South Korea – Semiconductors: What is the Trade?

Nothing really new here but Semiconductors and the way the sector was leading the market until a month ago (end of April 2019) could give us more clarity. This sector turned first despite recent technical breakout and many calls for “2000 kind of last spike”.

South Korea is know for being a big Semiconductor producer. From 2016 to 2018, it massively benefited from this industry.

To give more color, let’s look at a few charts:

South Korea Exports (Mil.$):

or South Korea Exports yoy:

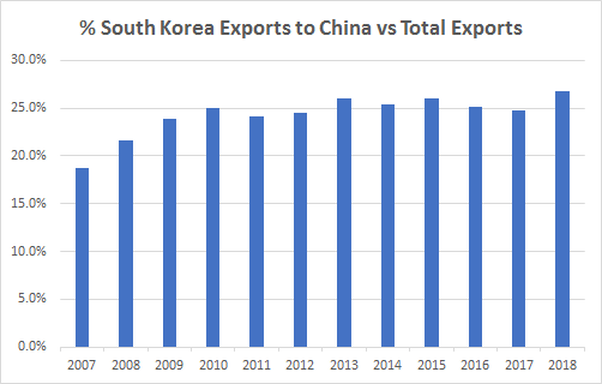

% South Korea Exports to China vs Total exports:

with 43% of Korean GDP from exports, China represents roughly 11% of the South Korean GDP.

But as a % of total exports, it stayed stable.

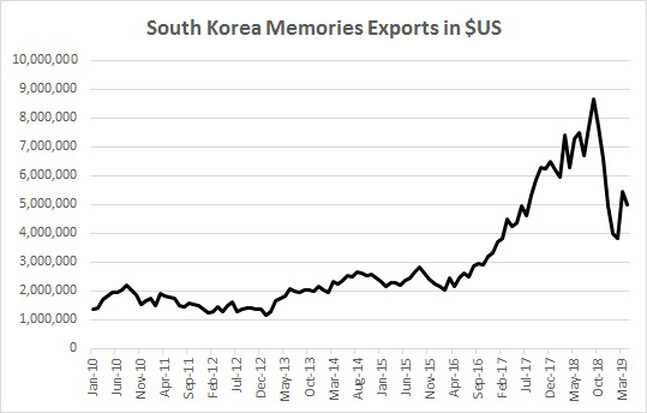

What is interesting is the increase of memories exports from South-Korea from 2016 (Mil.$):

with a peak in September 2018 and since December 2018, falls yoy between -20% and -36%.

Which (guess what?) translated into -1.35% GDP annualized for Q1 2019.

Yes when the semiconductor sector is slowing, South Korea suffers.

No surprise here but if China is the world’s largest chip consumer and imports $270 billions, any Chinese slowdown will impact South Korea.

With Samsung and Hynix holding around 70% of the DRAM market shares, they are the biggest players.

When I think about semiconductors, I immediately look at the Philadelphia Semiconductor Index (SOX).

The SOX is composed of 30 semiconductor companies:

https://www.investing.com/indices/phlx-semiconductor-components

That is the recent chart (monthly – log):

It tells you about:

– when it moves, it moves big.

– last push in 1999-2000 was very strong then we consolidated for a few months without making new highs

– nice move up between 2016-2018 explained by new technologies

– recent breakout on the upside (with many calling for a sky is the limit scenario) but quickly failing to hold the 1460 level.

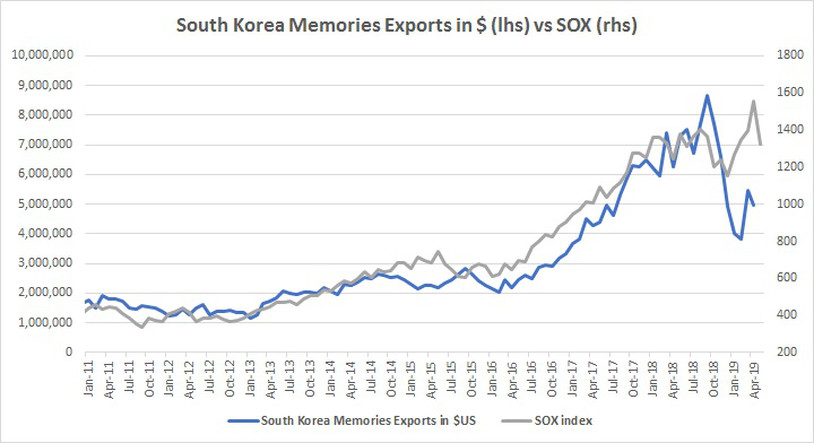

Now, let’s look at the SOX index vs South Korea Memories Exports:

and SOX vs Xilinx (XLNX):

When we look at a market, we always try to find the leaders = sectors that are trending and leading the market and the laggards or the dogs.

We try to identify if allocation between sectors is changing, if there is any sector rotation.

One week before the market top in early May, many semiconductors names like Xilinx or Intel went down sharply. Bad Price action. The sector rotation started. That was a warning that the market was looking for new leaders.

Looking at recent correlations between South Korea Memories exports and the SOX or XLNX (the lat 2 charts above), there still might be between -20 to -40% downside to this sector.

I hope it helps,

Gregoire

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions