Rotation Before Nvidia: Market Volatility, Sector Shifts & Earnings Catalyst – Nov, 17 2025

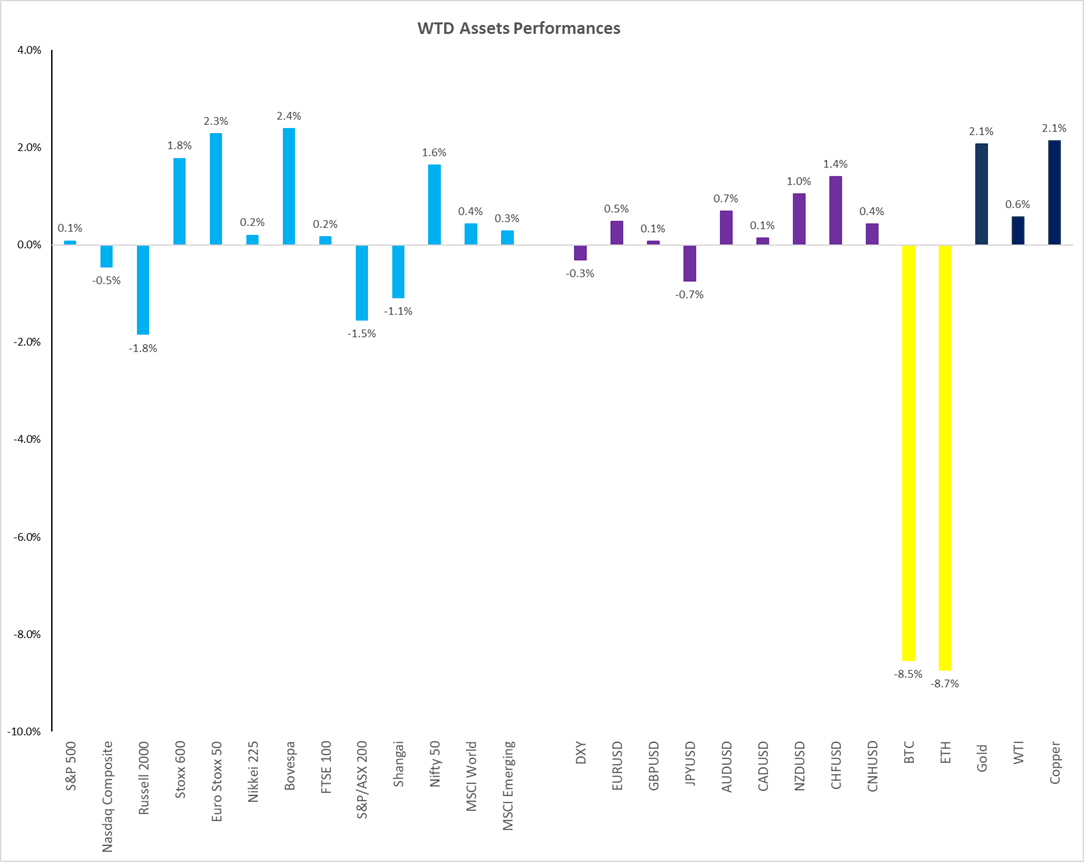

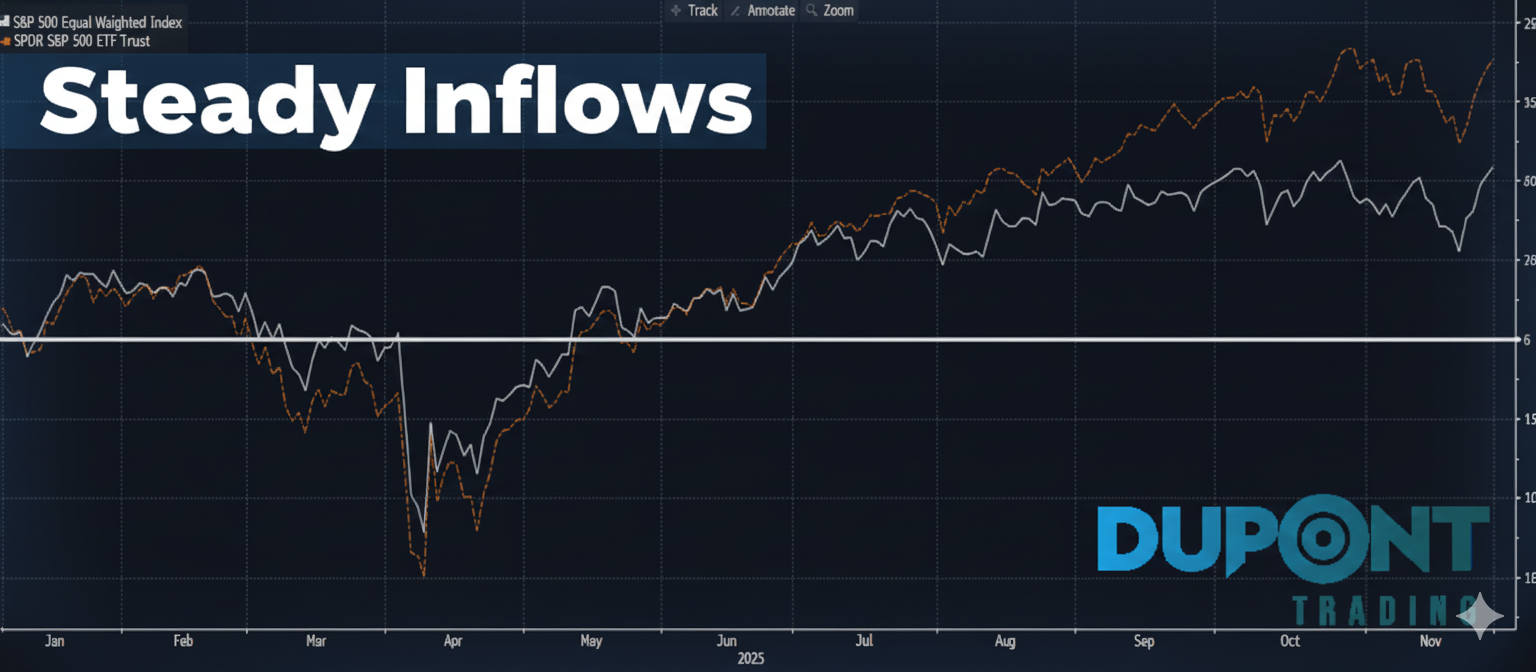

This week was all about rotation. Despite the S&P 500 and NASDAQ finishing flat, volatility surged as traders repositioned ahead of Nvidia’s earnings. The Russell 2000 lagged, down 2%, showing that underperformers are still struggling to catch up with the “Fabulous 7.”

- Momentum unwind: Goldman Sachs’ momentum index fell 12.5% from Monday to Friday, highlighting sharp reversals in high-flying names.

- Global picture: Europe held up well, currencies stayed flat, while crypto sold off hard.

- Commodities: Gold and copper both gained +2% on the week.

💹 Sector & Industry Rotation

The week-to-date industry performance showed dispersion:

- Winners: Healthcare, energy, materials, consumer staples.

- Losers: Semiconductors, nuclear, consumer discretionary (Tesla slipped below 400).

- Defensive tilt: Gold miners and staples outperformed, while high-beta sectors struggled.

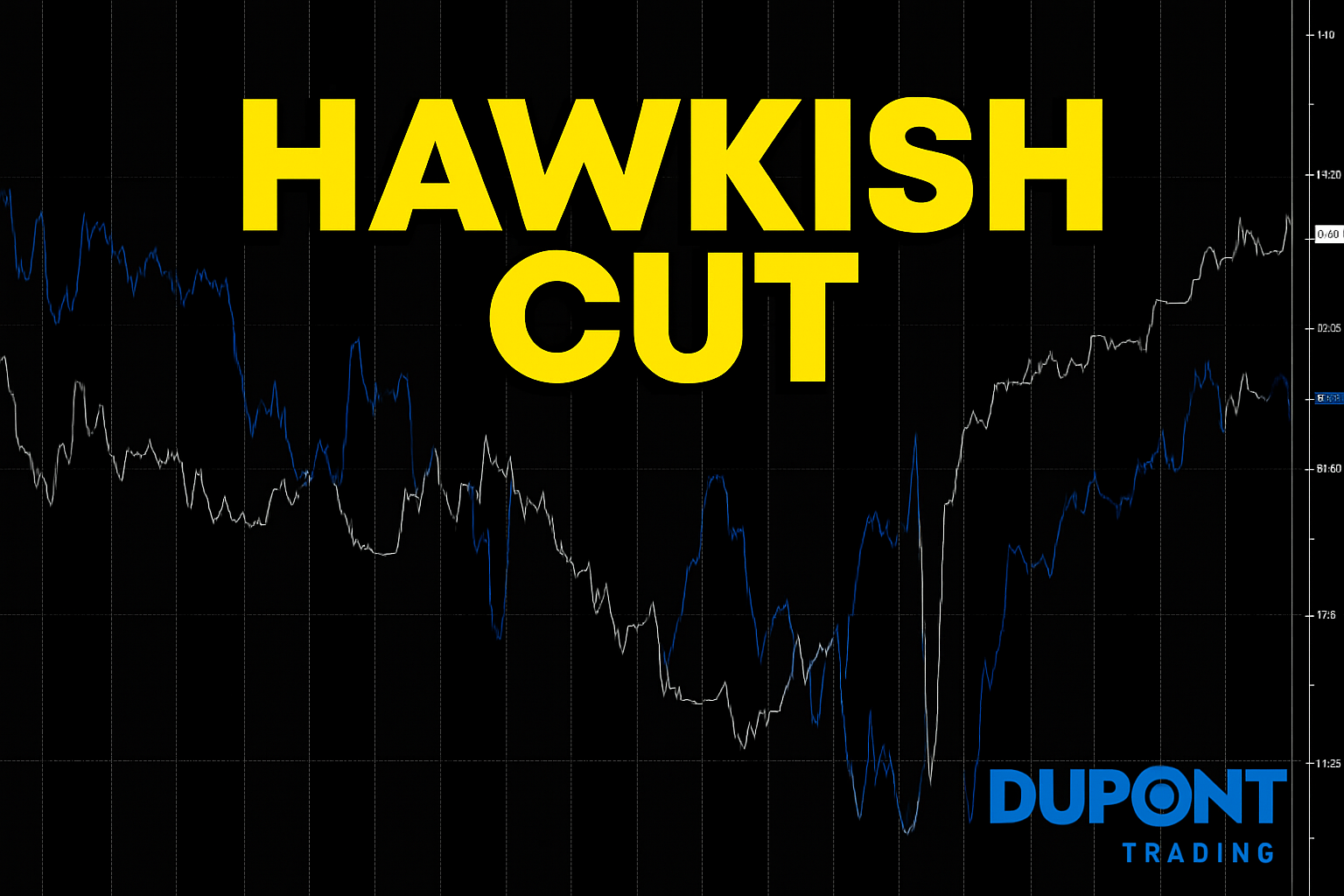

💰 Macro & Rates

- 10Y Treasury yield: Hovered around 4.15%, with inflation expectations creeping higher.

- Fed expectations: December cut odds dropped from 95% a month ago to ~40%.

- Data backlog: Due to the government shutdown, October’s economic data will not be released. September NFPs, CPI, and PPI are coming this week.

- Volatility: VIX remains elevated at 20, signaling macro uncertainty and consumer weakness.

📊 Technical Picture

- S&P & NASDAQ: Both bounced off their 50-day moving averages. Traders are watching closely—closing below could trigger a bigger sell-off.

- Bitcoin: Fell to 95,000 (-8.5%), with next support around 91–92k.

- Healthcare (XLV): Strong bounce driven by Eli Lilly, back to the 200-day MA.

- Consumer Staples (XLP): Defensive strength continues relative to SPY.

🚀 Momentum & AI Theme

Since early 2023, AI has driven 60–80% of S&P EPS growth. The Goldman Sachs momentum index surged from 400 to 580 (+40%) before this week’s pullback. Even with a 12% correction, the long-term trend remains strong.

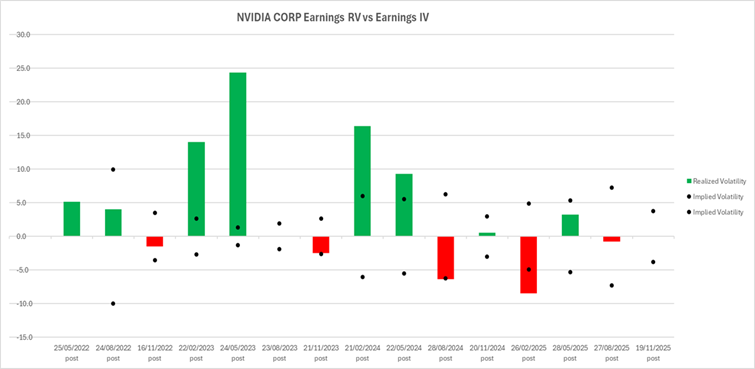

🏦 Nvidia Earnings – The Big Catalyst

All eyes are on Wednesday after the close:

- Expected move: Options pricing a ±6.5% swing.

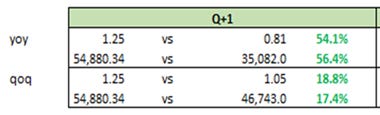

- Revenue forecast: ~$54B (+55% YoY, +18% QoQ).

- EPS growth: Also +55% YoY.

- Trend: Revenue beats are shrinking (from +5.8% to +1.5% over the last four quarters).

- Market impact: Could drive a ±2% weekly move in the S&P, with NASDAQ more sensitive due to higher beta.

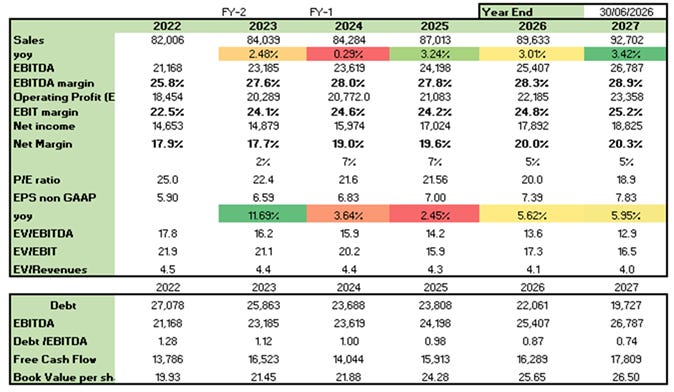

🛡️ Mentoring Highlight – Defensive Trade Idea

One mentee identified Procter & Gamble (PG) as a defensive play:

- EPS growth: 5–6%

- Free cash flow: ~$17B

- Valuation: P/E below market average

- Trade setup:

- Long PG vs. XLP with tight stop-loss (4–5%) and upside potential (~30%) → 6:1 risk/reward

- Alternative: Call spread into June 2026 to reduce idiosyncratic risk

📅 What’s Next

- Macro data: September NFPs & retail sales (Thursday), CPI/PPI backlog.

- Fed: FOMC minutes Wednesday, multiple Fed speakers.

- Earnings: Walmart Thursday, Nvidia Wednesday.

- Seasonal catalysts: Thanksgiving, Black Friday, Cyber Monday → US consumer check-up.

- December: FOMC meeting + year-end options expiry.

📝 Final Thoughts

This week’s rotation highlights the tension between defensive positioning and AI-driven momentum. Nvidia’s earnings will be the defining catalyst—setting the tone for year-end trading.

Stay nimble, manage risk, and keep an eye on both macro data and sector dispersion.

🔗 Join the Community

Want to dive deeper or join the community?

📧 Book mentoring for Q1 2026: https://duponttrading.com/mentoring/

🎥 Access the 4×4 video series: https://duponttrading.com/4×4-course/

💬 Join the Discord: 30 channels of trading insights: https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us atGreg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions