The AI Bailout: Who’s Really Funding the $1 Trillion AI Boom?

🚨 The Big Story: When Innovation Needs a Bailout

The buzz around AI has reached a new level — not just because of innovation, but because of financing.

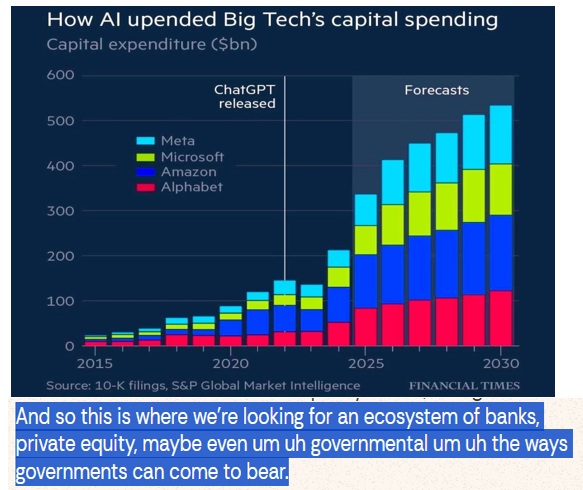

OpenAI’s CFO recently hinted that the company is exploring multiple sources of capital — including private equity, markets, and even banks — to sustain its expansion. That’s on top of Big Tech’s $1 trillion+ capex plans over the next few years.

It’s an astonishing shift: AI giants that once seemed unstoppable are now seeking financial support just to maintain their growth.

This raises the question: Who will fund the AI revolution — and at what cost?

💵 Financing the AI Boom

AI isn’t just consuming data — it’s consuming capital.

Credit markets have started flashing warning signals: credit default swaps (CDS) for major tech names are trending higher, making financing more expensive.

Even Alphabet recently issued $15–20 billion in bonds to finance AI infrastructure. As Big Tech keeps raising capital, we’ll see massive bond supply hitting the market — not just from governments but corporations, creating real competition for investor attention.

In short: the AI boom is now a bond story, not just a tech story.

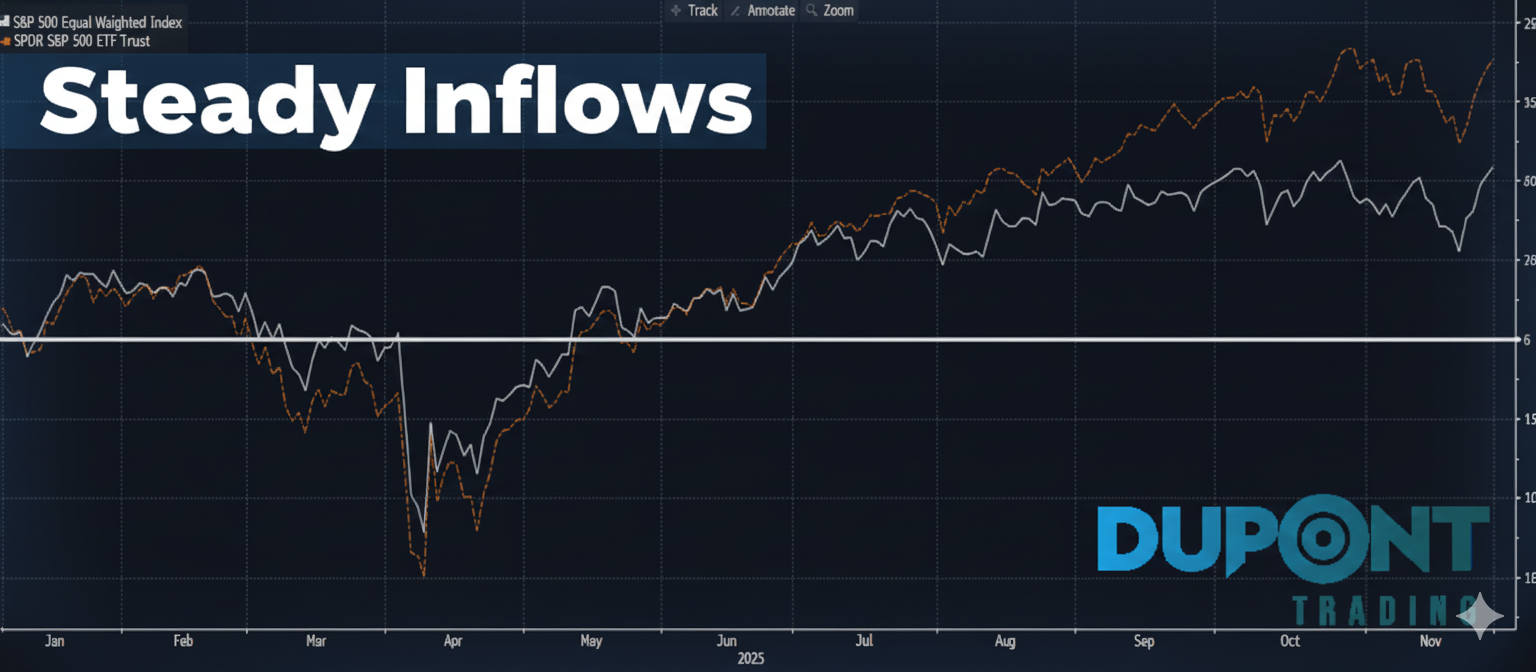

📉 Market Recap: Mean Reversion & Pressure Points

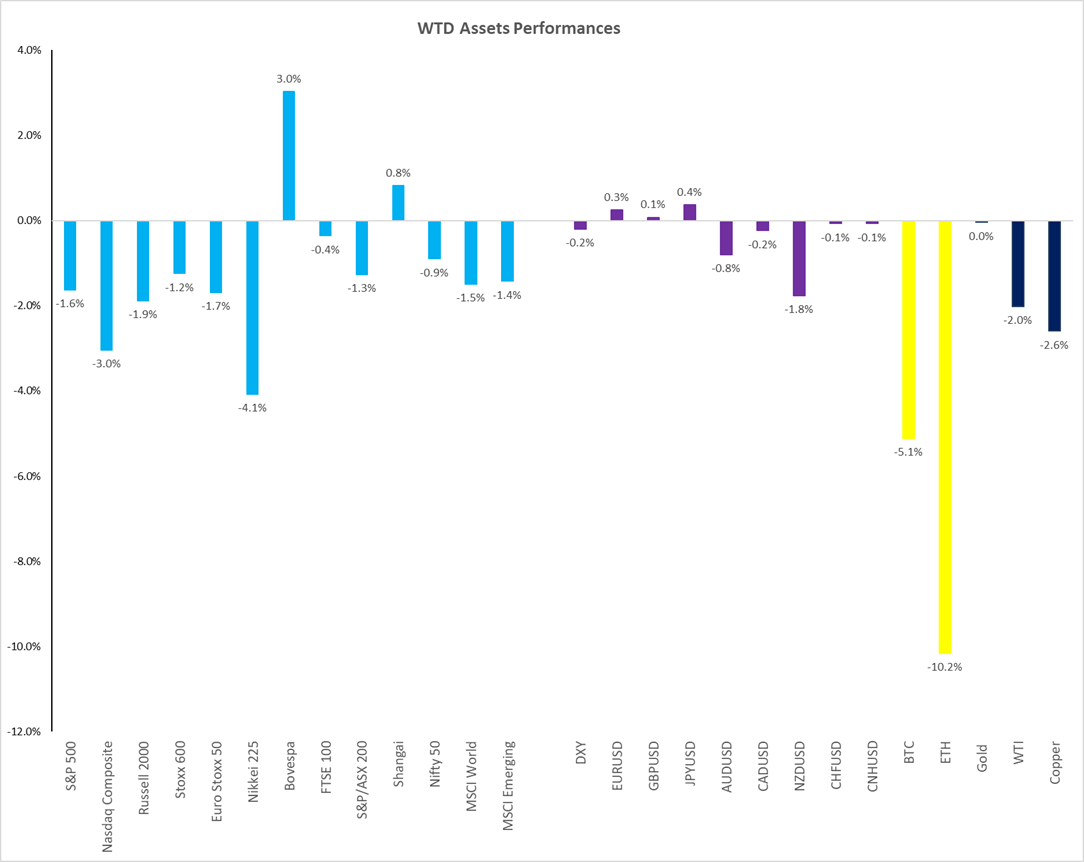

Last week saw broad mean reversion across asset classes:

- S&P 500: -1.6%

- Nasdaq: -3%

- Japan: -4%

- Crypto: -10% (Ethereum), -5% (Bitcoin)

- Gold: Flat

- Oil & Copper: Down

Meanwhile, retail stocks like Celsius (CELH) and ELF Beauty fell sharply after earnings, highlighting consumer weakness among U.S. middle-class households.

Sectors that had been on fire — tech, semiconductors, uranium, and internet — all cooled off, while financials and utilities held steady.

⚙️ Macro Picture: Bond Supply, Sticky Inflation, & the Fed

Yields remain stubbornly high (around 4.1%), despite the market’s wishful thinking about cuts.

Why?

- Persistent inflation near 3%

- Massive bond issuance from both governments and corporations

- The Fed signaling patience on rate cuts (currently ~60% odds for December)

Until we see inflation truly soften — and the government shutdown risk fade — the market will likely stay range-bound.

📊 Technical Setup: S&P, Nasdaq, and Bitcoin

- S&P 500: Testing the 50-day moving average around 6,700. Short-term top may be in, but long-term trend still intact.

- Nasdaq: Following a similar pattern — strong rally, now retracing toward support.

- Bitcoin: Facing repeated rejection near key resistance. Long-term holders (“whales”) appear to be trimming positions.

In short, the market looks tired — time for mean reversion before another leg up.

🧭 What’s Next

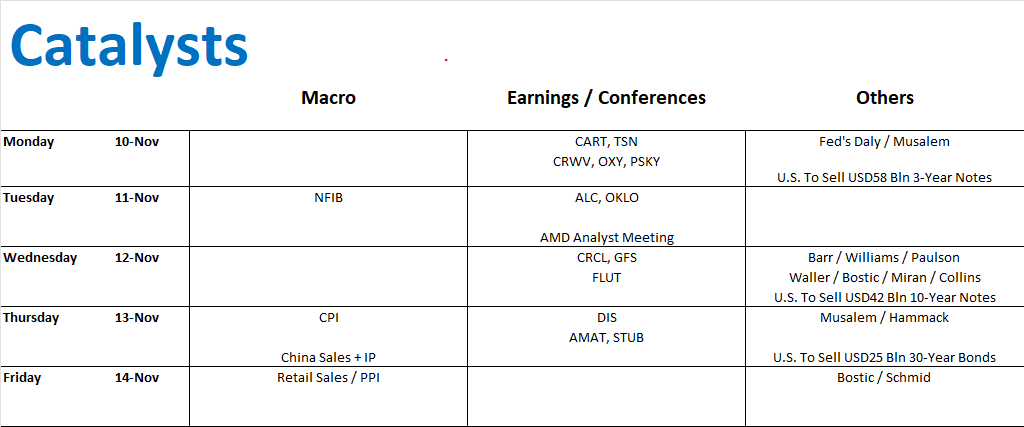

Here’s what to watch in the coming week:

- Government Shutdown: Potential deal could lift sentiment

- Earnings Watch: Cisco, AMD Analyst Day

- China Data: Retail sales & industrial production

- Bond Auctions: $120–130B in new issuance

- NFIB Small Business Report: Key signal for real economic activity

Expect continued volatility, with weekly options implying ±1.8% expected moves.

💡 Key Takeaways

✅ The AI boom is creating a capital crunch, not just a tech race.

✅ Bond markets are signaling tighter liquidity ahead.

✅ Retail weakness is spreading beyond small caps.

✅ Mean reversion trades are working — focus on quality setups.

✅ Stay nimble: volatility is your friend in this environment.

🔗 Join the Community

Want to dive deeper or join the community?

📧 Book mentoring for Q1 2026: https://duponttrading.com/mentoring/

🎥 Access the 4×4 video series: https://duponttrading.com/4×4-course/

💬 Join the Discord: 30 channels of trading insights: https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us atGreg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions