Nvidia’s $100 Billion Bet on ChatGPT

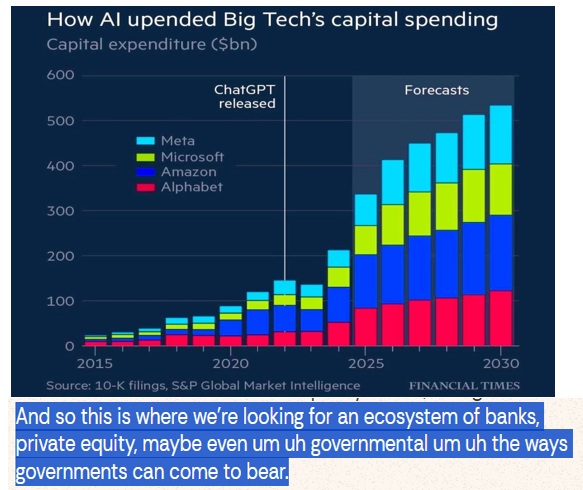

The headline of the week came from Nvidia and OpenAI. Nvidia announced a $100 billion investment into ChatGPT, with plans to supply chips while also taking equity in OpenAI.

This deal underscores the massive capital requirements of AI. OpenAI has already flagged the need for $500 billion to $1 trillion in future investments, with Oracle and SoftBank previously joining financing rounds. Still, questions linger about whether these astronomical sums will generate sustainable returns — reminiscent of the dot-com era’s “round-tripping.”

Reports from Bain and J.P. Morgan suggest that by 2030, AI-related companies may fall short of revenue targets by as much as $800 billion. Meanwhile, since November 2022, AI semiconductors alone have accounted for:

- 75% of S&P 500 returns

- 80% of earnings growth

- 90% of capital spending

Source: https://am.jpmorgan.com/us/en/asset-management/institutional/insights/market-insights/eye-on-the-market/the-blob-capital-china-chips-chicago-and-chilliwack/

The market is clearly betting big on AI — but not without risks.

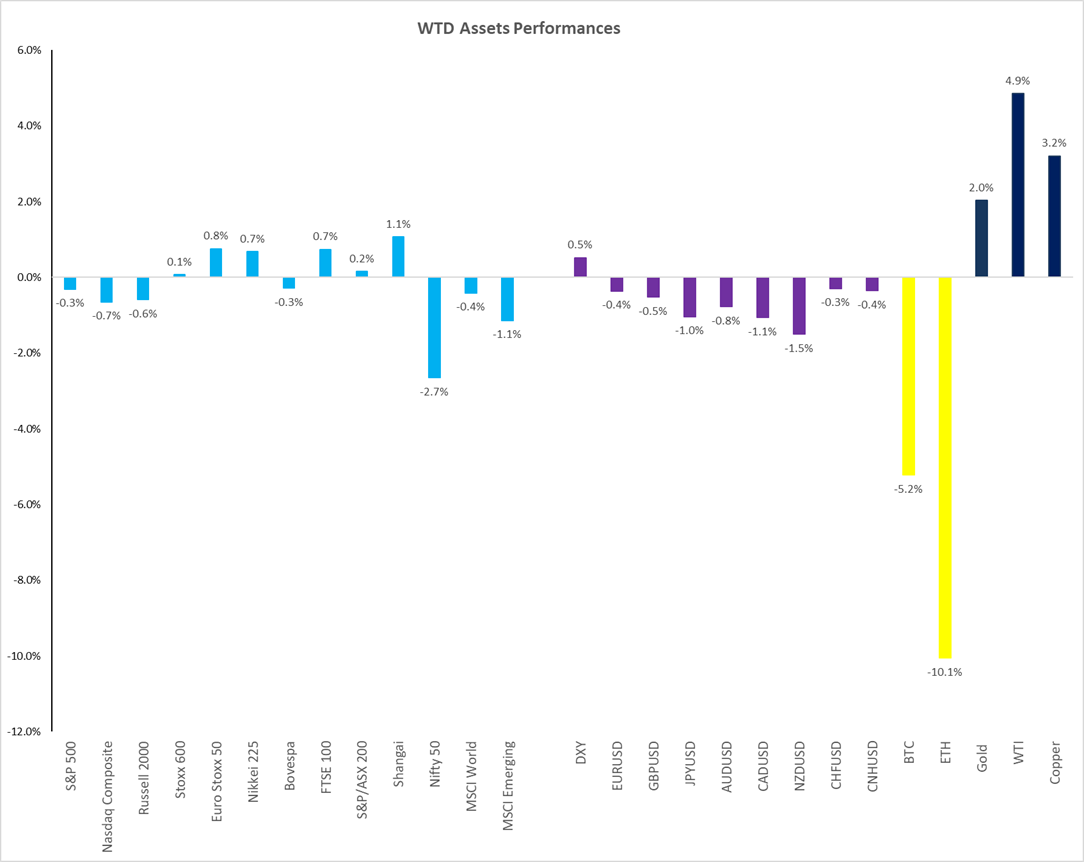

Market Performance

- S&P 500, Nasdaq, Russell: Flattish week with less than 2% pullback from highs.

- India equities: Down ~3%.

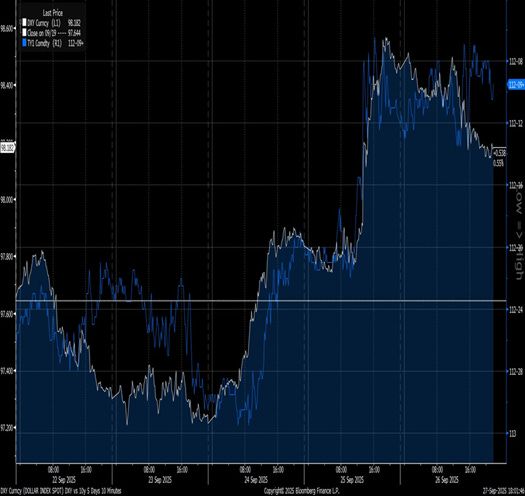

- Dollar: Strong early in the week, reversed midweek.

- Crypto: Bitcoin slipped below 110k; Ethereum under 4,000. Still strong since early July.

- Commodities: Gold, WTI, and copper all up over 2%.

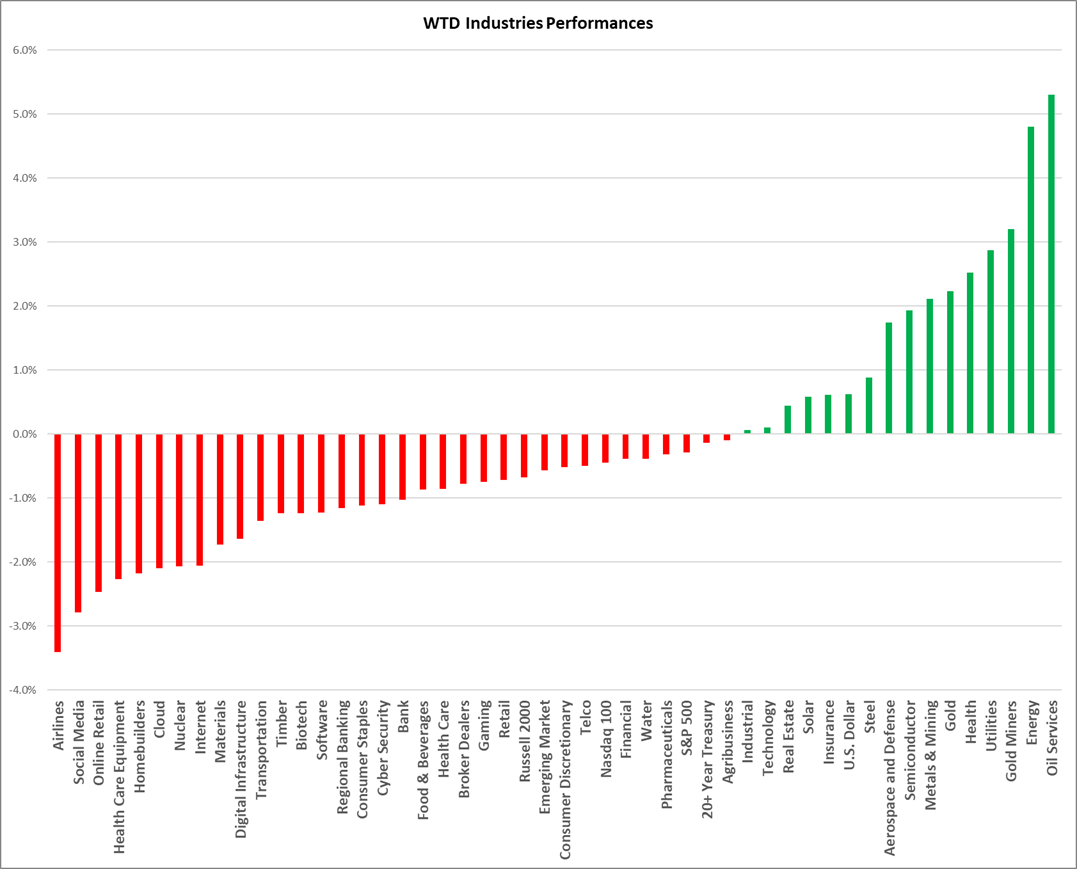

Sector highlights:

- Winners: Oil services, gold miners, utilities, semiconductors.

- Laggards: Airlines, online retail, homebuilders, consumer staples.

Rates, Macro & the Fed

- US 10-year yield: Climbed to 4.18%.

- Fed cuts: October cut remains priced at ~80–90% probability. December cut odds have fallen sharply after GDP revisions showed resilient US consumption.

- Volatility: VIX hovered around 15%. Some unusual buying of short-dated calls pushed implied volatility higher than realized.

The market is still trading on “good news is bad news” logic — stronger macro data reduces expectations for rate cuts, pressuring equities.

Technicals & Asset Watch

- S&P futures: Trend remains intact, though Russell 2000 shows a triple top.

- Oil (WTI): Strong at $66, supported by geopolitical tensions.

- Crypto: Pullback to July levels despite continued inflows.

- Dollar: Correlating closely with US 10-year yields.

DXY (lhs) vs 10y Futues (rhs)

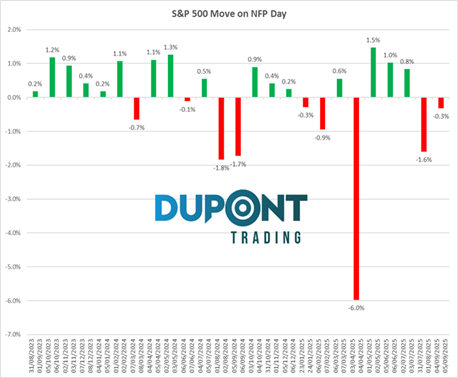

What’s Ahead

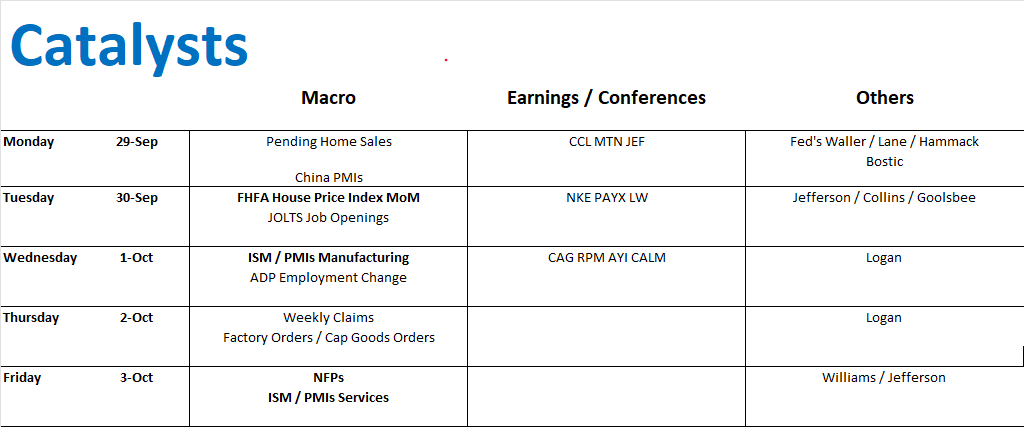

- Macro:

- Case-Shiller housing data (Tuesday)

- ISM Manufacturing & Services PMI (Friday)

- Nonfarm Payrolls (Friday) – consensus: 50–60k new jobs

- Earnings: Nike (Tuesday)

- Other: JPMorgan “collar” roll on Tuesday may bring late-session volatility.

Markets are also bracing for noise around the potential US government shutdown, though history suggests limited market impact.

Final Thoughts

September has been resilient despite seasonal headwinds, with flows into equities still strong. Looking ahead, October–December historically bring positive seasonality for the S&P 500.

Thanks to the new members joining our mentoring and Trading Community.For more information: https://duponttrading.com/4×4-course/

If you’d like to join or explore our 30+ private trading channels for $74.99/month, now’s the time.

https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions