Stargate vs Deepseek

Welcome to a new Trading week, where we analyze the key market trends and catalysts impacting the trading week. Here’s your comprehensive breakdown:

Major Highlights

- AI Investment Announcements:

- The Trump administration unveiled a $500 billion AI investment initiative alongside leaders from SoftBank, Oracle, and OpenAI.

- However, skepticism emerged, with Elon Musk noting the feasibility of such investments and hinting at a lower potential commitment.

- The announcement sparked debates on the U.S.’s competitiveness in AI versus China’s emerging AI project, “Deepseek.”

- China’s AI “Deeps”:

- Significant investment in “Deepseek,” an AI initiative from China, showcases their competitive stance in the global AI race.

- Implications for U.S. companies include increased competition and potential margin pressures.

Market Performance Recap

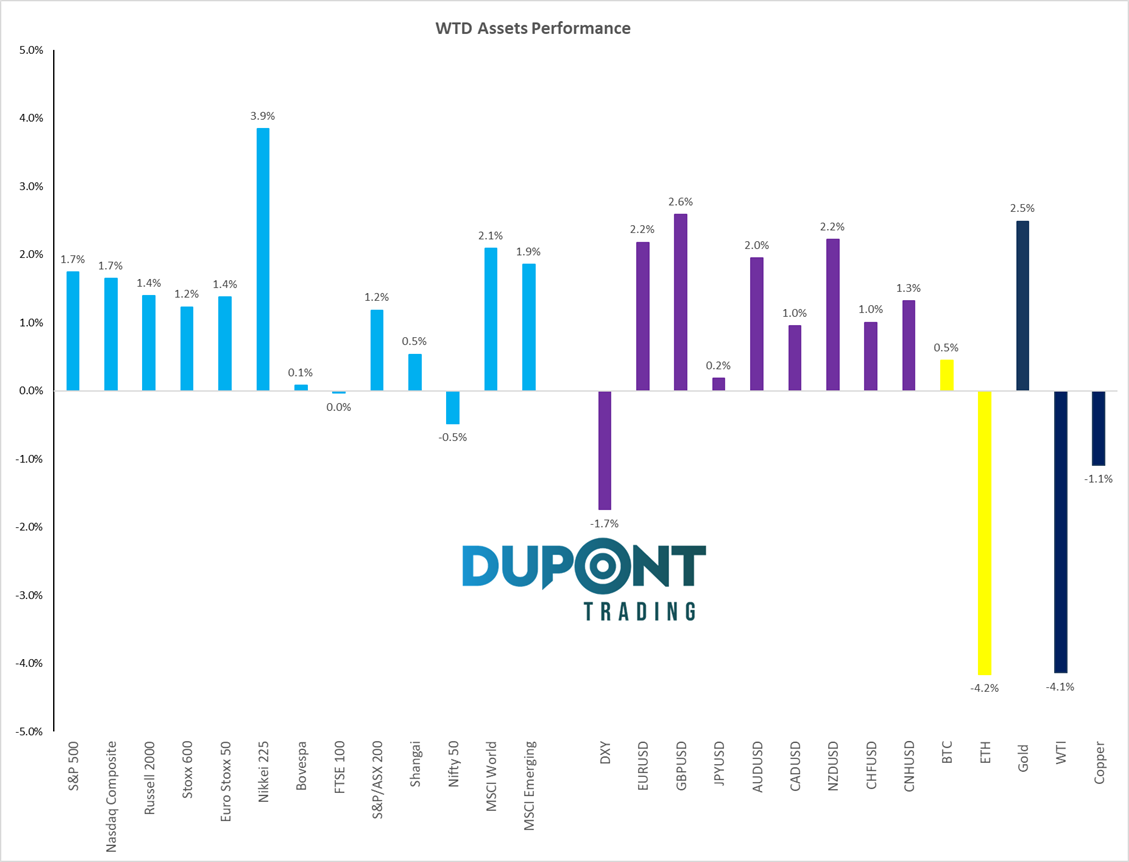

Week-to-Date Asset Performance:

- U.S. Stocks: Up ~2%.

- USD Weakness: The dollar fell 2% against major currencies, driven by extreme positioning and some macro data improvements in Europe and China.

- Energy Sector: Trump’s focus on pressuring OPEC led to underperformance in energy stocks.

- Strong Performers: Healthcare (+3%), Telecom (+3%), and Solar sectors.

- 10-Year U.S. Treasury Yield: Decreased slightly to 4.62%, following a recent peak of 4.8%.

Sector Highlights:

- Earnings Performance:

- Communications, Real Estate, and Utilities were the top-performing sectors.

- Artificial intelligence continues driving demand in utilities due to energy needs.

Volatility Trends:

- VIX: Below 15% for 30-day volatility; short-term trends indicate a resemblance to the low volatility levels of 2017.

Key Catalysts Ahead

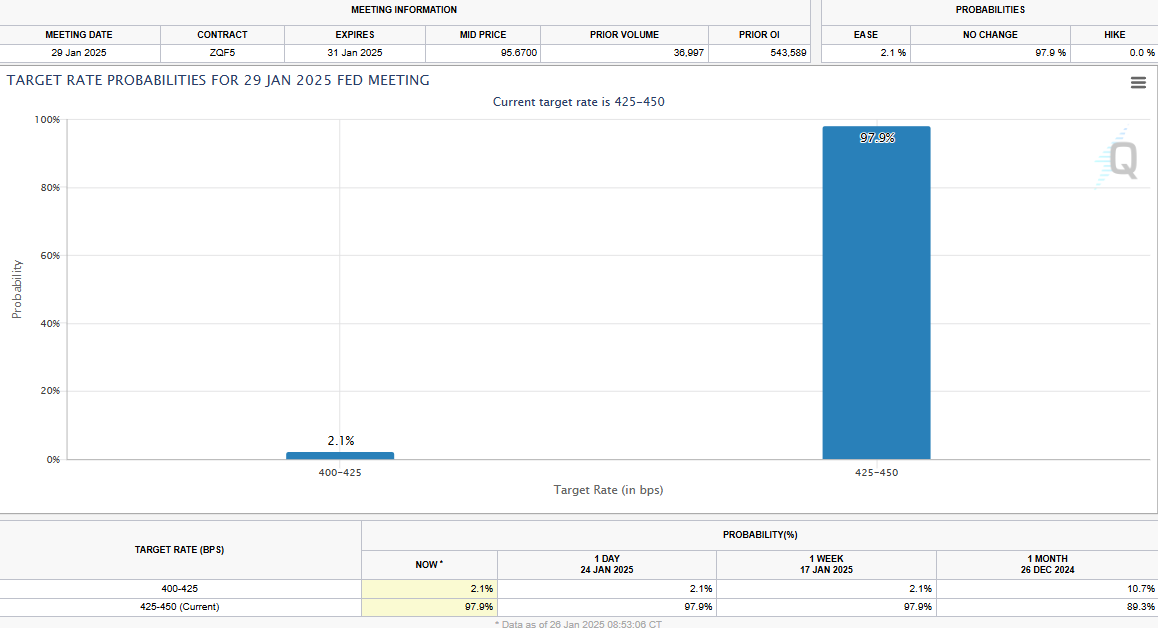

- Central Bank Actions:

- FOMC Meeting (Wednesday): No rate cuts expected, with the market pricing two cuts for 2025.

- Other rate decisions include the Bank of Canada (Wednesday) and the ECB (Thursday).

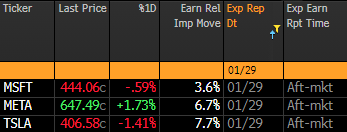

- Major Earnings Releases:

- Wednesday: Tesla, Meta, Microsoft.

- Thursday: Apple, Intel, Visa.

- These releases will significantly influence market sentiment.

- Macro Data:

- Chinese PMI Data (Sunday night/Monday morning): Key indicator for global growth trends.

- U.S. Q4 GDP (Thursday) and PCE Inflation Data (Friday).

- Political Developments:

- Trump’s daily announcements about U.S. projects and tariffs could drive market volatility.

- Trump’s daily announcements about U.S. projects and tariffs could drive market volatility.

Technical Analysis

- S&P 500:

- Testing new highs with decreasing volume and a “topish” RSI.

- Position: March put spreads (5-8% out of the money) offering a 9:1 risk-reward ratio.

- Euro/USD:

- Significant recovery from 1.03 to 1.05 last week, signaling strength in the Euro.

- Earnings Plays:

- Look at options pricing for names like Tesla and Meta. For instance, Meta’s implied move is ~7%, presenting opportunities if expectations misalign with reality.

- Look at options pricing for names like Tesla and Meta. For instance, Meta’s implied move is ~7%, presenting opportunities if expectations misalign with reality.

Upcoming Events & Trades

- End-of-Month Moves: Expect higher volatility during the last trading hour on Friday.

- Earnings Volatility Plays: Opportunities for implied volatility trades given recent compression.

- Mentorship Programs:

- Join our new Alpha Mentoring program with personalized sessions from experienced mentors.

- Learn risk management, options strategies, and more.

Join Our Community

- Discord: Engage with our vibrant trading community and access exclusive content. https://discord.gg/wrvGuF3M

- Mentorship Opportunities: Email Greg at greg@duponttrading for one-on-one mentoring or to join our 4×4 programs.

- Paywall Launch: Look out for new features and premium content in the coming weeks.

That’s all for this week. Best of luck in your trading endeavors!

Have a great trading week!

Greg

greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.