Options Frenzy & Market Momentum: Is Wall Street Too Easy Right Now?

🔥 Options Mania: Is the Market Too Easy?

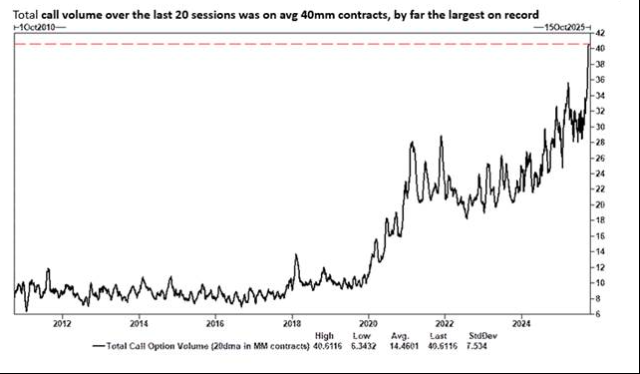

Social media is buzzing with stories of easy money in options trading. With over 40 million call contracts traded in the last 20 sessions, the market feels more like a casino than a disciplined investment environment. The surge in free options trading platforms and self-proclaimed educators has only added fuel to the fire.

Source: Goldman Sachs.

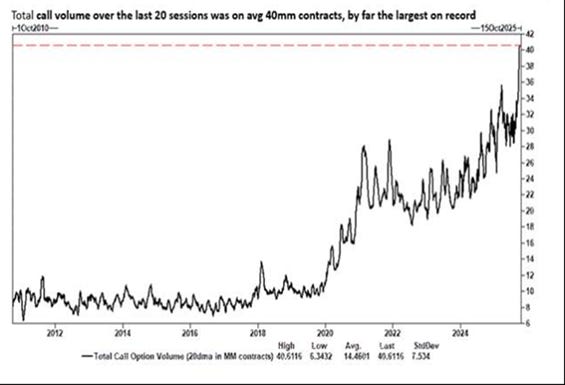

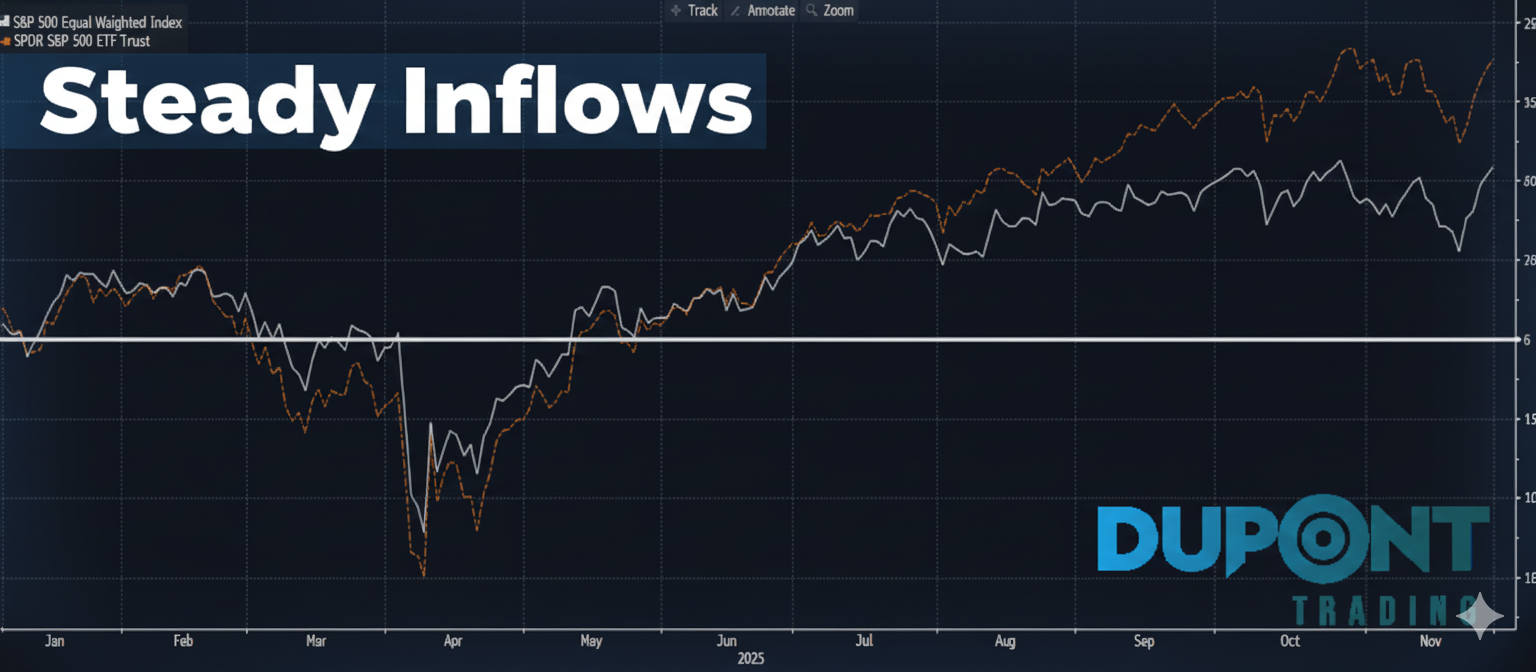

📊 Weekly Asset Performance

- S&P 500: +1.1% (exactly as predicted by the straddle pricing)

- NASDAQ: +1.3%

- Russell 2000: Slightly higher

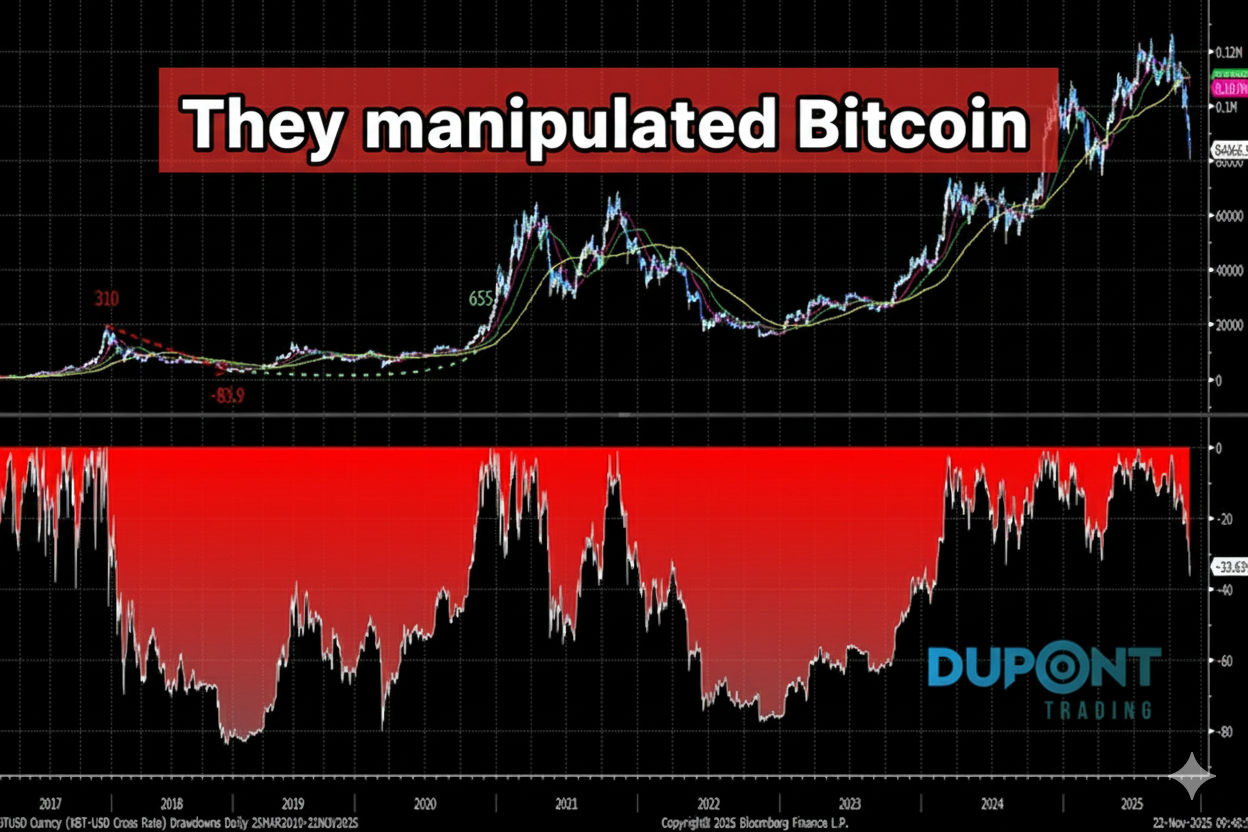

- Crypto: 🚀 Bitcoin hit a new all-time high of $125,000, Ethereum also surged

- Commodities: Gold and copper continue to climb; WTI crude dipped into the low $60s

- US Dollar: Flat

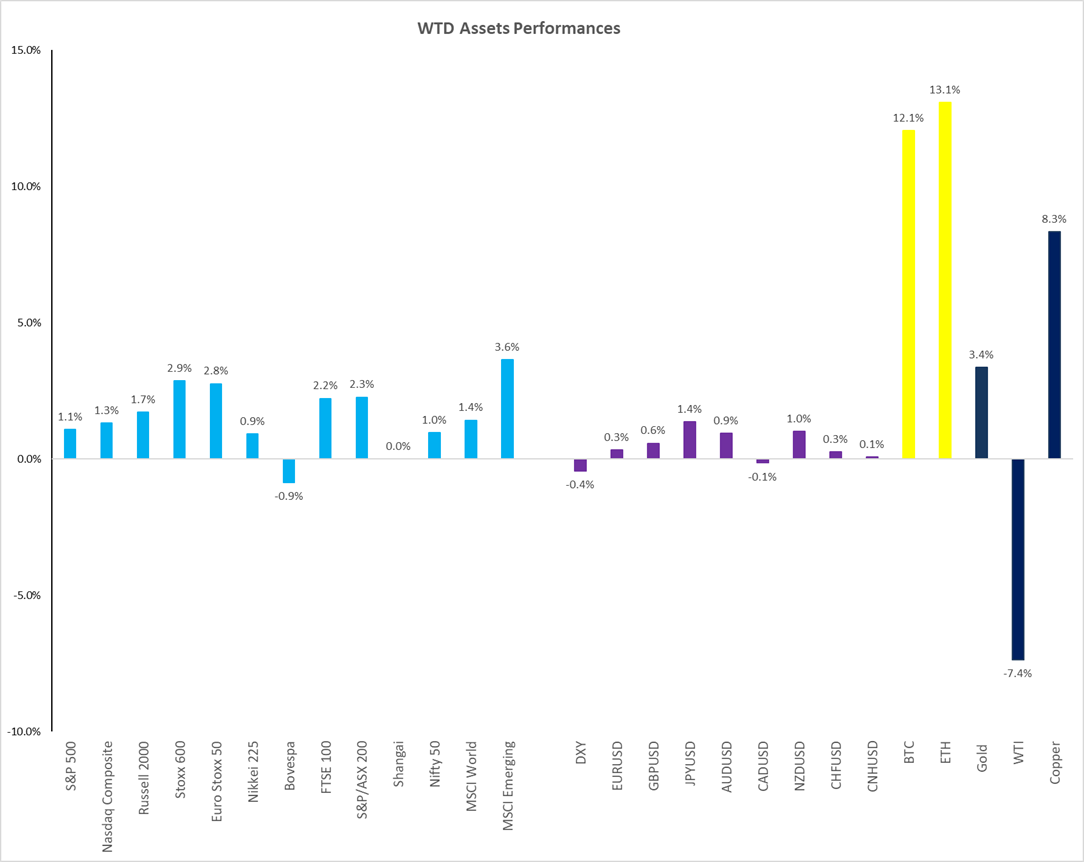

🏥 Sector Spotlight: Healthcare Roars Back

Healthcare (XLV) surged nearly 7%, driven by a major deal between Pfizer and the Trump administration. Biotech also rebounded, making this sector the week’s standout performer.

Meanwhile:

- Energy: Struggled due to falling oil prices

- Semiconductors: Continued strength

- Luxury (LVMH): Rebounding in Europe

📉 Rates & Fed Watch

- US 10-Year Yield: ~4.12%

- Rate Cuts Expected: 90% chance in October and December

- Government Shutdown: Markets unfazed—for now. If prolonged, risks to the economy increase.

📈 Volatility & Sentiment

Despite rising equities, the VIX (volatility index) also climbed—an unusual pairing that occurs only ~10% of the time. This signals heavy tail-risk hedging and aggressive call buying.

📉 Technical Trends

- S&P Futures: Overstretched, but still trending up ~1% weekly

- Russell 2000: Broke out of a potential triple top

- Europe (STOXX 600): Breaking higher, led by healthcare and banks

- Bitcoin: Strong weekend rally, slight pullback Monday morning

- XLV (Healthcare ETF): Strong momentum, led by Pfizer

- Palantir & Tesla: Weakness suggests cracks in the rally

🧪 Market Quality Check

Retail traders dominate, pushing non-profitable tech (+8.5%), meme stocks (+3.5%), and most-shorted names (+8%). But leadership from quality names is fading.

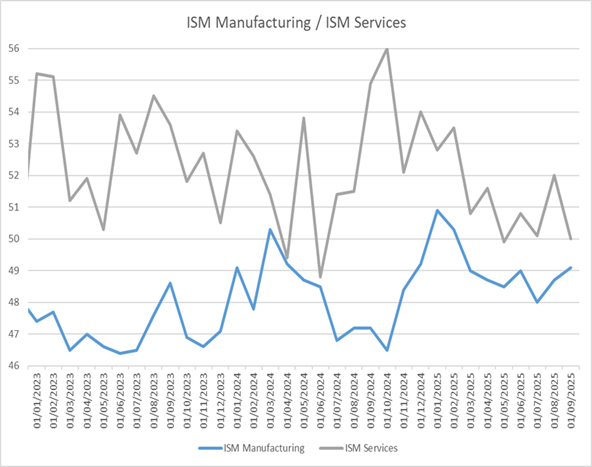

📉 Macro Signals

- Job Market: Weakening, supporting Fed rate cuts

- ISM Manufacturing & Services: Hovering near 50, implying ~1.5% GDP growth

- Inflation: Persistent, especially in services

🗓️ Looking Ahead

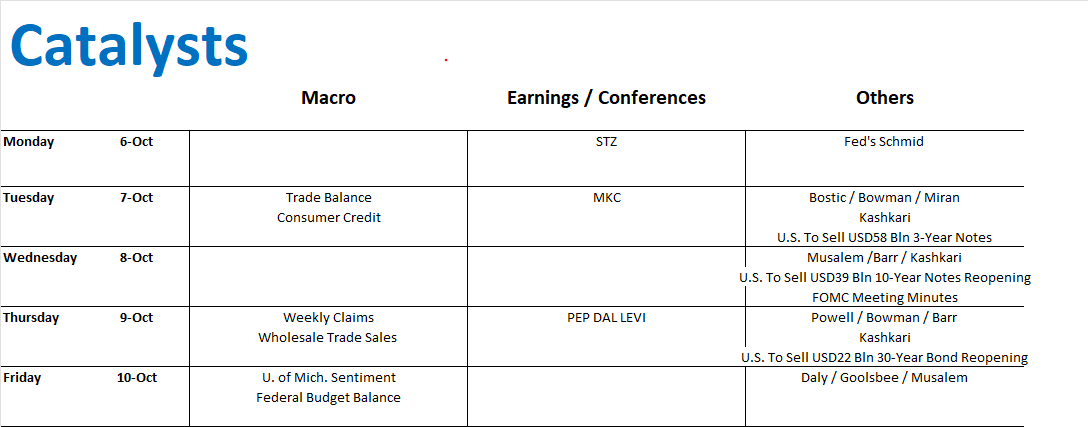

- Earnings Season: Starts in ~10 days with J.P. Morgan

- Q3 Earnings Growth: Estimated at +7%, down from Q2’s 11–12%

- Expected Market Move: ±1.2%

- Fed Speakers: Including Powell on Thursday

- Bond Auctions: $120–130B across 3, 10, and 30-year maturities

- Japan: New government, Nikkei hits all-time high

💬 Final Thoughts

Retail traders are in control, but the market is being driven by speculative, short-dated strategies. If you’re serious about trading, consider joining the 4×4 video series https://duponttrading.com/4×4-course/ , mentoring sessions, or the Discord trading community.

If you’d like to join or explore our 30+ private trading channels for $74.99/month, now’s the time.

https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions