Earnings Fools & Fabulous 7: Why Markets Are Rising Despite Weak Fundamentals – Nov, 02 2025

This week’s episode dives deep into earnings season, market breadth, global macro shifts, and what traders should watch heading into November. Let’s unpack the highlights:

🔍 Earnings Season: A Tale of Expectations vs Reality

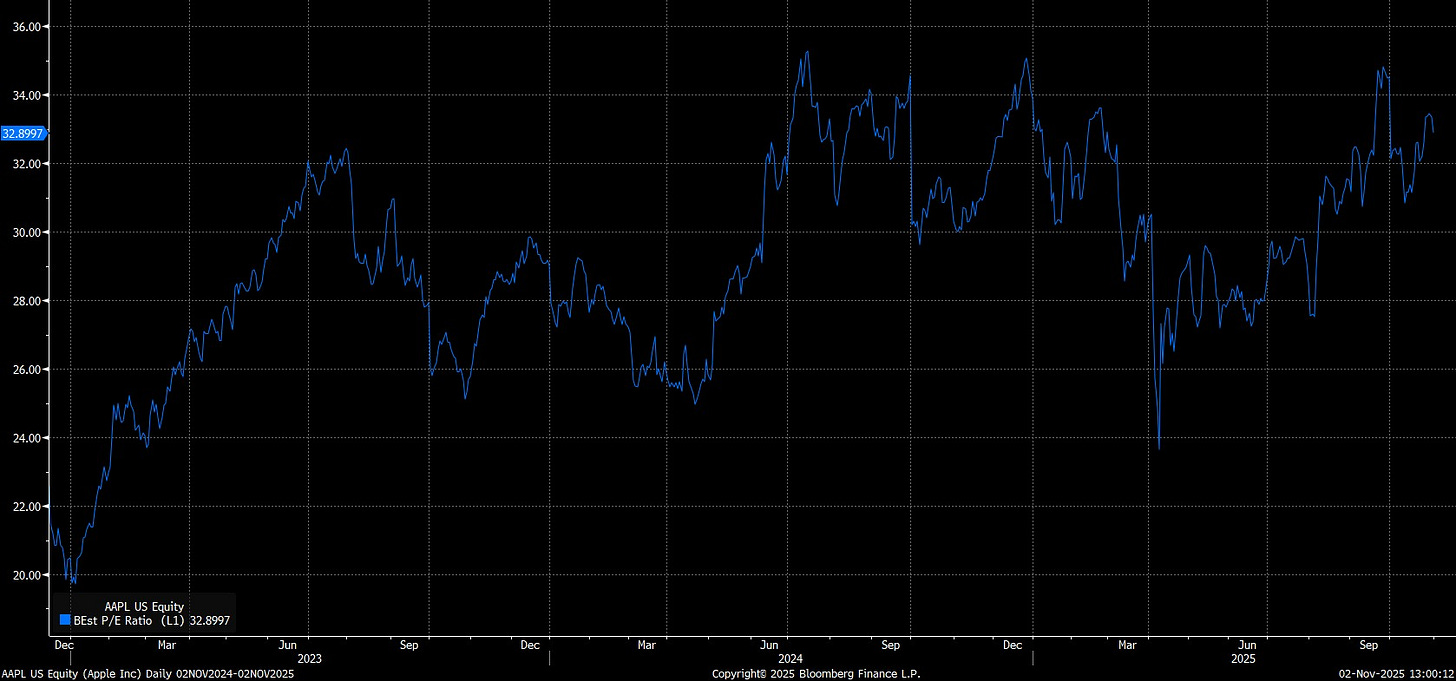

- Apple’s earnings were in line, not stellar — yet the stock surged to $277. Why? Massive multiple expansion. Apple now trades at over 32x earnings, up from 22x just a few years ago.

- Revenue miss: Apple posted $102.5B vs. the $108B expected at the start of 2023.

- Broader trend: Many companies are seeing flat or declining earnings vs. expectations, yet stock prices are rising — driven by a handful of tech giants.

📊 Market Performance: Winners & Losers

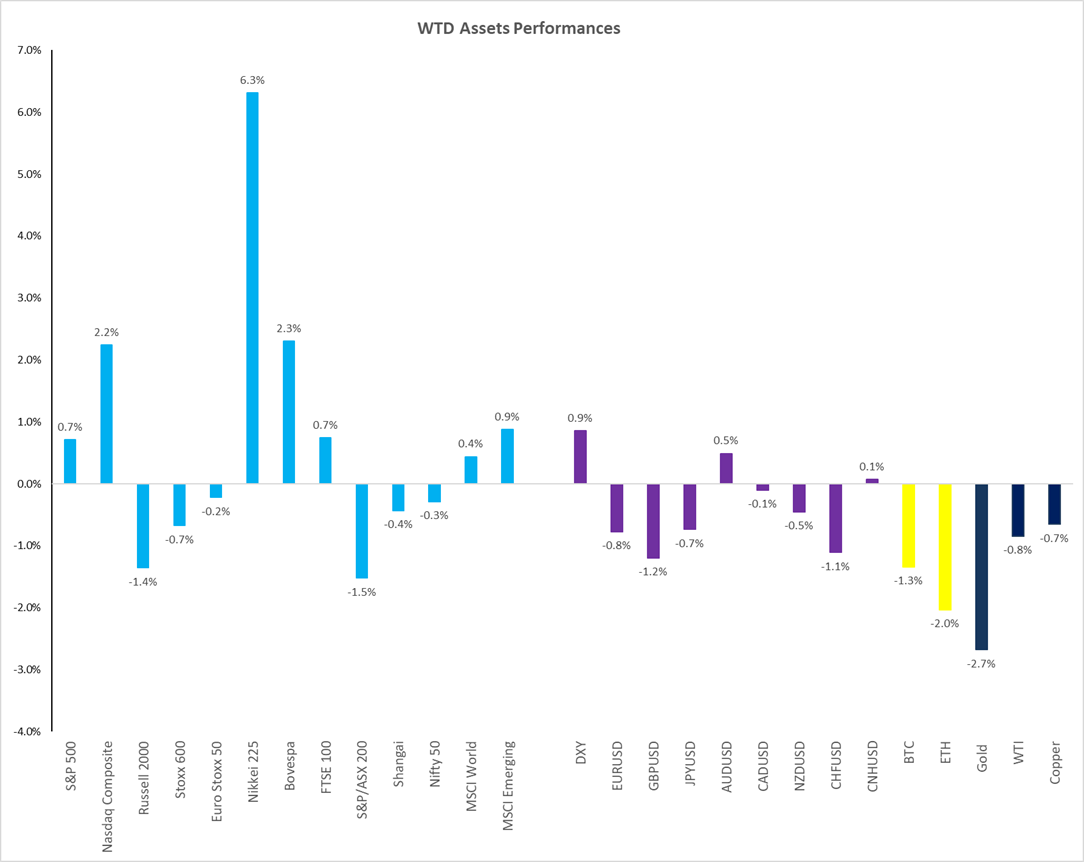

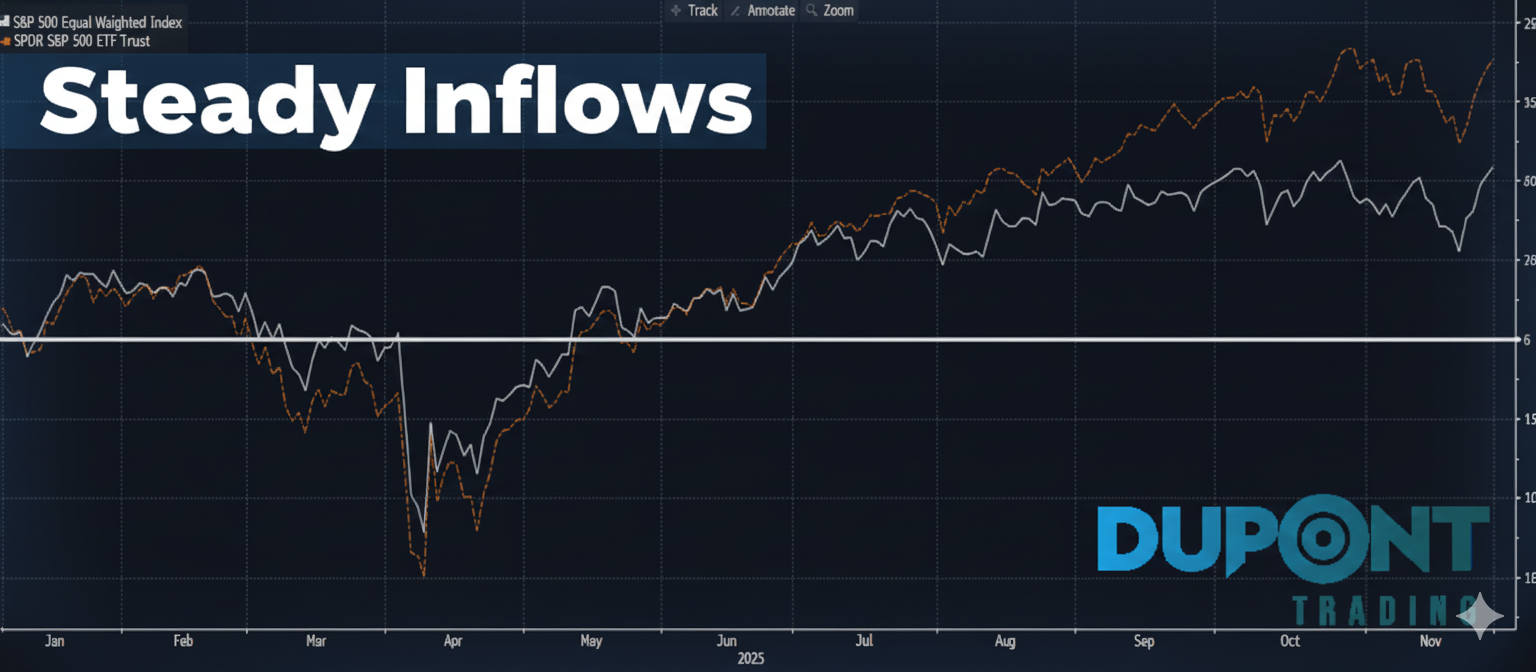

- NASDAQ & S&P 500: Up ~2% thanks to Big Tech.

- Japan: Up 6% on fiscal stimulus hopes and a weakening yen.

- Crypto & Gold: Weak performance, with gold showing signs of topping and crypto facing repeated rejection.

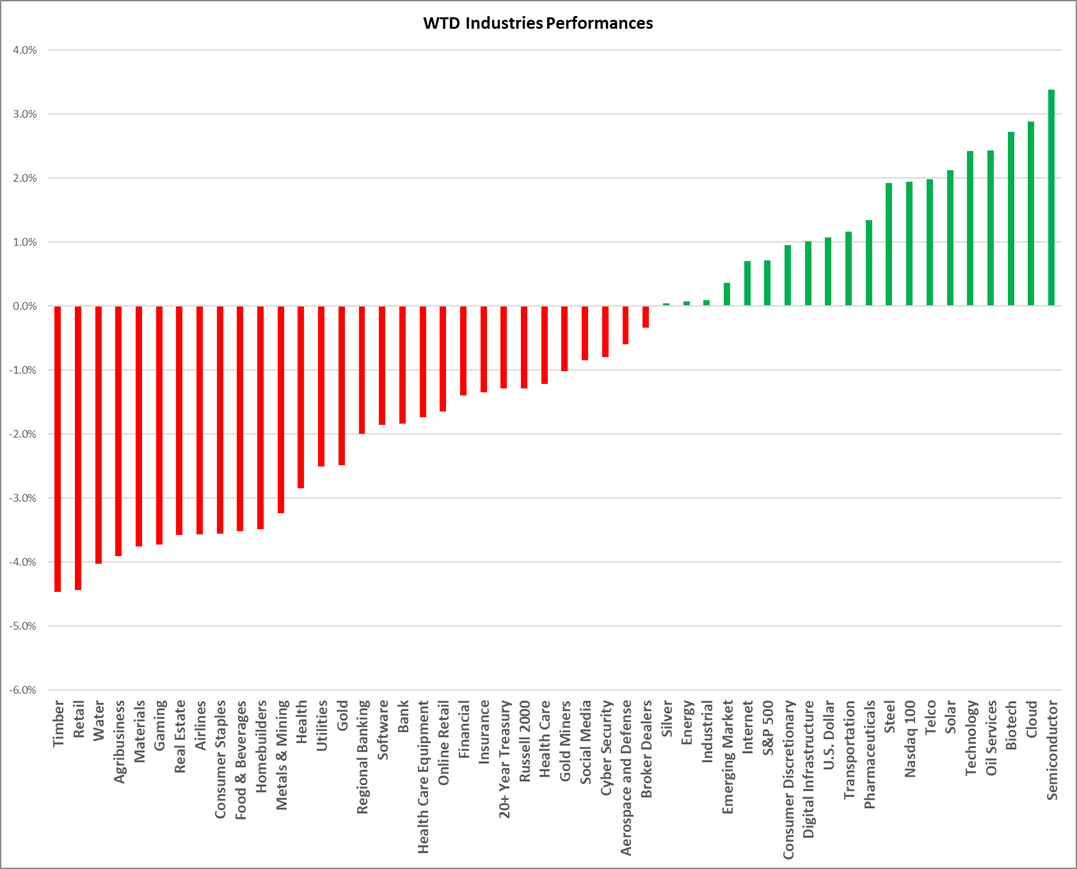

- Retail stocks: XRT down 4–5%. Consumer weakness is emerging, especially among middle and lower-income groups.

🧠 Sector Breakdown

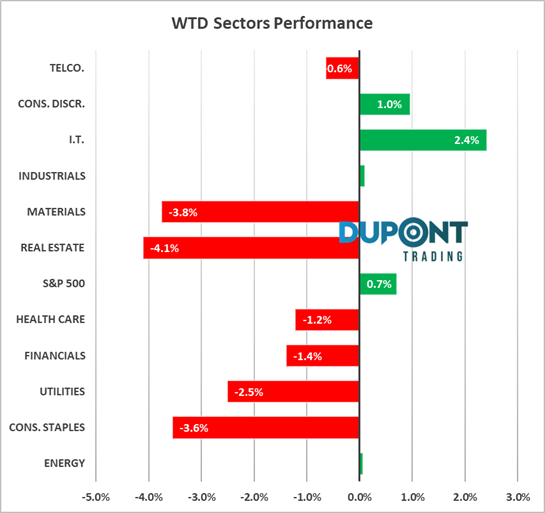

- Tech: Up 2.4%, led by semiconductors and the “Fabulous 7.”

- Consumer Discretionary: Mixed, with Tesla helping but others dragging.

- Staples, Real Estate, Materials: Down sharply due to weak earnings.

📉 Rates, Volatility & Macro Signals

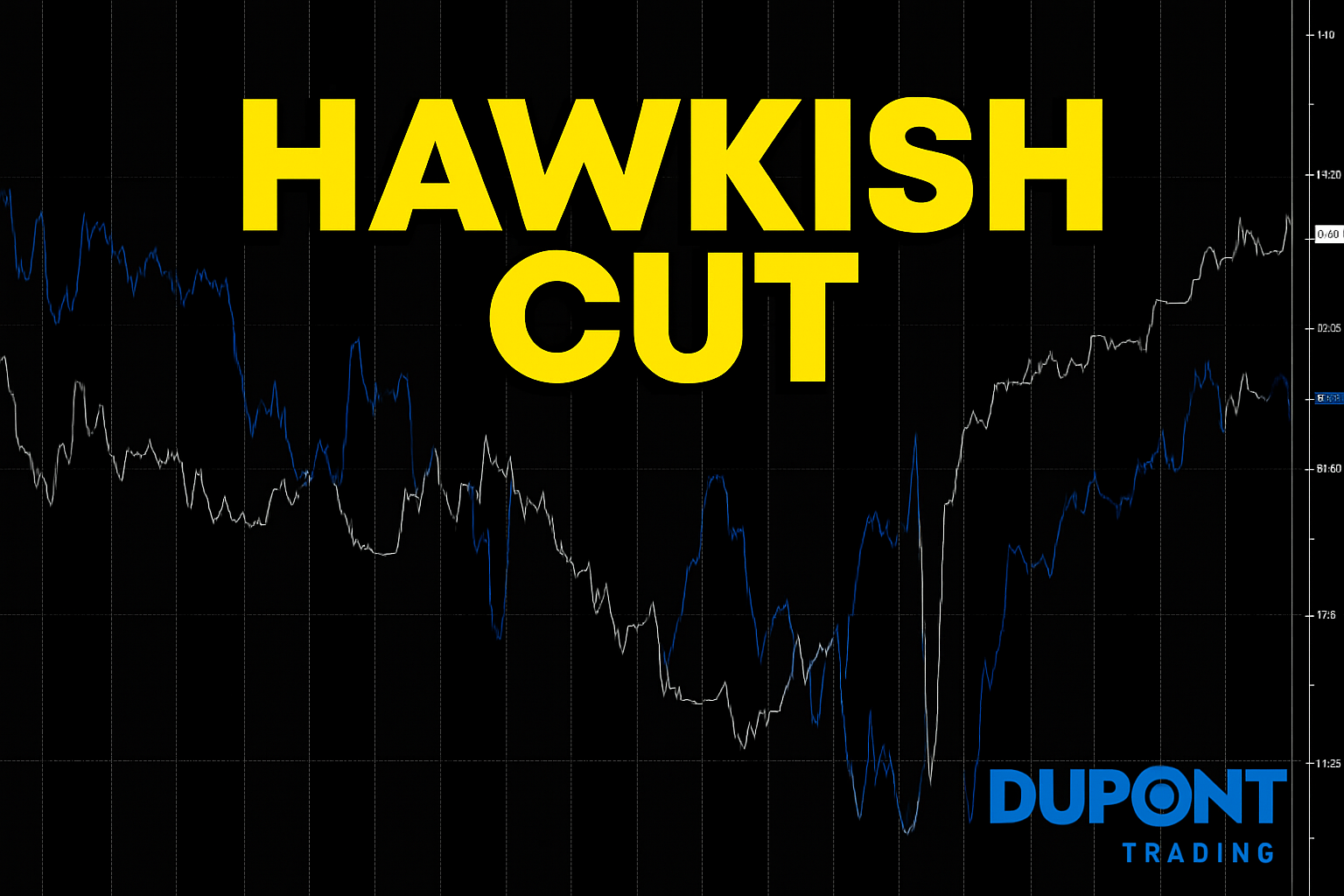

- US 10-Year Yield: Rose to 4.08% despite a Fed rate cut, signaling hawkish sentiment.

- Fed Funds Futures: Market now sees only a 60–65% chance of a December cut.

- VIX: Up to 17.5%, even as markets rallied — a sign of caution amid narrow leadership.

📉 Technicals & Breadth

- S&P Futures: Monthly chart looks okay, but weekly shows weakness.

- NASDAQ: Still trending higher.

- Russell 2000: Lagging — small caps aren’t participating.

- Semiconductors: Philadelphia index up 40% since July — a parabolic move.

- Breadth Warning: On days when indices rise, most stocks are falling — a classic sign of a fragile rally.

💬 Earnings Wrap-Up

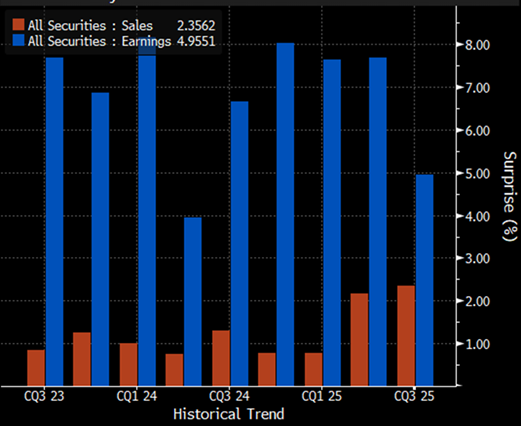

- 83% of S&P 500 companies beat expectations — but the average beat is shrinking (5.3% vs. 7% last week).

- Meta: Down >10% on AI capex concerns.

- Amazon: Strong performance.

- Retail & Hospitality: Chipotle, Royal Caribbean, and others showing signs of consumer fatigue.

📅 What’s Ahead

- Key Events:

- ISM Manufacturing (Mon)

- ISM Services (Wed)

- Australia & UK rate decisions

- Fed speakers

- Seasonality: November historically strong (+2.6% average), but consumer and breadth signals suggest caution.

- S&P Weekly Straddle: Implies a 1.44% move — expect volatility.

📣 Final Thoughts

The market is being driven by a narrow group of tech leaders, while broader sectors and consumers show signs of strain. With earnings season peaking and macro data in flux, November could be pivotal.

Want to dive deeper or join the community?

📧 Book mentoring for Q1 2026: https://duponttrading.com/mentoring/

🎥 Access the 4×4 video series: https://duponttrading.com/4×4-course/

💬 Join the Discord: 30 channels of trading insights: https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions