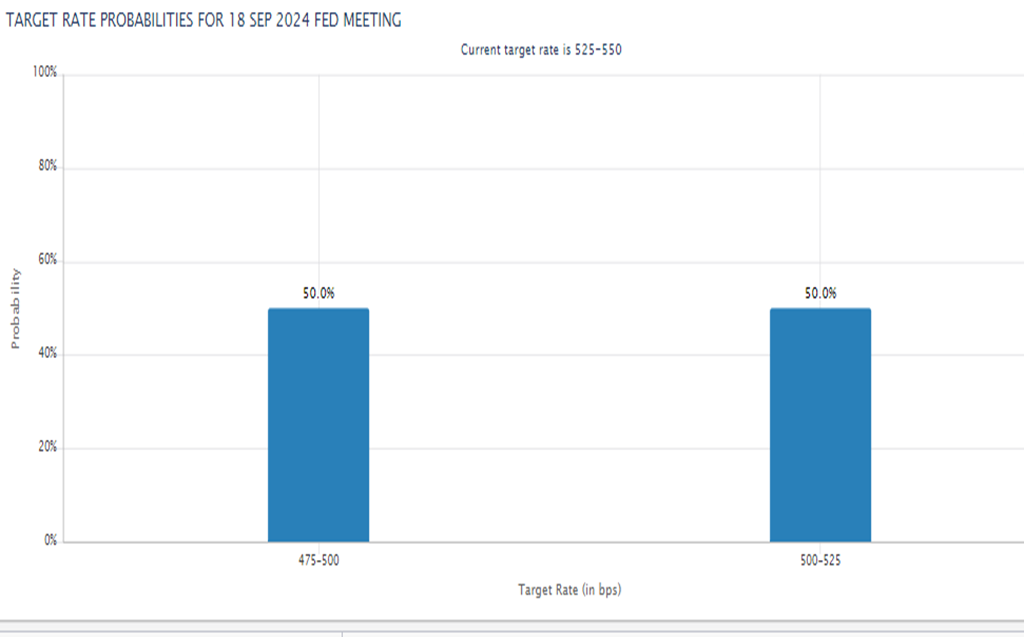

50/50 for 25/50

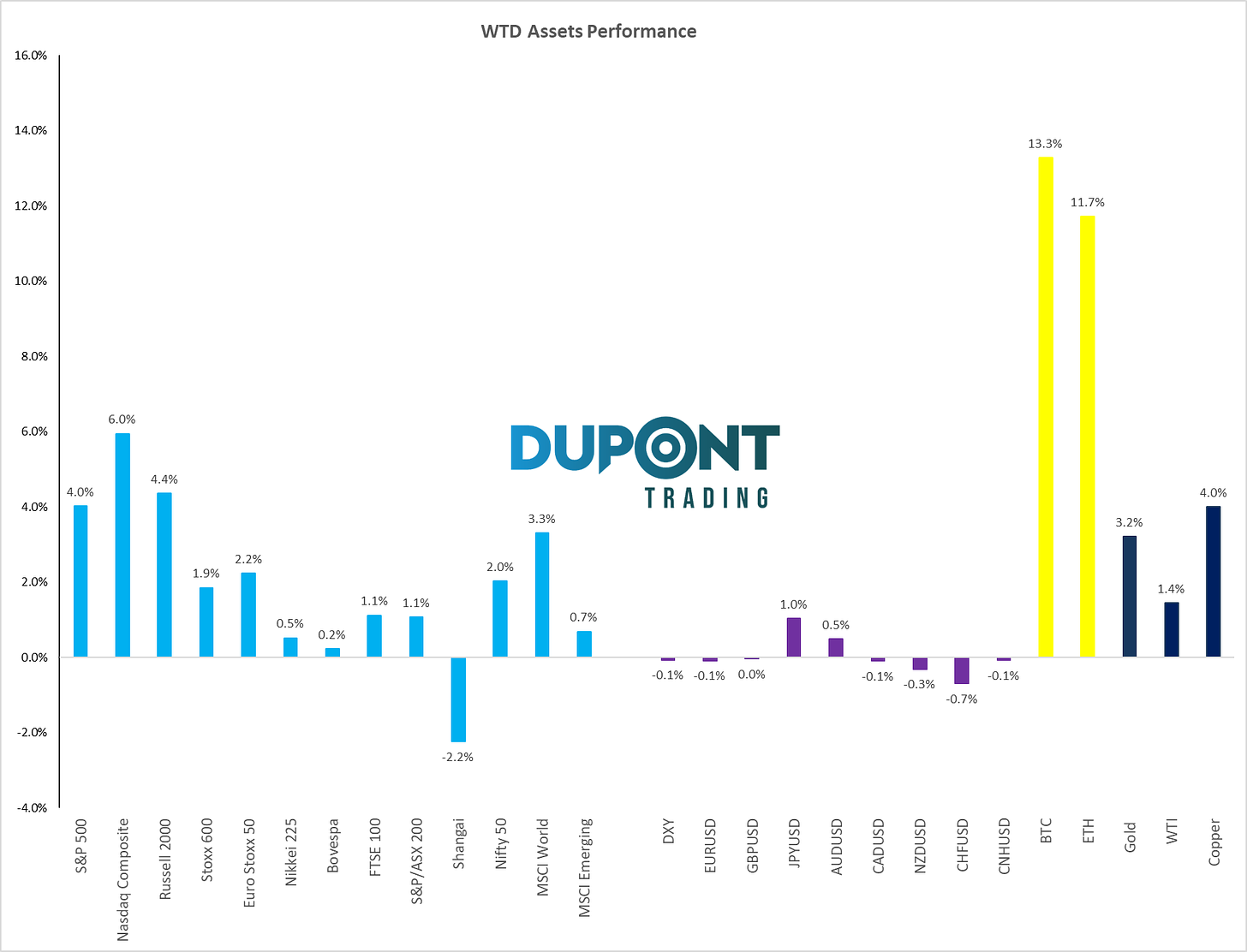

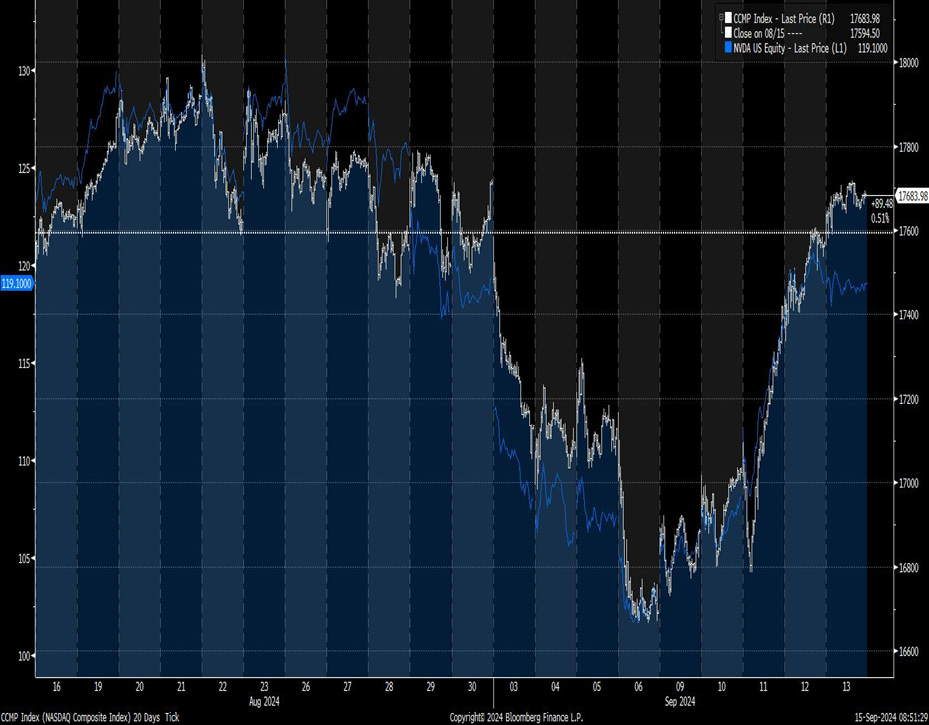

After a sharp downturn, the market quickly rebounded, with the S&P up 4% and the NASDAQ climbing as well. A key driver of this bounce was the semiconductor sector, particularly companies like Nvidia, benefiting from the artificial intelligence (AI) boom. Cryptocurrencies also had a stellar week, surging 13%, while gold climbed steadily, positioning itself as a reliable hedge.

Key Events Impacting the Market

Several critical events shaped the week:

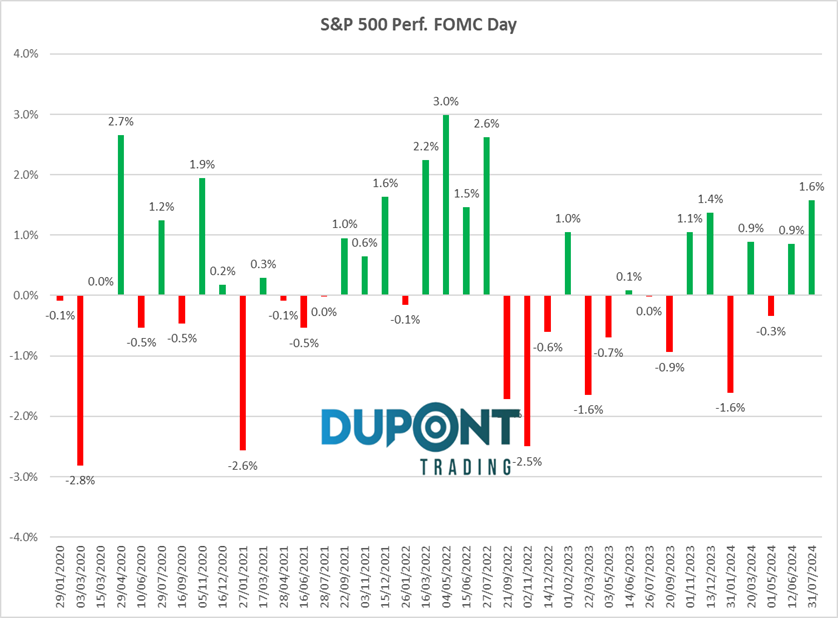

- FOMC Meeting (September 18th): The Federal Reserve is caught between a 50/50 decision to cut rates by either 25 or 50 basis points. Inflation has been trending down, but unemployment has risen, leaving the Fed in a difficult position as it tries to balance the two. Additionally, with the upcoming U.S. elections, the Fed faces pressure to remain as independent as possible.

Asset Performance: Winners & Losers

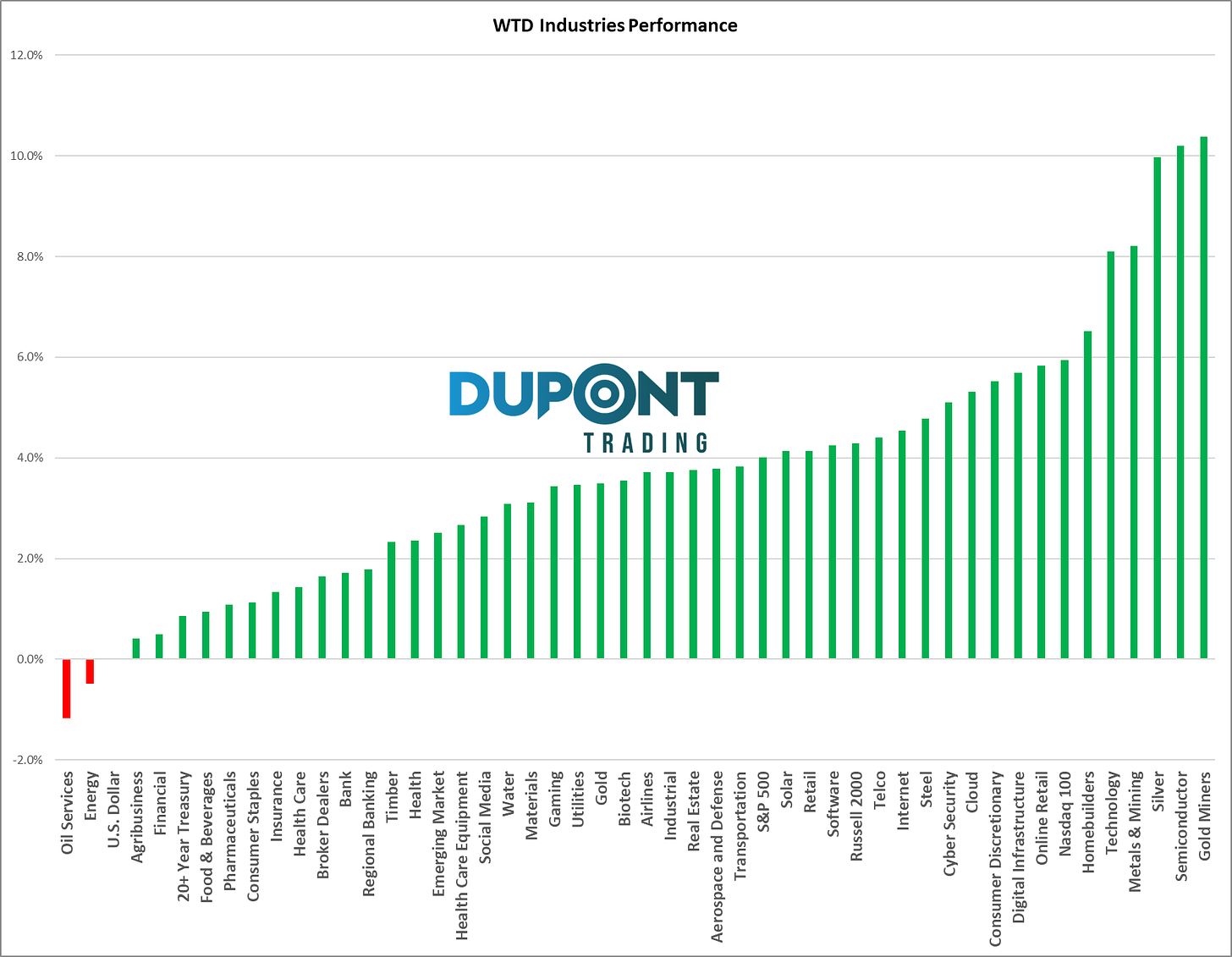

- Semiconductors: The standout performer, led by Nvidia, saw a rise of more than 10%, signaling renewed strength in tech.

- Energy & Financials: Energy stocks remained flat, while banks like JPMorgan faced lower earnings projections for 2025 due to falling yields. JPMorgan stock dropped 6-7%.

- Gold & Cryptos: Gold emerged as a safe haven, driven by expectations of a Fed rate cut, while cryptos saw triple-digit gains.

- WTI Crude Oil: WTI crude bounced back to $67 after dropping to $65 earlier in the week.

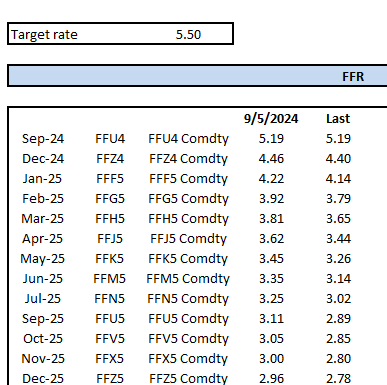

Fed’s Rate Cut Decision: 50/50 Odds

The upcoming FOMC meeting holds the key to the Fed’s rate-cutting strategy, with market odds split between a 25 or 50 basis point cut. The pace at which the Fed cuts rates will be crucial, as the market currently expects a 1.1% cut before year-end. This translates to four to five rate cuts over just three meetings, indicating aggressive monetary easing.

Sector Focus: A Deeper Look at the AI Push

Tech stocks, led by semiconductors, are on the rise. Nvidia and Oracle’s bullish forecasts on AI investment drove much of the week’s gains. Oracle’s earnings call suggested long-term growth prospects for AI and CapEx, while Nvidia’s stock shot up due to strong demand for its AI products.

NVDA (lhs) vs Nasdaq Composite (rhs).

Macro & Global Events to Watch

- Retail Sales & Housing Data: U.S. retail sales will be closely watched as a key indicator of consumer health. Similarly, housing numbers, such as building permits, will shed light on the state of the real estate market.

- Chinese Economic Data: Disappointing retail sales and industrial production figures from China suggest an ongoing slowdown in the region, although potential policy interventions from the Chinese government could provide a lifeline.

Looking Ahead: Key Catalysts for the Week

- FOMC Meeting: The primary focus will be on how quickly the Fed plans to cut rates and whether they opt for a 25 or 50 basis point reduction.

S&P 500 FOMC day recent performances.

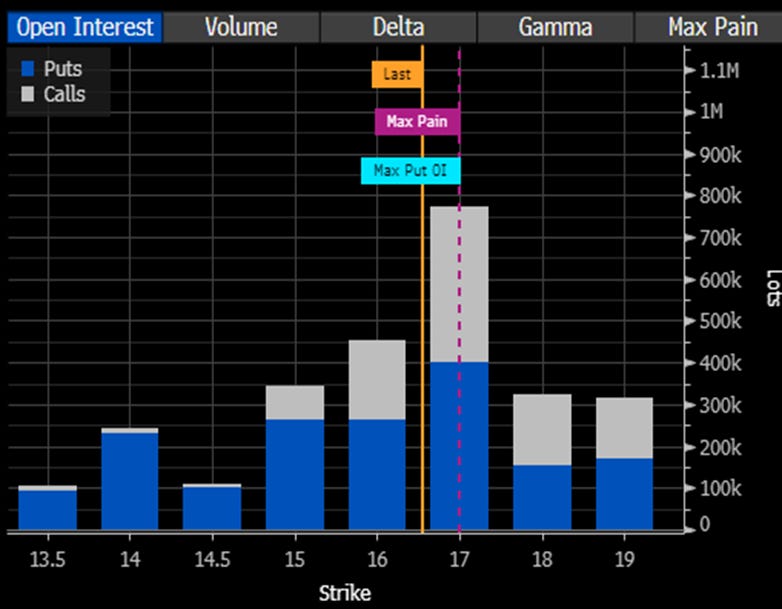

VIX & Options Expiry: Volatility is expected with VIX expiry on Wednesday and options expiry on Friday. Watch for significant movements as market positions unwind, especially with index rebalancing and companies like Palantir joining the S&P 500.

- VIX September OI.

Conclusion

The market is on the verge of hitting new all-time highs, but caution is advised as seasonality suggests a potential pullback in late September or early October. As always, keeping an eye on market trends, tech performance, and macroeconomic data will be crucial for the coming weeks.

For more detailed insights and strategies, join our trading community on Discord or check out our 4×4 Video Series: https://discord.gg/NedmqPVf

Have a great trading week ahead!

Greg Dupont

greg@duponttrading.com

https://substack.com/@gregoiredupont

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions