Tariffs Crash

This week has been nothing short of dramatic, with markets across asset classes experiencing significant sell-offs due to tariff announcements and growing recession fears.

Key Highlights:

- Tariff Impact:

- Trump’s Announcement: On Wednesday, Trump announced new tariffs, initially perceived as manageable at 10%. However, further details revealed much higher tariffs, leading to a market sell-off.

- Market Reaction: The S&P futures dropped from 5750 to 5100, a 12% decline over two days. The sell-off was orderly, with higher volumes but not excessively high.

- Recession Concerns:

- Drawdowns: Typical market drawdowns of 10% are common, but current declines of 15-20% suggest recession fears. Headlines from major financial institutions like JP Morgan indicate increasing odds of a recession.

- Earnings Compression: The market was priced for perfection, with high earnings growth expectations. Tariffs and other macro factors now threaten these projections, potentially leading to lower earnings and further market declines.

Expectations at the end of the year were for EPS 2025e = $268.16 and 24x+

- Drawdowns: Typical market drawdowns of 10% are common, but current declines of 15-20% suggest recession fears. Headlines from major financial institutions like JP Morgan indicate increasing odds of a recession.

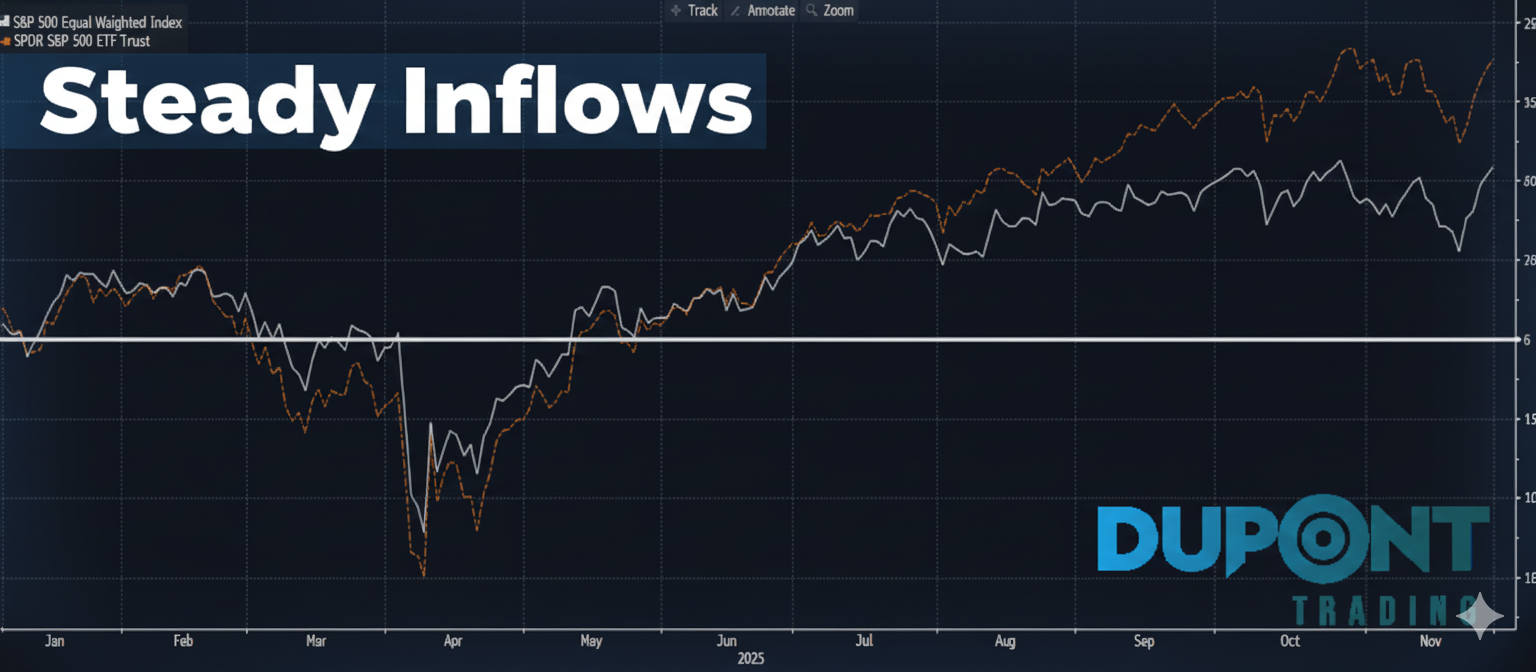

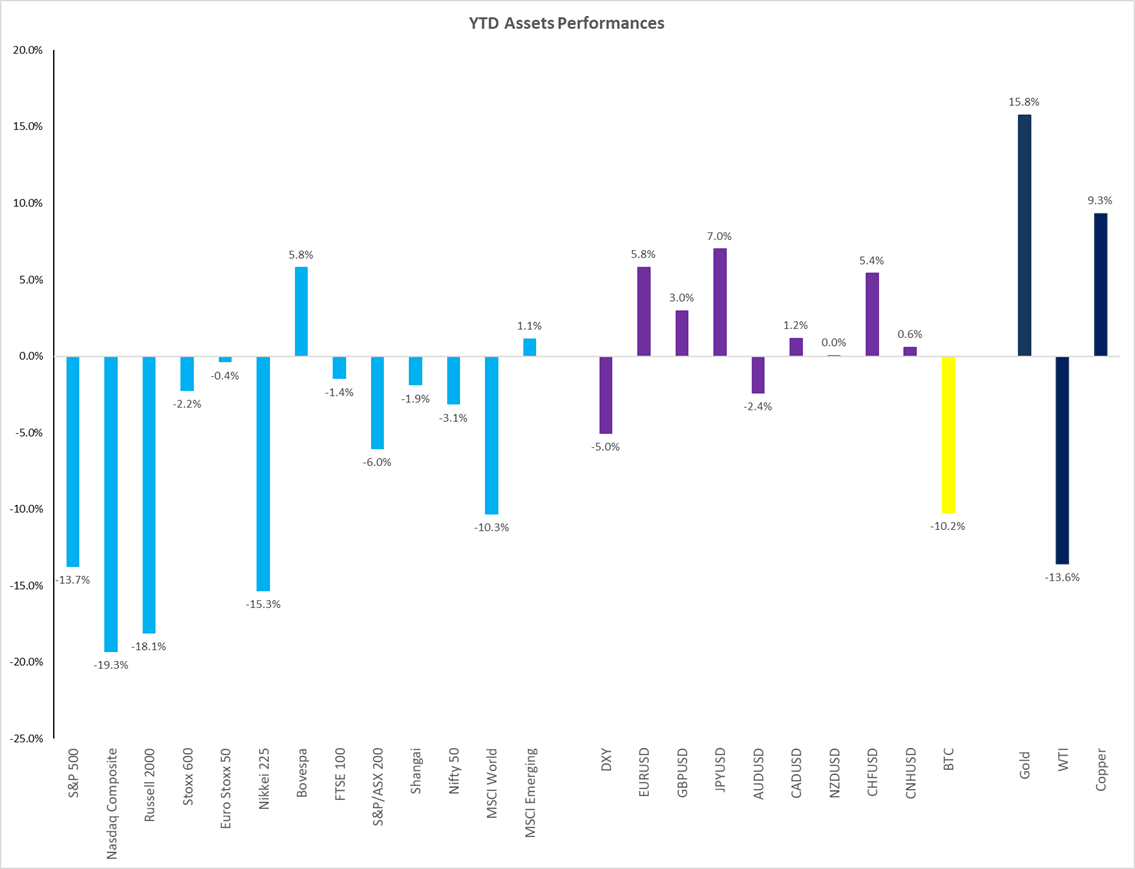

- Year-to-Date Performance:

- Equity Markets: NASDAQ is down 20%, S&P 13%, and Japan 15%. The US dollar has weakened by 5%.

- Commodities: WTI oil down 14%, copper up 9%, and gold +16%.

- Equity Markets: NASDAQ is down 20%, S&P 13%, and Japan 15%. The US dollar has weakened by 5%.

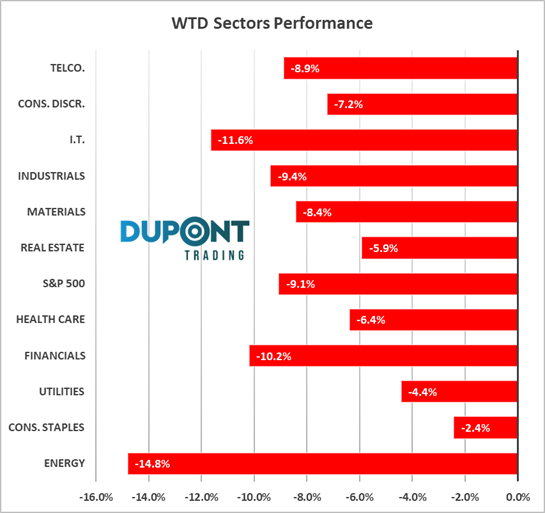

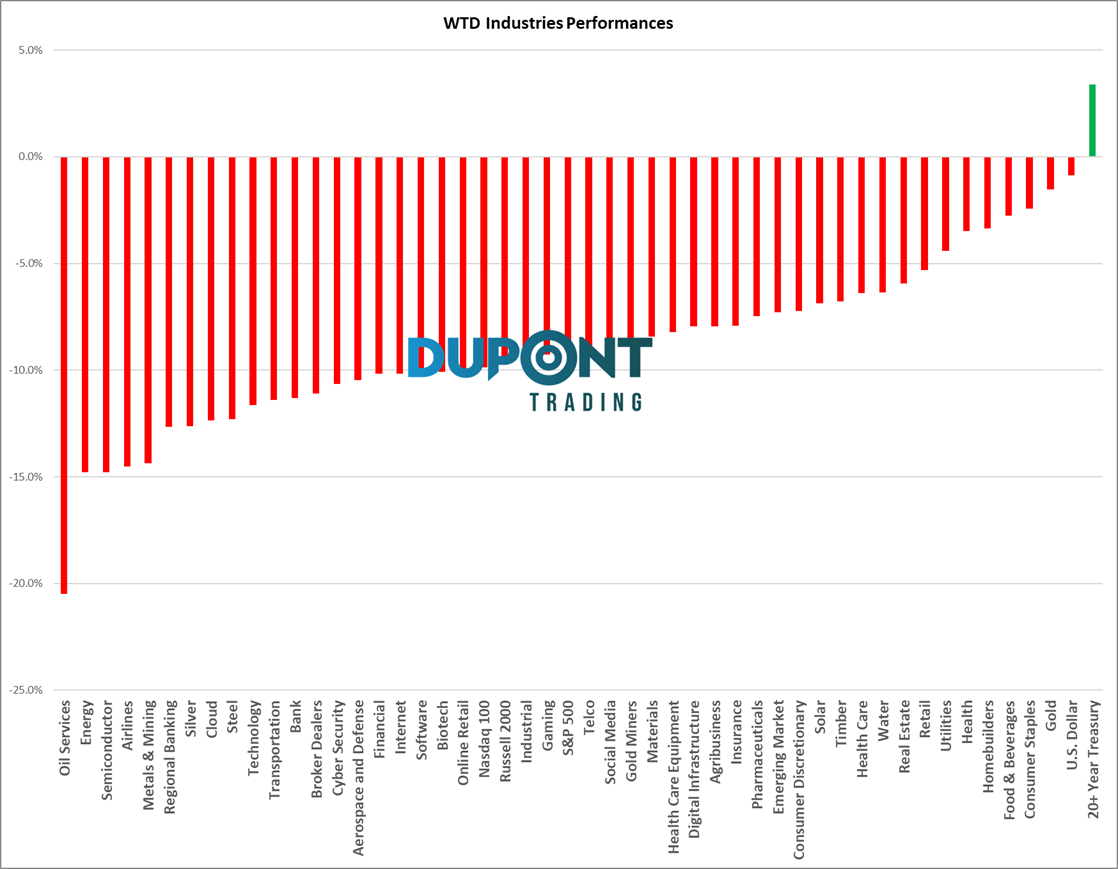

- Sector Performance:

- Defensive Sectors: Utilities and consumer staples showed relative strength.

- Cyclical Sectors: Energy, semiconductors, and airlines faced significant pressure.

- Defensive Sectors: Utilities and consumer staples showed relative strength.

- Technical Analysis:

- S&P Futures: The trend is broken, indicating potential further declines.

- NASDAQ: Similar patterns to the S&P, with significant sell-offs.

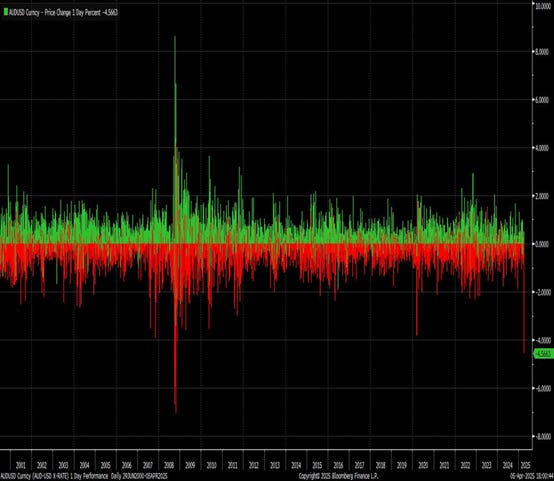

- Other Assets: Gold, Australian dollar, and European stocks also experienced notable moves.

AUDUSD Price Change 1 Day Percent

- S&P Futures: The trend is broken, indicating potential further declines.

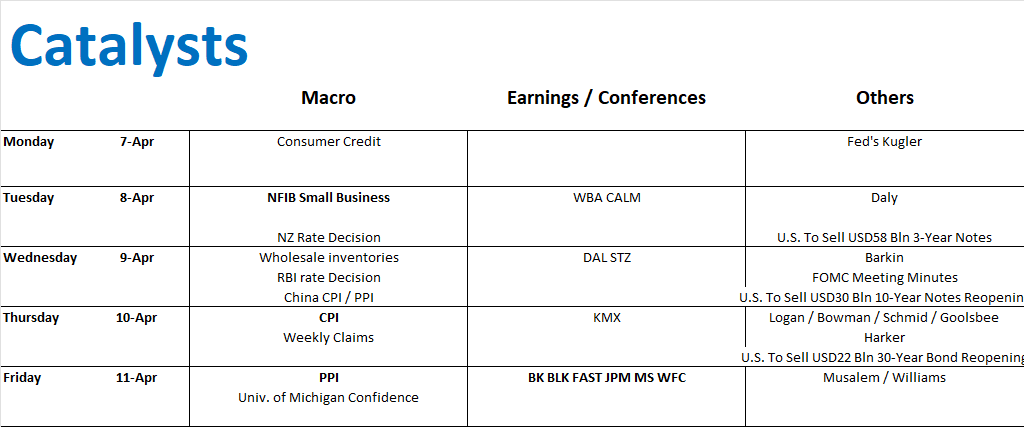

- Upcoming Catalysts:

- Tariff Talks: Daily updates on tariff negotiations will continue to impact markets.

- Credit Market: Watch for widening credit spreads and pressure on high-yield bonds.

- Earnings Season: Starting with JP Morgan, expect increased volatility and significant stock movements.

Special Offer:

For those looking to deepen their market knowledge, consider joining our 4×4 Video Series https://duponttrading.com/4×4-course/

In light of the recent market turmoil, we’re offering a 25% Easter discount on the 4×4 video series. This comprehensive investment process will help you navigate these challenging times. The discount is available until April 21st. Use Coupon Code: EASTER25

Join the Community:

- Mentoring Program: Dual mentoring sessions with Greg and Etienne.

- Trading Community: Access to 30 channels for just $75 per month.https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

Risk Management:

Remember, it’s all about risk management. Many traders have faced losses recently, but with proper education and strategy, you can turn the tide. Reach out to Greg at greg@duponttrading.com for personalized advice.

No Episode Next Week:

Due to Easter, there will be no episode next week. Enjoy the holiday with your family, and we’ll be back soon with more insights.

Stay informed, trade smart, and have a great trading week!

Greg📩 Contact: greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.