UNH, FOMO & the Downgrade Drama May, 18 2025

This week’s market action was a rollercoaster—from Chinese tariff headlines to Moody’s surprise downgrade of U.S. debt. But the spotlight was firmly on UnitedHealth Group (UNH). With a $260B market cap, UNH has been under pressure, dropping nearly 60% over recent months due to a downgraded outlook, DOJ scrutiny, and a CEO shake-up.

Despite repeated calls to “buy the dip,” UNH kept falling. This is a textbook case of FOMO (Fear of Missing Out) clouding judgment. Without a clear process, traders risk chasing bottoms that keep moving lower. The lesson? Stick to your strategy.

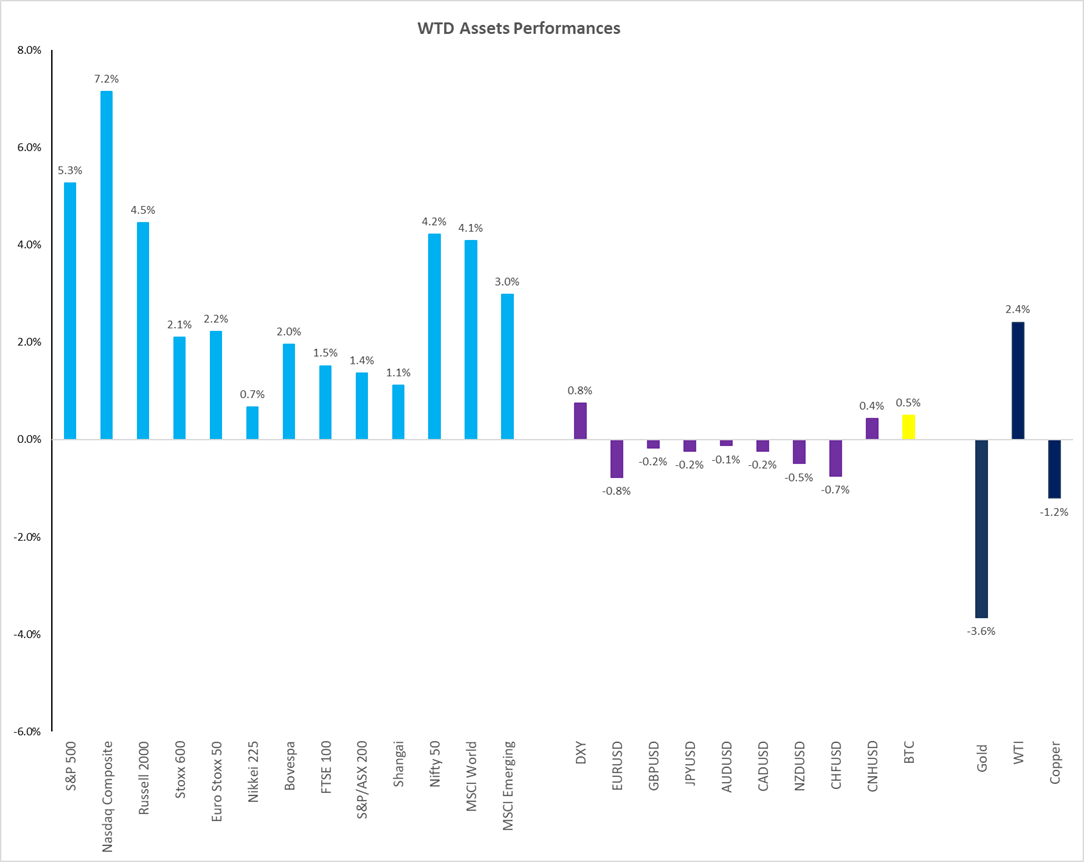

📊 Week-to-Date Performance Snapshot

- S&P 500: +5.3%

- NASDAQ: +7.2%

- Gold: -3.6%

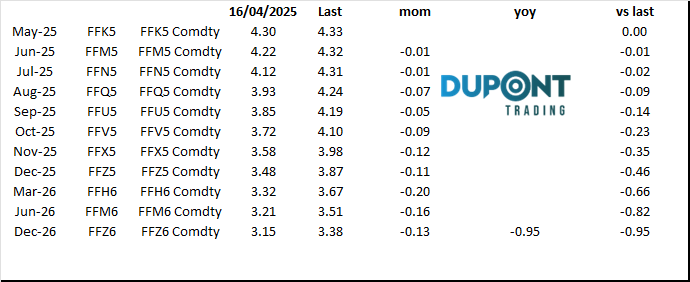

- U.S. 10-Year Yield: 4.48% (up 10 bps)

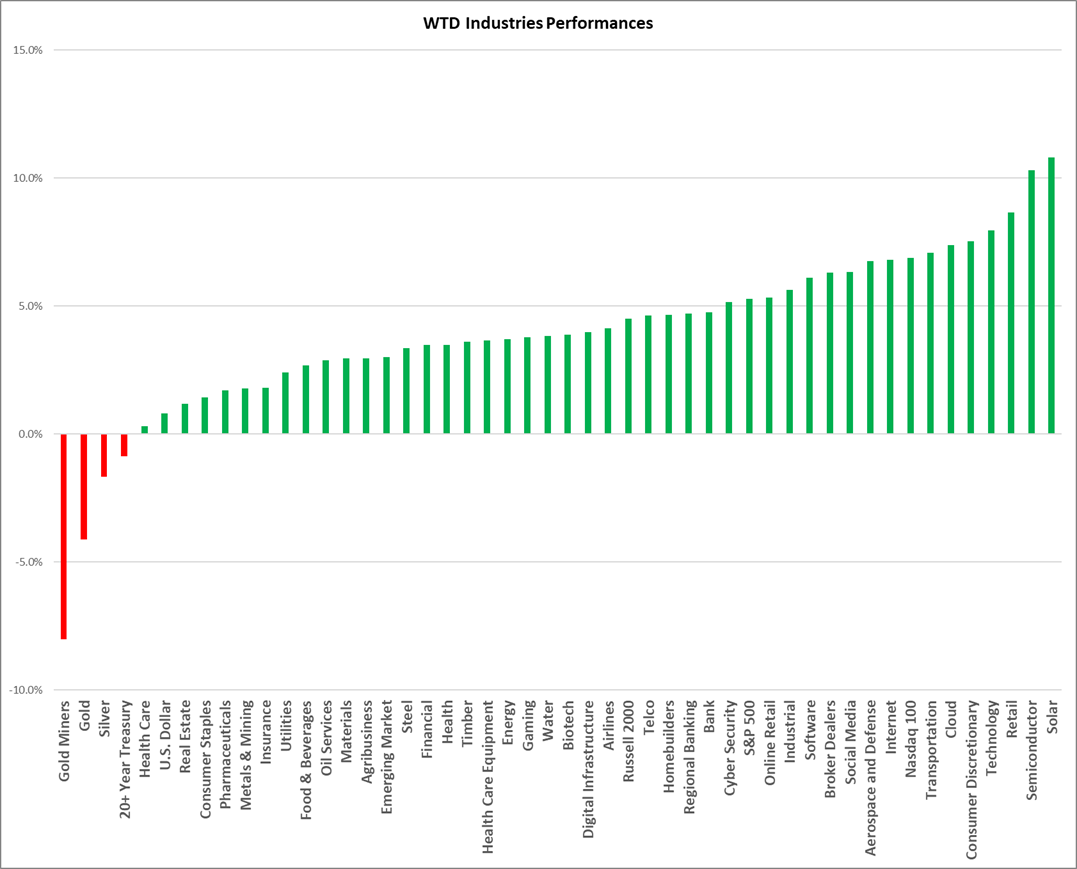

The rally was driven by a narrow group of names—semiconductors, FANG stocks, and high-beta tech. Nvidia surged on China tariff news and Middle East deals, while defensive sectors like healthcare, real estate, and utilities lagged.

🧠 Sector & Style Rotation

- Winners: Tech (XLY), Consumer Discretionary (Tesla, Amazon), High-Beta Stocks

- Losers: Healthcare, Utilities, Staples

- Strategy: Long high-beta, short low-beta = strong outperformance

💣 Moody’s Downgrade: Echoes of 2011?

Moody’s downgraded U.S. debt after Friday’s close, echoing the S&P downgrade of 2011. The U.S. now carries a 124% debt-to-GDP ratio and a 5–7% deficit, raising serious questions about long-term fiscal sustainability.

Expect volatility early next week, especially in bonds and the U.S. dollar. The downgrade could shift sentiment away from U.S. assets in favor of global diversification.

🔮 Fed Watch & Volatility Trends

- Rate Cuts: Market now pricing in just 2 cuts in 2025, starting around October

- VIX: Crushed post-OPEX; short-term vol at 14%, 30-day at 17.2%

- S&P Weekly Straddle: Implied move of just ±1.3%—volatility compression in full effect

📉 Technicals & Trade Setups

- S&P 500: Rallied from 5500 to 5975, breaking through 5830 resistance

- NASDAQ: Similar pattern, outperforming slightly

- Gold: Down ~10% from highs; weaker demand from China and ETFs

- DAX (Germany): New all-time highs—bullish breakout

🛍️ M&A Watch: Retail Revival?

- Foot Locker acquired by Dick’s Sporting Goods at an 85% premium

- Chart mirrors UNH—massive drawdown before the pop

- Reminder: FOMO trades often ignore the pain that preceded the gain

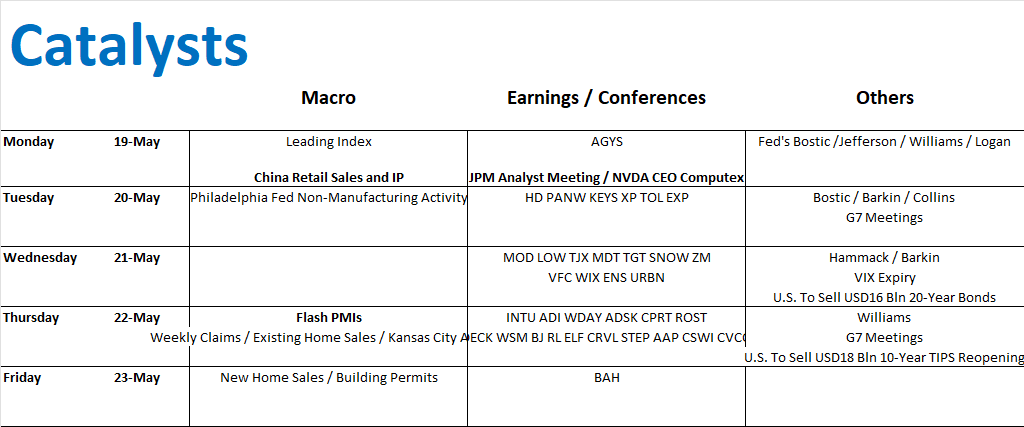

🗓️ What’s Ahead: Key Events to Watch

- Chinese Retail Sales & Industrial Production (Sunday night)

- JPMorgan Analyst Day – Jamie Dimon speaks

- Nvidia at Computex – Ahead of May 28 earnings

- Flash PMIs (Thursday)

- VIX Expiry (Wednesday) – Potential market inflection point

- G7 Meetings & Ukraine Talks – Geopolitical backdrop

💬 Final Thoughts

We’re in a familiar regime: high-beta, short-squeeze, tech-led rallies. Until the market signals a shift—via sector rotation or macro surprises—stay with the trend. But be cautious. The downgrade, compressed volatility, and overbought conditions suggest a potential turning point.

Community and Mentoring

- Join Our Community: Our Discord community offers both free and advanced channels for in-depth discussions: https://discord.com/invite/Yf42SgAx7f

Access to 30 channels for just $74.99 per month. https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

- For personalized mentoring, reach out soon as slots are filling up quickly.

Have a good Trading Week!

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions