Multiple Deadlines

🗓️ Market in a Holding Pattern: Waiting for the Next Catalyst

Over the past three weeks, markets have been trading sideways. The S&P 500 and NASDAQ have fluctuated within a narrow 2–3% range, with the S&P hovering between 5900 and 6050. Investors are in “wait-and-see” mode, anticipating several key deadlines:

- Tariff Deadline: Set to hit in early July, 90 days after the initial announcement in April.

- Geopolitical Tensions: Ongoing uncertainty around Iran-Israel relations and U.S. diplomatic involvement. The US launched an operation called “Midnight Hammer” involving 125 aircraft, including B-2 stealth bombers, to strike Iran’s nuclear sites with 30,000-pound bunker-buster bombs.

- Earnings Season: The next wave begins mid-July.

🔥 Hot Money Returns: Meme & Momentum Trades Are Back

Despite the flat market, there’s a surge in speculative trading:

- SPACs are making a comeback, with Goldman Sachs reportedly re-entering the space.

- Meme stocks and momentum trades are gaining traction, reminiscent of the 2020–2021 frenzy.

- Circle, a stablecoin company, IPOed at $31 and soared to $240 following favorable regulation.

Circle last (rhs) vs CRCL Total Calls (lhs).

📊 Weekly Asset & Sector Performance

- Major Indexes: Flat for the week.

- Europe: Underperformed, down 1–2% after a strong YTD run.

- US Dollar: Stabilized after a 10% decline ytd.

- Bitcoin & Gold: Both down ~2%.

- Oil (WTI): Rose to ~$75 amid Middle East tensions.

Sector Highlights:

- Winners: Broker-dealers, nuclear, and banks (e.g., JP Morgan nearing all-time highs).

- Losers: Solar, healthcare, and biotech—pressured by potential Trump-era regulatory shifts.

💬 Fed Watch & Macro Outlook

- FOMC Meeting: No rate change, but dovish tones from Fed officials like Waller suggest a possible July rate cut.

- Fed Funds Futures: Still pricing in two cuts by year-end.

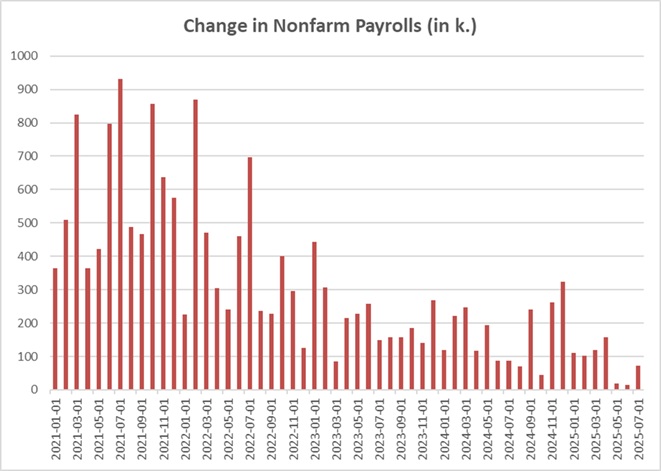

- Macro Data: Weak retail sales and softening hard data signal potential economic slowdown.

- Volatility (VIX): Spiked to 20% short-term due to geopolitical risks.

🔍 Technicals & Options Insight

- S&P 500: Pinned around the 6,000 level due to heavy options open interest.

- Momentum Stocks: Up 6% despite flat indices, driven by aggressive call buying and gamma squeezes.

- Oil & Gold: Rising on geopolitical noise, but fundamentals remain stable.

🗓️ What to Watch This Week

- Fed Speakers: Including Powell on Tuesday.

- Iran / Israel War.

- Economic Data: Flash PMIs (Mon), PCE inflation (Fri), University of Michigan sentiment.

- Tariffs.

- Earnings: FedEx (Tues), Micron & Nike (Wed).

- Bond Supply: $114B in auctions mid-week.

- Bank Stress Tests: Results due Friday after the close.

📌 Final Thoughts

Markets are calm on the surface but bubbling underneath with speculative energy. With multiple deadlines approaching—tariffs, Fed decisions, Iran War and earnings—expect volatility to return soon.

Community and Mentoring

- Join Our Community: Our Discord community offers both free and advanced channels for in-depth discussions: https://discord.com/invite/Yf42SgAx7fhttps://buy.stripe.com/5kA3dmdVV1g4cuIaEE

- For personalized mentoring, reach out soon as slots are filling up quickly.

Have a good Trading Week!

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions