The Low Volume Factor

On one hand, some will argue that it is risky to go against a dull market, that you should not fight the trend.

On the other hand, some will argue that the low participation reflects low conviction, hence you should sell it. The trend is your friend until it ends.

From my recent little experience, I tried to short a dull market in 2017 and I was not really successful.

So unless you see a pick-up in volumes, it is hard to take a stance. Volume is a big story teller.

Best is to probably reduce longs on the way up, and/or stay on the sidelines with neutral net exposure, and/or building short exposure with put options (“cheap” premium).

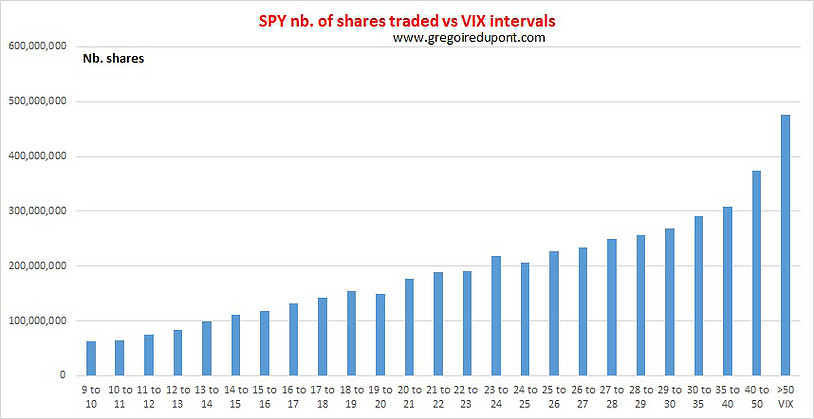

To look at U.S. market participation, I like to follow the volumes on the SPY.

(For some of you, SPY being an Exchange Traded Fund that is tracking the S&P 500 index).

SPY volume is a good broad indicator.

Let’s look at SPY volume over the last 10 years.

The average daily volume (nb. of shares) has been:

Last 10 years = 136.2m

Last 5 years = 98.2m

Last year = 86.1m

Last 6months = 90m

From 26/12/2018 low = 83m

Last 3 months = 73.3m

Month before High 01/05/2019 = 57.6m

Again not new here but really if you look at last 10years trend, volumes are just drying and recent developments are no exception. Recently we had many sessions with volume around 50m shares, which are normally happening for sessions like Thanksgiving. Market was quiet, very quiet.

For those who might argue that market was a short based on low participation for quite a long time, just look at facts:

We had already low volumes when SPY was at 270 or 280, meaning 5% to 10% below the highs.

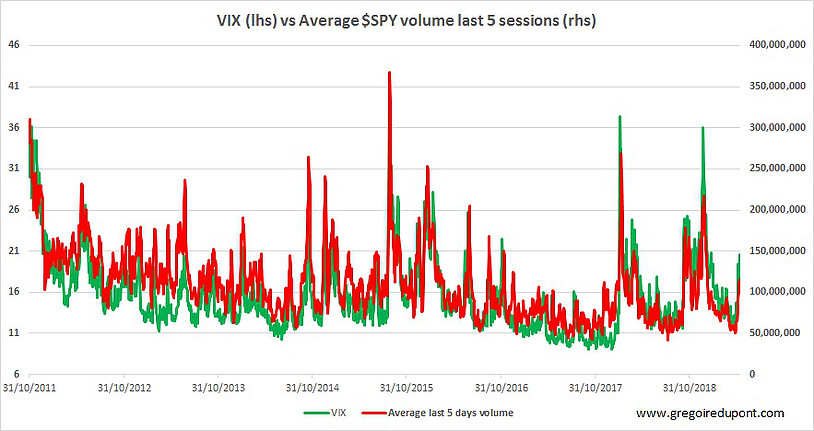

As I posted recently on twitter, I like to look at the correlation between VIX and volume:

and

Volume could pick up but recent correction has been in lower volume than usual for such a VIX spike.

One of the reasons might be the abnormal VIX short interest carried by the market before the sell-off.

That would be like VIX “overreacting” on short squeeze.

Otherwise, based on recent VIX around 20-21, you would be looking at volumes for the SPY between 180 and 200m shares.

Based on recent historical moves, how is the -2.51% fall recorded by the SPY on Monday the 13th of May?

Facts:

Since 2007, the SPY recorded 89 moves between -2% and -3% with

Average Volume = 285.1m

Median Volume = 259m

And that gives you:

With 127m shares traded on the 13th of May 2019, SPY had the lowest volume for a -2% to -3% move over the last 10 years.

Looking at the correlation with VIX, we should be looking at a volume close to 200m.

Looking at past moves, we should be looking at volume around 250m.

Like with the recent volume on the way up (my introduction), you can choose head or tail, ie bulllish or bearish.

Less than 10days ago, some people/analysts were calling for a melt-up in the S&P500. Now some market participants think a big meltdown is coming.

In the past, I have been right and wrong. But recent volume trends tell you one thing for sure:

liquidity and participation are very poor.

So be very careful as moves could be abnormal in the future.

As always, it is very hard to time when it could/would happen but the risk is significant.

I hope it helps,

Gregoire

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions