions, and upcoming market catalysts. Retail Traders Driving Market Moves Retail traders have been increasingly aggressive in buying dips, leveraging options, and treating the market like a casino. The past two […]