Oracle Prophecy

Welcome to this week’s edition of Your Next Trade, where we unpack the biggest market movers, macro catalysts, and trading opportunities. This week was packed with action—from Oracle’s explosive earnings to a shift in the AI narrative withAI inferencing market outlook September 2025

🔑 Key Takeaways

- AI remains on fire – Oracle results highlight a shift from training to inferencing, signaling the next phase in AI growth.

- Markets rally – S&P +1.6%, NASDAQ leading, Japan and emerging markets strong, crypto surging.

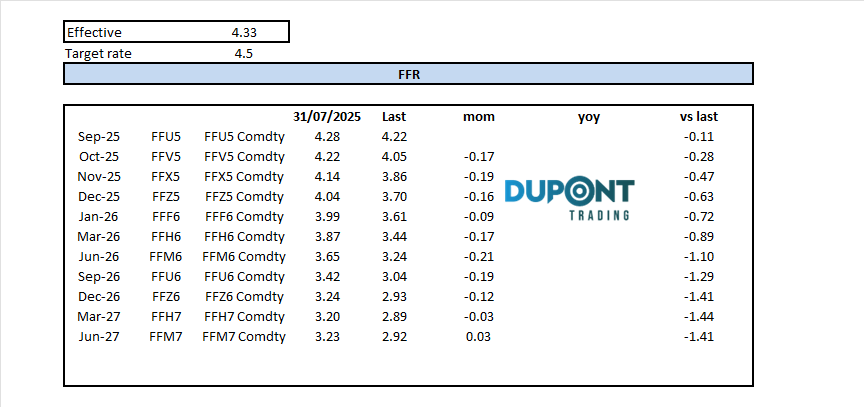

- Fed in focus – The FOMC is expected to cut rates by 25 bps on Wednesday, with more cuts likely in September, October, and December.

- Volatility compressed – VIX remains below 15%, but expiries could trigger spikes.

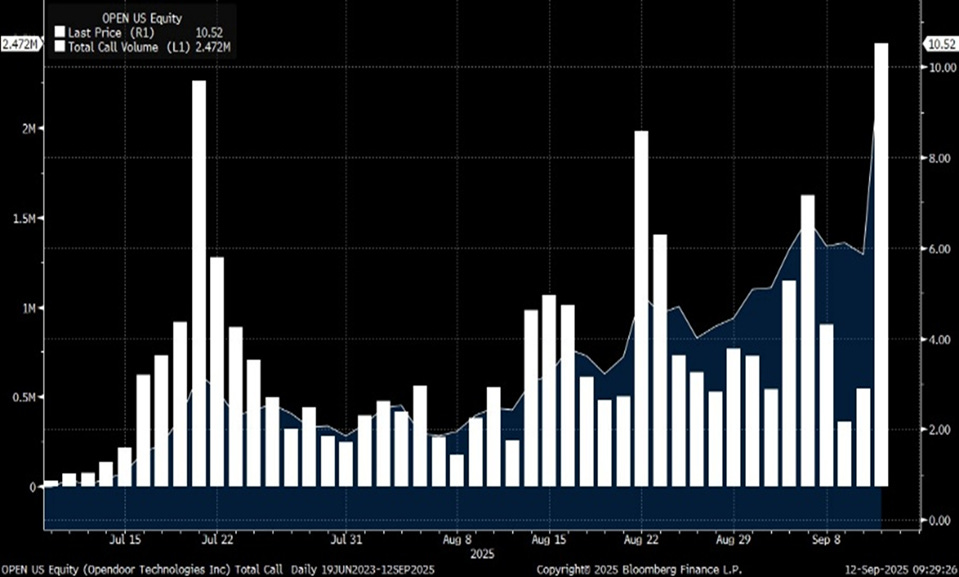

- Retail traders back in force – Meme-like momentum stocks surging, with Tesla and “OPEN” leading.

OPEN Calls (lhs) vs Last (rhs).

🧠 Spotlight: Oracle & the AI Shift

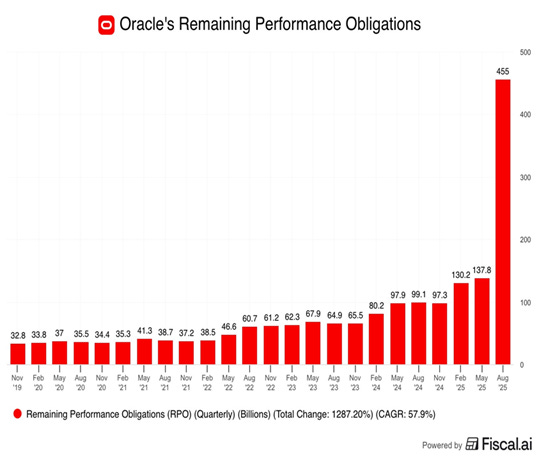

Oracle’s earnings revealed a massive backlog jump from $138B → $455B, but a large portion is tied to ChatGPT’s reported $300B commitment. The big story?

We’re moving from:

- Phase 1: Training AI models (infrastructure buildout – Nvidia, GPUs, chips).

- Phase 2: Inferencing (AI applied to tasks, robotics, automation – boosting Tesla, Micron, SanDisk, wafer makers in Europe).

Trader’s note: This transition is driving semiconductor momentum and creating new opportunities in robotics-linked stocks: MU, SNDK, TSLA…

📊 Market Recap

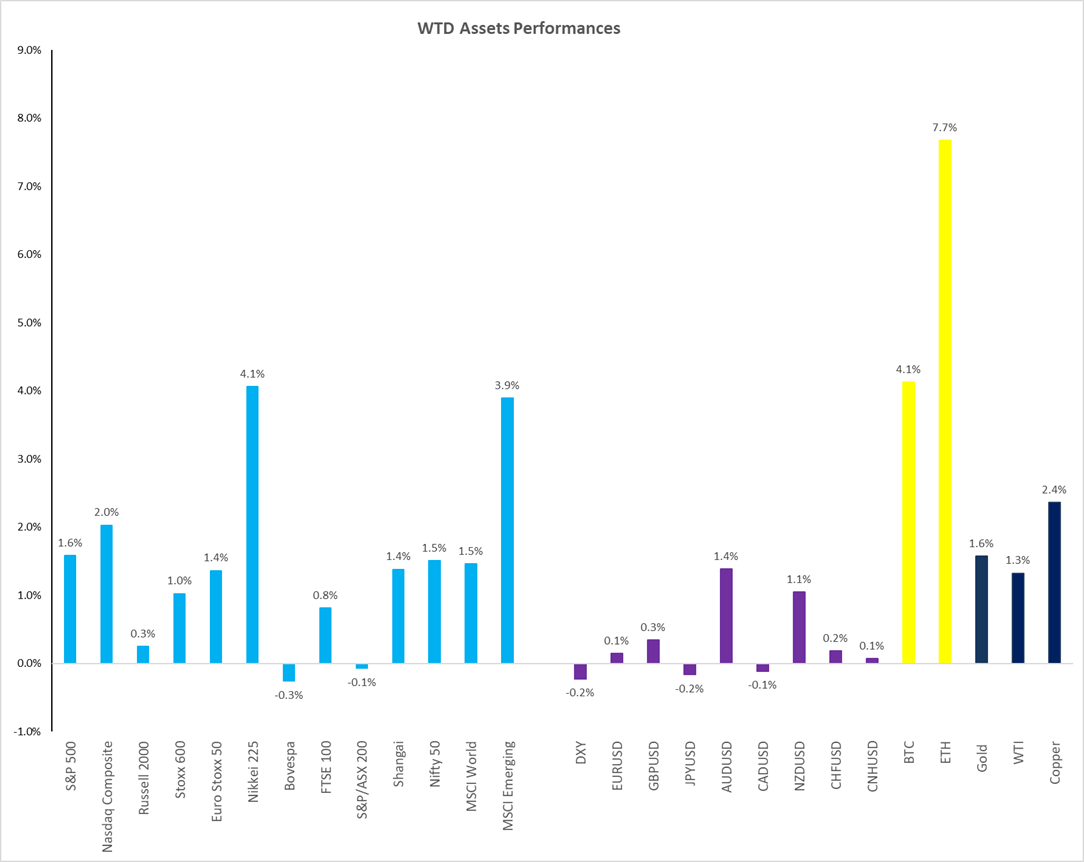

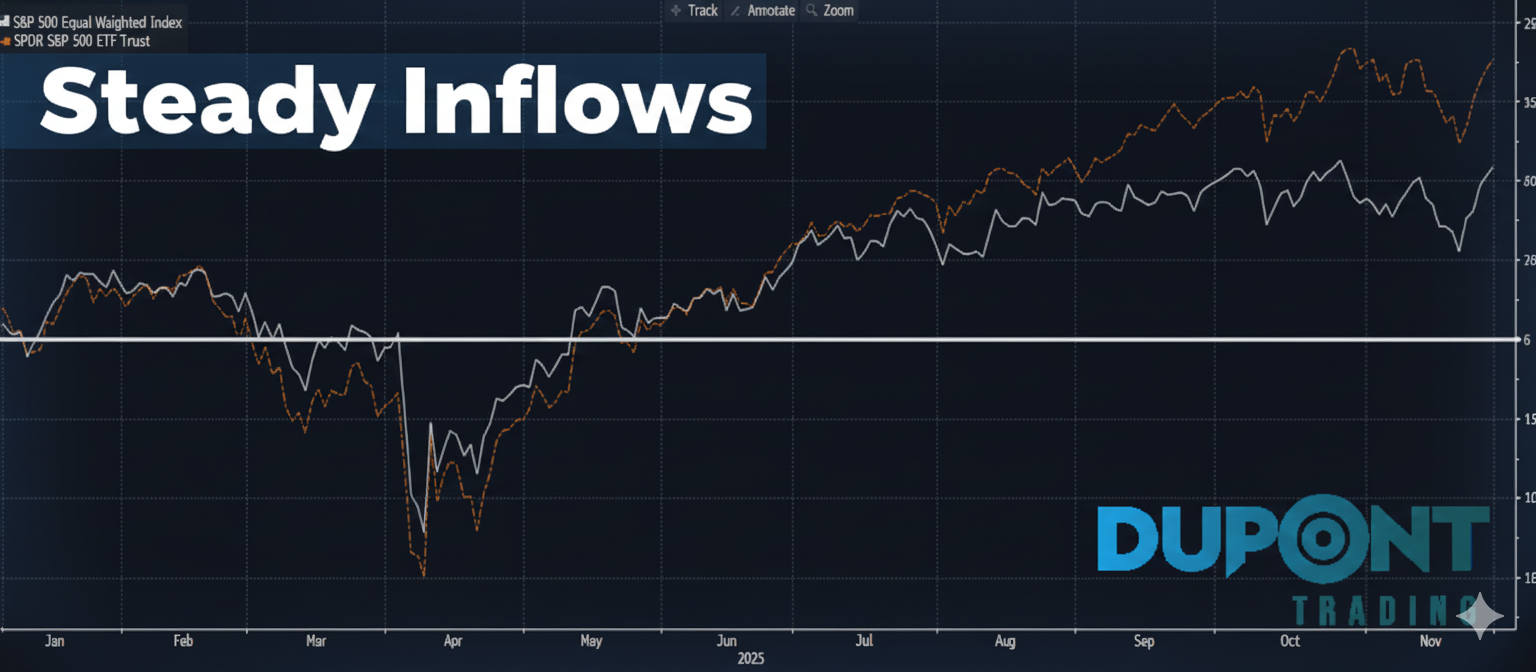

- Equities: Strong week – S&P +1.6%, NASDAQ outperformed, Japan & emerging markets surged.

- Crypto: Bitcoin +4%, Ethereum +7%.

- Commodities: Broad strength.

- Rates: Despite hotter CPI (+0.35% MoM, 3.1% YoY), yields dipped below 4% before rebounding; Fed expected to ease policy.

- Volatility: VIX compressed (<15%), risk-on sentiment dominating.

Sector winners: Tech, semis, cloud, social media.

Sector laggards: Defensives like consumer staples & materials.

🔥 Retail & Momentum Action

- “Open” stock exploded on meme-like momentum with 1B shares traded in a single day, surpassing its market cap.

- Tesla surged +10% on AI/robotics optimism and Musk’s new contract, with retail-driven call options fueling gains.

- High-beta momentum stocks gained ~10% for the week.

🏦 Central Banks & Catalysts Ahead

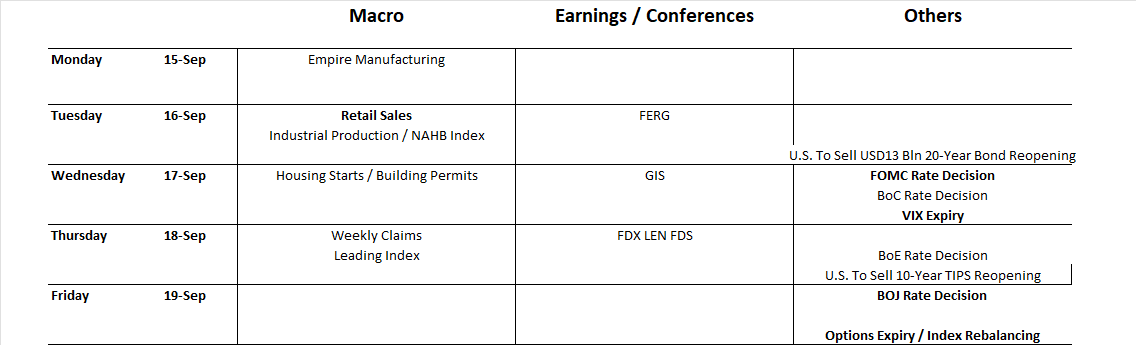

A busy week for policy and expiries:

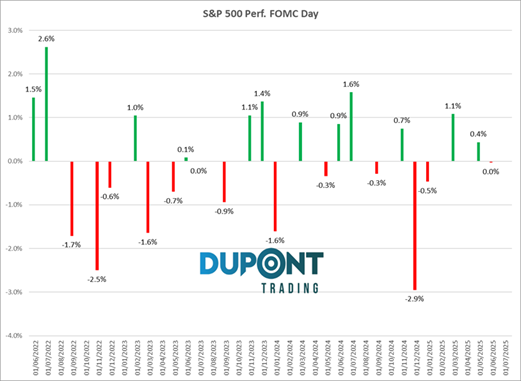

- FOMC decision (Wed) – 25 bps cut expected, Powell’s press conference in focus.

S&P 500 Performance on FOMC Day.

- Other central banks: Canada (Wed), England (Thu), Japan (Fri).

- Expiries:

- VIX futures (Wed)

- Options expiry (Fri)

- Index rebalancing (Fri close)

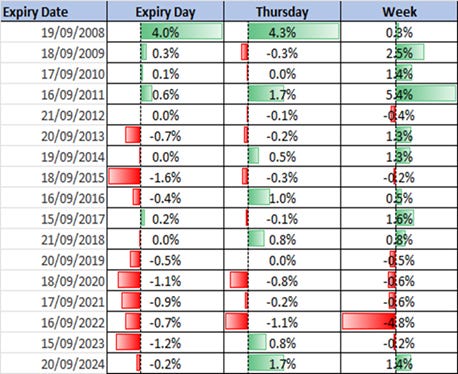

S&P 500 Performance for September OpEx Week.

- Macro data: Retail sales, housing starts, building permits, weekly jobless claims.

Expect volatility clusters around mid-week (FOMC, VIX expiry) and Friday (OPEX + rebalancing). SPY Weekly Straddle at low levels: + / -1.2%.

👥 Community Note

These insights are shared and debated daily in our Discord trading community. If you’d like deeper dives—like the upcoming AI second-wave playbook webinar—stay tuned or drop me a note.

📧Our 4×4 educational video series is available, plus limited spaces in the mentoring program for the next 3–6 months (especially US & Asia time zones).

For more information: https://duponttrading.com/4×4-course/

If you’d like to join or explore our 30+ private trading channels for $74.99/month, now’s the time.

https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions