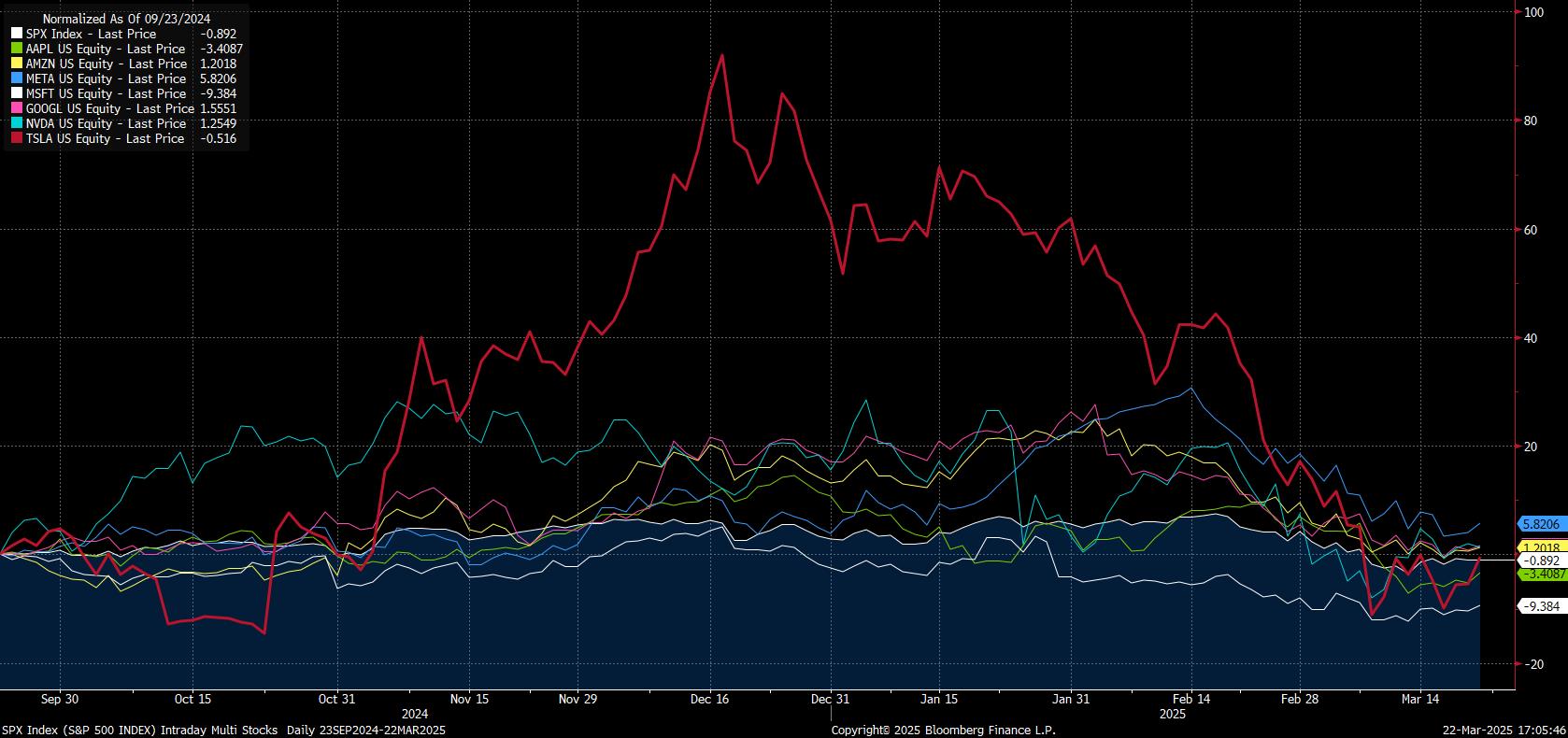

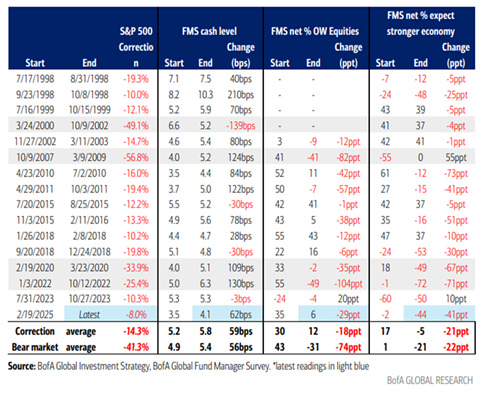

Tesla Crashing

🚗 Tesla Under Pressure: Crash or Correction?

Tesla has been underperforming since mid-December, despite having surged post-election. A key point? Musk’s support of the Trump Administration initially drove flows into the stock, but recent months have seen a retreat.

- Short-Term View: After spiking very hard after the elections, Tesla has tracked the “Fabulous 7” closely over a 3-4 months period.

- Long-Term View: Over a decade, Tesla has massively outperformed the S&P 500 .

- Valuation Debate: Bulls see a multi-trillion-dollar future (robotaxis!), while bears argue it’s just another auto stock—implying a price around $500.

- Technical Target: Eyes on $180–185. Sales are slipping in China and elsewhere.

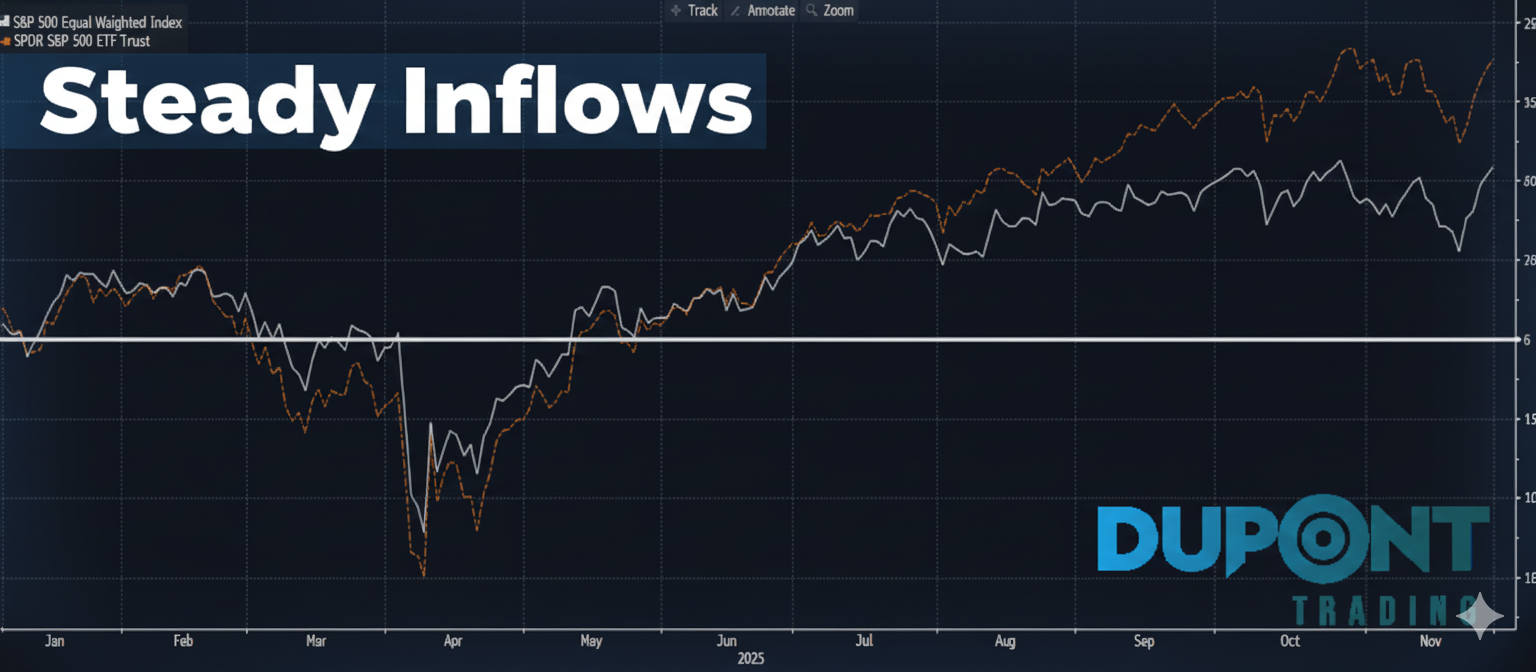

📊 Macro Market Snapshot

- YTD Performance:

- S&P 500: Down 4%

- NASDAQ: Down 8%

- Europe: Strong, buoyed by Germany’s €500B “fiscal bazooka” over 10 years.

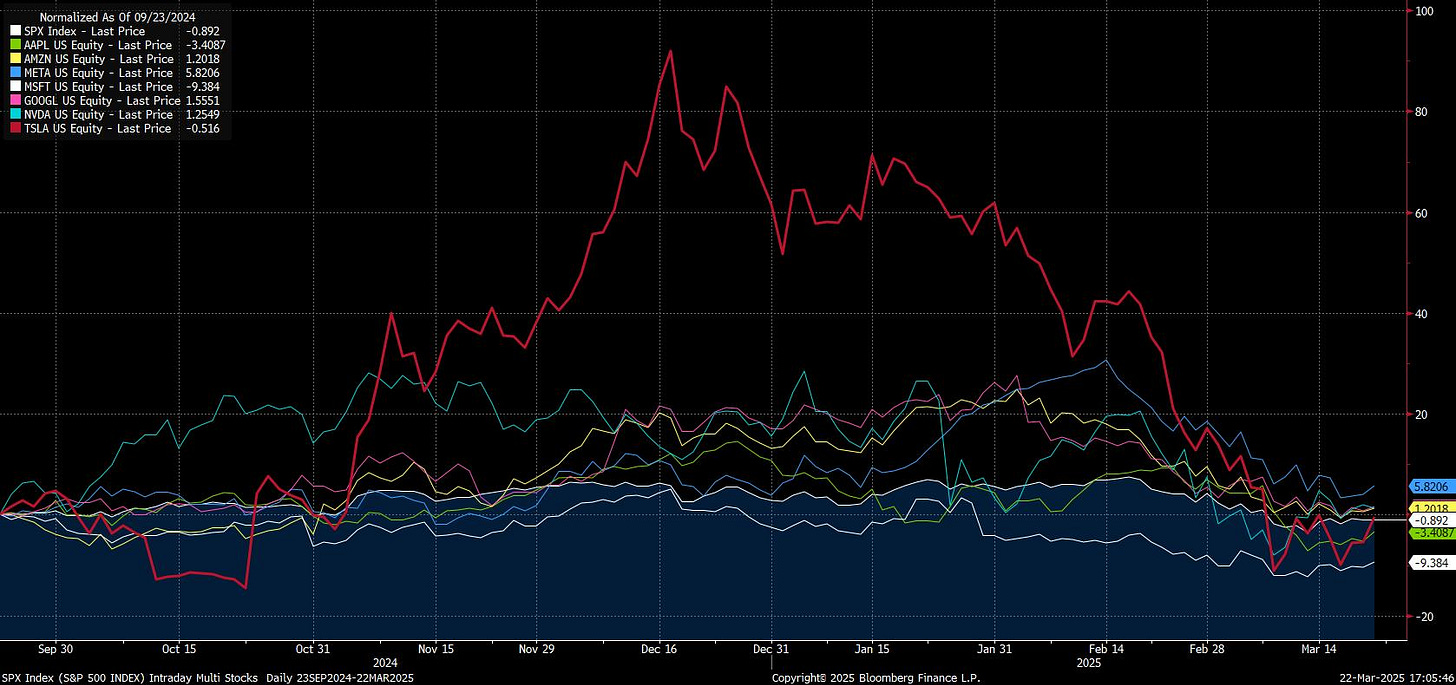

- Recession Fears?

- GDP expectations for 2025 have been revised down to 1.5% by big players like JP Morgan and Goldman Sachs.

- Normal corrections are 5-10%, but 30-40% drops signal recession.

- Commodities & Currencies:

- Gold: Above $3,000

- Oil (WTI): Stable at $66-69

- Copper: New highs

- Turkish Lira: Volatile, driven by poor liquidity and political factors.

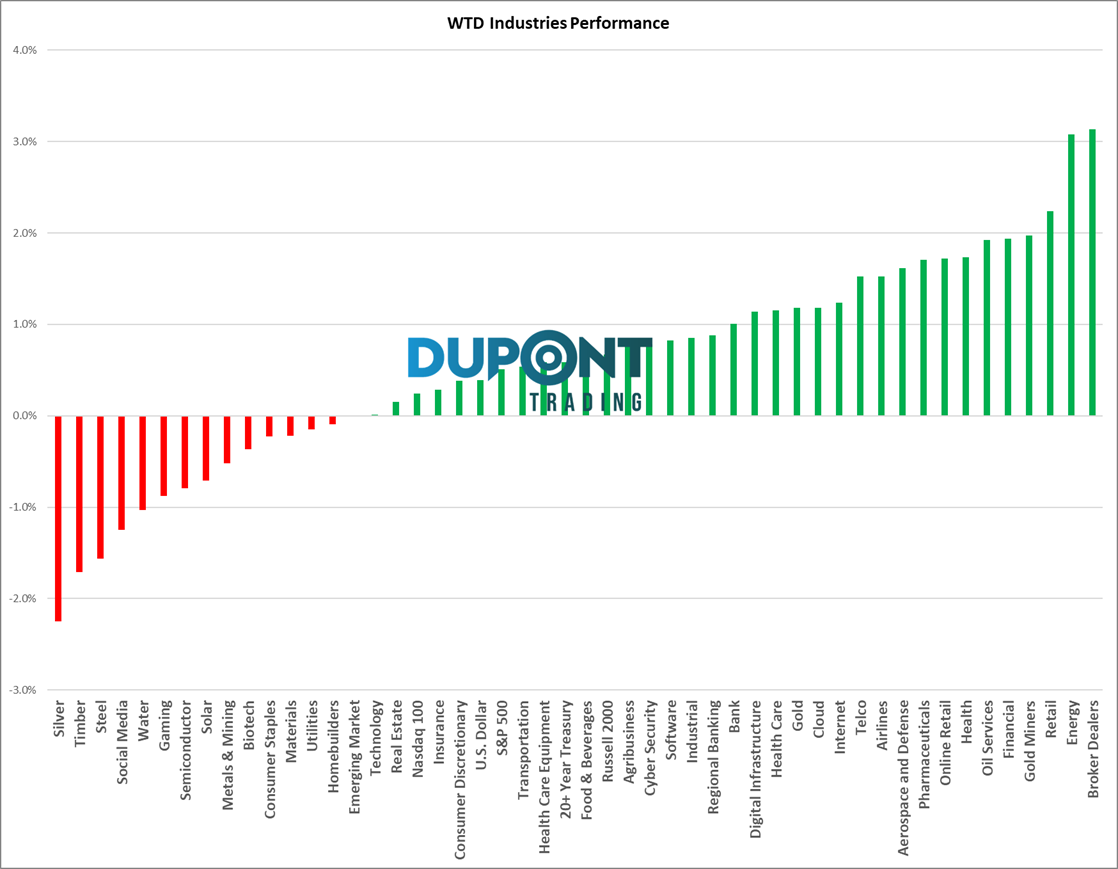

📈 Sector & Asset Class Performance

- Winners: Energy (+3% for the week), Brokers, Airlines (cyclicals).

- Laggards: Silver, Utilities, Consumer Staples.

- Financials: Holding up, but watch JP Morgan’s chart—recent weakness flagged.

- Momentum Stocks: Outperforming, despite broader market choppiness.

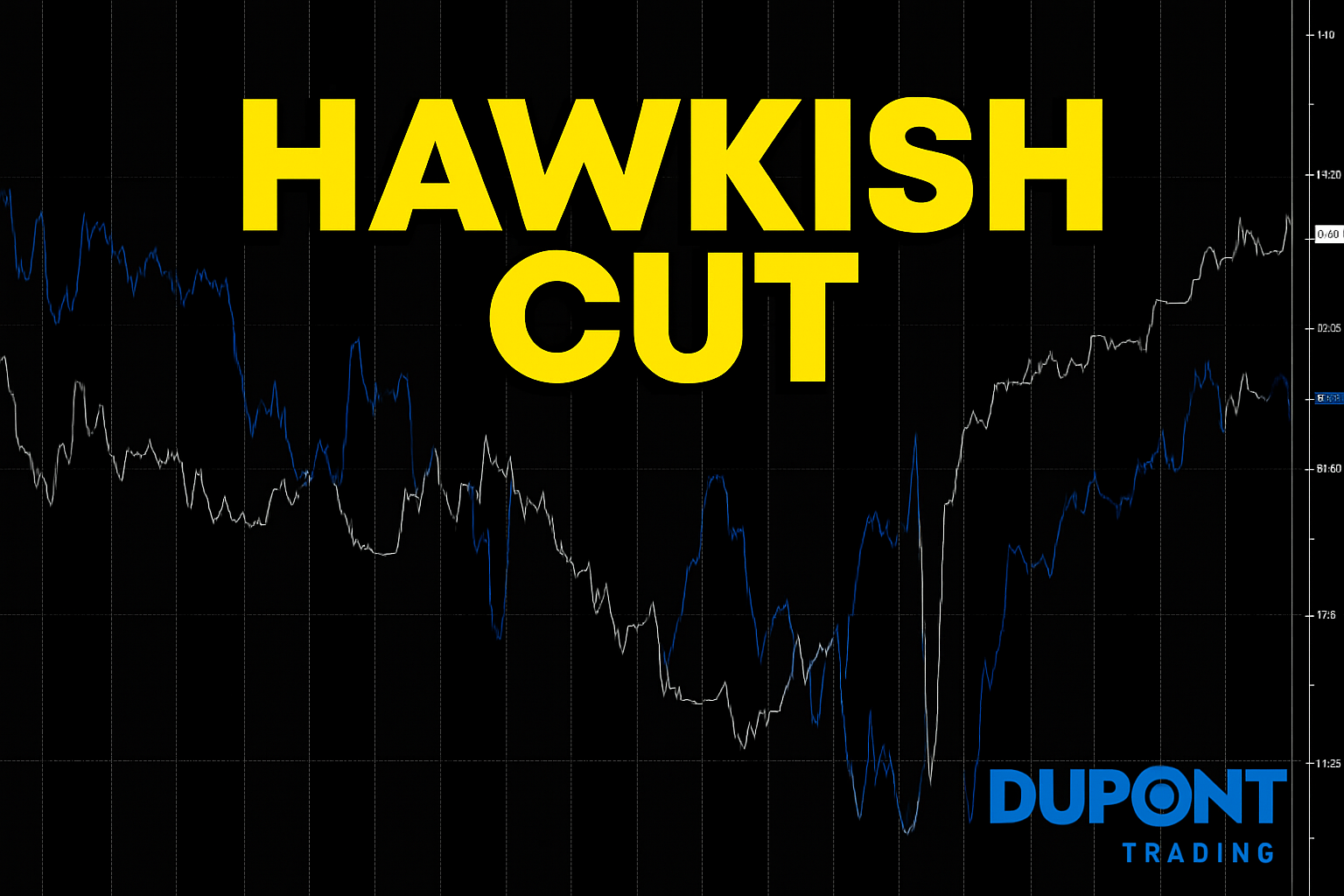

🧩 Interest Rates & Inflation

- 10-Year Yield: 4.25%, stuck in the 4.10–4.70% range.

- Fed’s Take: Lower growth, higher inflation expectations (tariffs incoming).

- Bond Supply: Surging due to deficits; yields may rise further.

- Rate Cuts: Market pricing in 2.5 cuts for 2025, first cut expected July.

🧮 Technical Analysis Highlights

- S&P Futures: Consolidating post-selloff; 6150 to 5500 drop was the “easy” move.

- NASDAQ Futures: Weak consolidation—feels like it could head lower, though seasonality is a plus.

- Oil (WTI): No real change since September, despite election noise.

- Fabulous 7: Underperforming, minor rebound driven by end-of-session rebalancing (Apple, Microsoft).

🎯 Recent Trade Ideas & Hits

- Accenture Short: Called out in December due to exposure to government contracts—played out perfectly after earnings.

- Capgemini Short: Another successful call in Europe.

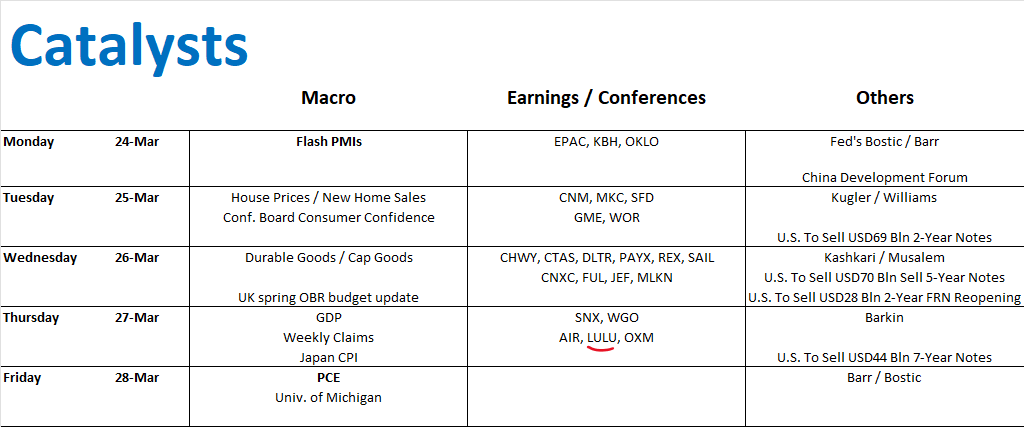

📅 What’s Ahead: Key Catalysts

- Flash PMIs (Monday): Services slipping, manufacturing improving.

- PCE Inflation (Friday): Watch for impacts from tariffs.

- UK Budget (Wednesday): Potential volatility for UK/EU bonds.

- Earnings to Watch: Lululemon (Thursday).

- Tariff Watch: April 2nd—mark your calendar, could drive volatility.

- Market Magnet: S&P 500 potentially gravitating around 5560 until end of the month due to the J.P. Morgan collar.

Final Word

Markets are in a wait-and-see mode—volatility has dipped, but risks remain. Watch inflation, bond markets, and key economic indicators closely. If credit markets wobble, expect the Fed to step in.

For those looking to deepen their market knowledge, consider joining our 4×4 Video Series https://duponttrading.com/4×4-course/ or one-on-one mentoring sessions https://duponttrading.com/mentoring/ to build a professional trading process.

Join our Discord community for real-time insights, macro data, and sector-specific discussions. Subscribe for full access to our research and market commentary:

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

Stay informed, trade smart, and have a great trading week!

Greg📩 Contact: greg@duponttrading.com

Want this in your inbox every week? Subscribe now for updates, trade ideas, and technical insights.

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions