Trump vs. “Too Late” Powell

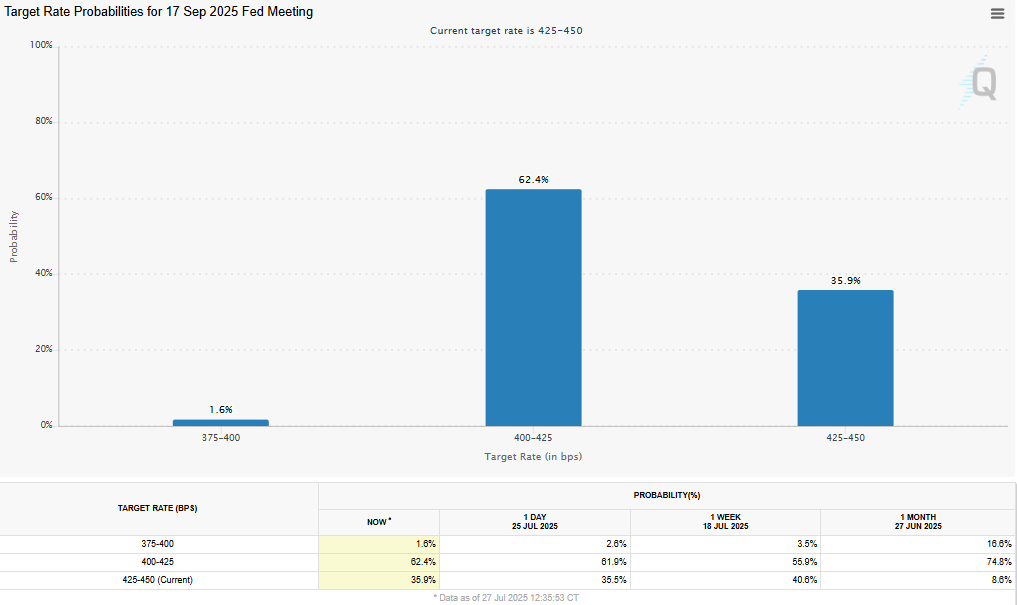

President Trump made headlines again, visiting a Fed building and criticizing Chair Jerome Powell for being “too late” on rate cuts. Trump argues that rates are 200 basis points too high and is expected to ramp up pressure if the Fed holds steady at this week’s FOMC meeting.

FOMC Preview:

- 📅 Meeting: Wednesday

- 📉 Market expects no change (98% probability)

- 📆 Next potential cut: September (60% chance)

📊 Markets at a Glance

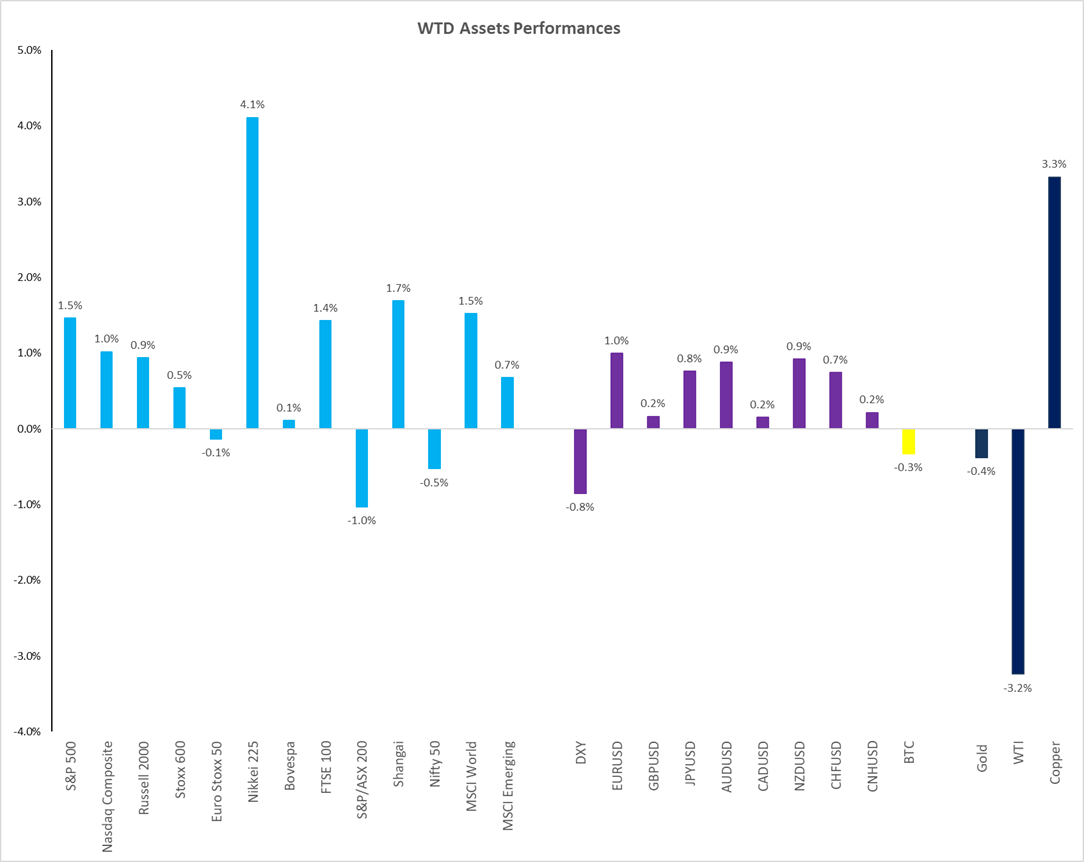

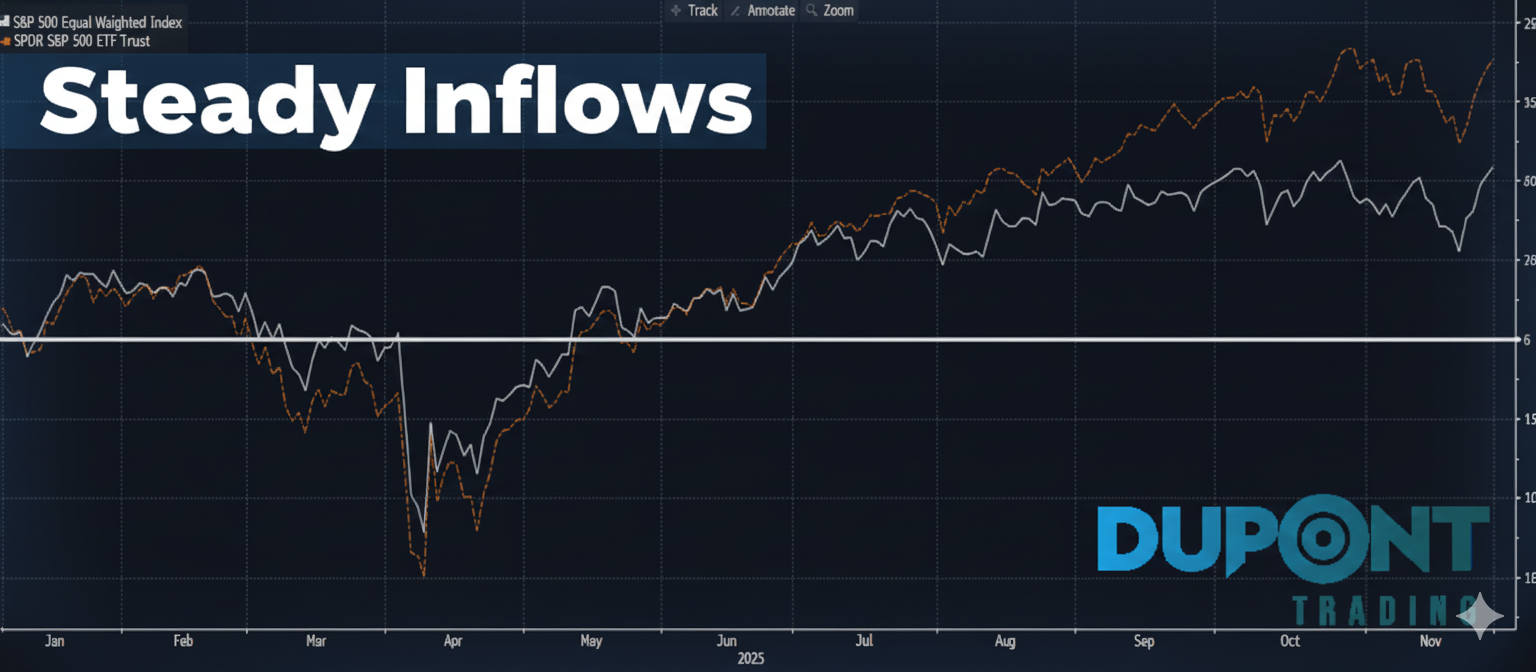

Despite the noise, markets are climbing:

- S&P 500: +1.5% (week-to-date)

- Japan: +4.1% (post-election stimulus hopes)

- Dollar: Sideways, slight weakening vs. Euro (~1.1750)

- Bitcoin: Flat

- Ethereum: New highs driven by stablecoin inflows

- WTI Oil: Down

- Copper: Up

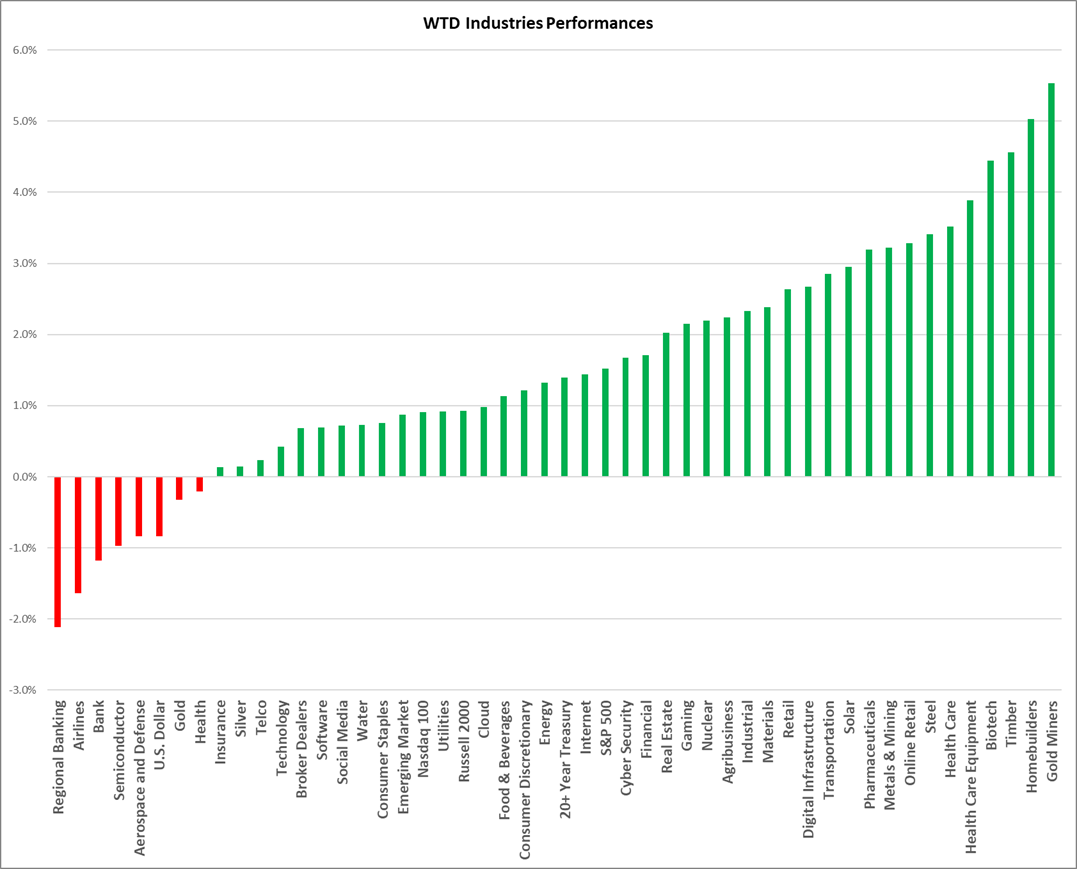

🏠 Sector Watch: Housing, Healthcare & More

- Homebuilders: Strong earnings despite high mortgage rates

- Healthcare: Catching up after underperformance

- Regional Banks & Airlines: Some profit-taking

- S&P Trend: Broadening strength, but some argue it’s a sign of exhaustion

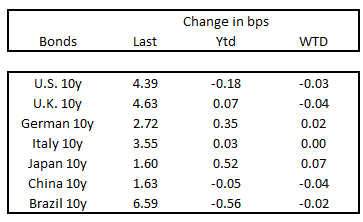

📉 Rates & Yields

- US 10-Year: 4.4%

- Japan 10-Year: 1.6% (+7 bps)

- Reflects global trend of rising yields due to deficits and bond supply

- Higher financing costs are the new normal

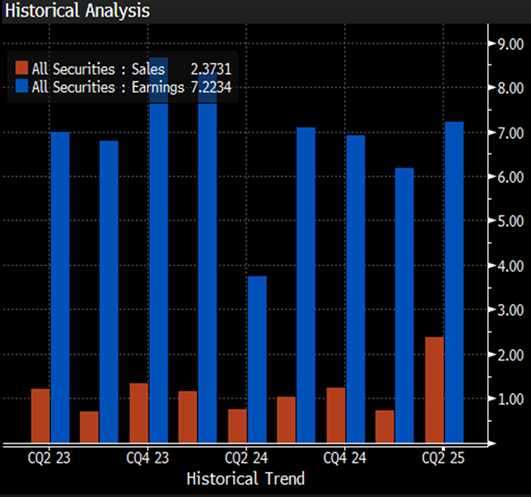

🧠 Earnings Season: Strong Top-Line Beats

- 500 companies reported (20% of US market)

- Sales beats: +2% vs. usual +1%

- Earnings beats: 80%+ of companies

- Notable: Google raised capex by $10B, signaling strong AI investment

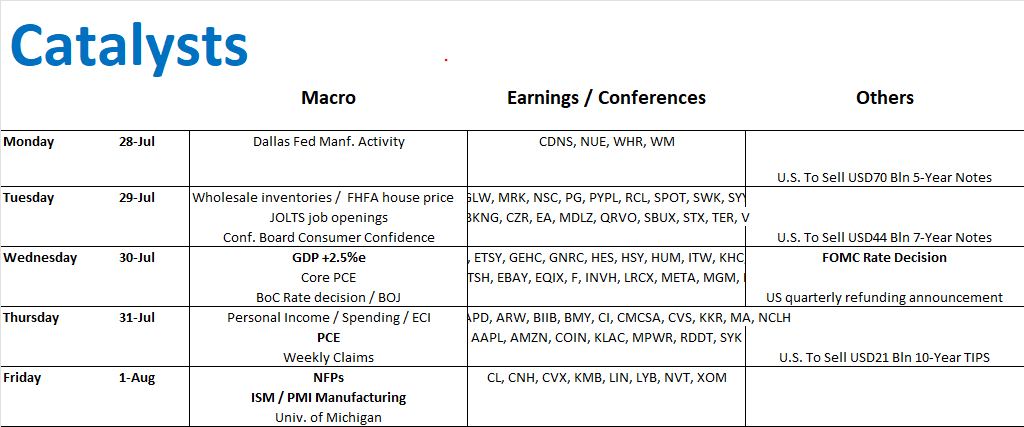

🧪 Macro Catalysts This Week

This is the busiest week of the year for macro and earnings:

🧾 Economic Data:

- Wednesday: US GDP (+2.5% expected)

- Thursday: Core PCE

- Friday: NFP Jobs Report + ISM Manufacturing (US & Global)

💼 Earnings Highlights:

- Big Tech: Meta, Microsoft, Amazon

- Other Sectors: Visa, Starbucks, Energy names

🧨 Volatility: Calm Before the Storm?

- S&P 30-day implied vol: <15%

- Weekly straddle pricing: ±1.3%

- Retail traders: Still active in short-dated options (e.g., OpenAI-style meme trades)

Despite looming catalysts, the market is pricing in calm. Protection is cheap—but few are buying it. As always, this could end in tears, but for now, the grind continues.

📈 Chart of the Week: S&P Futures

The long-term uptrend remains intact. Most stocks are trading above key moving averages. While some signs of overextension exist, momentum remains strong.

💬 Community & Mentoring

Interested in joining the trading community or mentoring program?

- Discord: 1 free channel, 30+ premium channels ($75/month)

- Mentoring: Limited seats for September start

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

🧭 Final Thoughts

Markets are grinding higher with broadening participation. But with macro data, earnings, and geopolitical developments all converging this week, stay sharp. Volatility may be low—but the catalysts are plenty.

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions