L’Arroseur Arrosé?

Italy has been recently under the radar for its 2019 budget.

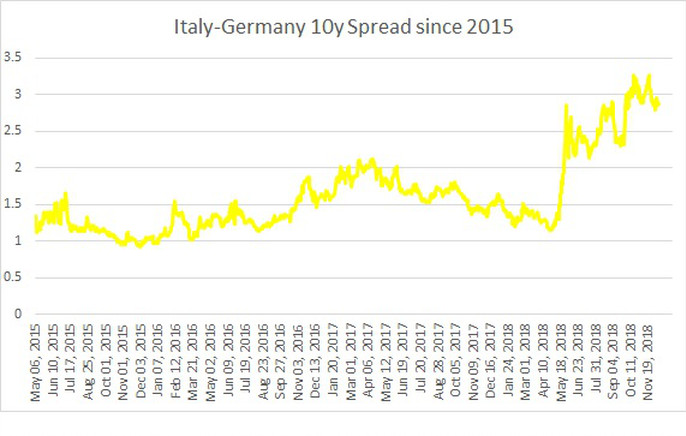

Since May 2018, Italian sovereign debt is experiencing selling pressure with the BTP (Italy) – Bund (Germany) spread up 160 basis points and trading now around 300 bps.

What about France after the recent social events and Macron’ latest announcements?

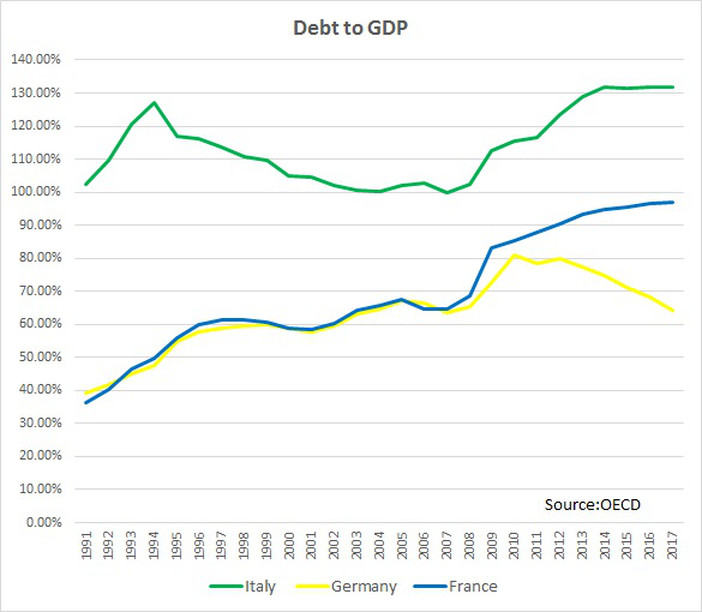

In 2012, the European Union introduced a new stability pact with 2 major rules:

1. Total Government Debt must not be more than 60% of GDP.

2. The Government Deficit must not be more than 3% of GDP except in particular circumstances.

We all know that almost no country is respecting those criteria. So which countries respect criteria 1?

Well, there are some but the “big ones” are above or well above.

Italy for instance stands at more than 130% but most of it comes from bad management of public finances in the 80s with Debt to GDP standing already at more than 90% in 1990.

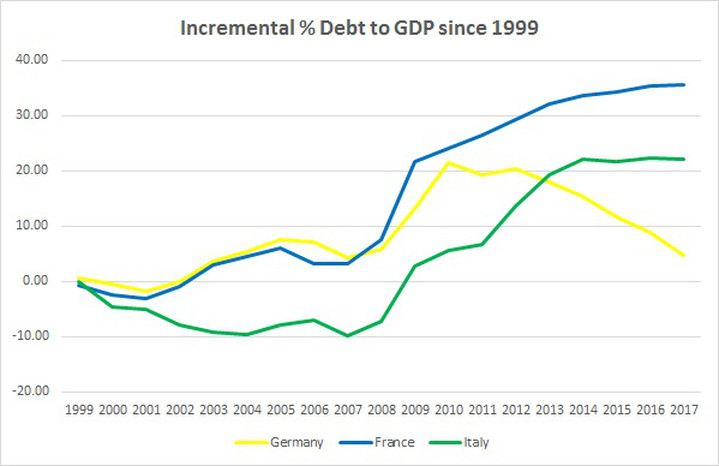

Now let’s look at the same data since the launch of the Euro in January 1999:

Since the launch of the Euro, France is doing much worse than Italy.

It is fair to say that Italy is coming from a much higher level but France added “35 points” vs 22 for Italy.

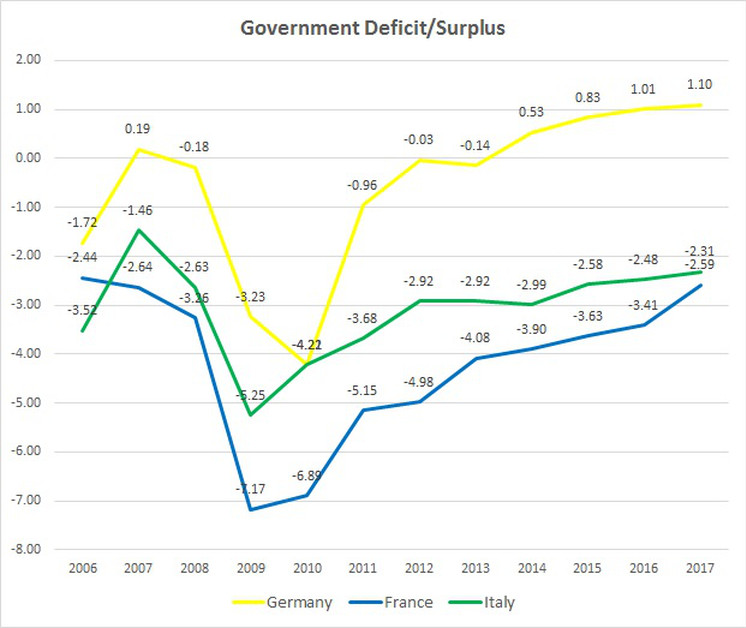

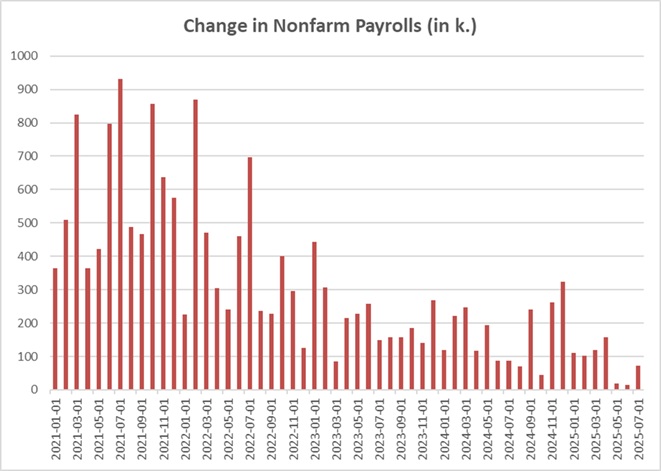

What about criteria 2 = Government Deficit?

Recently BTP’s, Italian Government were under massive pressure for budgeting a 2.4% deficit in 2019.

In the meantime, last September, France was forecasting a budget deficit of 2.8% of gross domestic product.

Two comments here:

– Assumption for this budget was that the French economy will grow by 1.7% in 2019. This is to compare with 1.4% yoy in the 3rd quarter of 2018 and 1.6% in the 2nd quarter.

– The last announcements from President Macron (on SMIC, taxes…) represent at least 8-10bn eur and/or at least 0.4% incremental deficit to GDP.

On the back of these new expenses and a probable slowdown of the French economy, there is very little chance that France will respect the 3% threshold.

Looking at the chart below, over the last 10years, France had only a Government deficit below 3% of GDP in 2017. So this is not new for France.

So yes again like for the Debt to GDP criteria, France has been doing much worst than Italy recently.

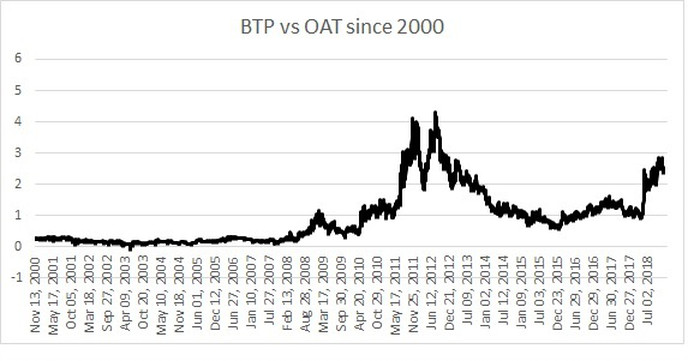

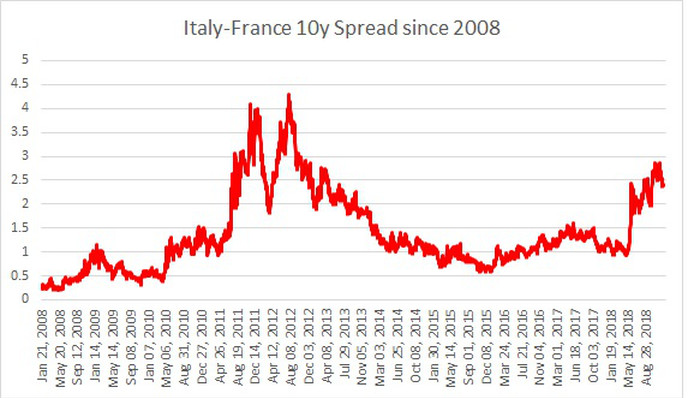

Let’s now have a look at the Sovereign Debt Market and at 3 spreads:

1. Italy 10y vs German 10y:

2. France 10y vs Germany 10y:

3. Italy 10y vs France 10y:

So before the recent Italian Budget crisis, spread between BTP and OAT was around 100 basis points and is now around 240. Still France is not yet experiencing any significant selling pressure on it sovereign debt.

No doubt that Italy Debt to GDP is much higher than France; by quite a big margin.

Nonetheless, the last 20 years have shown that Italy is doing much better than France on those 2 metrics.

We could argue that France was seen as a much more “stable” country in Europe but recent developments might alter Investors’ perception. France needs to be careful as you do not want to “unleash the dragon” in the bond market. Stocks of French banks have experienced roughly the same performance ytd as the Italian stocks; down between 20 and 30%.

As France has been calling for months for Italy to respect those criteria, recent developments on the French budget and socially could backfire.

France does not want to become l’arroseur arrose.

I hope it helps,

Gregoire

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions