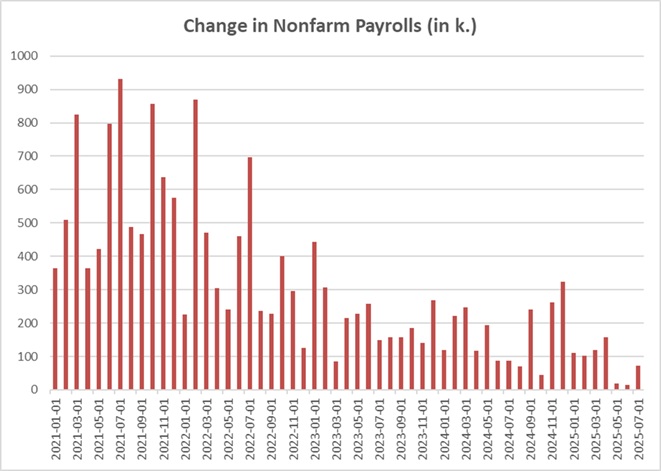

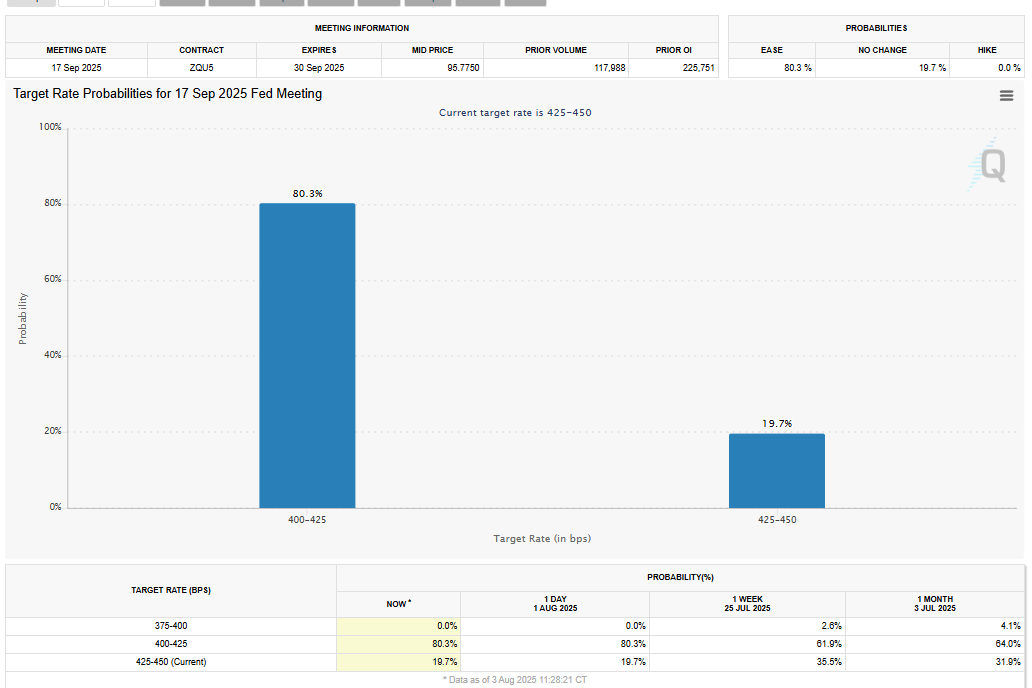

Fake Job Data

It’s been an eventful week, spanning macroeconomic news, price action developments, and shifts in investor sentiment. As we head into August—and possibly my seasonal break (French tradition!)—let’s unpack the major themes moving the markets.

Macro & Market Recap: Tariffs Take Center Stage

July ended with a bang. After a strong run across asset classes, Thursday saw a dramatic market sell-off, triggered by renewed tariffs and continued into Friday’s session. The end-of-month turbulence was magnified by the US Non-Farm Payrolls (NFP) data.

Jobs Data Disappoints:

The headline NFP number came in at 73,000, but the real story was in the downward revisions for previous months. The market initially sold off on the weak jobs data, followed by the usual political spin—President Trump immediately called the number “fake.”

Many retail traders are crying foul, but the reality is more subtle: ongoing artificial intelligence trends and global uncertainties (like tariffs) are putting pressure on the job market, especially for consultants and major outsourcing firms like Accenture and Capgemini. Company planning has become more difficult, and job creation is suffering.

Remember: employment data is a lagging indicator. The same caution applies to the recent 3%+ US GDP print, which is largely a reflection of falling imports. Core US consumer spending is up only 1%—not as robust as some headlines suggest.

Asset Review: Risk-Off Week

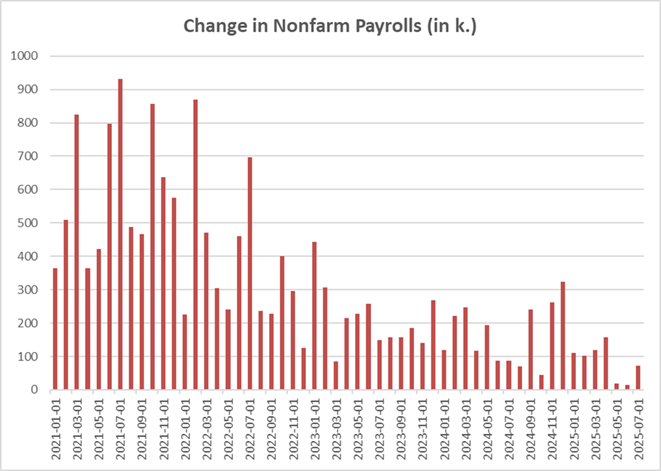

Almost all asset classes took a hit this week, with some dramatic moves:

- Copper: Down 20%, heavily impacted by the tariffs.

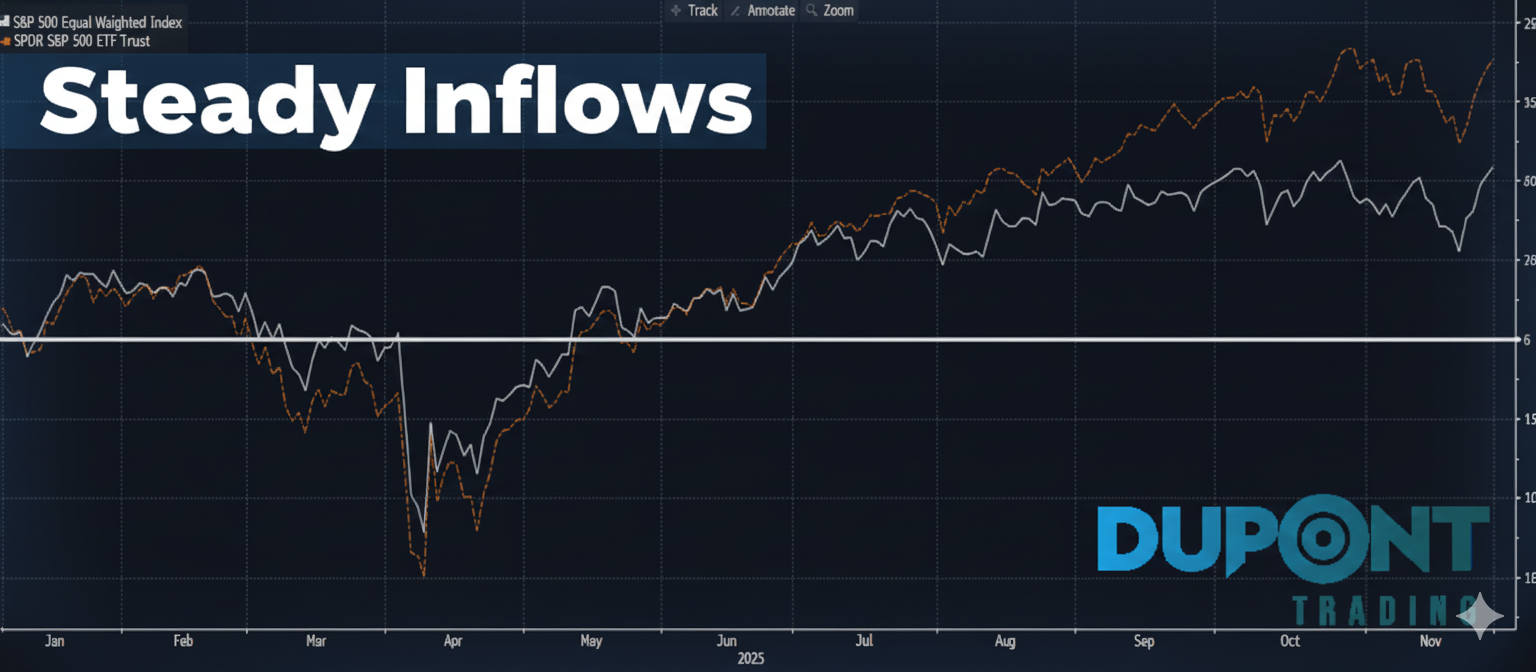

- S&P 500: Down 2.4%. Tech stocks, which make up 30-40% of the index (think Meta, Microsoft), outperformed—but most industries fell behind.

- Cyclicals Lag: Sectors like nuclear and transportation underperformed badly.

- Crypto: Both Bitcoin and Ethereum gave back some of their July gains.

- Dollar: Strong on the week, though retraced 1/2 the recent move on Friday.

Rates & Fed: Policy Pivot Incoming?

- US 10-Year Treasury: Ended the week at 4.22%, down 17 basis points. Yields remain range-bound (4.20–4.50%), but the weak job data and negative revisions have shifted expectations.

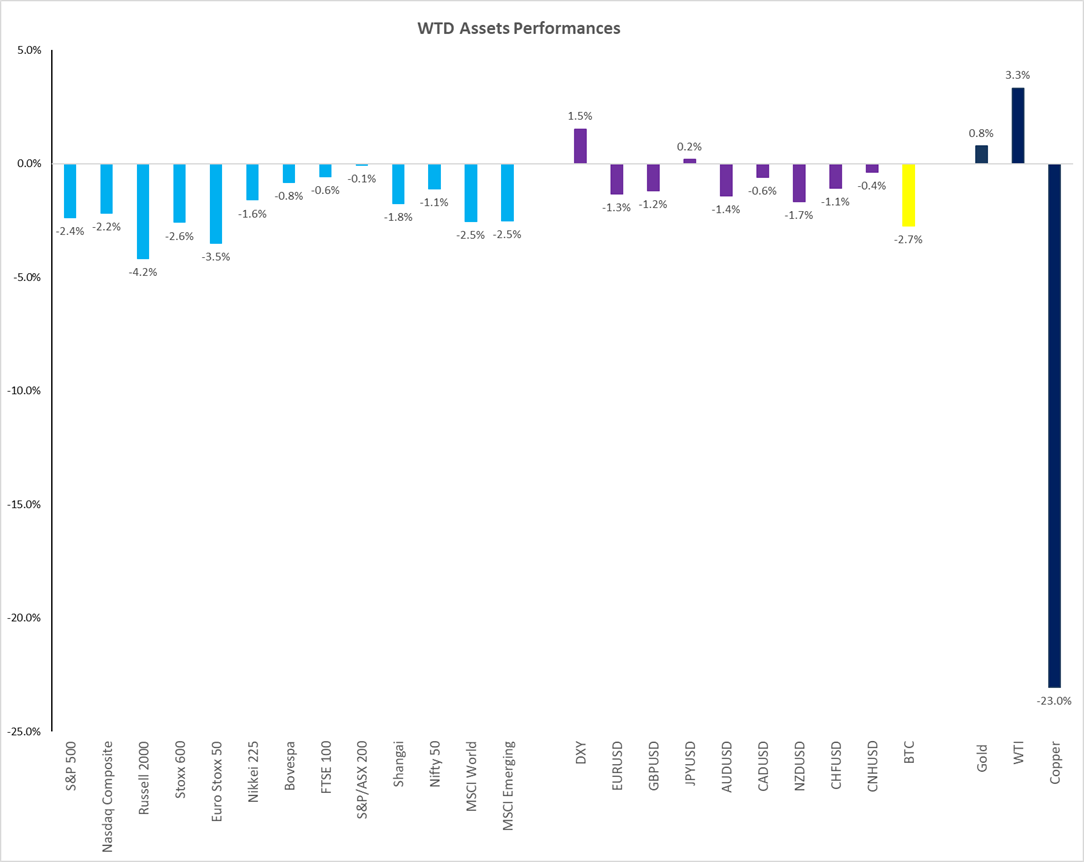

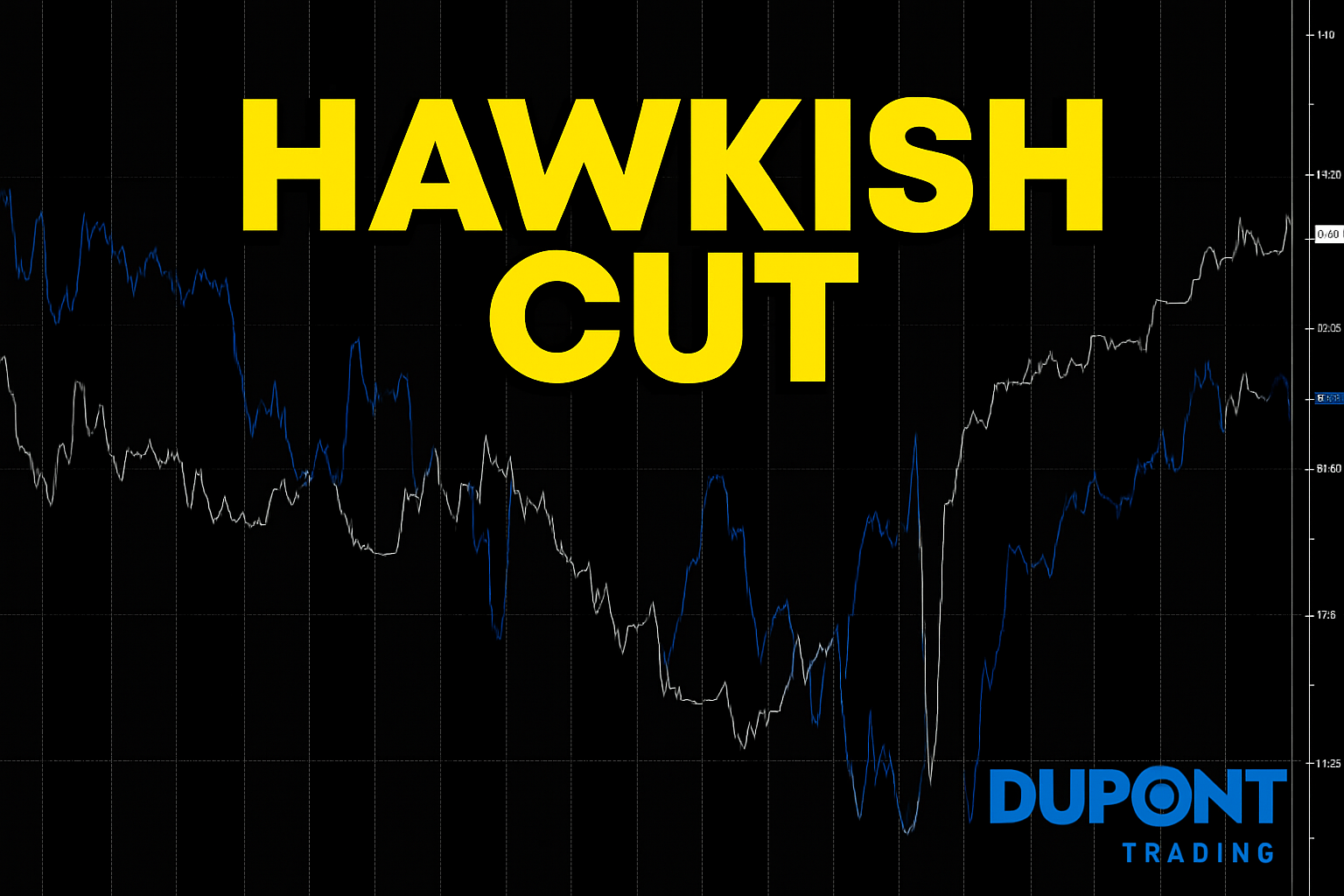

- Fed on Hold—But For How Long?: After a data-dependent pause from Powell at the latest FOMC, market consensus now expects a rate cut as soon as September (odds: 80%). The outlook for 2025 is also more dovish: two cuts now back in play.

Volatility: Calm Before the Storm?

Too many investors have grown complacent. With funds persistently selling volatility, we’re at risk of another volatility spike—especially if forced sellers or bond market tremors emerge.

Technical Analysis: Key Levels at Play

- S&P 500 Futures: The uptrend from April’s lows has now been broken. Two big down days, coupled with hefty trading volumes, make this a significant development. Next support sits at the 50-day moving average (~6160).

- NASDAQ: Still outperforming, but the technical picture is similar—expect near-term corrections of 2–3% (could extend to 5% from the highs).

- Euro/Dollar: Despite many calling the euro “a short,” the major trend from the low at 1.02 to 1.18 remains intact. Recent weakness, driven by fresh US tariffs on Europe, bears watching.

Looking Ahead

Uncertainty persists—from trade tensions and tariffs to shifting central bank policy. Macro data is showing cracks, especially beneath the surface of headline GDP and job numbers. As we approach a possible rate cut and ongoing sector rotations, stay vigilant and keep risk management front and center.

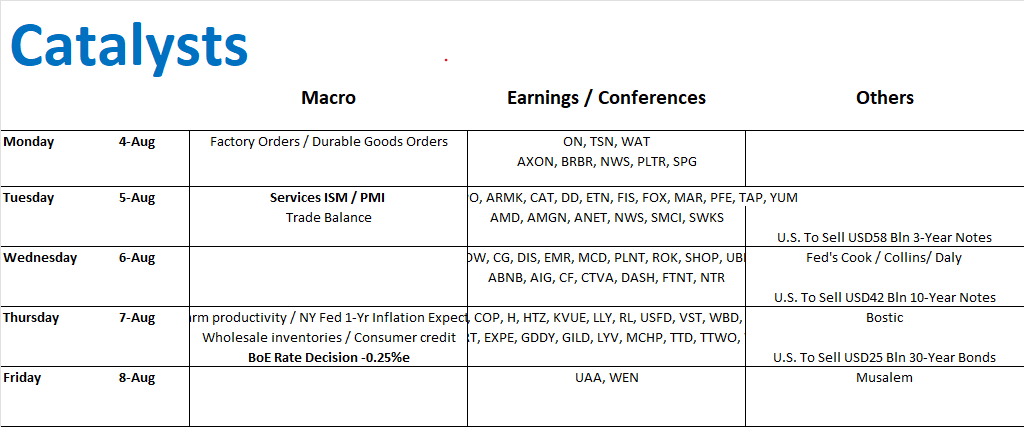

For the Catalysts, we have some macro, many earnings and the usual tariffs + the Russia/Ukraine deadline

For the Earnings:

I’ll see how I feel next week—maybe I’ll sneak in another episode before my “official” August break. Till then, stay sharp and trade safe!

Community & Mentoring

Interested in joining the trading community or mentoring program?

- Discord: 1 free channel, 30+ premium channels ($75/month)https://discord.com/invite/Yf42SgAx7f

- Mentoring: Limited seats for September start

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions