Finish line

This week’s update of Your Next Trade covers critical market events shaping our week ahead, from the U.S. election results to the Federal Reserve’s next moves.

📅 Upcoming Market Events:

- U.S. Elections (Tuesday): A highly anticipated event that could take longer to confirm if the results are close. Both asset markets and polls suggest a tight race between Harris and Trump. In recent sessions, sectors favoring a Harris outcome have started to outperform.

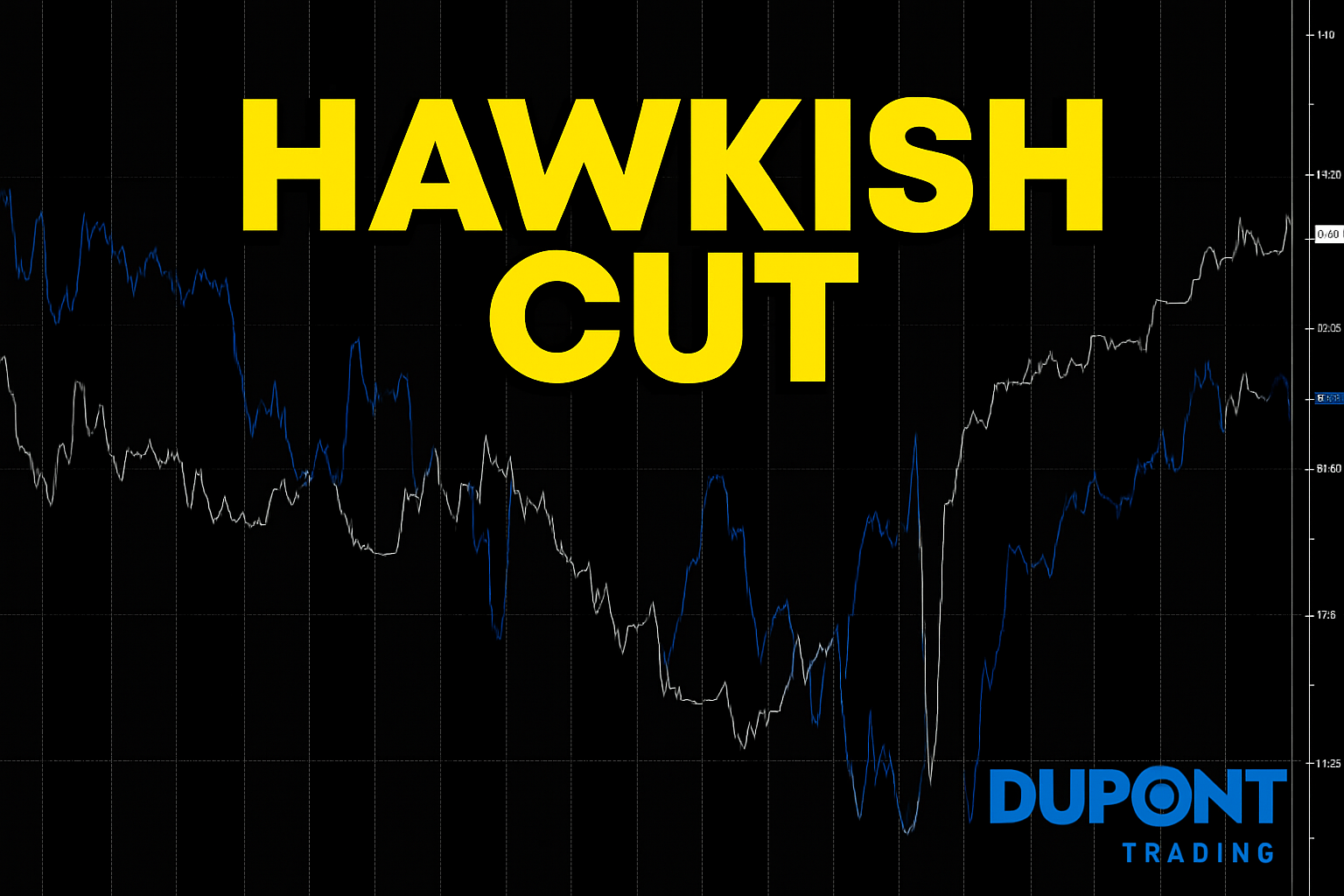

- Federal Reserve Meeting (Thursday): The FOMC is expected to announce a 25 basis point rate cut, with an 80% chance of approval. Job data released last week showed only 12,000 jobs added, well below expectations—another signal favoring a rate cut.

- China’s Policy Bureau: Meeting this week to decide on a significant fiscal stimulus package, which could have a lasting impact on global markets.

📈 Market Recap:

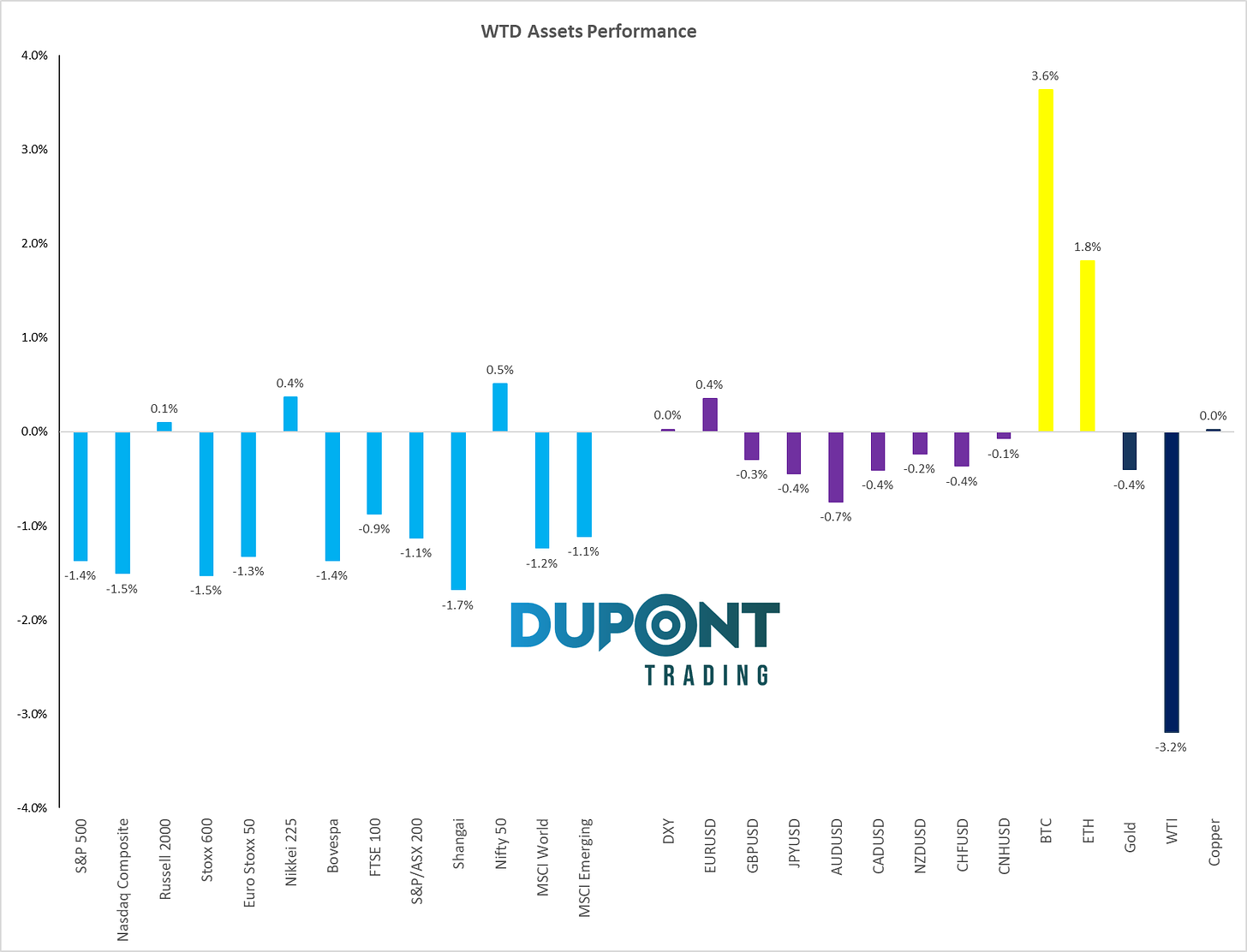

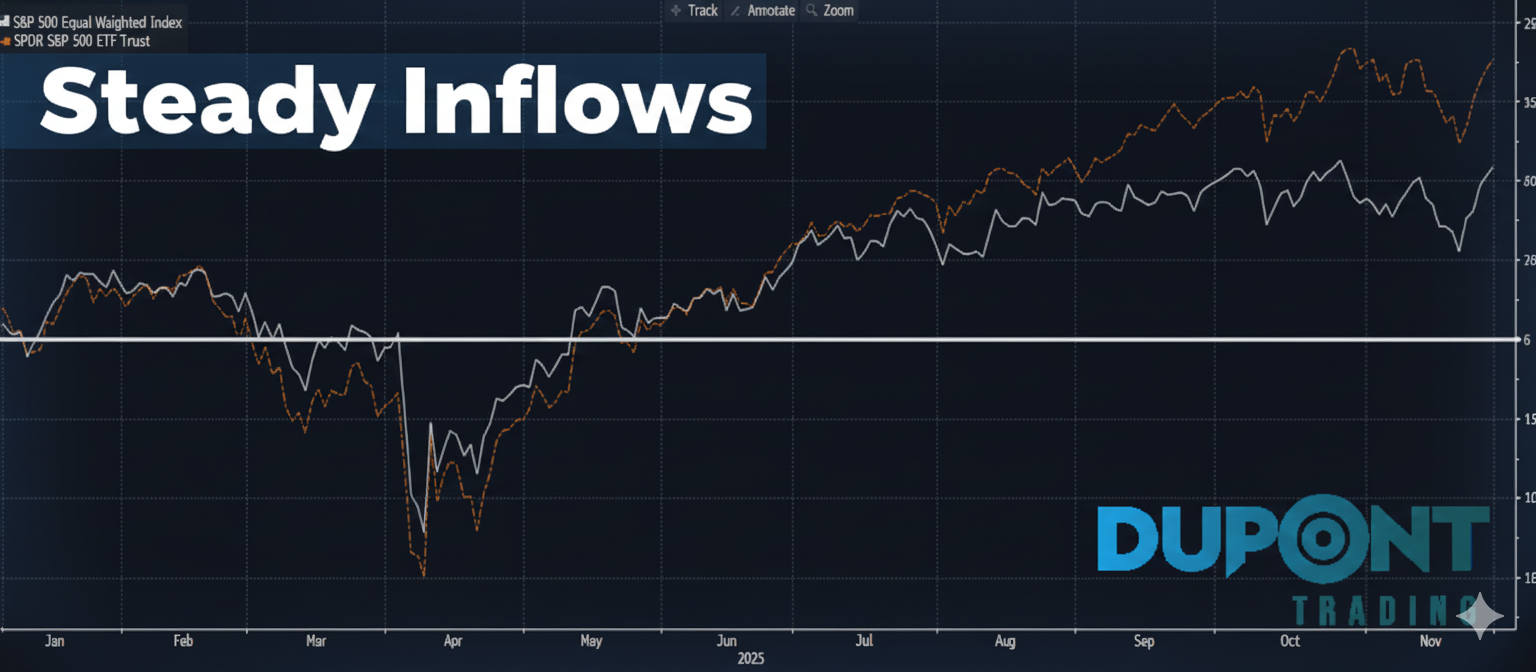

- Stocks: Last week saw some profit-taking across sectors. Equities, including real estate, utilities, and tech, dropped around 1.5%, mainly due to profit-taking and rising yields. The S&P has been on an upward trajectory since August, with minor pullbacks in recent sessions.

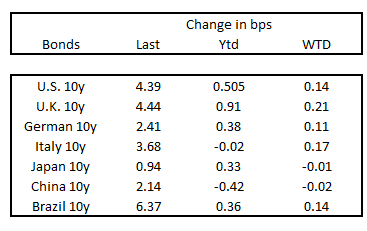

- Bonds & Yields: The 10-year U.S. Treasury yield rose to 4.39%, reflecting market expectations of a large U.S. deficit, whether Harris or Trump wins. Similarly, U.K. yields spiked following recent budget announcements.

- Oil & Commodities: Oil prices continue to hold steady around $67, supported by demand and OPEC’s decision to delay supply cuts. Meanwhile, there has been slight profit-taking in precious metals like gold and silver.

🏷️ Sector & Stock Performance:

- Tech: Microsoft posted ok earnings but reacted negatively on the day, though Amazon performed well. With profit-taking across major tech names, volatility may remain high, especially as earnings season wraps up.

- Real Estate & Utilities: Sectors were down 3% due to higher interest rates, making these yield-sensitive investments less appealing.

- Special Stock Spotlight – SMCI: AI-related supplier SMCI, once a high flyer, has dropped 70% since its inclusion in the S&P 500. Short sellers have raised concerns about its balance sheet, a situation that might be worth watching.

📊 Economic Indicators:

- Volatility & VIX: Volatility continues to rise, with the VIX at 22%, reflecting the uncertainty tied to elections. Historically, election periods see spikes in volatility as traders adjust to unexpected results.

- Trading Levels to Watch: The S&P 500 has been consolidating in the 5850-5900 range. Last week we broke a wedge and a 5,850 support. With U.S. elections and other macro events, a breakout toward 6,000 or a dip to support levels like 5730 could define the market’s next big move.

🔍 Looking Ahead – Key Catalysts:

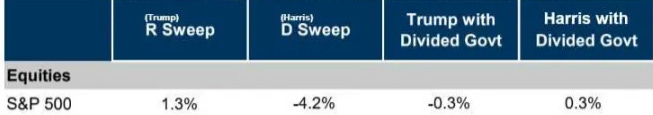

- Election Results: Finalized Tuesday or Wednesday, which could bring significant market swings. A Trump win or a divided Congress may provide near-term market stability, but a fully unified government could lead to different dynamics.A Republican or a Democrat sweep could bring significant volatility. Goldman Sachs has the following expectations for an S&P 500 Move:

- FOMC & Central Banks: The Fed, Bank of England, and other central banks are in focus this week. Rate decisions and statements could provide clues on policy direction as economic indicators show mixed signals.

- Earnings Wrap-Up: Earnings season isn’t over yet, and big names are still releasing results, which could influence sector sentiment further.

Want more insights?

Join our Discord community for in-depth discussions, access to premium content, and more! https://discord.gg/wrvGuF3M

In the near future, the most advanced channels will go beyond a paywall.

And if you’re interested in personalized mentoring, the 4×4 Video Series or the most advanced Disscord channels please send us an email.

Have a great trading week!

Greg

greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions