Never Short a Dull Market

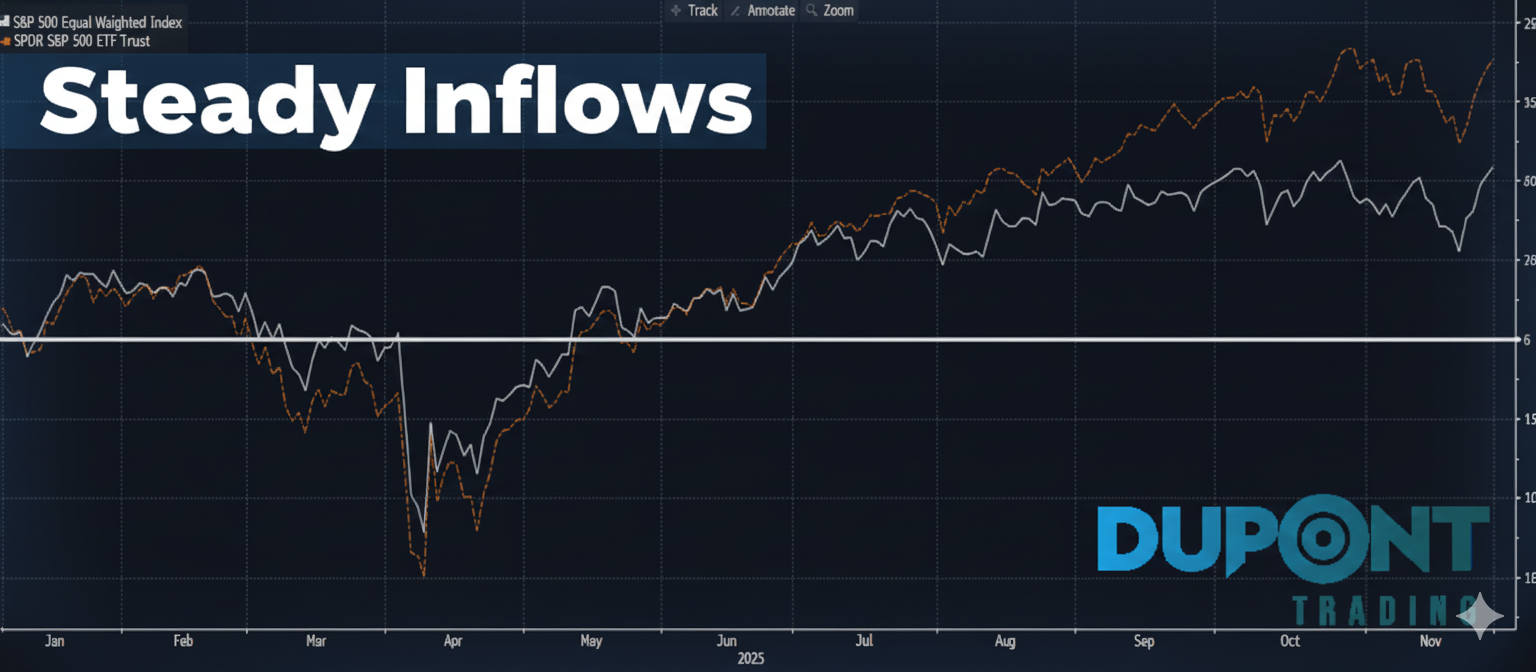

Over the last six months, the S&P 500 has experienced a steady climb from 5,000 to 5,900, reflecting a 17% growth. Despite this rise, market volumes have been decreasing, signaling low participation from traders. With hedging dominating the options market, participants continue to expect a downturn, though stocks keep grinding higher.

In the meantime, due to the coming elections, puts have been pretty much in demand (left tail) vs little calls (right tail).

Key takeaway: Low-volume, slow markets can still be strong performers, but always remain cautious of unexpected shifts.

- U.S. Elections & Their Market Impact

With U.S. elections approaching, the market is pricing in a potential Trump win. This has significantly influenced sector performances, with cryptocurrencies like Bitcoin seeing strong gains, driven by investor sentiment around future regulatory shifts. On the downside, oil services and solar sectors have been struggling, largely due to the political outlook and volatile oil prices.

U.S. Republican Winners vs U.S. Democrat Winners

- Week-to-date performance highlights:

- S&P 500: +0.9%

- NASDAQ: +23% YTD

- Bitcoin: Strong upward momentum

- WTI (Oil): -8% on the week

- Financial Sector: Strong Earnings Boost

As the U.S. economy continues to outperform expectations, financial stocks have been thriving. Strong earnings from JP Morgan and Goldman Sachs reflect this, with financials exceeding forecasts due to the robust economic environment.

GDP growth estimates have increased to 3% for Q4, bringing down recession odds to just 5-10%. Meanwhile, bond yields are on the rise, with the 10-year U.S. Treasury yield crossing 4%, though it’s expected to become problematic only if it reaches 4.2% and higher.

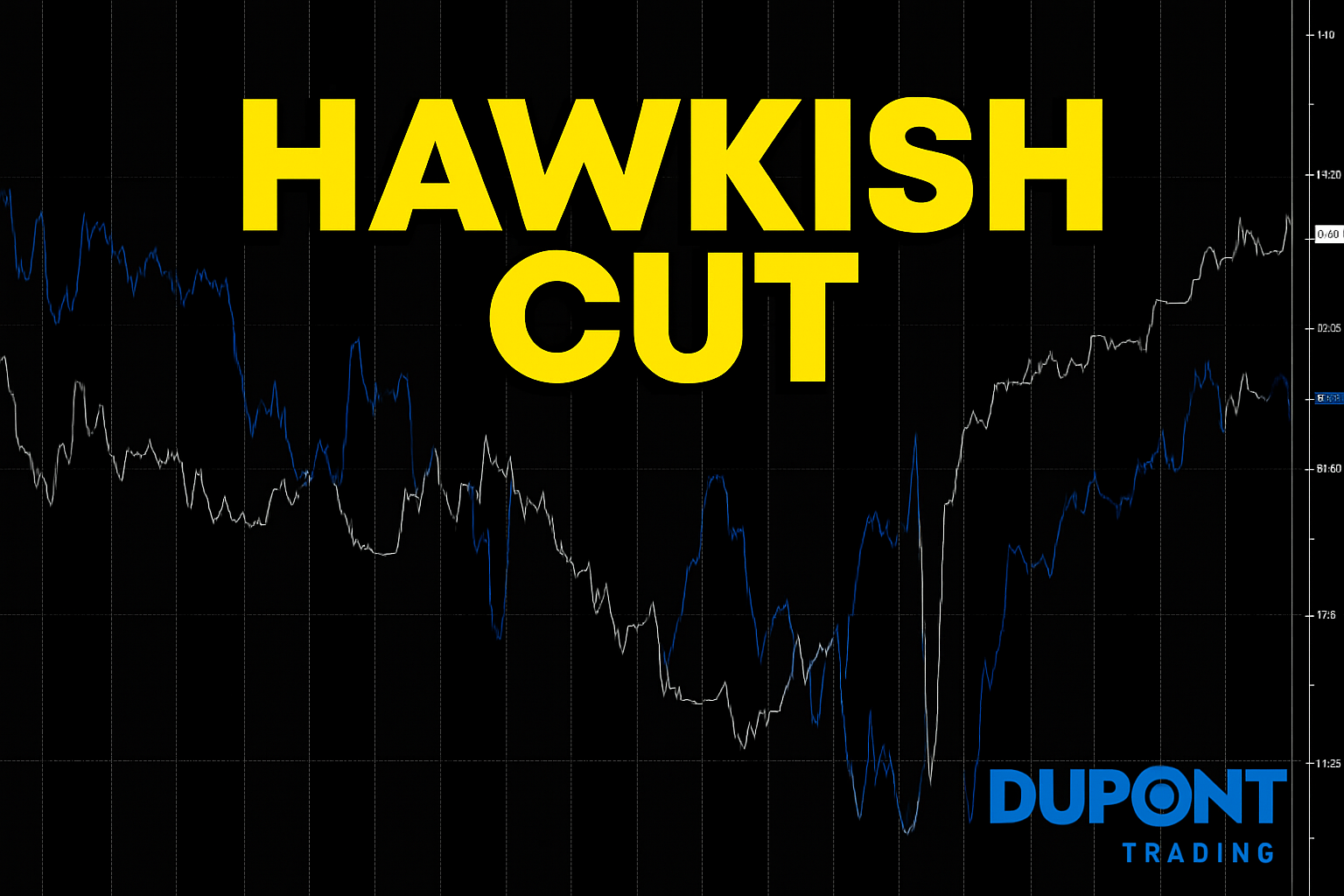

- Volatility Outlook

While the VIX (volatility index) sits at 19, signaling heightened caution, the market’s actual volatility remains low, with small weekly moves of around 0.5-1%. This suggests that, despite some investor nerves, there isn’t significant disruption anticipated in the near term.

Key takeaway: Hedge cautiously, but don’t expect major shifts as long as the economic fundamentals remain strong.

- Earnings Season: Key Results & Insights

The U.S. earnings season has kicked off strong, with 79% of companies outperforming expectations. However, the index is also reporting its lowest earnings growth since Q2 2023 (-4.2%) (Source: Factset).

https://insight.factset.com/sp-500-earnings-season-update-october-18-2024

So far in the U.S., stocks that beat expectations had an outlier upside move: JPM, NFLX…

On the contrary, European stocks that missed have been severely punished: ASML, LVMH…

Industrial stocks will be a key focus in the coming week as earnings continue to roll in. The semiconductor sector, led by TSM, remains a solid bet for 2025, thanks to robust demand from AI technologies.

Keep an eye on upcoming earnings reports, especially from industrials and cyclicals, which will provide critical insight into U.S. economic health in 2025.

- What to Watch This Week:

- U.S. Earnings: Industrials are in focus. Many big names.

- Global Macro Data: Key indicators include retail sales, flash PMIs, and the Bank of Canada’s rate decision (expected 50 bps cut).

- Market Trends: Watch for moves in WTI crude, silver, and financials, as these sectors react to macro and geopolitical news.

The episode wraps up with a reminder to stay informed, especially with upcoming elections and continued earnings reports. Despite the low market volatility, opportunities abound for those who remain cautious but engaged.

Want more insights?

Join our Discord community for in-depth discussions, access to premium content, and more! https://discord.gg/wrvGuF3M

And if you’re interested in personalized mentoring, be sure to reach out soon, as slots are filling up quickly: https://duponttrading.com/mentoring/

Have a great trading week!

Greg

greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions