Fed Cuts Rates

The Fed, led by Chair Jerome Powell, cut rates by 25 basis points in a “risk management” move prompted by signs of a weakening job market and persistent inflation hovering around 3%, which may become the new target rather than the previous 2%. Despite the rate cut, bond yields have risen slightly, reflecting ongoing inflation concerns and substantial US deficits, causing tension between rising yields and falling rates.

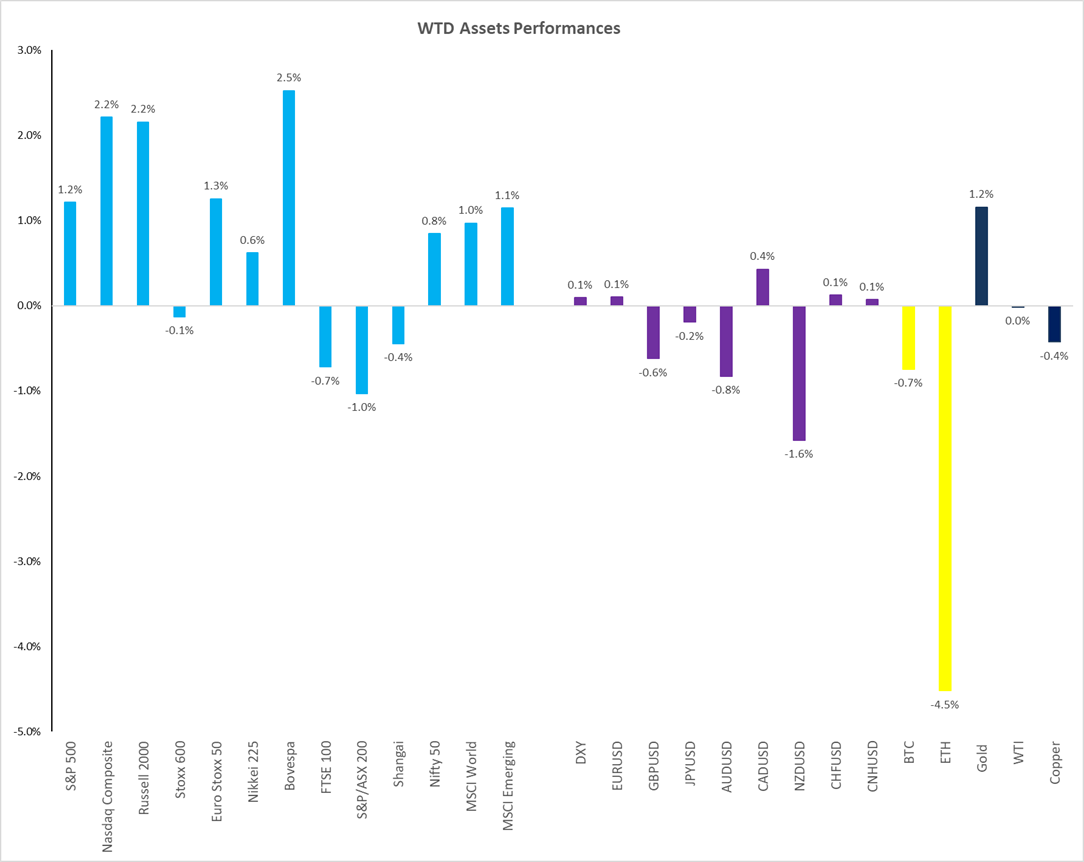

Markets celebrated, pushing the S&P up 1.2% and the Nasdaq up 2.2%. Yet beneath the surface, signs of overheating are emerging, with comparisons being drawn to the year 2000.

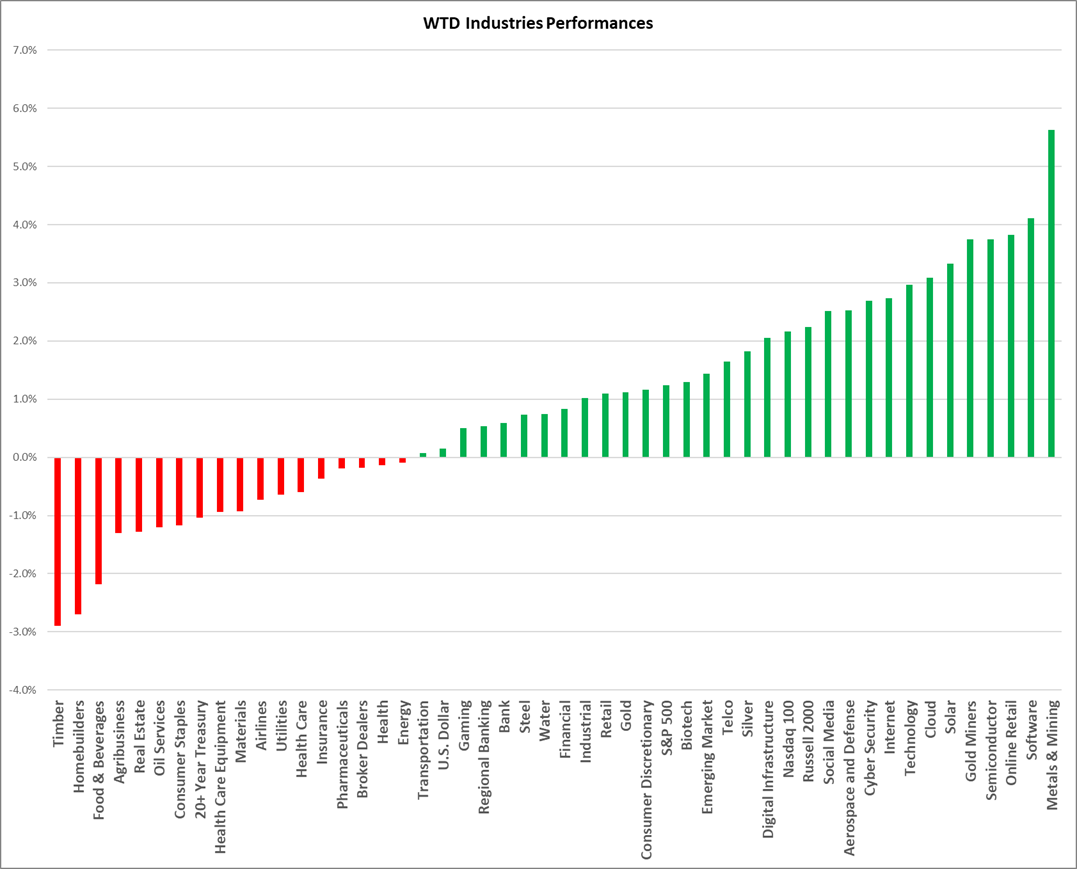

Market Performance Snapshot

- Equities: Strong gains led by semiconductors, software, tech, and cybersecurity.

- Laggards: Homebuilders, utilities, real estate, and consumer staples—all pressured by rising yields.

- Currencies: USD softened briefly post-FOMC before rebounding.

- Crypto: Ethereum slipped ~5% on the week.

- Commodities: Gold, WTI, and copper traded flat.

Rates & Yields

- 10-Year Treasury: Rose to 4.13% despite the Fed cut, highlighting persistent deficits and sticky inflation.

- Looking Ahead: Markets expect two more 25 bps cuts in October and December (per CME futures).

Volatility Update

- VIX: 15.5% — implied volatility is low, but realized volatility is even lower.

- Implication: A case exists for further compression in implied volatility, though shorting vol remains risky.

Technicals at a Glance

- S&P 500: Approaching resistance, still trending higher.

- Nasdaq: Continues making new highs.

- Russell 2000: Stalling near a potential triple top; many components remain unprofitable.

- Momentum Trades: Goldman Sachs’ momentum index up 20% in just 10 days — retail traders firmly in control.

Special Situations

- S&P 500 Inclusions:

- Applovin surged 30% since the announcement of its inclusion in the S&P 500.

- Robinhood also spiked on heavy passive fund buying.

- Corporate Moves: Intel revealed a $5B Nvidia share purchase.

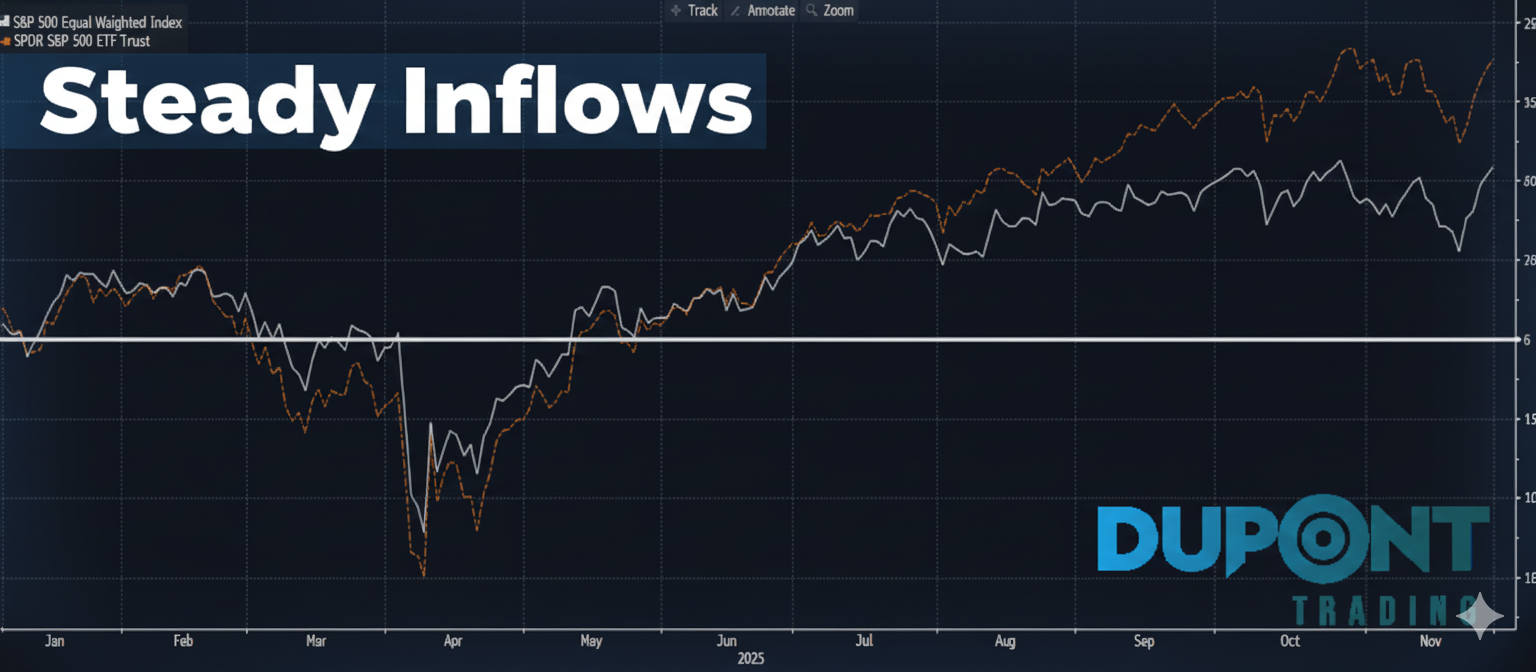

Macro & Flows

- Retail Sales: Strong August (+0.7% MoM, +5.4% YoY), confirming the U.S. consumer remains the growth engine.

- Fund Flows: ~$70B inflows this week, with $30–40B into tech alone.

- Meme Trades: High-beta and uranium-linked names soared double digits in just five days.

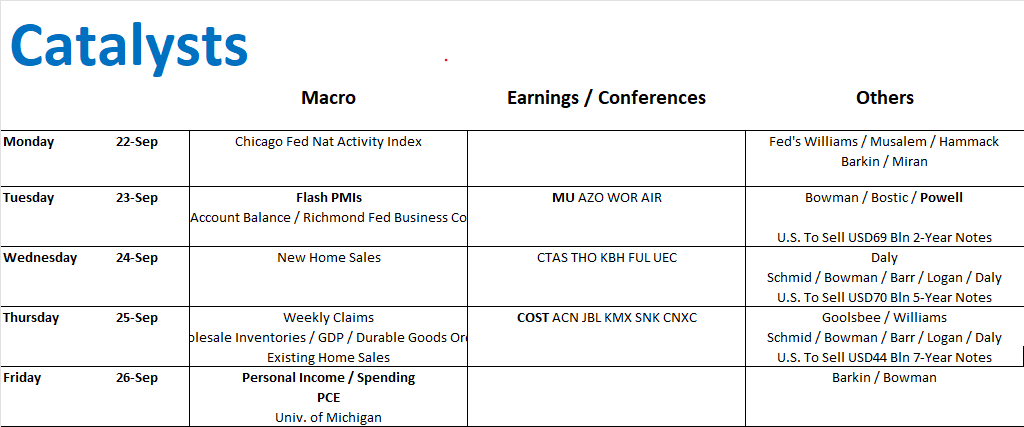

The Week Ahead

- Macro Data:

- Tuesday: Flash PMIs

- Thursday: Weekly jobless claims

- Friday: PCE, personal income, University of Michigan sentiment

- Earnings to Watch:

- Micron (Tuesday) – key AI/semis read

- Costco (Thursday) – retail strength check

- Fed Speakers: Post-blackout, Powell and others in focus.

- Bonds: $200B supply (2Y–7Y), keeping pressure on yields.

Key Risks & Outlook

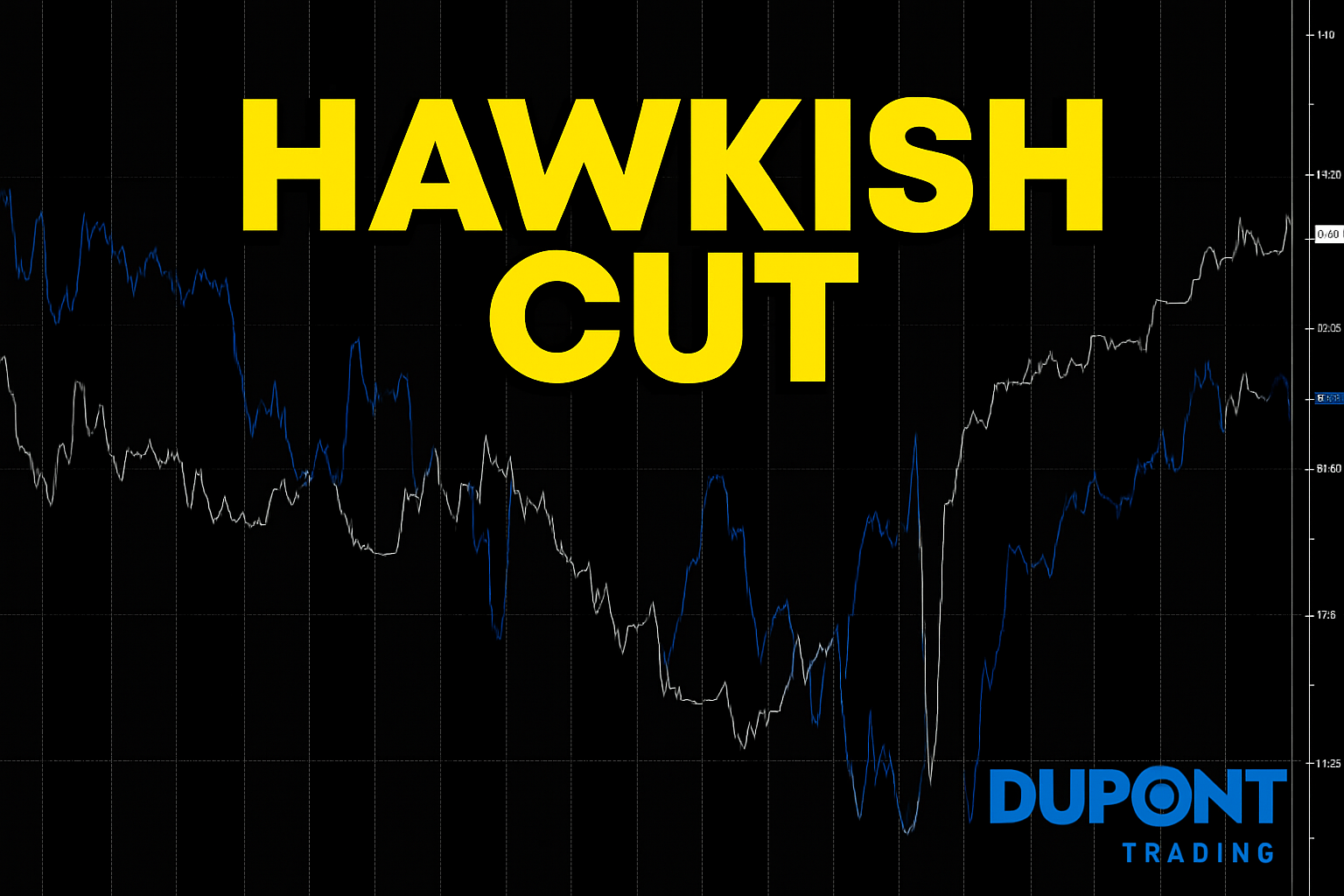

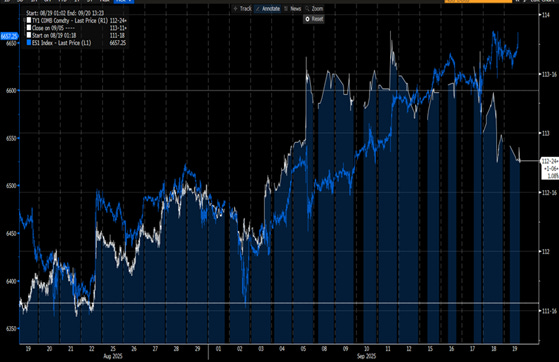

- Divergence is forming between rising stocks and higher yields — historically unsustainable.

S&P 500 Futures (lhs) vs 10-Year T-Note (rhs).

- Technicals and flows point to an overbought market.

- Expect a possible 2–3% pullback in the S&P over coming weeks.

Community Note

These insights are shared and debated daily in our Discord trading community.

📧Our 4×4 educational video series is available, plus limited spaces in the mentoring program for the next 3–6 months (especially US & Asia time zones).

For more information: https://duponttrading.com/4×4-course/

If you’d like to join or explore our 30+ private trading channels for $74.99/month, now’s the time.

https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.