VIX at 24 and so what?

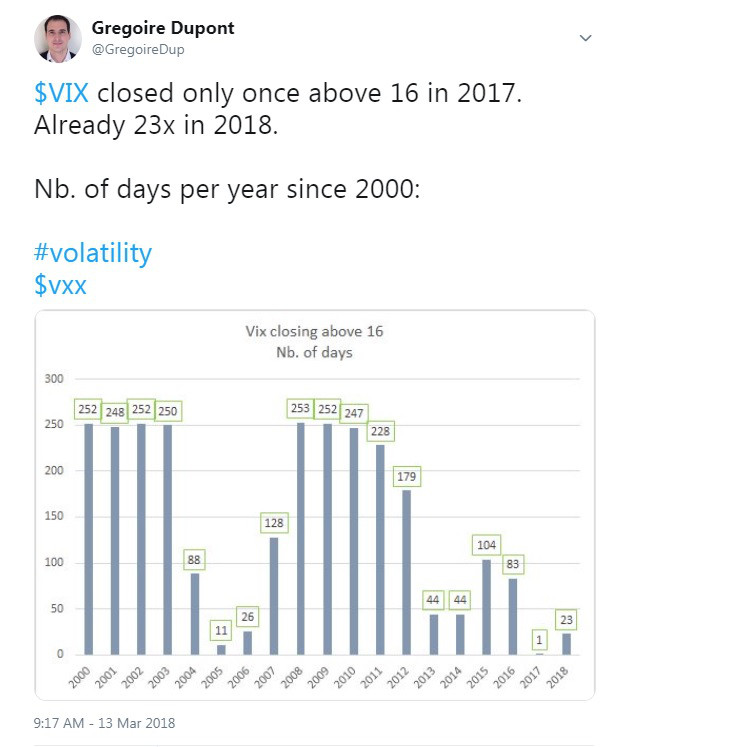

Back in March, I tweeted about the VIX and the number of days it was above 16 year to date.

What is the VIX?

The VIX represents one standard deviation of the market’s estimation of changes in the price of the S&P500 during the next 30 days.

Why did I choose 16 on the VIX?

Because that is roughly the equivalent of a daily volatility of 1% (happening 68.2% of the time or one standard deviation). Easy to understand and easy to remember!

This is what we called the “Rule of 16“.

VIX = 16

=> 16/ √ 252 = 1.008%

with 252 trading days in a year

This same chart shows how we experienced very low volatility in 2017 with ONLY 1 close above 16. Yes you read that correctly: Only one close above 16 in 2017.

In 2005-2006 (less than 10% of occurrences) and 2013-2014 (less than 20%), volatility was very compressed and below 16.

Update now of the same chart with another 48 trading days in 2018:

So in 2018 we will probably experience the same number of days with the VIX > 16 as 2016-2017. But still nothing crazy versus 2000-2003 or 2008-2011.

So in 2018 we will probably experience the same number of days with the VIX > 16 as 2016-2017. But still nothing crazy versus 2000-2003 or 2008-2011.With the VIX averaging 19.30 since its creation in January 1993 and 17.31 as median, it might be the confirmation that the last 18 months were just too quiet and a new cycle might be coming.

I hope it helps,

Gregoire

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions