Who blinks first?

This week, we dive into the latest market movements and the impact of recent geopolitical events on various asset classes.

Market Overview:

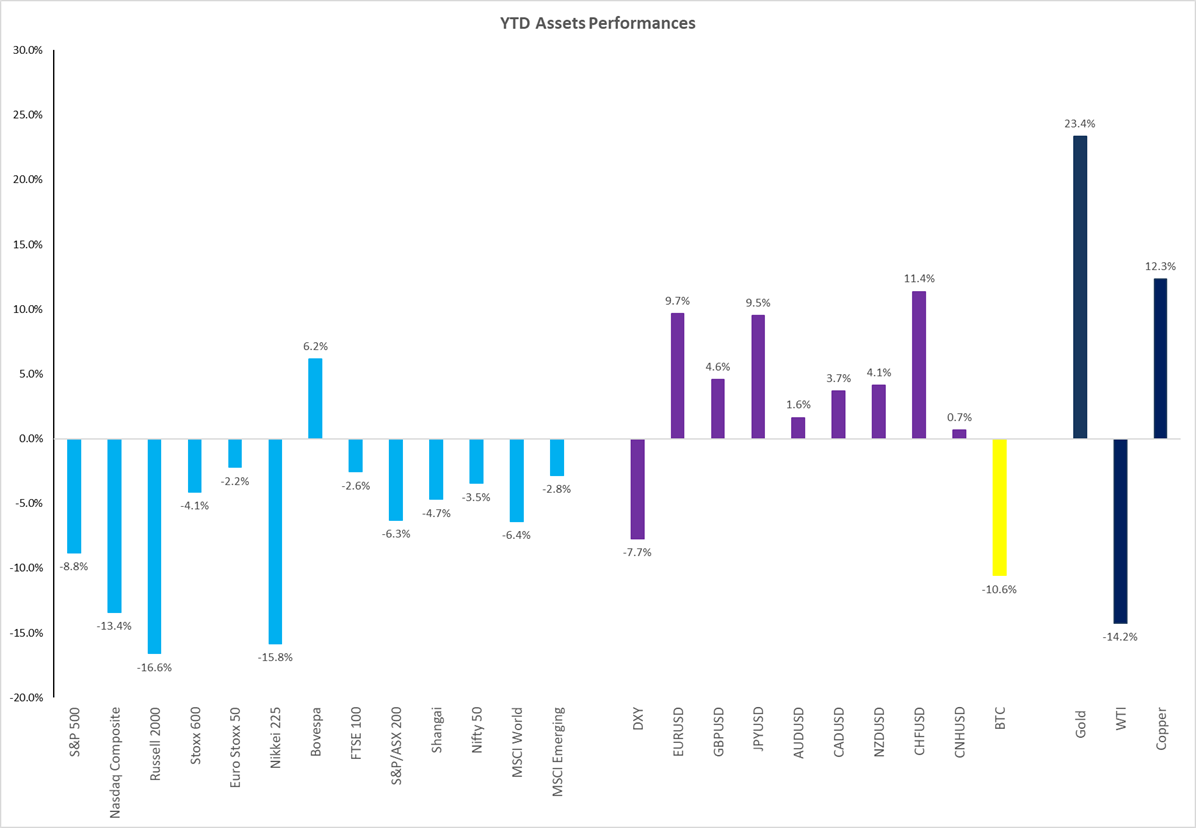

- Tariffs and Market Reactions: The week started with concerns over new tariffs imposed on April 2nd. This decision led to significant market movements, with the US 10-year Treasury yield fluctuating between 4% and 4.6%. However, on Wednesday, the pressure on the Bond Market forced President Trump to announce the removal of tariffs above 10%, except for those on China.

U.S. 10 year with yields up 50bps since the 2nd of April Announcement.

- Flight to Safety: The volatility in the market led to a sell-off in stocks and not the usual flight to safety in bonds. The recent sell-off in US Treasuries by foreign investors, particularly from Japan and China, added pressure on the market.

Key Players and Their Moves:

- Trump Administration: The administration’s decision to remove tariffs above 10% was seen as a response to market pressure. This move is expected to benefit tech stocks like Apple and Nvidia, which were previously affected by semiconductor tariffs.

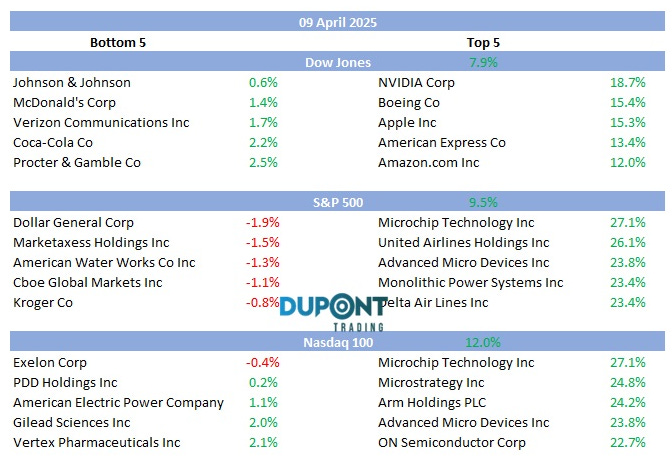

- On the announcement of the removal of Tariffs above 10%, stocks experienced an historical move up.

- Federal Reserve: The Fed is expected to cut rates three times by the end of the year, with the first cut anticipated around July. This is in response to the market’s volatility and the need to stabilize the economy.

Asset Performance:

- Stocks: The S&P 500 is down 9% year-to-date, while the NASDAQ is down 13%. European markets are outperforming, and the US dollar has weakened significantly.

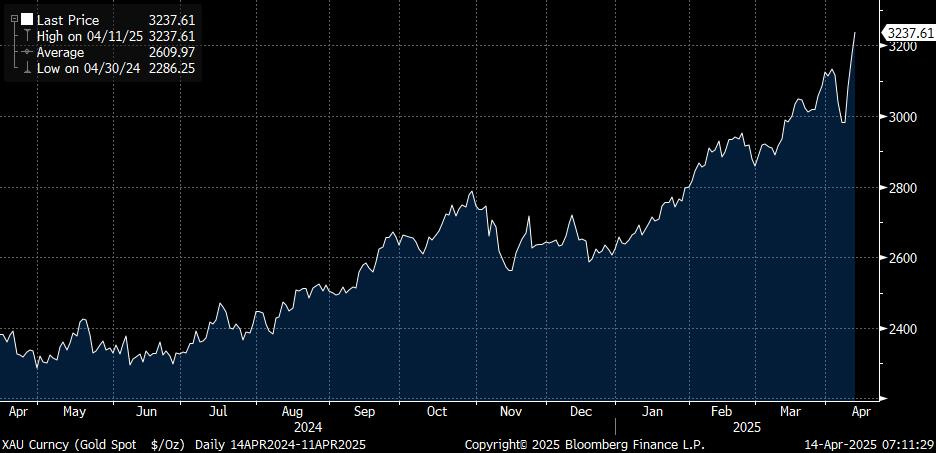

- Gold: Gold has seen a strong performance, reaching new highs as investors seek safe-haven assets.

- Oil: Oil prices have been under pressure, trading around $60 per barrel.

Technical Analysis:

- S&P 500: The index is expected to find support around 4,800-4,900 which could now be seen as the Trump Put. On the way up 5,700 is resistance.

- Euro-Dollar: The Euro has strengthened significantly against the US dollar, moving from 1.10 to 1.14 over the week.

Upcoming Events:

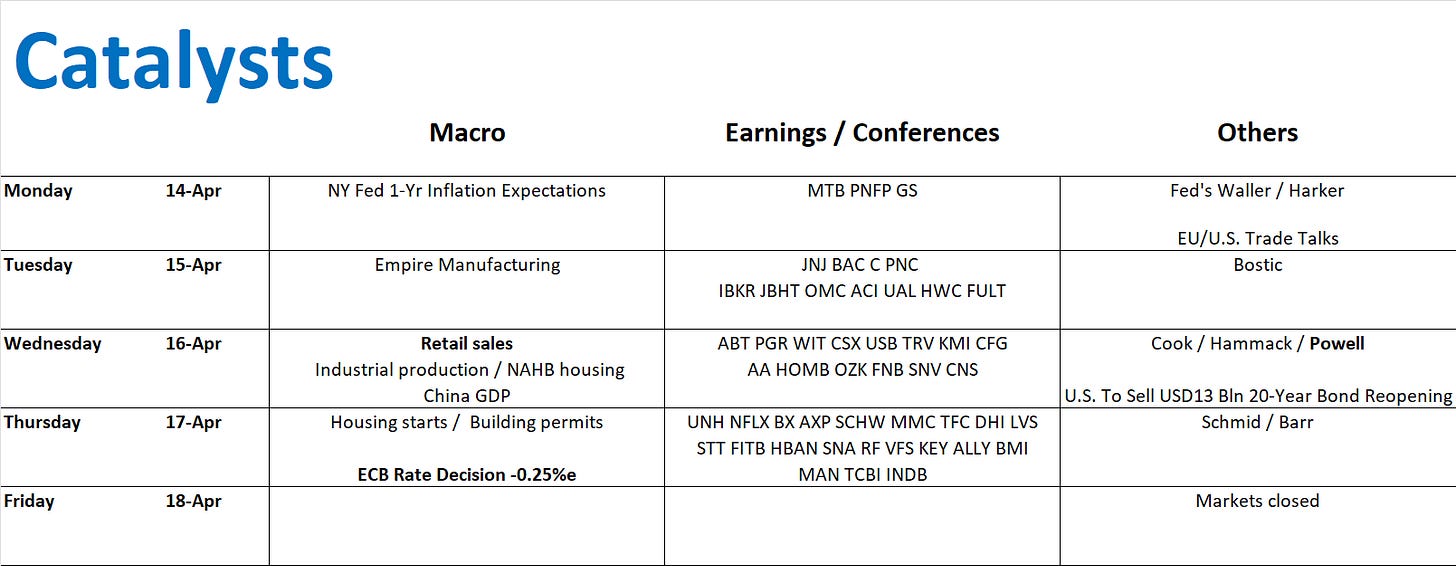

- Earnings Season: The earnings season has started, with key reports from Bank of America, Citigroup, and Netflix expected this week.

- Economic Data: Retail sales data and the ECB rate decision are key events to watch. The ECB is expected to cut rates by 25 basis points. Markets will be closed on Friday due to Easter.

Conclusion:

- The market remains volatile, with geopolitical events and economic data driving significant movements. Stay tuned for more updates and insights in our next episode.

For those looking to deepen their market knowledge, consider joining our 4×4 Video Series https://duponttrading.com/4×4-course/

In light of the recent market turmoil, we’re offering a 25% Easter discount on the 4×4 video series. This comprehensive investment process will help you navigate these challenging times. The discount is available until April 21st. Use Coupon Code: EASTER25

Join the Community:

- Mentoring Program: Dual mentoring sessions with Greg and Etienne.

- Trading Community: Access to 30 channels for just $75 per month.https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

Have a good Trading Week! And Happy Easter!

Greg📩 Contact: greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.