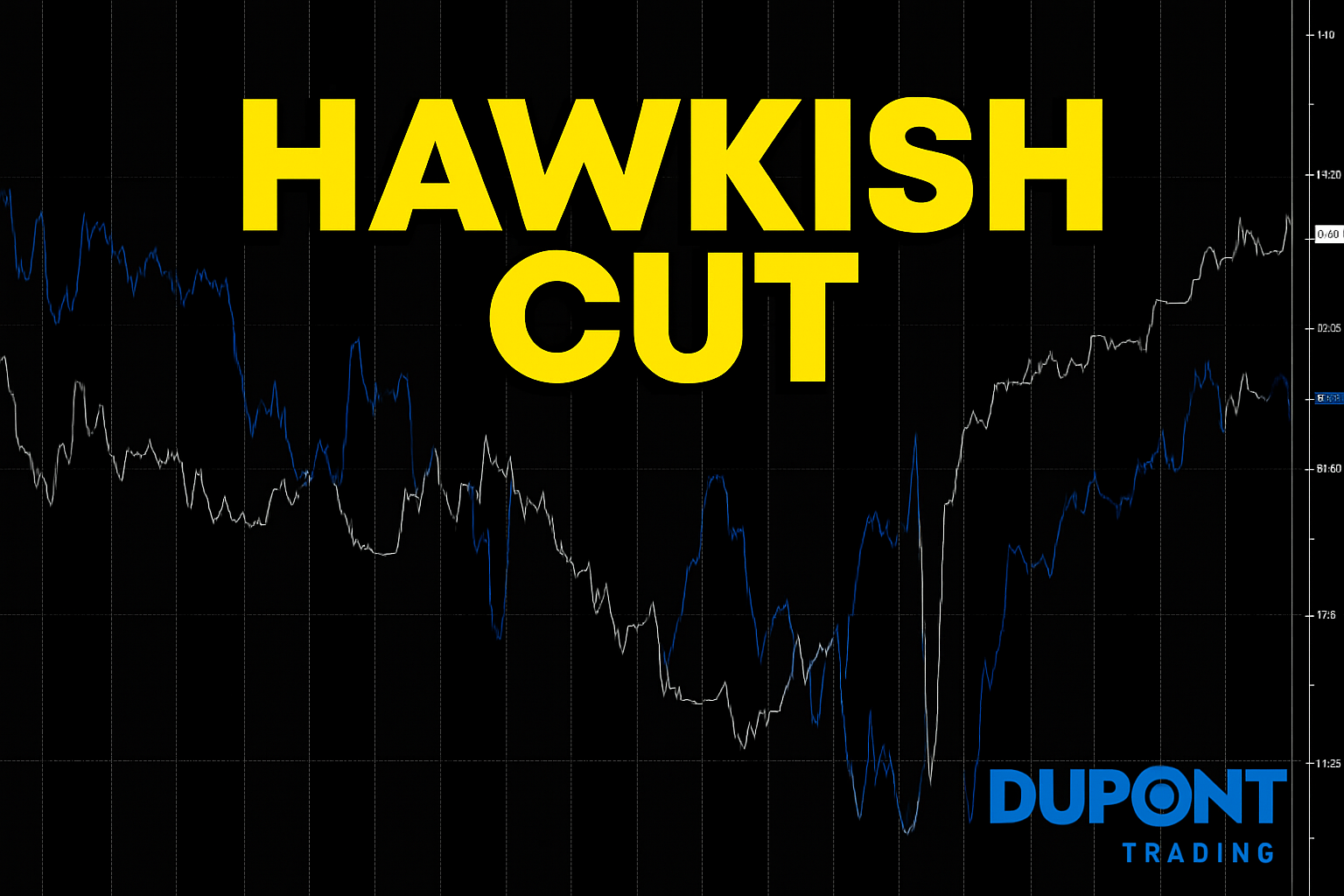

The Hawkish Cut: How the Fed’s 0.25% Move Is Fueling a Two-Week Market Rally

Welcome back to Your Next Trade. This week’s edition explores one of the most important turning points of the year: the FOMC’s expected 0.25% rate cut and the powerful, broad risk-on rally that has unfolded over the past two weeks.

Below, you’ll find a full breakdown of what’s driving markets, the key technical levels across major asset classes, and the catalysts to watch as we head into the final stretch of the year.

🔍 Market Overview — A Two-Week Risk-On Frenzy

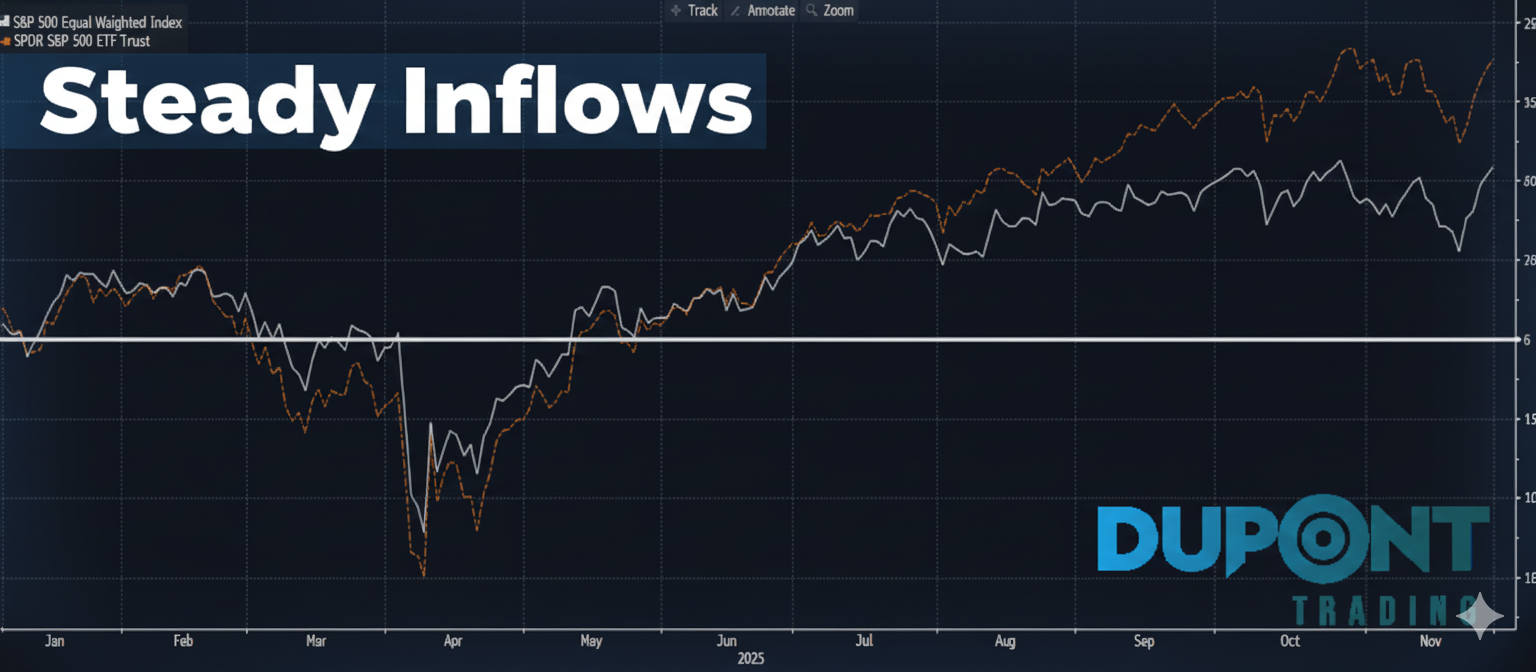

Expectations for a Fed rate cut have surged from 30% to over 90% in just two weeks—and the impact has been immediate.

Equities have climbed virtually in a straight line, with only one down day in the past 10 sessions. Volatility has been crushed from 26% to 15%, allowing volatility-control funds and systematic strategies to increase exposure.

What’s notable:

- Tech continues to dominate.

- Retail traders have returned, pushing up anything high-beta and high-short-interest.

- Market breadth remains weak—a troubling sign beneath the surface.

- Crypto is still underperforming (BTC & ETH both saw a sharp dip on Friday).

- Commodities mixed: Copper & silver strong, WTI steady around $59–60.

- Brazil and the UK lag—political risk & currency strength weigh.

💡 The Macro Backdrop — Why the Rally Looks “Hawkish”

Despite the risk-on mood, yields haven’t fallen, with the US 10-year holding around 4.14%.

Two forces are at work:

1. Governments Are Running Large Fiscal Deficits

US, Europe, and Japan all continue aggressive deficit spending.

More deficit → more bond issuance → investors demand higher yields.

2. Inflation Remains Sticky

The latest PCE print came in at 2.8% YoY, still above target.

This means the coming Fed cut may be hawkish in tone—offering support, but not turning fully dovish.

📈 Asset Class Breakdown

Equities

The S&P 500 and Nasdaq futures are now within 1–2% of all-time highs.

Price action resembles a VWAP-driven grind, typical when large institutional programs are active.

Leaders:

- Non-profitable tech

- High-beta retail favorites

- Short-squeeze names (e.g., Carvana entering S&P 500)

Laggards:

- Utilities (hurt by higher yields)

- Healthcare

- Consumer Staples (PG flagged weak low/mid-income demand)

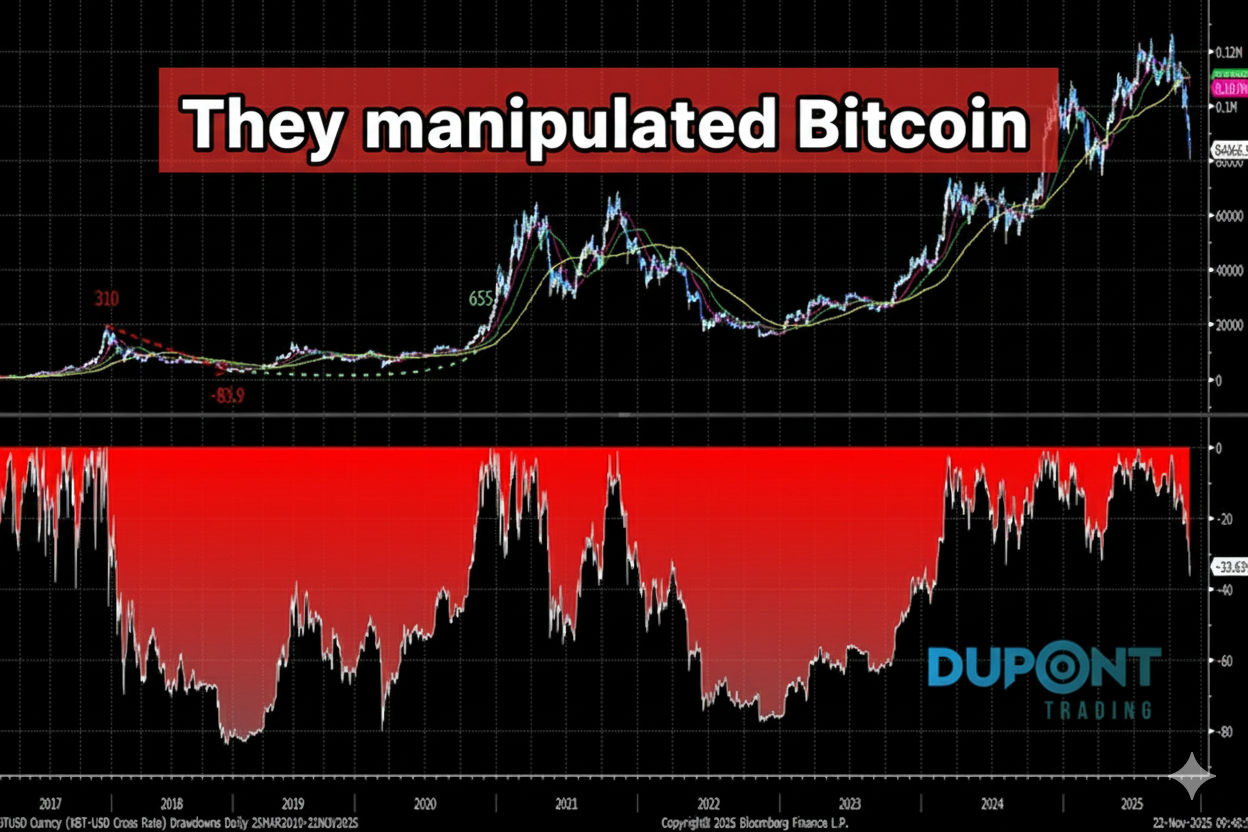

Crypto

Crypto remains decisively out of favor:

- BTC and ETH underperformed sharply last week

- Crypto is no longer leading risk assets

- Market prefers AI, tech, and short-squeeze plays

FX

- USD/JPY pushing toward 160—trend remains strong

- EUR/USD consolidating but upward bias remains

- Brazilian Real struggled due to geopolitical tensions

Rates & Volatility

- Yields stable above 4%

- VIX crushed to ~15%

- Systematic buying likely to continue into next expiry (two weeks)

📊 Technical Setups

Apple (AAPL)

- Making new highs with no major news.

- Market increasingly prices Apple as an AI beneficiary.

- Partnership with Google Gemini seen as a long-term positive.

Oracle (ORCL)

- Major volatility around earnings expected this Wednesday.

- Key concern: ORCL’s deep investment in AI infrastructure and whether OpenAI monetization will justify it.

- Stock rebounded off the 200 level but remains fragile.

Indexes

- S&P Futures: strong uptrend, single red day in 10 sessions.

- Nasdaq Futures: similar structure; watch 27,000 resistance.

🧨 Macro & Earnings Catalysts This Week

1. FOMC Meeting — The 0.25% Cut

Market expects:

- A cut,

- But muted market reaction.

Last 4 FOMC meetings moved markets less than 0.1%.

This week’s implied range: ±1.5–2%, signaling confidence.

2. AI-Era Earnings

Three critical AI-linked names report:

- Oracle (Wed)

- Adobe (Thu)

- Broadcom (Thu)

These earnings will heavily influence the market’s AI narrative.

3. Costco (Thu)

Key insights into the US consumer, especially low/mid-income pressure:

- Recent monthly sales slightly below expectations

- Valuation remains rich at ~35–40× forward earnings

4. Macro Data Backlog

With the US government reopened, expect daily data drops, especially from October.

5. Bond Supply

Over $100B+ of new issuance hitting the market this week.

Expect yield volatility around auctions.

📺 Big Corporate Move: Netflix Acquires Warner Bros

One of the largest M&A announcements in years:

- Estimated value: $80 billion+

- Expected combined free cash flow (2026): $15–20B

- Massive $58B bridge loan secured

This cements content + data synergies as a major competitive moat.

📌 Bottom Line — What Traders Should Watch

We’re in a compressed-volatility grind-up, supported by:

- Systematic flows

- Retail momentum

- Rate-cut expectations

- Strong tech leadership

But beneath the surface:

Breadth is weak, yields are sticky, and macro risks remain.

This week, focus on:

✔️ FOMC language (tone > cut)

✔️ AI earnings and their forward guidance

✔️ Yield reaction to bond supply

✔️ Whether crypto finds a bottom

✔️ Market breadth & tech dependency

🧭 Stay Connected

Want to dive deeper or join the community?

📧 Book mentoring for Q1 2026: https://duponttrading.com/mentoring/

🎥 Access the 4×4 video series: https://duponttrading.com/4×4-course/

💬 Join the Discord: 30 channels of trading insights: https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us at Greg📩

Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions