Gold Breaks Out, Bonds Rally, and Lululemon Tanks

This week’s call was packed with updates across asset classes—from bonds and gold to equities like Lululemon and Broadcom. Let’s dive into the highlights.

📰 The Big Picture: Weak Jobs, Strong Market Reactions

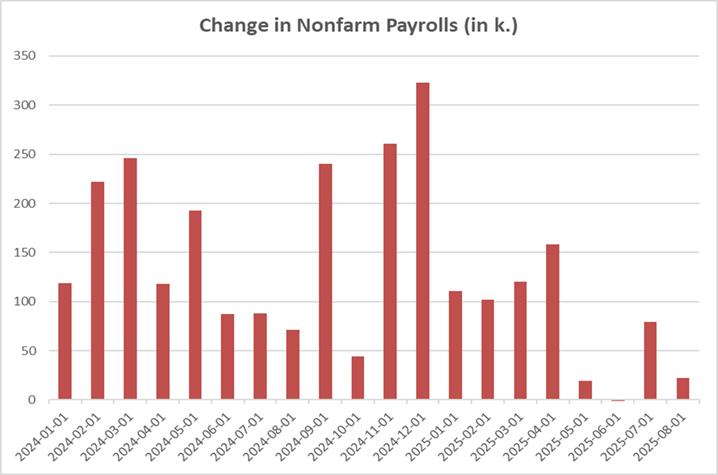

- U.S. Jobs Report: Only 22,000 jobs were created in August, far below consensus. Since May, job growth has been stalling, raising questions about the strength of the labor market.

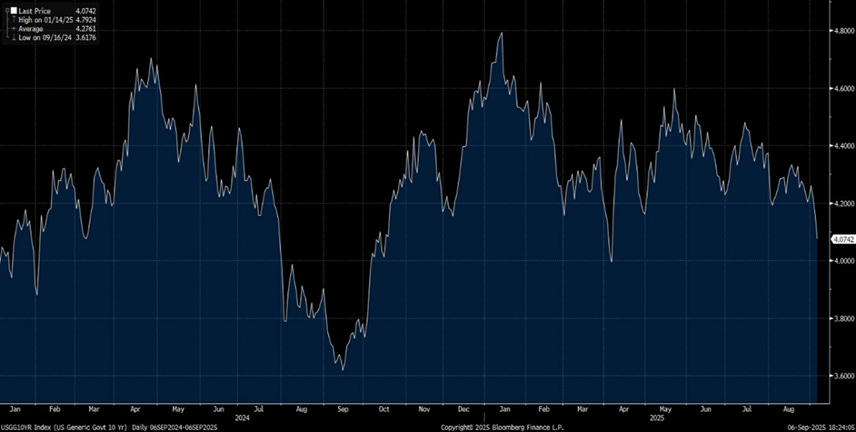

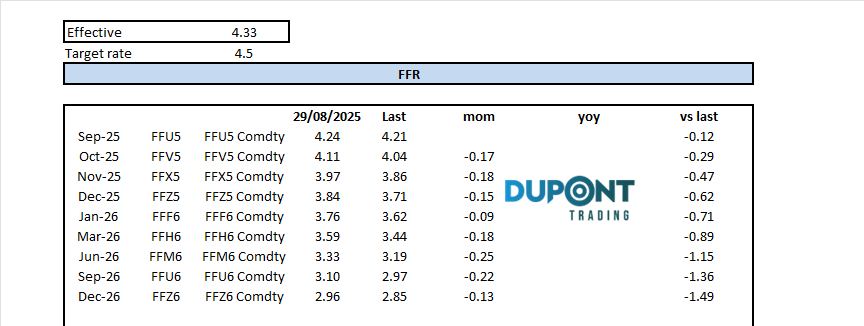

- Bond Market Rally: U.S. 10-year yields broke below 4.10%, fueling expectations for a more dovish Fed. Markets are now pricing in three rate cuts by year-end 2025.

- Key takeaway: The bond market remains the most important driver—watch yields closely.

🪙 Gold Breakout Confirmed

- Gold surged +4% this week, cementing its role as the primary flight-to-safety asset.

- For the first time in months, bonds are also fulfilling that role again, giving investors multiple hedging tools.

- Gold miners followed suit, outperforming alongside bullion.

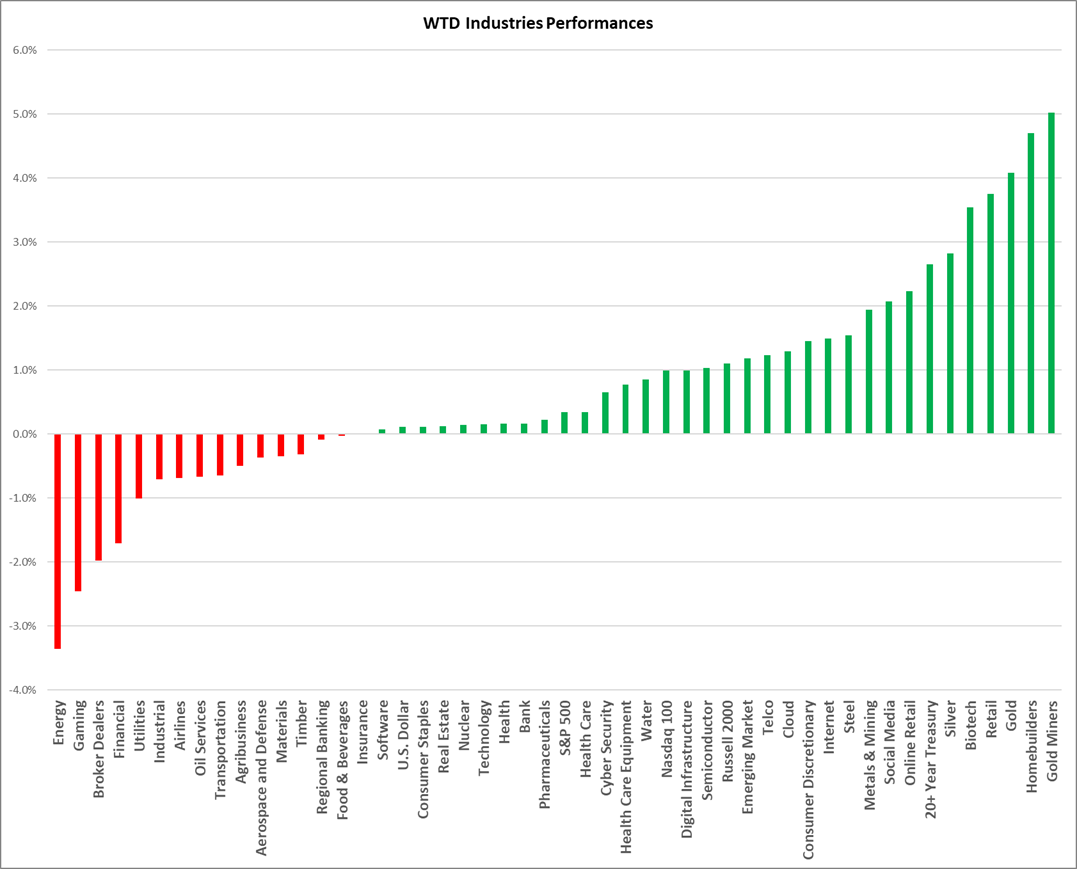

📊 Sector & Asset Class Moves

- Equities: S&P 500 was flat overall, but dispersion was wide:

- Losers: Energy (dragged by falling WTI crude, -3%), Financials (pressure from lower yields), Utilities (AI infrastructure slowdown).

- Winners: Homebuilders (benefiting from lower yields), Gold miners, and Telcos (Alphabet strength).

- Currencies: The U.S. dollar stayed weak, down ~10% YTD vs. major peers.

- Commodities: Oil slid on expectations of extra OPEC supply.

📌 Stock Spotlights

- Alphabet (GOOGL): Strong rally after regulators signaled no forced breakup of Chrome/Google.

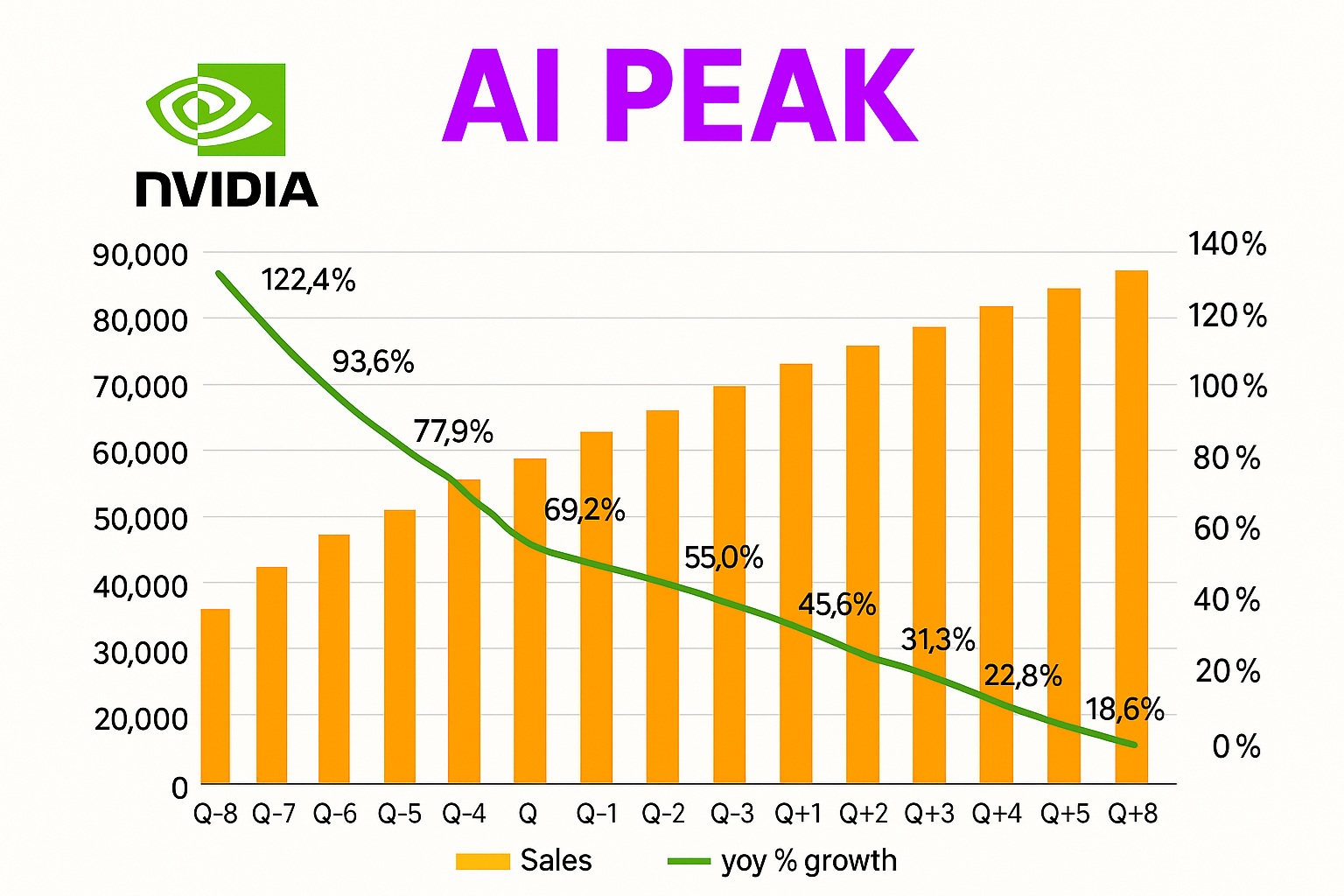

- Broadcom (AVGO): Post-earnings surge as money rotates out of Nvidia into broader AI plays.

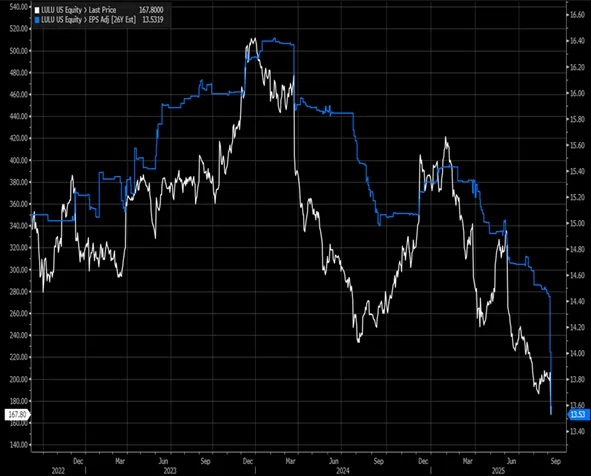

- Lululemon (LULU): EPS guidance cut from $14 → $12 for 2026. Stock plunged ~17%. Lesson reinforced: earnings revisions drive stock trends.

🏦 Macro Watch: Fed, CPI & Bond Supply

- Fed Funds Outlook: Market pricing in 3 cuts (Sep, Oct, Dec). Some chatter of a 50 bps “jumbo” cut in September, though likely premature.

- Inflation Data:

- CPI expected at +3.1% YoY core this week.

- Fed tolerance seems to be shifting—“3% is the new 2%.”

- Bond Auctions: Heavy issuance scheduled (Tue–Thu). Watch demand closely.

⚡ Other Highlights

- Volatility (VIX): Modest uptick but still compressed (~15%).

- IPO Market: Initial pops remain common, but new IPOs have underperformed on average in subsequent weeks.

- Seasonality & PMI: Recent global PMI numbers improved, suggesting some resilience in services and manufacturing.

🔮 What to Watch This Week

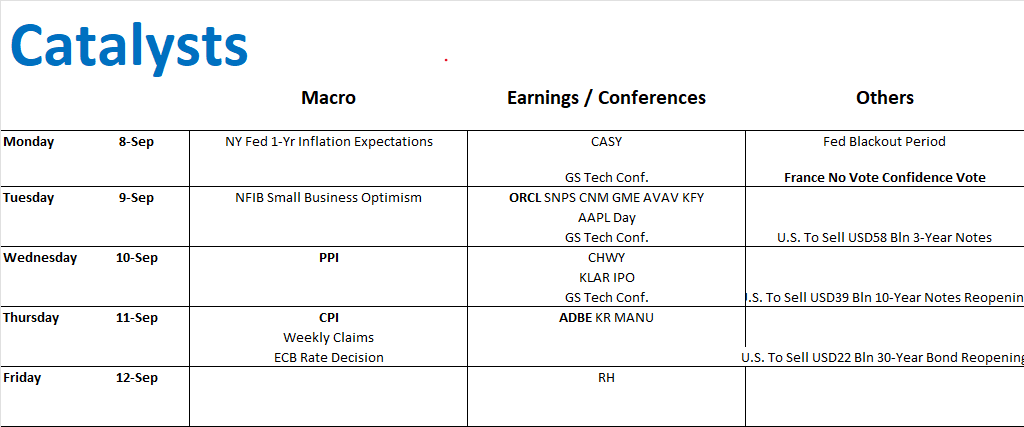

- Key data: CPI (Thursday), PPI, bond auctions.

- Events: Oracle (Tue) & Adobe (Thu) earnings, ECB rate decision, and a busy conference calendar.

- Themes: Inflation stickiness, bond demand, and gold’s continued momentum.

👥 Community Note

These insights are shared and debated daily in our Discord trading community. If you’d like deeper dives—like the upcoming AI second-wave playbook webinar—stay tuned or drop me a note.

📧Our 4×4 educational video series is available, plus limited spaces in the mentoring program for the next 3–6 months (especially US & Asia time zones).

If you’d like to join or explore our 30+ private trading channels, now’s the time.

https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.