They manipulated Bitcoin

Welcome to this week’s newsletter, distilling the key market movements, economic drivers, and technical analysis from our latest session. It was another week defined by a risk-off sentiment across asset classes, with several major concerns impacting the markets.

📉 Key Market Drivers

The market’s performance continues to be influenced by several significant factors:

- AI Bubble Concerns: A major question for the market is whether AI is currently in a bubble. Over the last two to three years, roughly 80% of all earnings growth has come from AI, highlighting the market’s strong AI dependency.

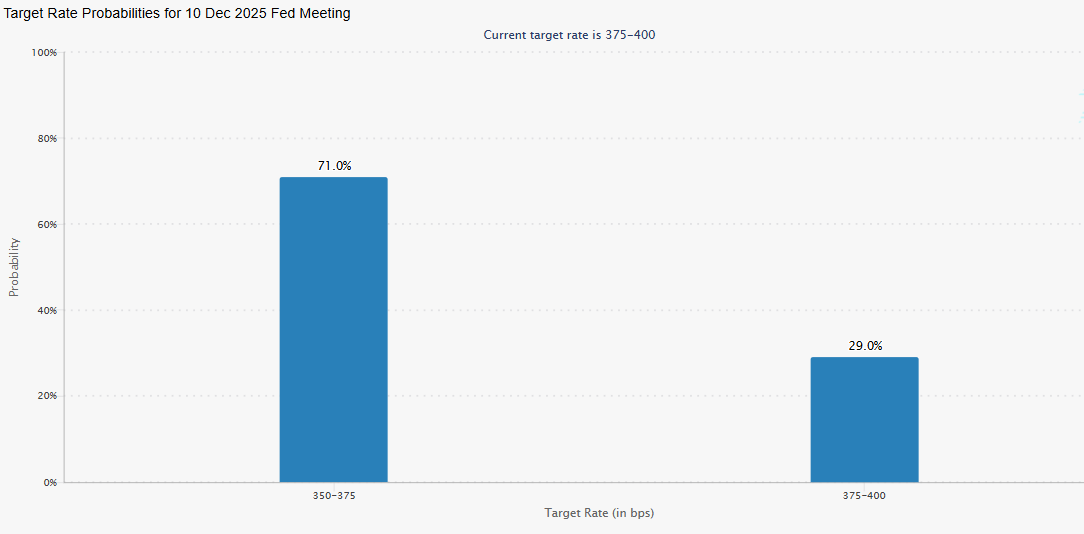

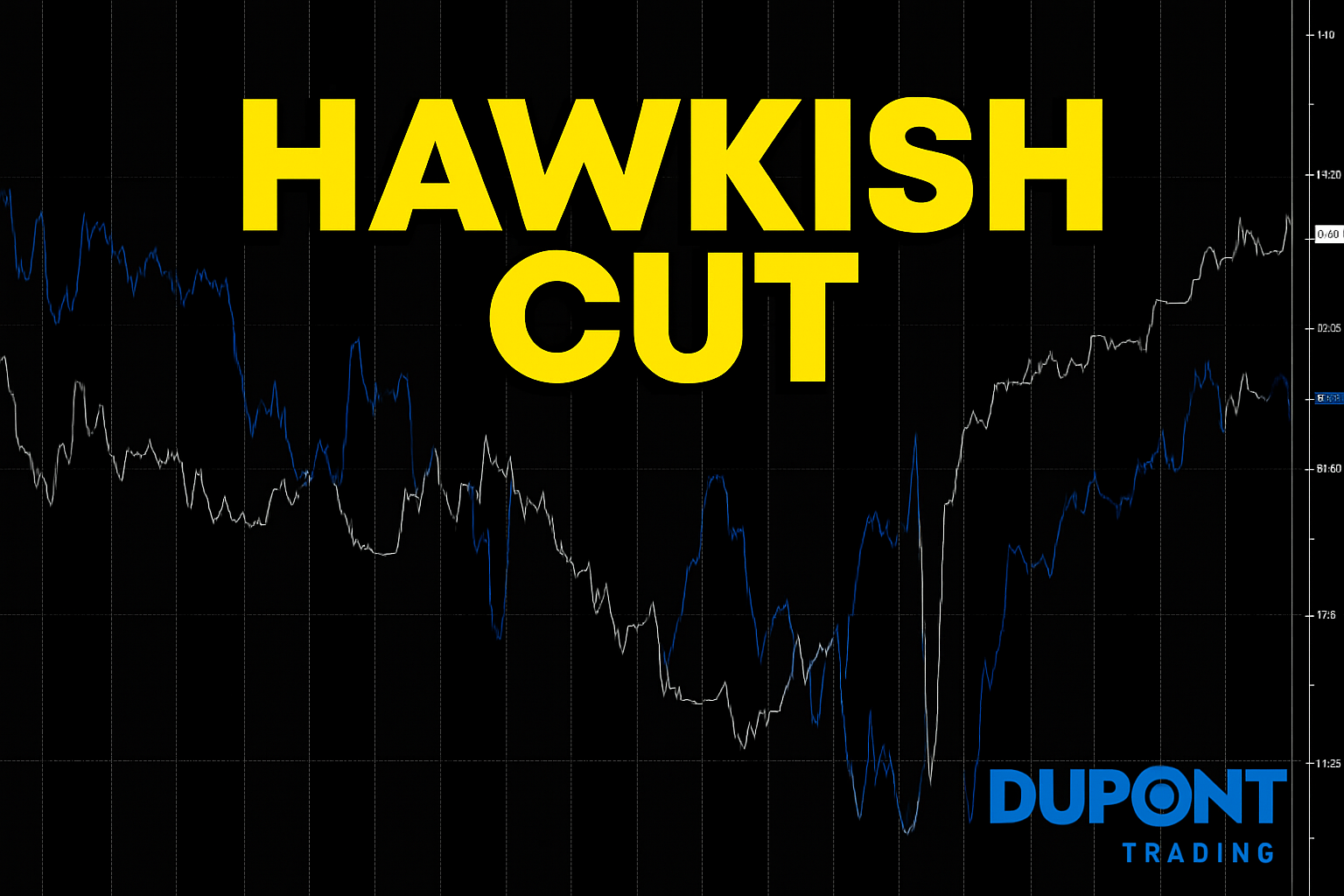

- The Fed and Rate Cuts: There is increasing focus on whether the Fed will cut rates in December. The market is now roughly expecting a 70% chance of a cut in the December FOMC meeting, spiking from 40% on Friday after a Fed speaker’s comments.

- Tariffs Reversal: The possibility of a tariffs reversal decision in the US, potentially coming around December, is another driver.

- Japanese Yen and Fiscal Stimulus: Japan’s significant fiscal stimulus is weakening the Japanese yen, which has ripple effects across various asset classes.

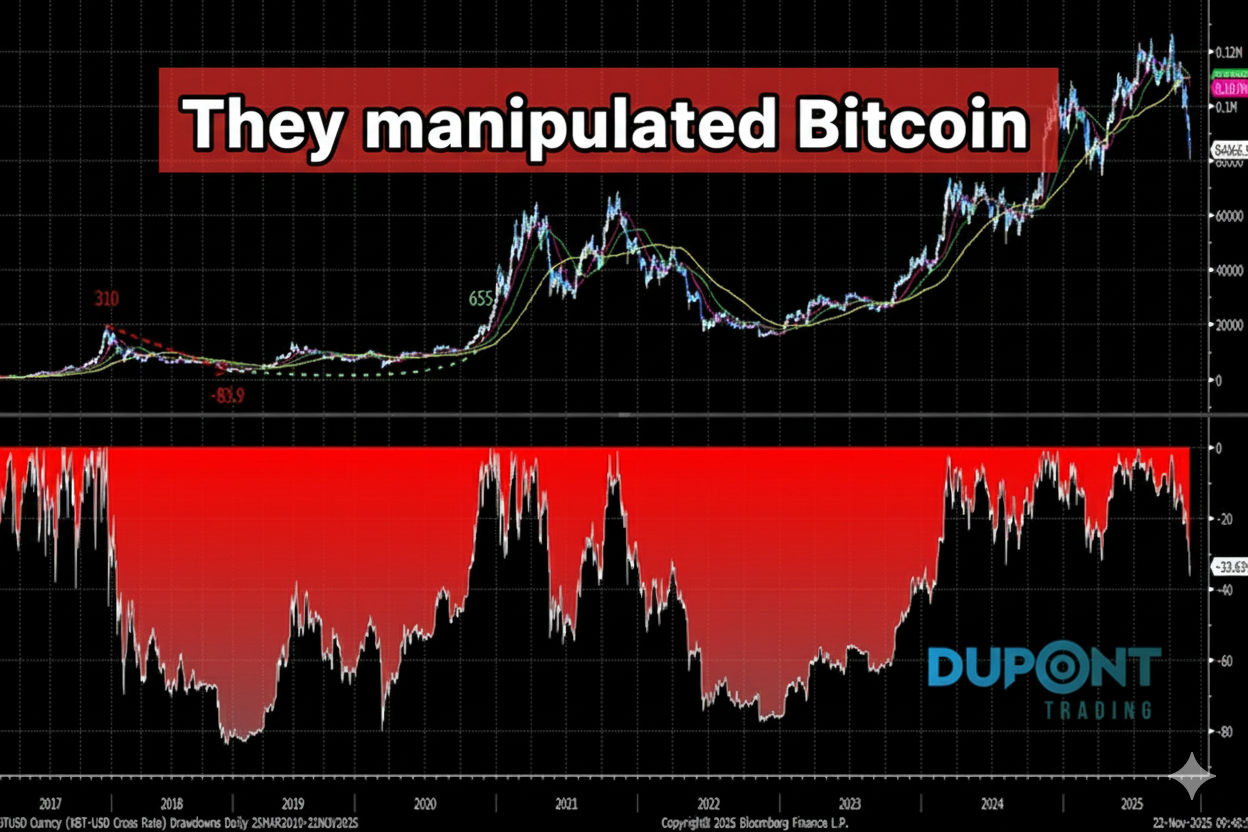

₿ Cryptocurrency Corner: Bitcoin’s Selloff and “They”

The week saw a continued selloff in Bitcoin, which is now back below $\$85,000$.

- Current Selloff: The current selloff is approximately 35% from its all-time high. Historically, Bitcoin has seen drawdowns of roughly $70\%$ to $80\%$ twice over the last eight years.

- Post-ETF Average Price: Since the creation of Bitcoin ETFs (start of 2024), the Volume-Weighted Average Price (VWAP) for holders is around $\$88,000$ to $\$89,000$. This means investors who joined the crypto space via ETFs are now down 5% to 10%.

- The “Manipulation” Red Flag: There is striking trend of people, even at a CNBC event, claiming that “they” manipulated Bitcoin lower. This is flagged as a huge red flag. There is “nothing like they in the market,” and poor performance is a reflection of wrong positioning, wrong risk management, or individual mistakes.

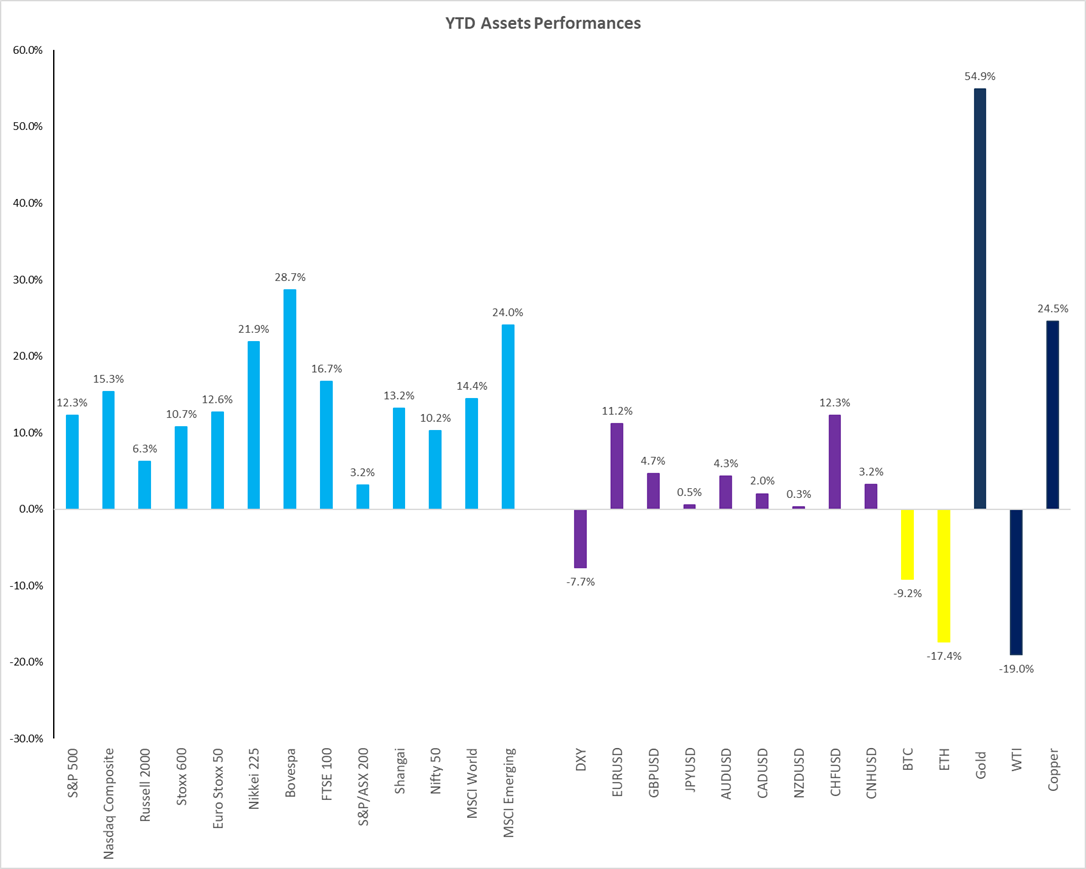

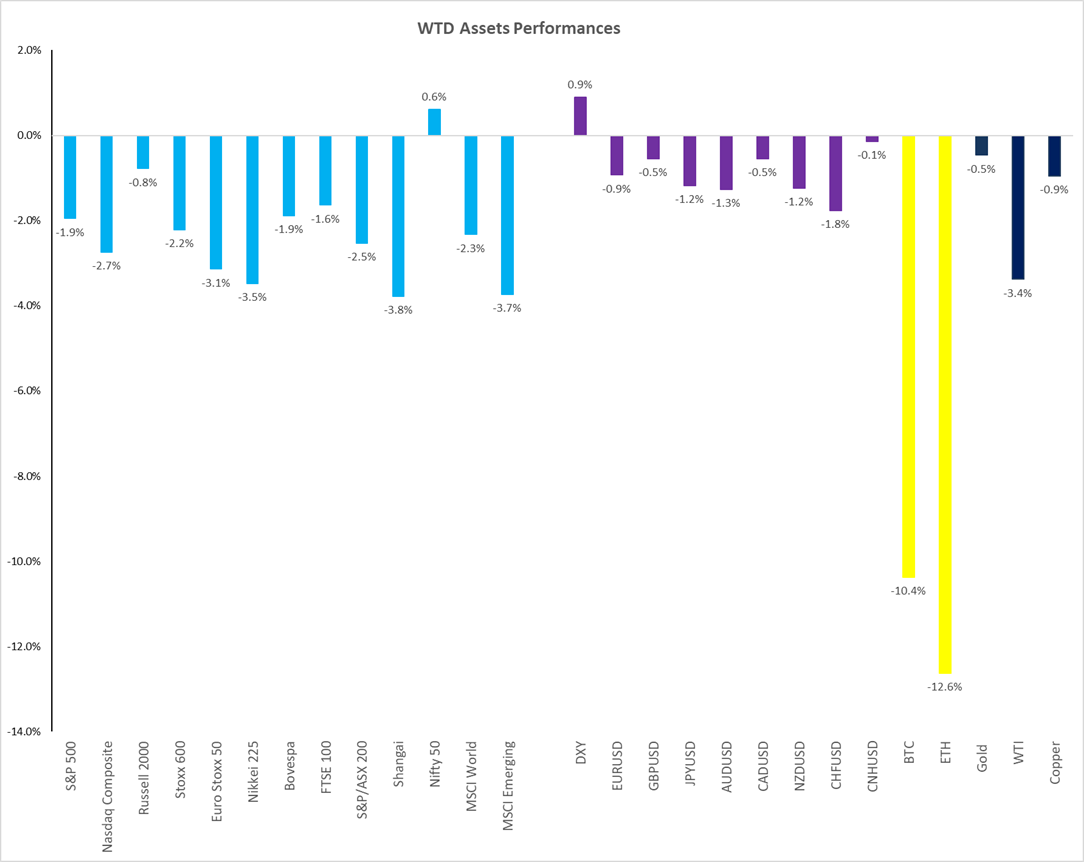

📊 Year-to-Date & Week-to-Date Asset Performance

Asset Class Year-to-Date Performance

Week-to-Date Performance (Risk-Off)

💡 Sector Reversion and Alpha Generation

- Sector Performance: Sectors that were strong year-to-date (like Semiconductors, Technology, Internet, and Cybersecurity) saw a lot of red and are experiencing a reversion to the mean.

- Defensive sectors like Healthcare and Consumer Staples (up $\approx 1\%$ on the week) performed well, confirming the defensive call from last weekend’s session.

- The Alpha vs. Beta Distinction: The price action across top stocks is similar, meaning simply buying them is often just doing beta (carrying systematic market risk). Generating alpha is key in the industry, which means outperforming the overall market, such as the call for Proctor & Gamble versus the S&P 500.

🚨 Technical Analysis & Key Stock Movers

- S&P 500 Futures: Broke the 50-day moving average. The next big support is the 200-day moving average, which is $\approx 400$ points or $7\%$ away.

- VIX Volatility: The VIX experienced very high volatility, spiking massively on Wednesday and Thursday due to the expiration of the November futures contract, leading to repositioning and rehedging.

- Nvidia Earnings: The stock saw a “buying the rumors, selling the news” reaction after earnings on Wednesday, leading to a huge move on Thursday. It literally opened at the top and closed at the lows, moving from $\$197$ to $\$180$.

- AI Winners: Not all AI stocks are selling off. Apple is seen as potentially buying cheap companies since it hasn’t spent heavily on capex. Alphabet (Google) is doing very well following the launch of Gemini, cementing its status as one of the biggest winners in the AI space.

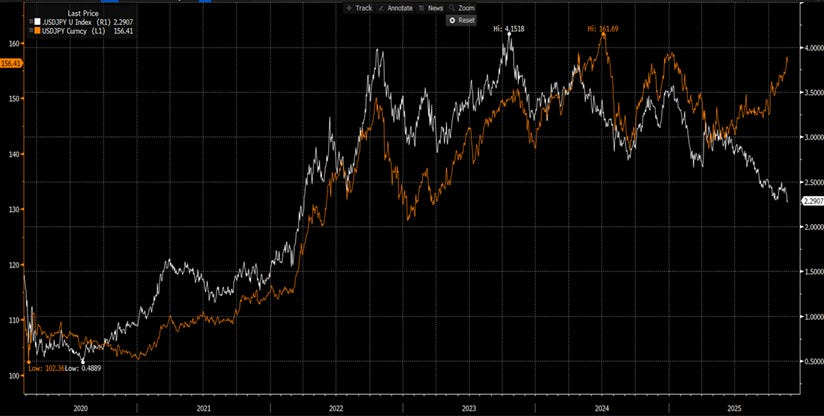

🇯🇵 Focus: The Dollar/Yen Divergence

The Dollar/Yen ($/¥) cross is a crucial space to watch.

- The Stimulus Effect: A new government in Japan has signed a huge fiscal stimulus (over $\$100$ billion).

- Divergence: Despite Japanese rates and yields going up (10-year, 30-year) , the Japanese yen has been weakening. There is a massive divergence between the rate differential (US 10-year vs. Japan 10-year) and the dollar/yen.

- Implications: This pattern (raising rates while the currency weakens) is often seen in emerging markets and could lead to more talks of FX intervention.

USDPY (lhs / orange) vs U.S.10y – JP10y (rhs / white)

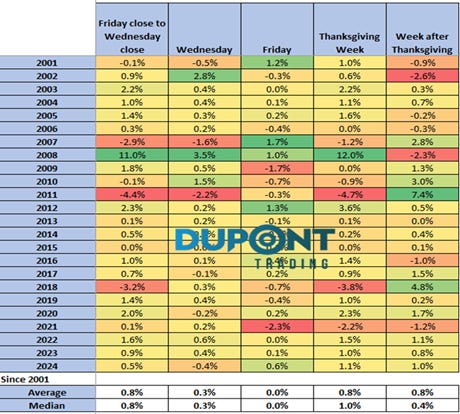

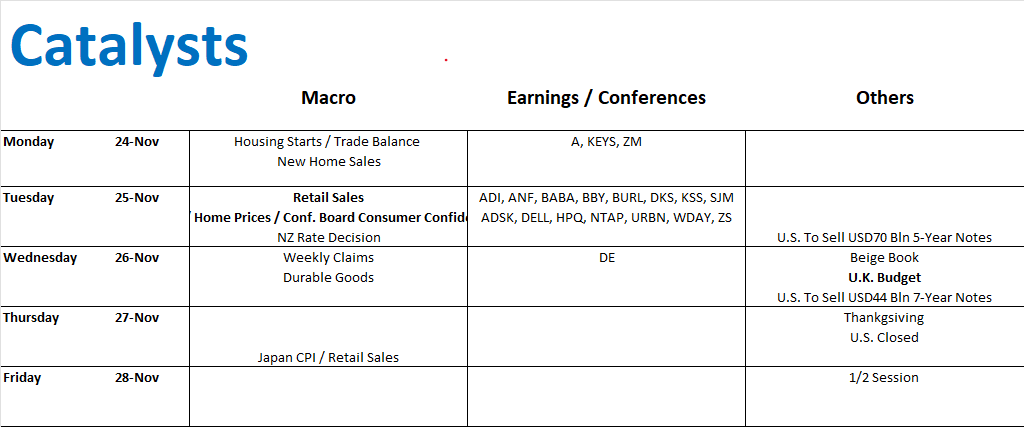

🗓️ The Week Ahead (Thanksgiving Week)

- US Holiday: The US market is closed on Thursday for Thanksgiving and will only have a half-session on Friday. This will likely result in a drying up of market depth and liquidity, which could lead to extended, volatile moves.

- Thanksgiving Season Historically: Historically, the S&P 500 has done pretty well during the week of Thanksgiving.

- Catalysts:

- Ukraine/Russia Deadline: A deadline from the US on Ukraine/Russia aid this Thursday is one to watch.

- Earnings: Dell on Tuesday and Dem on Wednesday are key earnings.

- Japan CPI & Retail Sales: Japanese CPI and retail sales on Thursday are important to watch given the fiscal stimulus.

🔗 Join the Community

Want to dive deeper or join the community?

📧 Book mentoring for Q1 2026: https://duponttrading.com/mentoring/

🎥 Access the 4×4 video series: https://duponttrading.com/4×4-course/

💬 Join the Discord: 30 channels of trading insights: https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us atGreg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions