Credit Next

Equity Markets: Correction or Recession?

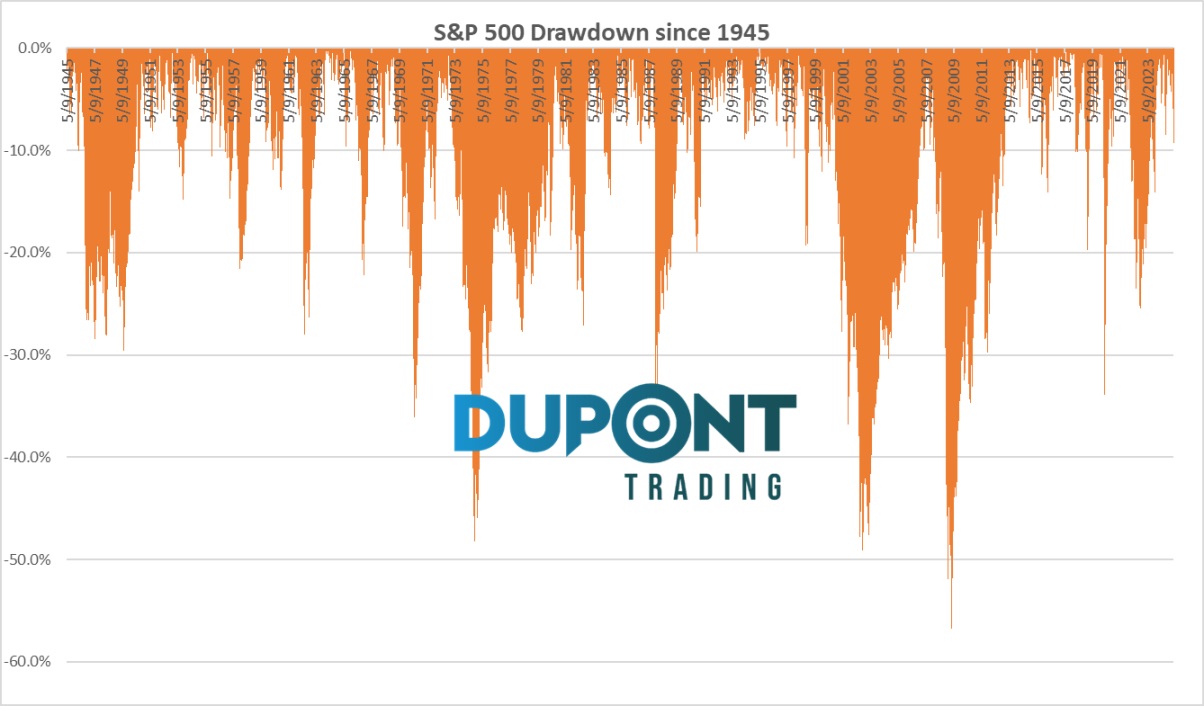

Since mid-February, we’ve seen a 10% correction in the S&P 500, pushing U.S. equities into negative territory for the year. Historically, a 10% drop is normal in non-recessionary environments. But if you’re anticipating a recession, 30-50% drawdowns are historically more common.

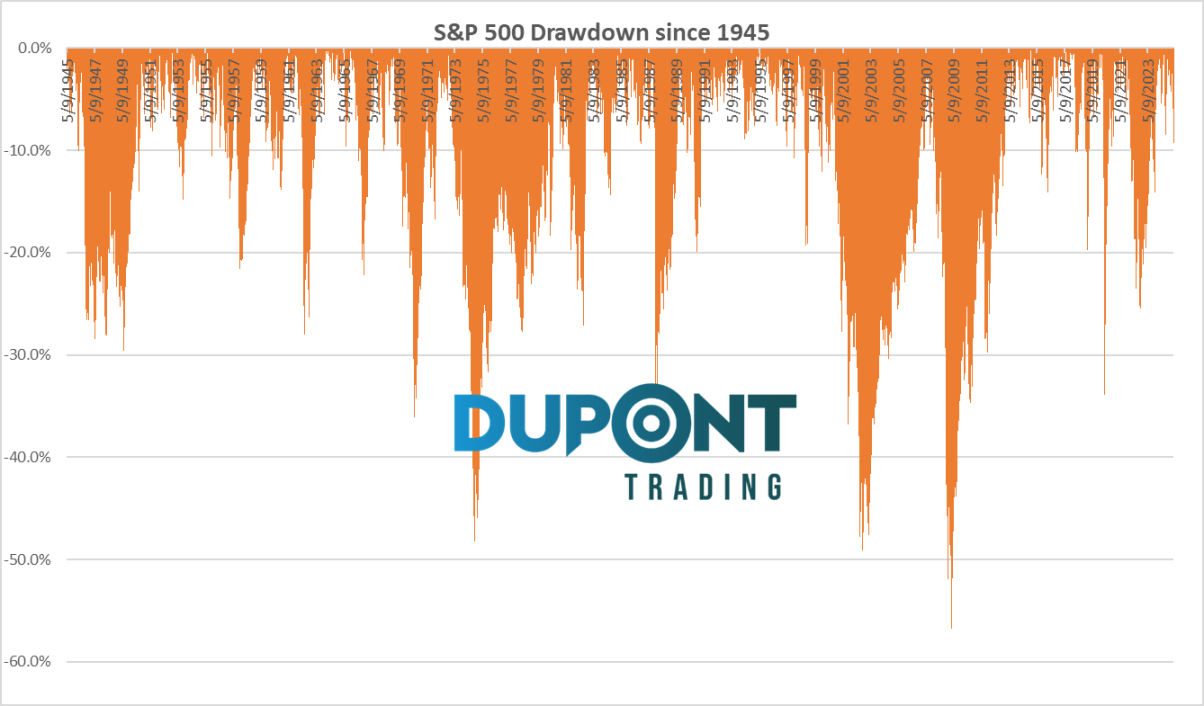

Key Takeaway:

Credit markets are stable, suggesting no recession yet. The high-yield ETF market is calm, and that’s usually where the Fed steps in—not just when stocks fall.

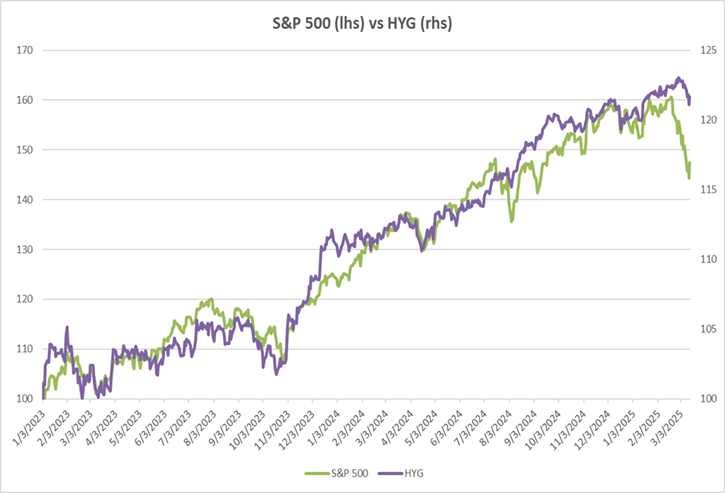

🌍 Asset Performance Year-to-Date (YTD)

- U.S. Equities

- NASDAQ: -8%

- Russell 2000: -8%

- S&P 500: -4%

- Europe (Stock 600): +7% to +10%

- Boosted by Germany’s €500B fiscal stimulus over the next 10 years.

- Gold: Above $3,000, strong risk-off asset.

- Cryptos (BTC): -10% YTD

- Oil (WTI): Down 6%, trading $65–$70

- U.S. Dollar: Weaker by 4-5%, aiding U.S. exports.

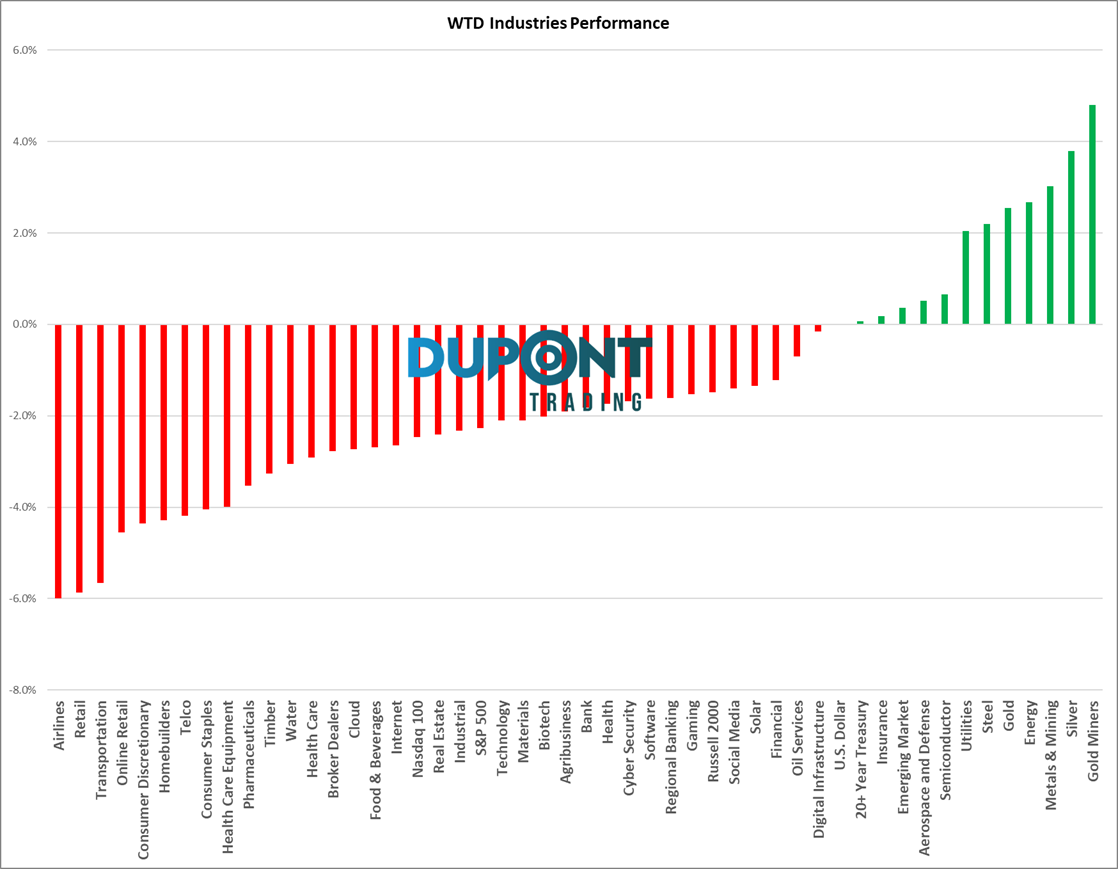

🏭 Sector Trends: Winners & Losers

Winners:

- Metals & Mining

- Semiconductors: Up last week

Losers:

- Airlines, Retail, Transportation: Reflecting consumer spending fears.

- Homebuilders: Signaling caution about economic cycle.

- Tesla & Discretionary Stocks: Still under pressure.

Utilities and Consumer Staples: Holding steady, reflecting defensive positioning.

📊 Bond Markets & Rate Watch

- U.S. 10-Year Yield: Trading between 4.2% and 4.7%

- Rising debt issuance = higher yields due to supply glut.

- European Yields: Climbing post-German stimulus; raises questions about ROI in France, Spain, Italy.

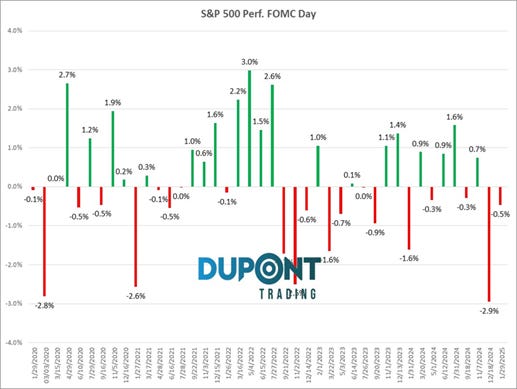

🏦 Fed Watch: All Eyes on FOMC

- Wednesday’s Meeting: No rate changes expected.

- Markets are pricing in ~2.5 cuts by December.

Volatility (VIX):

- Dropped from 27% to 22%—but beware, vol can spike fast.

- High volatility complicates downside trade setups.

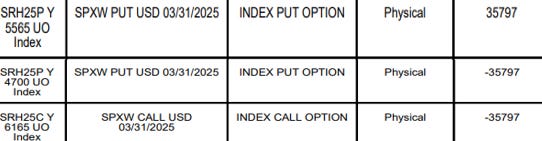

📈 Technical Levels & Option Flows

S&P 500 & NASDAQ: Broke trend channels—potential bear traps with FOMC & options expiry ahead.

JP Morgan Collar Option Structure:

- Massive influence at S&P 5565 level.

- Market gravitating toward this strike due to large open interest (~36,000 contracts).

📰 Macro Highlights

- CPI/PPI Data: Core CPI lower than expected—Fed-friendly.

- Retail Momentum: Friday’s rally shows retail isn’t dead; momentum stocks surged.

- Hedge Fund De-Grossing: Firms like Citadel & Millennium sold big names after poor performance.

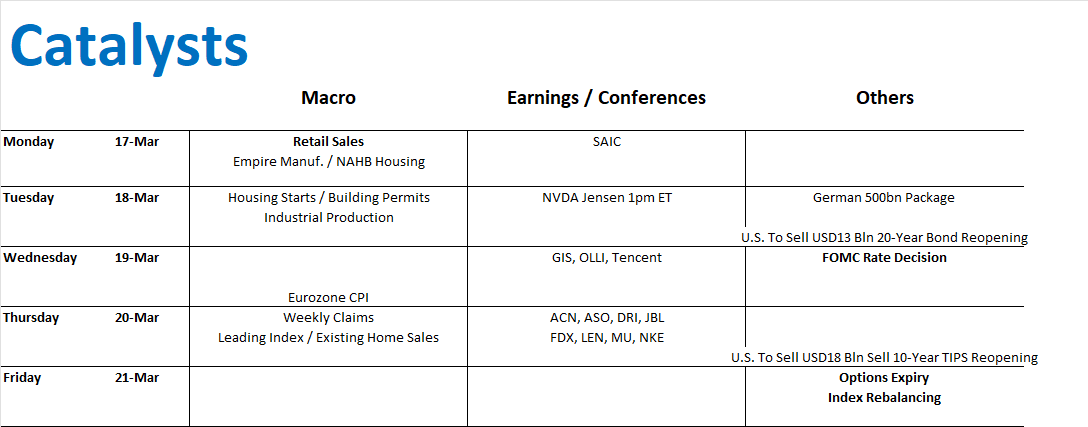

🔮 Key Catalysts This Week

- Monday: U.S. Retail Sales – Key for GDP outlook.

- Wednesday: FOMC Meeting – Watch the press conference.

- Friday: Options Expiry & Index Rebalancing – Expect volume & volatility.

Earnings Watch:

- Accenture, FedEx, and all eyes on NVIDIA’s CEO Jensen Huang Tuesday 1PM ET.

📊 Volatility Snapshot

- 1-week S&P Straddle: Implied move ±2.4%

- Last week: ±2.6%

- Realized move: ~4%

🚀 Join Our Trading Community

For those looking to deepen their market knowledge, consider joining our 4×4 Video Series https://duponttrading.com/4×4-course/ or one-on-one mentoring sessions https://duponttrading.com/mentoring/ to build a professional trading process.

Join our Discord community for real-time insights, macro data, and sector-specific discussions. Subscribe for full access to our research and market commentary:

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

Stay informed, trade smart, and have a great trading week!

Greg

📩 Contact: greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions