Market Capitalization vs Enterprise Value.

The concept of Enterprise Value is one of the first thing I looked at during my mentoring program.

For example, recent move in General Electric stock showed how only looking at its market capitalization was misleading.

In recent years, companies (not all) took benefit from a low yield environment to leverage their balance sheets for share buybacks, dividends, even sometimes acquisitions… Enterprise Value is essential when analyzing a company.

Debt matters and Enterprise Value helps.

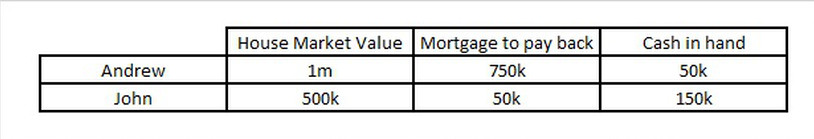

Let’s start with an example with 2 friends net worth.

To make it practical, we will include House price, Mortgage and Cash:

By only looking at house price, you would/could think that Andrew net worth is higher than John’s, even x2 bigger: 1m vs 500k.

But as we all know, a mortgage is simply the money we owe to the bank and as long as we have not pay back the mortgage, we do not strictly own the asset.

After including debt and cash, we have:

John’s net worth = 500k -50k + 150k = 600k

Andrew’s net worth = 1m – 750k + 50k = 300k

Where John’s net worth is x2 bigger than Andrew’s.

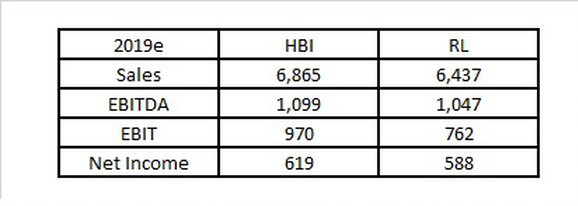

Now let’s look at 2 companies in the same sector and same industry:

HBI = Hanesbrands which manufactures and sells apparels and clothing products

and

RL = Ralph Lauren with very similar activities.

To make it easy we will include market cap (share outstanding x price per share),

By only looking at market cap., HBI looks “smaller” than RL by 3.4bn and/or 33% “smaller”.

But then let’s look at where is the market consensus for 2019e Income Statement:

So, how come HBI and RL have pretty similar Sales-EBITDA-EBIT-Net Income numbers but HBI market capitalization is 33% smaller than RL?

Intuitively we could start to understand that only looking at market capitalization is not good enough, that something is missing.

In fact, only looking at Market Capitalization does not reflect the capital structure of the company. That only gives us the Equity part.

To be more accurate, to measure the Total Value of a company we need to take into accounts its debt and/or cash or all the assets needed for revenues and results.

This is the Enterprise Value (EV):

EV = Market Cap. + Debt – Cash (short version)

Or

EV = Market Cap. (common + preferred shares) + debt + minority interest – cash and equivalents

That gives us for our 2 companies:

EV (HBI) = 6.4 + 3.5 – 0 = 9.9bn

EV (RL) = 9.8 + 0 -1.1 = 8.7bn

By looking at the Enterprise Value and not only the Market Capitalization, we can more accurately look at the return on assets or what assets are needed for its activity.

Let’s continue with our previous companies and look at the Income Statement:

Even if the ratios are not perfectly equal, they are much closer.

As a conclusion, looking at market capitalization could be helpful to classify companies into small, large and big companies. Nonetheless, this metric for a company analysis is too simplistic and we need to use its Enterprise Value.

To get a better and realistic picture of the company’s value, looking at Enterprise Value is more efficient. Then by getting EV, you will be able to look at all those ratios and do a real sector/industry analysis. In fact, most sector analysis and/or peer analysis are based on EV ratios.

I hope it helps,

Gregoire

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions