The Market’s Hidden Divergence: What Gold, VIX, and Banks Are Telling You

Last week was a rollercoaster, with gold stealing the spotlight, earnings season kicking off, and regional banks flashing warning signs. Here’s what stood out:

Gold: The Meme Stock of 2025?

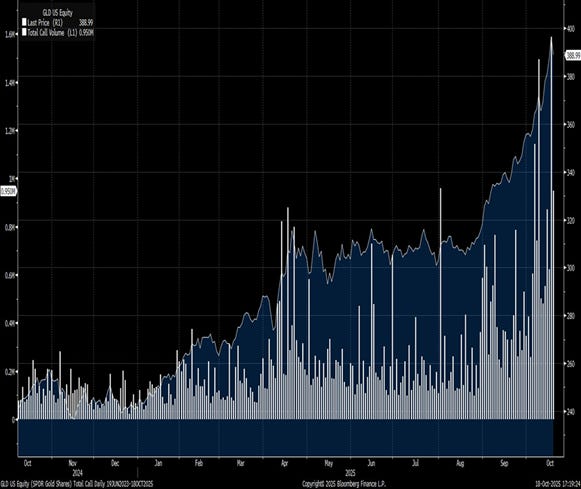

- Gold (GLD) surged to new highs, fueled by retail call options and a gamma squeeze reminiscent of meme stocks like Palantir and Tesla.

- Key observation: Gold options expire on Mondays, Wednesdays, and Fridays—unlike the weekly maturities for stocks. Thursday saw massive call volume, but the rally continued, suggesting a potential short-term top.

- Caution: Playing the contrarian side is risky. Wait for a correction or a high-volume reversal before betting against the trend.

- The Key Signal: We’re likely approaching a near-term top. Friday showed huge volume candles, and while the exact timing is impossible to call, the pattern suggests a climax is near. If you’re thinking of shorting, proceed with extreme caution—the trend is still up, and fighting momentum rarely works. The smart play is patience: wait for a correction and watch for the actual reversal signal.

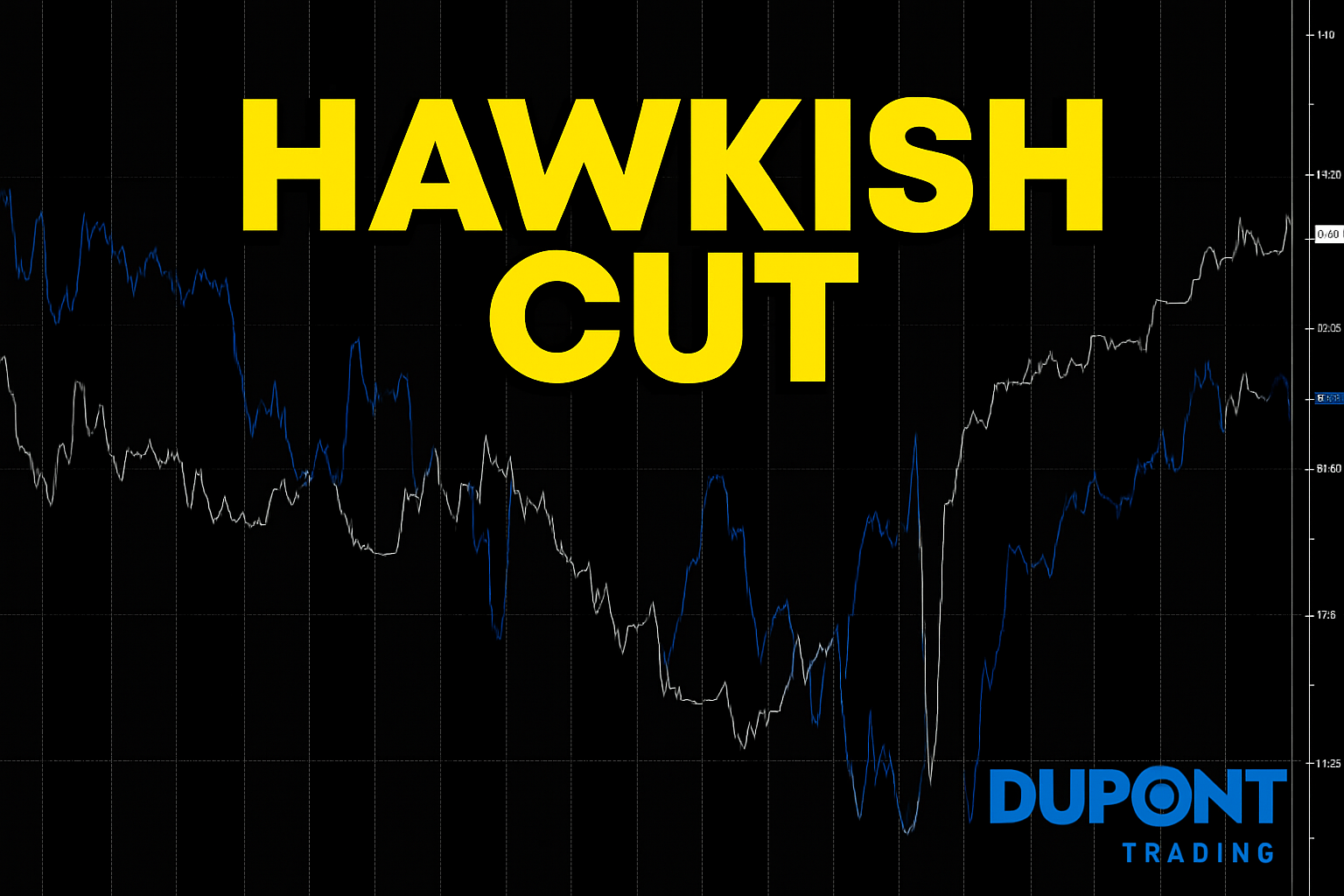

Stocks vs. Volatility: A Divergent Picture

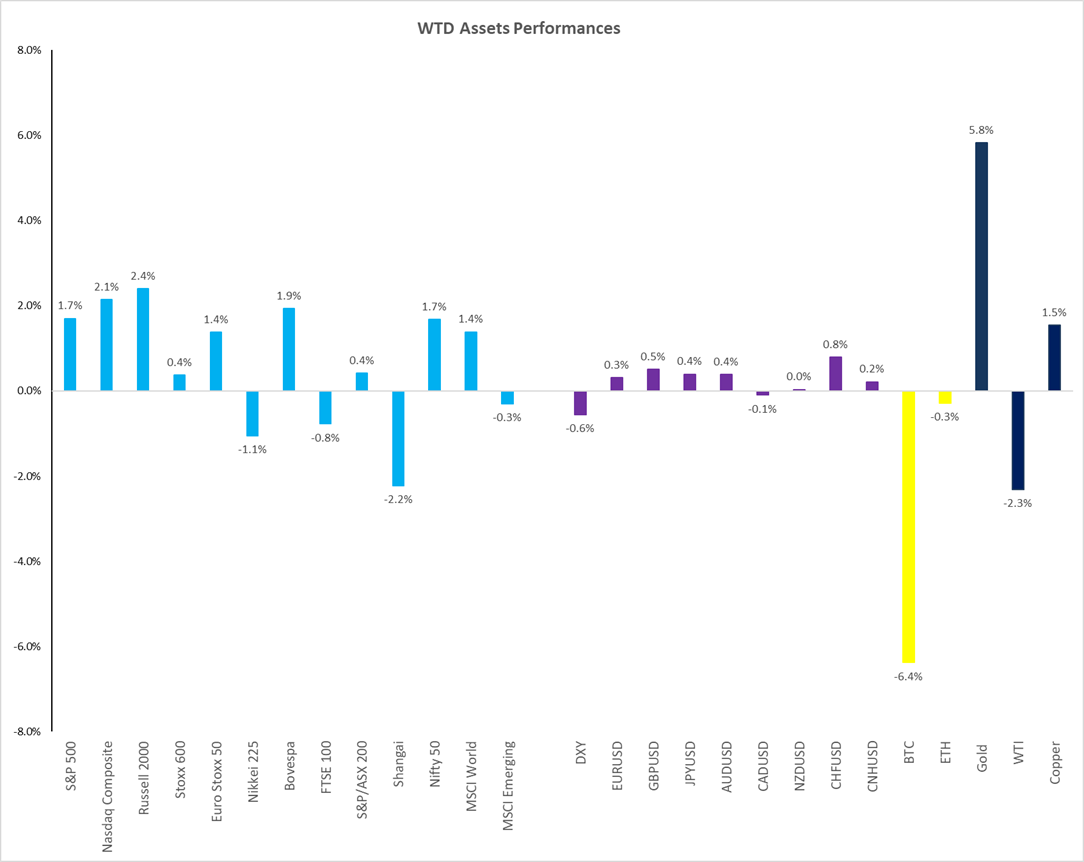

- S&P 500 (+1.7%) and NASDAQ (+2.1%) inched closer to all-time highs, but the VIX spiked above 25%, signaling underlying unease.

- Sector performance: Semiconductors led the charge, while regional banks and insurance stocks lagged.

- Why? Credit spreads remain compressed, pricing in little risk—leaving traders exposed to asymmetric downside if conditions worsen.

Regional Banks: Déjà Vu?

- Earnings from big banks (JPMorgan, Citigroup) beat expectations, but price action was tepid. Meanwhile, regional banks faced pressure due to rising loan provisions.

- JP Morgan CEO Jamie Dimon’s warning: “Cockroaches in the credit market”—are we seeing isolated issues or the start of a broader trend?

- Watchlist: Credit spreads, loan loss provisions, and financing conditions for smaller banks.

📊 Earnings Season: Early Takeaways

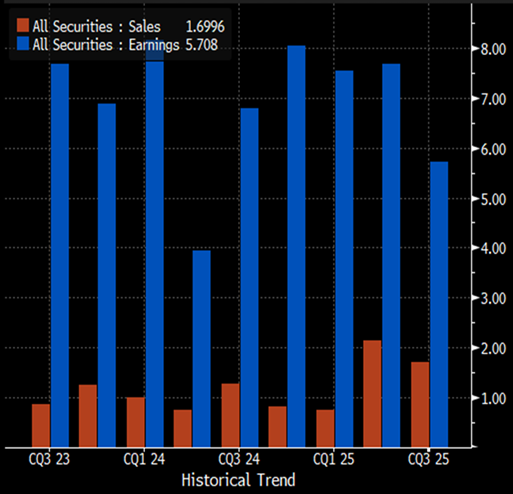

Only 12% of S&P 500 companies have reported so far, but patterns are emerging:

- Beat rates: 86% on EPS (vs. 78% average) and 84% on sales.

- Magnitude: Earnings beats are smaller (+5.9% vs. +8.4% historically).

- Sector reactions: Financials and consumer discretionary stocks struggled post-earnings, while tech (especially AI-related) remained resilient.

Key question: Is this a sign of slowing growth, or just conservative guidance?

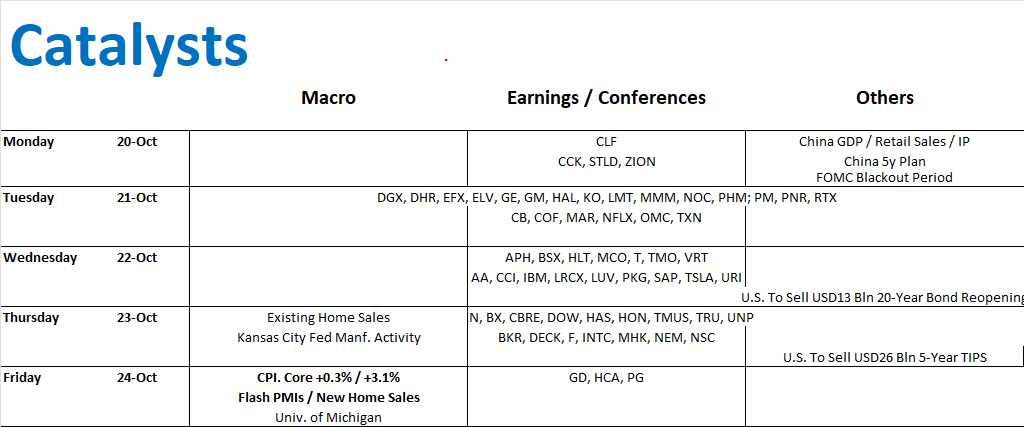

📅 Catalysts Ahead: What to Watch

Macro Events

- Friday, October 24: US CPI report (core CPI expected at +0.3% MoM, +3.1% YoY). Inflation remains sticky, but the Fed’s focus is shifting to employment.

- China data dump (Sunday, October 19): Keep an eye on economic indicators—China’s recovery could impact global risk sentiment.

- FOMC meeting (October 29): Two rate cuts are priced in for 2025. Will the Fed signal more?

Earnings Highlights (Week of October 20)

- Tuesday: Coca-Cola, Netflix

- Wednesday: Intel, Tesla

- Tech theme: AI deals (e.g., OpenAI-Broadcom) continue to drive momentum.

Technical Levels

- S&P 500 futures: Trading in a 180-point range (6,520–6,700). The 50-day moving average is critical support.

- Gold: Watch for a high-volume reversal—could signal a short-term top.

- VIX: Elevated implied volatility suggests hedging demand remains high.

Trading Insights

- Gold: Avoid chasing the rally. Look for exhaustion signals (e.g., high volume with a flat/down close).

- Regional banks: Monitor credit spreads and loan provisions for signs of contagion.

- Tech/AI: Momentum remains strong, but valuations are stretched. Use pullbacks to enter.

- Volatility: With the VIX elevated, consider tail-risk hedges (e.g., VIX calls) ahead of CPI and FOMC.

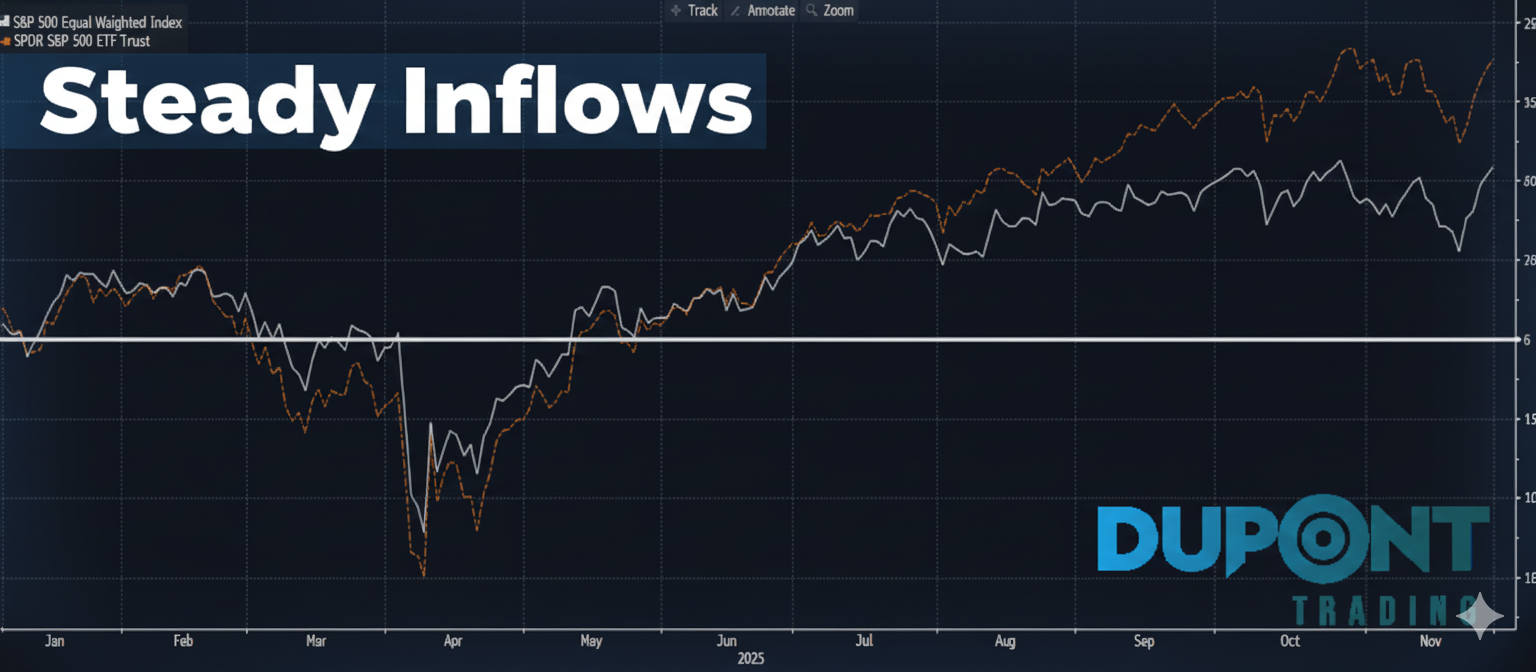

Stocks are near all-time highs, but signals are mixed. Gold is climaxing. The VIX is elevated. Regional banks are struggling. Credit spreads are absurdly tight. Two major hedging strategies (vol control and CTAs) just unwound significant positions.

This is a market where the payoff structure is skewed—if things go smoothly, you make almost nothing. If they don’t, you lose a ton. Tread carefully.

Expected S&P movement for the week: ±1.9% or about 130 points. That’s material, and with earnings, macro data, and political headlines flowing, volatility is likely to persist.

If you’d like to join or explore our 30+ private trading channels for $74.99/month, now’s the time.

https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions