Your Election Next Trades

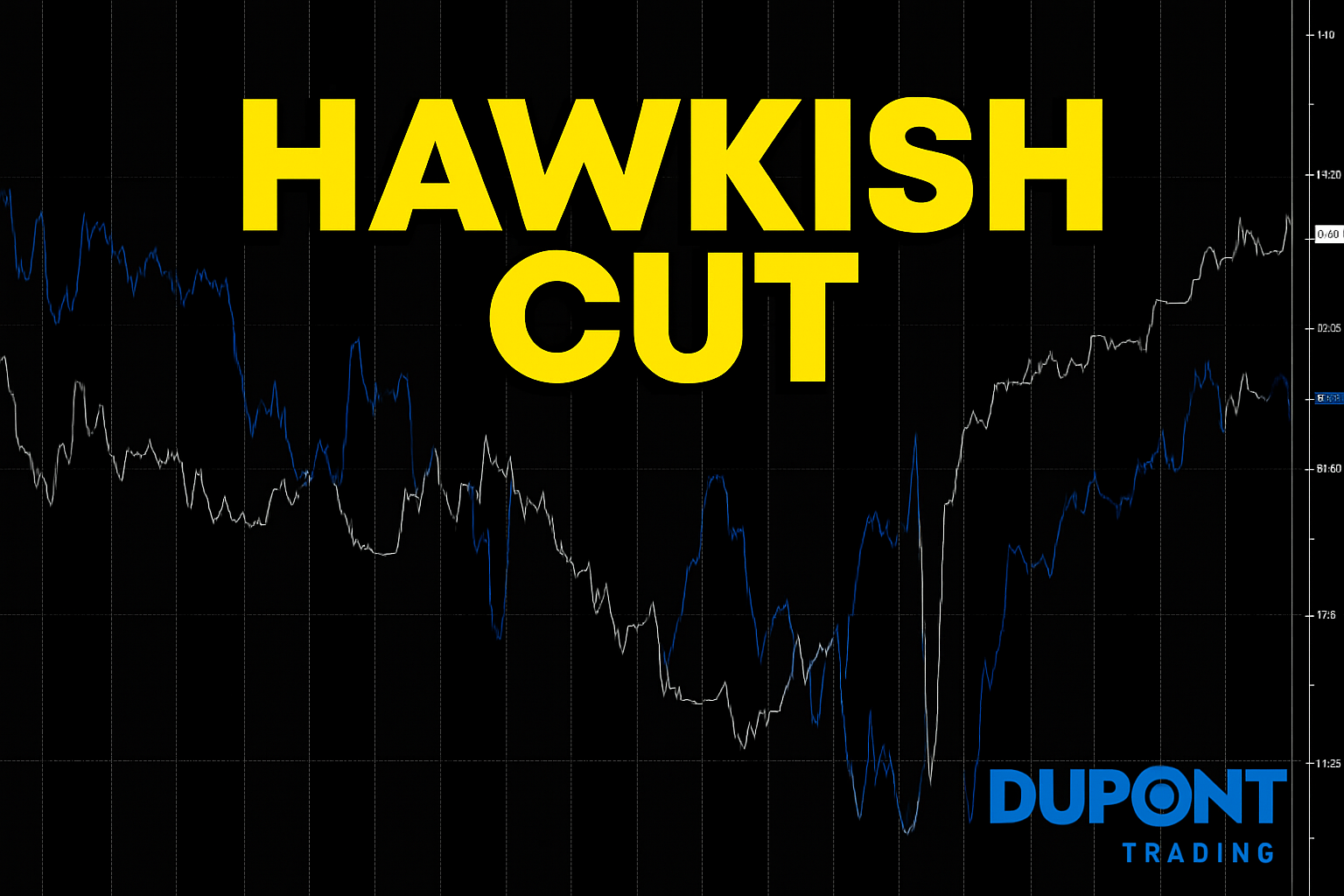

If you were trading on November 6, 2024, it’s a day you’ll likely remember with a bit of nostalgia. We saw significant shifts across various asset classes.

With Trump now elected and the first major market reaction behind us, let’s focus on identifying potential trades for the next 2-3 months.

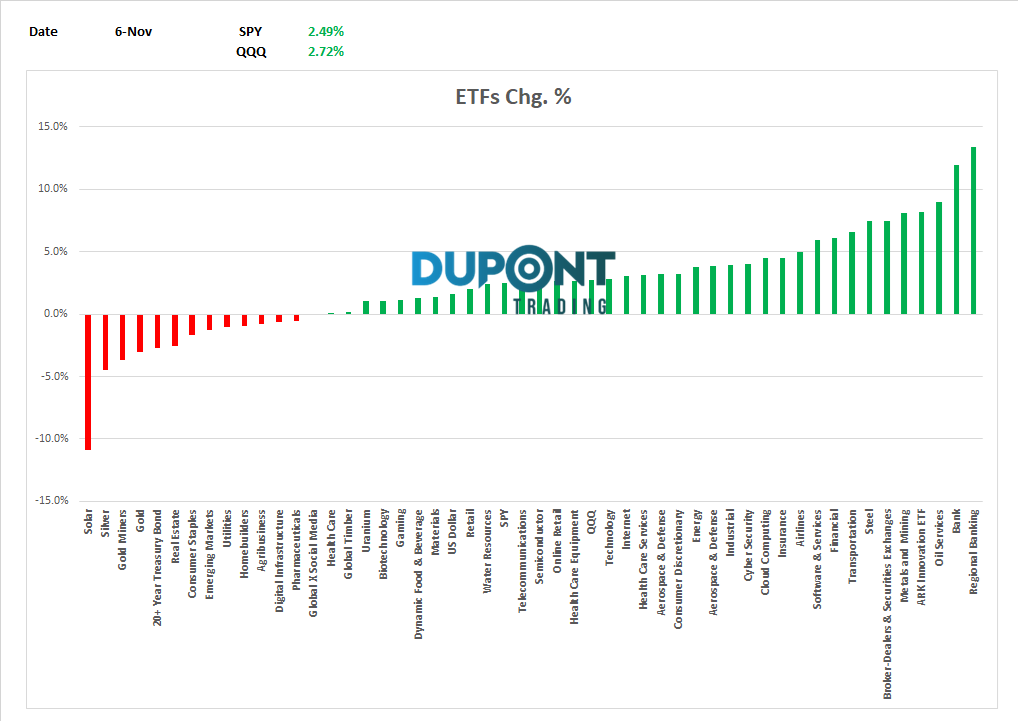

Let’s begin by reviewing the industry movements from that day:

Yes, Banks +10% on the day vs Solar -10%. No need to say that my lotto trade on Solar did not do well. From +100% winner to -50%. That was a lotto ticket, meaning it was a very small size (OTM call spreads) and it allowed me to come light into the event.

When volatility spikes, there is some P&L to do in active trading. That was the case on that day and it offered for me great opportunities. I made 100x what I spent on those lotto tickets.

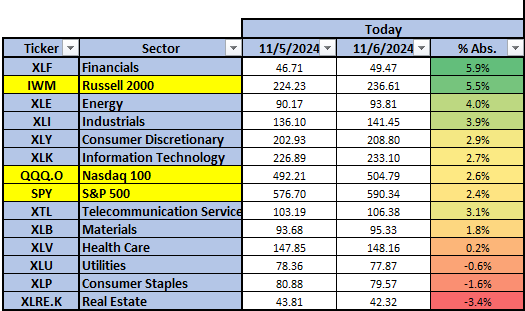

Now let’s look at how the sectors did on the day:

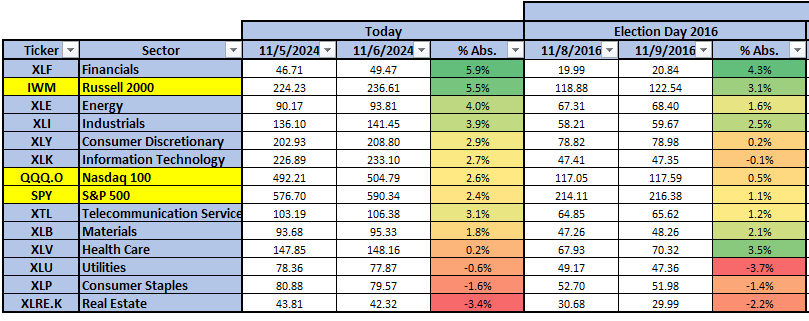

And now, this is where we are lucky to have a Discord community as one of our members spotted the obvious: Compare those returns with 2016.

As you can see here, there are some serious similarities:

As you can see, performances yesterday were pretty much the copycat of 2016 performances with some adjustments (XLV for example).

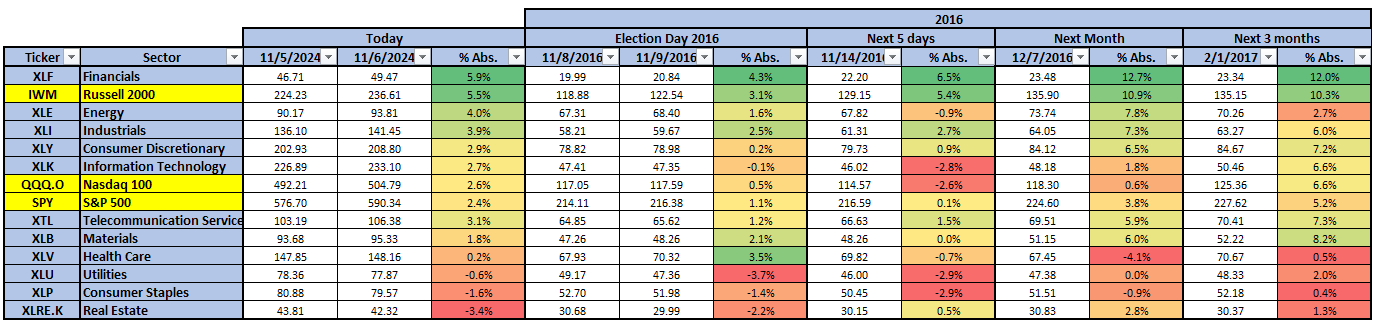

Now enough of the back trading and look and what could happen next, taking the moves that were made after the 2016 Elections Results.

Yes, looking at how the different sectors did after Trump Victory might be a good start. Financials and Russell 2000 did very well in 2016.

But we can do more than the ETFs level and we can drill down even more and look at single names.

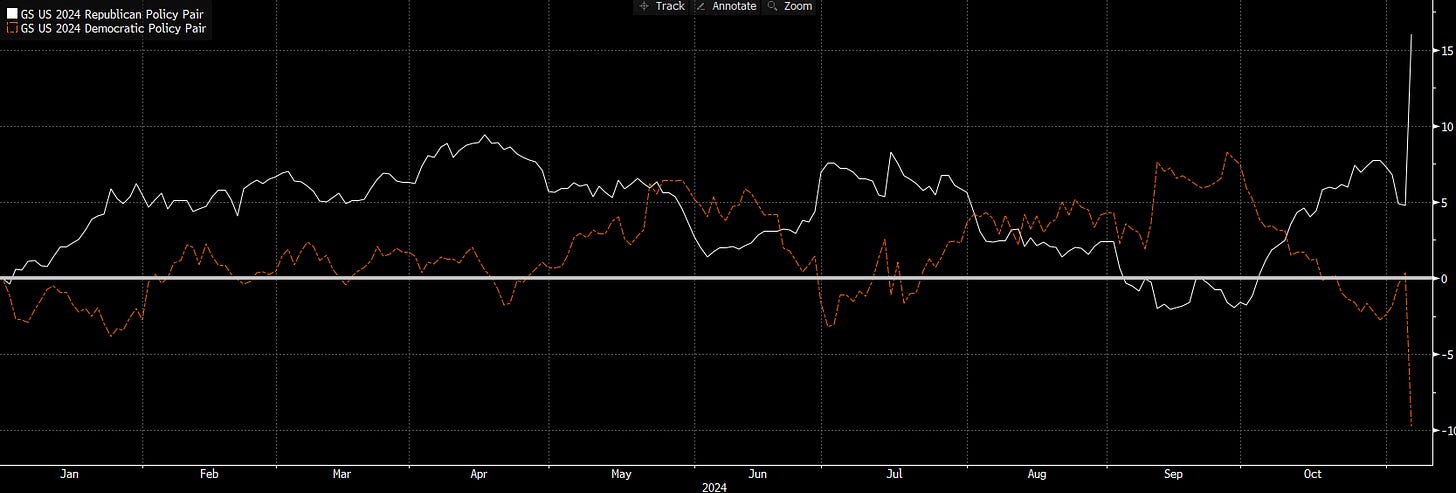

To do so, I used Goldman Sachs Republican Pair Index that represents an equal notional pair trade of going long GS24REPL (GS24 Rep Pol Outperform) and short GS24REPS (GS24 Rep Pol Undrperform) and I compared that with the Goldman Sachs Democratic Pair Index GSP24DEM.

That is the ytd performance with a 26% difference.

But the big move was yesterday with the Republican Index up +10.73% and the Democratic Index down -10.07%

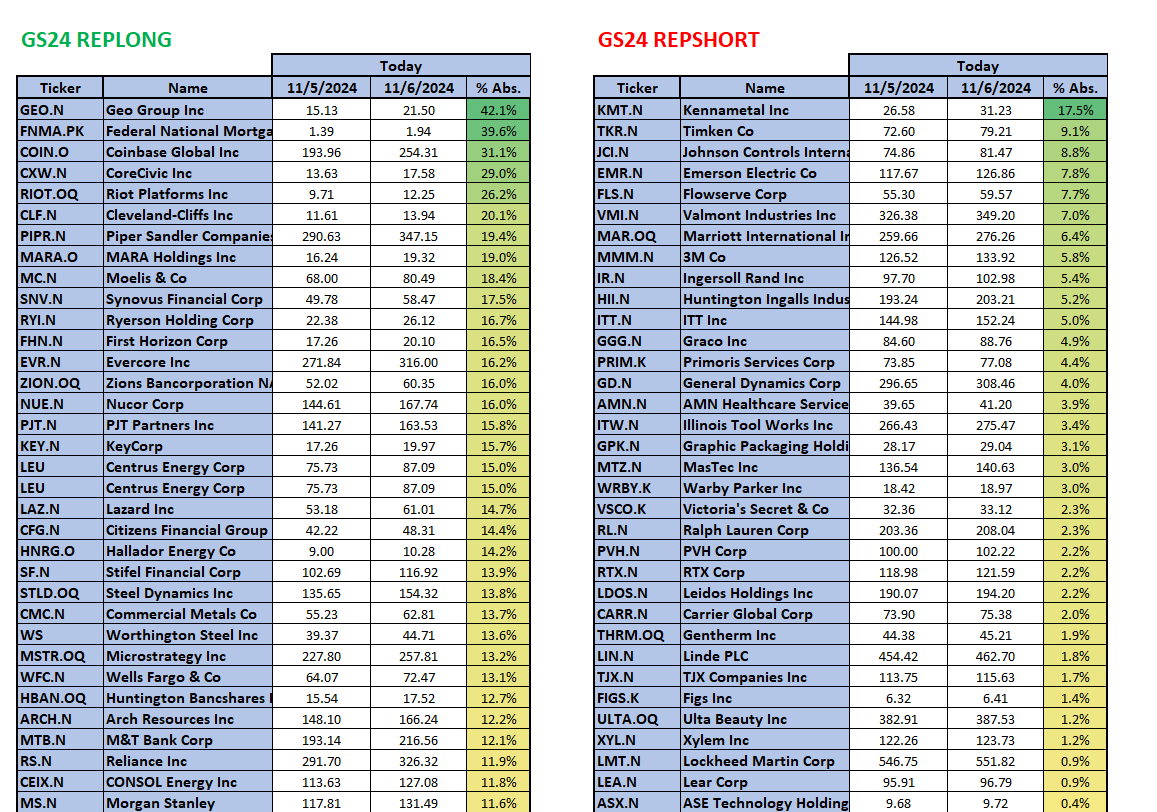

Going forward we should be interested in the different constituents of those indexes and where the outperformance could come from.

Below is a screenshot of a spreadsheet that I shared on Discord with the most advanced members:

From ETFs levels to stock levels, there will be many trading opportunities.

Join our Discord community for in-depth discussions, access to premium content, and more! https://discord.gg/wrvGuF3M

In the near future, the most advanced channels will go beyond a paywall.

And if you’re interested in personalized mentoring, the 4×4 Video Series or the most advanced Discord channels please send us an email.

I hope it helps,

Greg

greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions