Powell Caved

I hope you had a great summer. Many of you shared your winning trades from the past few months—congratulations! While some educators were busy trading from the beach, I chose to fully unplug. Now, let’s dive into the markets and what’s ahead.

🏦 Powell at Jackson Hole – Did He Cave?

Jerome Powell struck a slightly more dovish tone at Jackson Hole, sparking headlines about him “caving.” But let’s look at the facts:

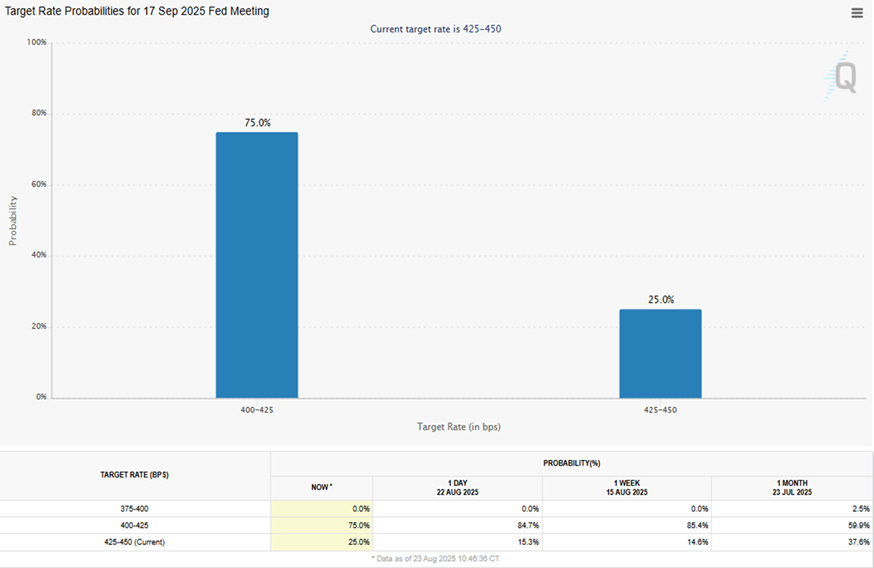

- September Fed expectations: Still 75–80% probability of a rate cut, slightly lower than before his remarks.

- Employment vs. Inflation:

- NFP shows job growth slowing (just 30k–50k per month on average).

- Inflation is ticking higher, reinforced by ISM PMIs and Walmart’s outlook (tariffs adding to inflation in coming months).

Powell is balancing slowing employment with stubborn inflation—while avoiding a repeat of 2021–22’s inflation missteps.

📊 Market Performance

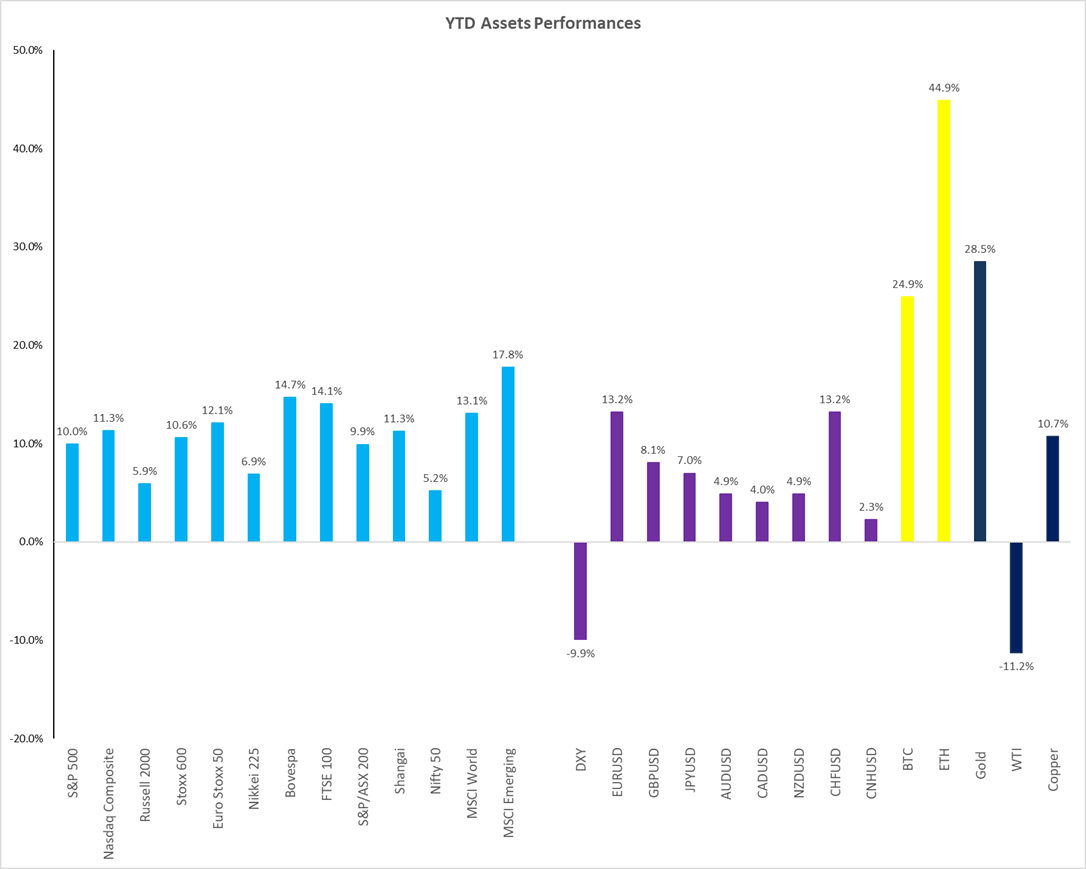

Year-to-date (YTD):

- S&P 500: +10%

- NASDAQ: +11%

- Russell 2000: catching up with strong momentum

- US Dollar: -10%, meaning US assets underperformed on an FX-adjusted basis

- Ethereum: +45% (boosted by stablecoin legislation)

- Bitcoin & Gold: +25% each

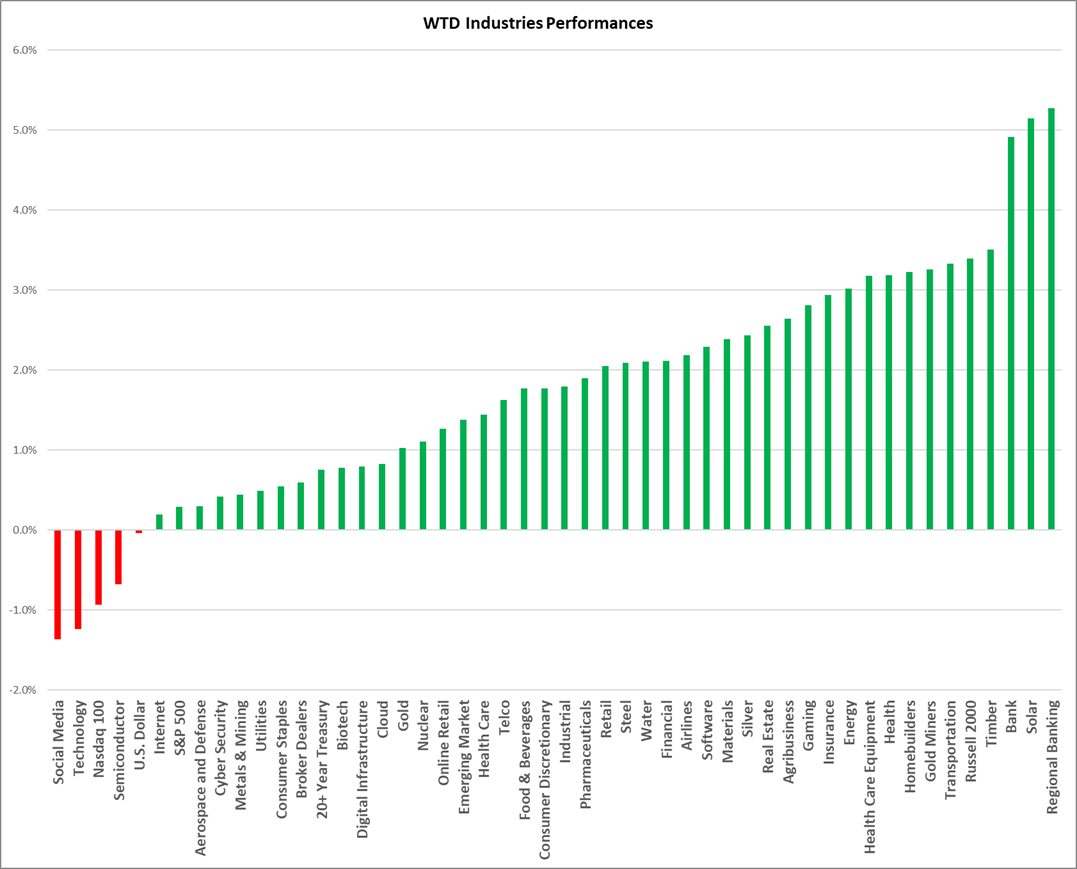

Week-to-date (WTD):

- Russell 2000: +3% (biggest winner)

- S&P 500 / NASDAQ: flat

- Social media, semis, big tech: underperforming

- Regional banks & small/mid caps: leading

👉 The theme: rotation away from mega-cap tech into broader sectors.

💹 Rates & Fed Outlook

- US 10-Year Yield: steady at ~4.26% (range 4.2–4.5%)

- September: ~80–90% chance of a cut

- December: now priced for a second cut (back to the Fed’s original 2025 plan)

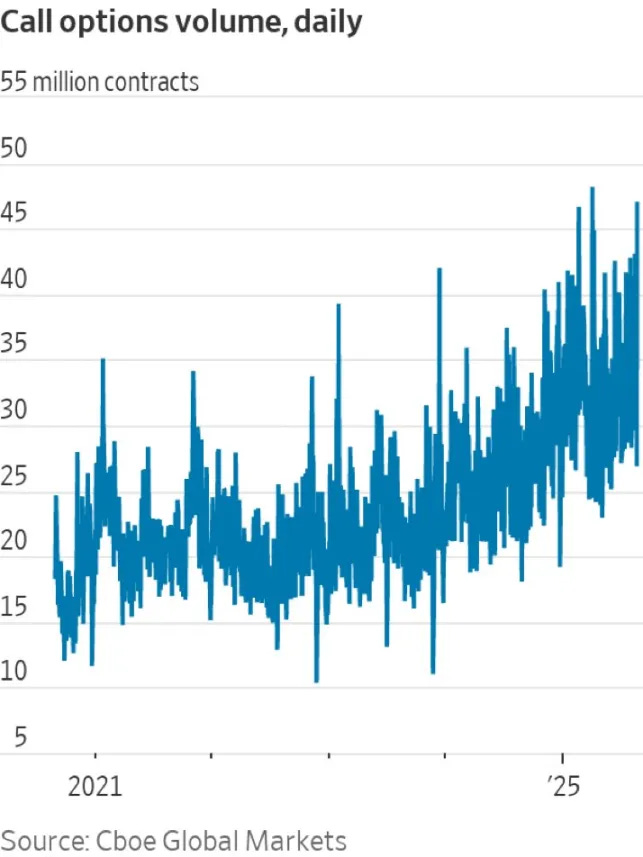

😮 Volatility & Retail Activity

- VIX: 14%, compressed below long-term averages

- Options activity: record call volumes, especially in zero-day expiries

- Retail traders: still fueling momentum in familiar names

🔍 Technical Picture

- S&P 500: Grinding higher, near all-time highs

- NASDAQ: Slight pullback but above the 50-day MA

- Russell 2000: Strong breakout, supported by dovish Fed tone

- EUR/USD: Stuck in 1.16–1.18 range

Rotation continues—tech consolidates while small/mid caps show strength.

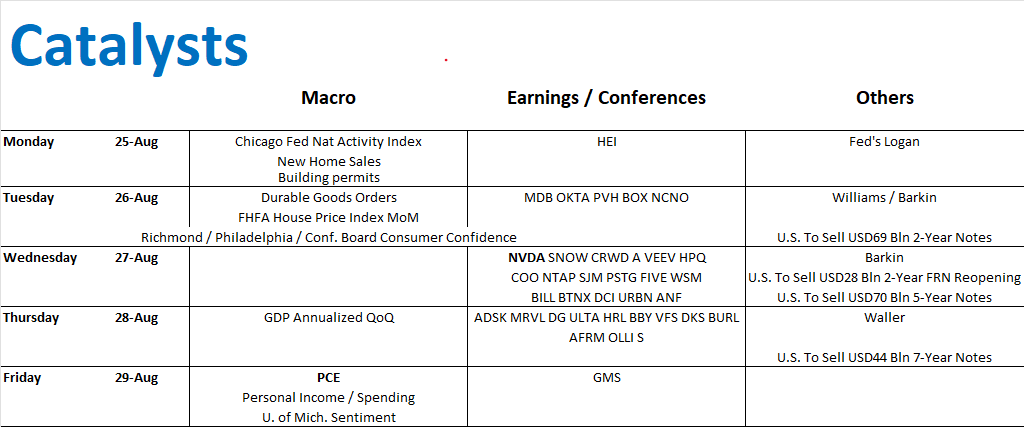

🖥️ Key Earnings & Data to Watch

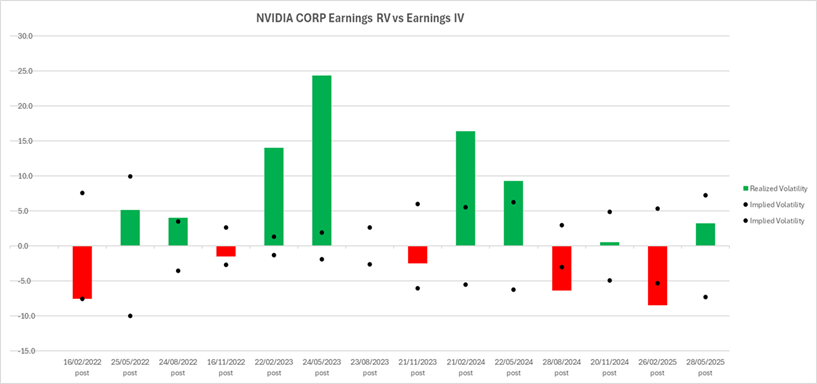

- NVIDIA earnings (Wed, post-close):

- Implied vol: 5.8%, nearly equal to realized vol (rare setup due to compressed vol).

- Expect volatility around China/export headlines and sector rotation.

- Other names: Retail, CrowdStrike, Snowflake

- Macro data:

- Building permits (Mon)

- PCE inflation (Fri) – critical for September Fed decision

- University of Michigan sentiment

- Treasury auctions ($200B+ in supply)

🎯 Looking Ahead

- Market still pricing +/-1.2% weekly S&P move (~70–80 points).

- Rotation broadens market strength—watch Russell & regional banks.

- Inflation data will determine whether September rate cuts stick.

📚 Back-to-School Learning

Our 4×4 educational video series is available, plus limited spaces in the mentoring program for the next 3–6 months (especially US & Asia time zones).

If you’d like to join or explore our 30+ private trading channels, now’s the time.

https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions