New Records

Hello Traders,

This week, we celebrated Thanksgiving and reflected on a remarkable November in the markets. Here’s a recap of the key highlights:

Market Overview

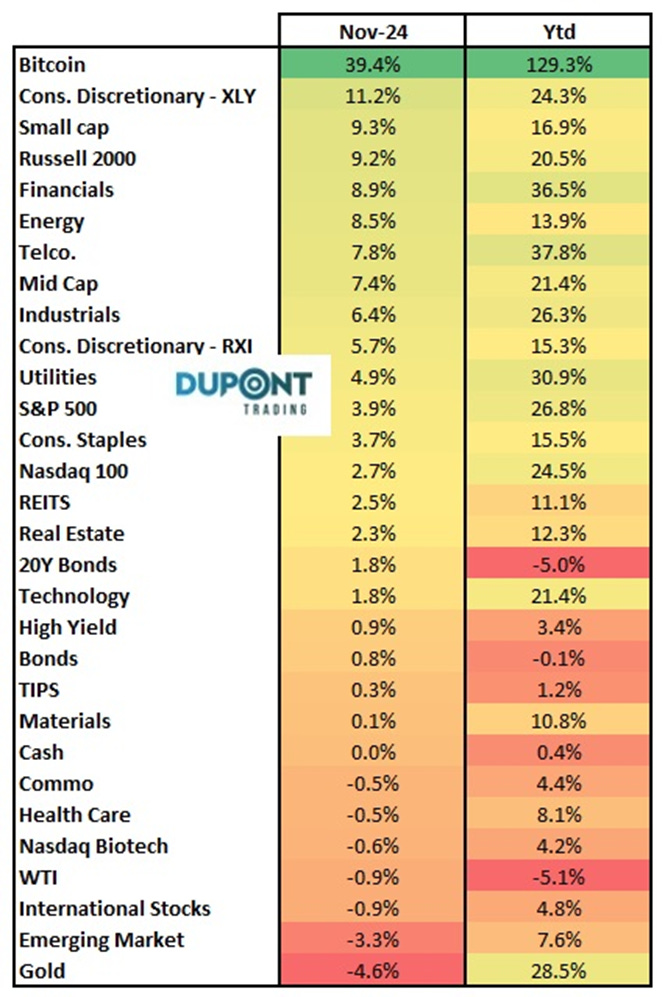

- November Performance:

- Bitcoin: Up 40%.

- Russell 2000 (Small & Midcaps): Up 10%.

- S&P 500: Up 4%.

- Key Sectors: Financials and Energy surged by 9%.

- 2024 is shaping up to be an exceptional year, with the S&P 500 marking its best performance of the century.

- Weekly Highlights:

- US Markets gained 1.1%, exceeding the Thanksgiving week historical average of 0.8–0.9%.

- Brazil struggled, down 3% due to fiscal concerns and currency challenges.

USDBRL since 2021

Sector Insights

- Broadening Market Flows:

- Funds are shifting from tech giants like Nvidia into sectors such as solar, online retail, and biotech. We are seeing rotation.

- Retail Strength: Companies like Urban Outfitters are performing well, bolstered by Black Friday and Cyber Monday sales.

XRT Retail ETF last 20 sessions

- Energy and Commodities:

- Energy down 2% for the week, with WTI trading near $70.

- Gold weakened slightly, while Ethereum showed strength.

Key Macro Developments

- US Treasury News:

- Trump nominated a new Treasury Secretary, Scott Bessent (formerly of Soros Fund Management). His “Three Arrows” policy focuses on:

- Reducing the US deficit to 3% of GDP.

- Targeting 3% GDP growth.

- Increasing oil production by 3 million barrels/day.

- Trump nominated a new Treasury Secretary, Scott Bessent (formerly of Soros Fund Management). His “Three Arrows” policy focuses on:

- Interest Rates & Fed Expectations:

- The US 10-year yield dropped to 4.17%.

- A 66% probability of a December rate cut remains.

- Global Updates:

- French budget concerns persist, with widening bond spreads affecting CAC 40 performance.

French CAC 40 / Europe STOXX 600 (lhs) vs FR10y -DE10Y (rhs)

Technical Trends

- S&P 500: The upward trend continues, with new highs being made regularly.

- Russell 2000: Benefiting from sector rotation and strong retail performance.

- Shorted Stocks: Surged 30% in November, driven by short-covering flows rather than fundamentals.

Looking Ahead – Week Catalysts

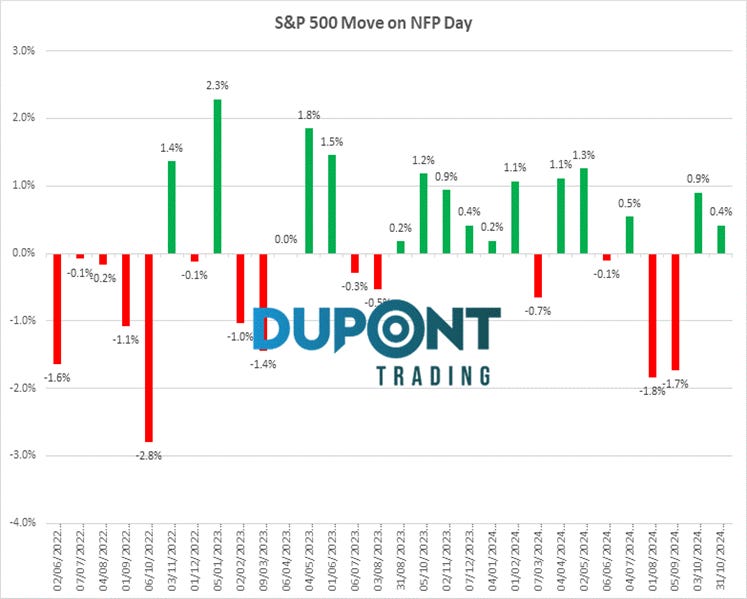

- Macroeconomic Data:

- Manufacturing (Monday) and Services (Wednesday) PMIs, ISM reports, and Non-Farm Payrolls (NFP) on Friday.

- The job market remains a critical indicator for Fed decisions.

S&P 500 on NFP day.

- Earnings Reports:

- Notable names this week: CRM, Marvel, and Lululemon.

- Fed Speeches:

- Keep an eye on Jerome Powell’s address on Wednesday.

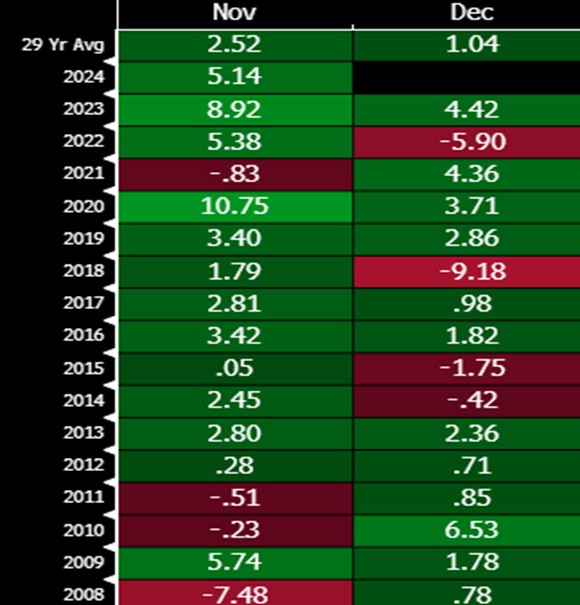

- Seasonality:

- Historically, December starts weak before rallying post-options expiry.

S&P 500 November and December Performances.

- Historically, December starts weak before rallying post-options expiry.

Want more insights?

Join our Discord community for in-depth discussions, access to premium content, and more! https://discord.gg/wrvGuF3M

In the near future, the most advanced channels will go beyond a paywall.

And if you’re interested in personalized mentoring, the 4×4 Video Series or the most advanced Discord channels please send us an email.

Special Offer

Don’t miss out on our Holiday Discount! Get 25% off the 4×4 video series until the end of 2024. Use code HOLIDAY25 to join our growing trading community.

Have a great trading week!

Greg

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.