Peak or no Peak?

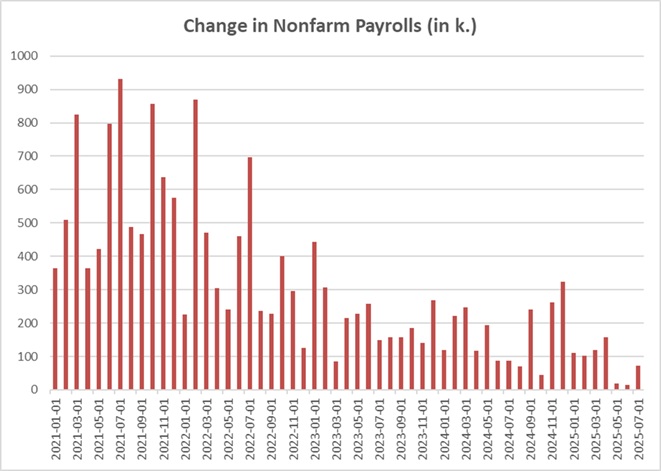

With more than 9 years into the U.S. economic cycle, it is fair to look at the possibility of the end of it. This question has been floating around for quite some time as this cycle is quite extended versus historical data. For example, different indicators were already flashing orange in 2015.

The recent correction in the Equity Market, troubles in Emerging Markets, 75% of the World GDP experiencing an economic slowdown, Central Banks (not all of them though) tightening credit conditions, etc… might be signals that the end of the cycle is near.

As Morgan Stanley did recently, I would like to look at 2 indicators that helped in predicting recent downturns (economic cycle and S&P 500):

The Conference Board Leading Indicator (LEI) and U.S. Consumer Confidence.

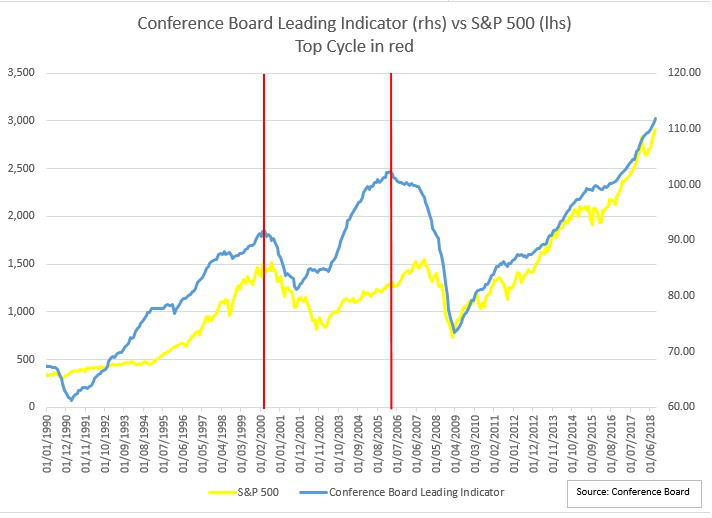

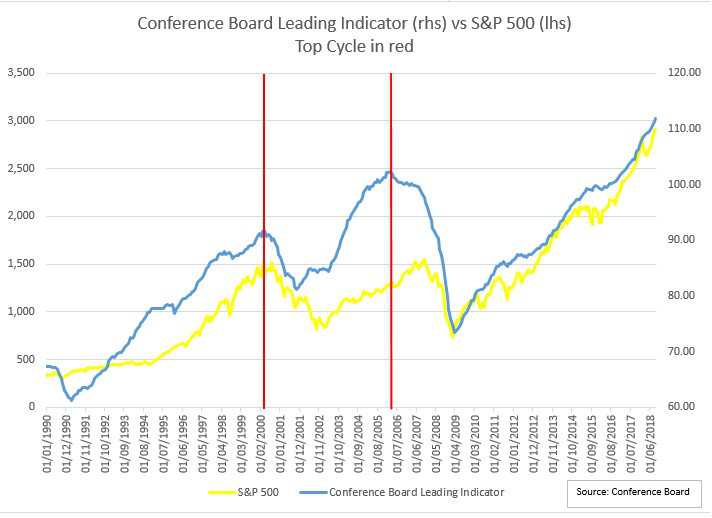

The Conference Board Leading Indicator (LEI) is a composite index of 10 supposedly leading indicators like Building Permits or New Orders.

In its report, MS underlines that peak in LEI is leading the next recession by 15 months and the peak in the S&P 500 by 8 months.

As shown below, it worked well in predicting the last 2 market downturns and the end of the economic cycle:

Below since 2009:

It shows great correlation.

The latest comments from the Conference Board are:

“Economic growth could exceed 3.5 percent in the second half of 2018, but, unless the momentum in housing, orders and stock prices accelerates, that pace is unlikely to be sustained in 2019.”

=> Not sustainable pace means probable lower growth but not necessarily end of cycle.

Peak or no Peak?

Let’s now look at Consumer Confidence through the Conference Board Consumer Confidence.

This index measures the level of optimism/pessimism of U.S. consumers in the economy in the near future.

The findings between the peak in Consumer Confidence and the start of a recession and a downturn in the S&P 500 were very similar to the Conference Board Leading Indicator.

The chart below confirms how Consumer Confidence (Conference Board or University of Michigan) were good indicators in predicting the recent downturns:

Again graph since 2009 and strong correlation:

With the recent comments:

“The Expectations Index posted another gain in October, suggesting that consumers do not foresee the economy losing steam anytime soon. Rather, they expect the strong pace of growth to carry over into early 2019.”

=> At least 3 months left of robust growth.

No peak yet.

Or the following correlation between the University of Michigan Consumer Sentiment Index (UMCSI) Index and the S&P 500:

With the following interesting comments:

“The data only indicate that the tipping point toward escalating pessimism has not been reached.”

No peak yet.

Through those graphs, we can better visualize the correlations between those indicators and the S&P 500. The same can be said about their abilities in forecasting the most recent economic downturns.

Until recently, those indexes have not experienced reversal. In fact, those data are not yet flashing red. Obviously, they might be peaking but they are still “constructive” (I hate that word though).

Still we need to be careful with those data as they are only part of the big picture and obviously more indicators are needed. On top of that, their abilities to predict the end of the cycle might have been reduced or damaged after the violence of the last downturn in 2008-2009 (specially with consumer confidence).

As always with those indicators, we are facing the same question: Is this time different?

I hope it helps,

Gregoire

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions