Intraday vs Overnight? Cash vs Future? What Outperforms?

After an almost -3% drawdown on the S&P 500 in January, today the S&P 500 is about or close to taking its all time highs (~3,338).

Tesla is up more than 100% year to date, trading 30% of the market cap every day, on social media there is euphoria around market, stocks, no hedging, “I told you so”, “Sky is the limit”…

If we open around 3320-3330, it will happen after 2 nice overnight moves which will result in 2 following gaps on the S&P 500. S&P 500 is back to the trend started in October and despite my views a week ago, trend is not broken. (Risk Management 101: stop-loss used and move on).

In this post, I would like to discuss Overnight Performance vs Intraday Performance and trying to figure out when should we be holding the risks and if there has been any difference over the last few years.

I can already hear some of you saying it does not matter as market is bull, meaning keep your longs days and nights and that will do. Ok but that is not entirely the point here. The idea is trying to identify when is the performance coming from: during sessions or overnight.

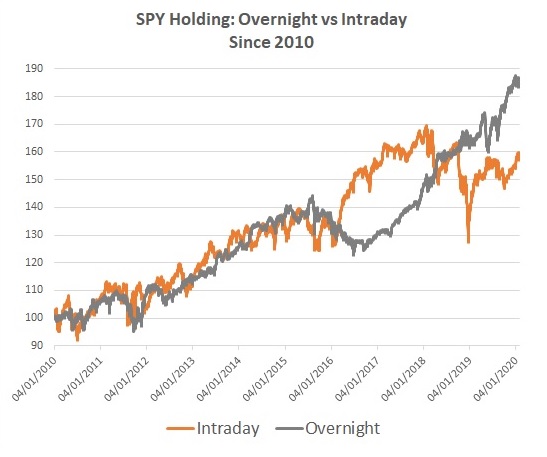

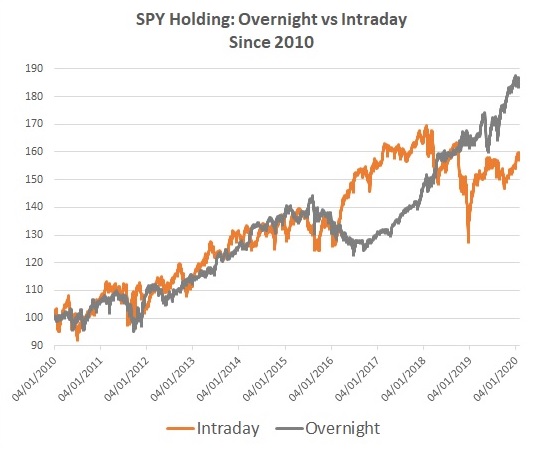

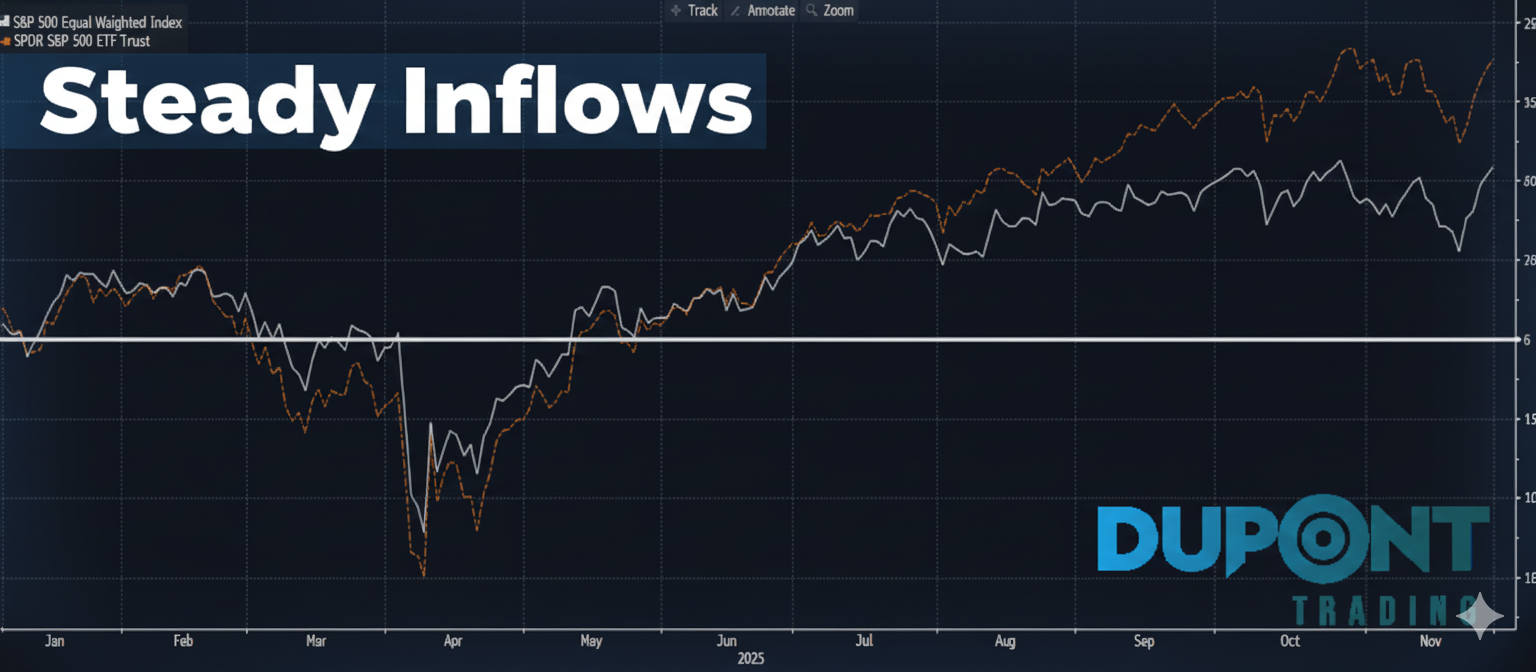

Let’s look first at the following chart:

In orange: compounded return (base 100 on 31/12/2009) of buying SPY (the SPDR S&P 500 ETF) at the open and selling at the close. Meaning intraday position.

In grey: compounded return (base 100 on 31/12/2009) of buying SPY (the SPDR S&P 500 ETF) at the close and selling at the open. Meaning overnight position.

As we can see from the chart above, the performance was almost equally coming from the intraday move or the overnight move up to 2015. In other words, a trader who would have been long only intraday would have done like a trader only holding risk overnight.

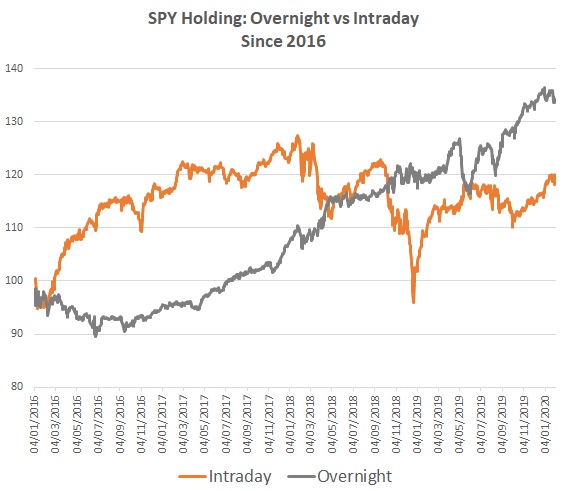

Nonetheless from 2016, there has been a massive change in this “equal returns” between intraday holding and overnight holding.

Or for each year, the following returns:

| Intraday base 100 on 31/12 | Overnight base 100 on 31/12 | |

| 2010 | 106.9 | 105.5 |

| 2011 | 97.1 | 102.8 |

| 2012 | 109.5 | 103.6 |

| 2013 | 115.8 | 112.0 |

| 2014 | 102.3 | 108.8 |

| 2015 | 99.0 | 100.2 |

| 2016 | 115.7 | 94.7 |

| 2017 | 105.7 | 112.9 |

| 2018 | 83.2 | 112.5 |

| 2019 | 114.1 | 112.8 |

(Note: The returns on the SPY here are not taking into account dividends. Meaning to get the yearly SPY performance, you should add ~2% every year, or the SPY dividend yield).

As I said before, up to 2015, returns were almost equally coming from the intraday session and the overnight session.

Nonetheless in 2016, trading cash hours outperformed massively overnight hours. Compounded, the S&P 500 went up +15% during market hours vs -5% overnight.

In 2018, S&P 500 was down -17% during trading hours and up +12.5% overnight. What do we have here: a market that was mainly driven by futures.

As an “out of date trader” (that was how I was called recently), I am always trying to understand the mechanics, the flows, the performances…

Over the last few years, volume for stocks has been drying on the cash and more and more moving towards futures and options. In that sense, understanding the intraday moves vs the overnight moves are important to me.

I hope it helps,

Gregoire

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions