Earlier Fed Cut

The market analysis focuses on the strong performance of US stocks following recent geopolitical and economic events. After the option expiry ten days prior, US equities showed gains between 3% to 5%, despite uncertainties stemming primarily from Middle East tensions and upcoming tariffs expected in early July. The initial geopolitical concern was the US attack on Iran, which the market quickly dismissed as a one-off event, leading to a strong recovery in stock prices. The market regime has shifted since April’s lows, driven by improving earnings expectations, particularly with the upcoming Q2 earnings season starting mid-July with key banks like JP Morgan. Technology stocks, especially those connected to artificial intelligence and electricity-related sectors such as nuclear power, continue to attract significant investor interest.

The narrative around central banks has evolved from expecting a hawkish stance due to inflation concerns and tariffs to a more dovish outlook. Market participants now anticipate potential rate cuts starting September, with growing chances of earlier easing if economic data weakens. This dovish pivot has supported the recent rally in equities, alongside a weakening US dollar, which has boosted earnings for companies with substantial foreign exposure. Meanwhile, commodities like oil have declined due to ample supply and easing geopolitical tensions.

Sector performance highlights a risk-on environment with strong gains in technology, telecommunications, and regional banks, while energy stocks lag due to falling oil prices. The bond market reflects easing inflation expectations, as the 10-year Treasury yield declines and the terminal Fed funds rate forecast is lowered. Volatility has decreased significantly, with the VIX settling around 16%, and Goldman Sachs’ dispersion trade—long single-name volatility versus short index volatility—is gaining traction ahead of earnings season.

Technically, the S&P 500 and NASDAQ have broken out of recent trading ranges, supported by strong volume and bullish leadership from key stocks like JP Morgan and Nvidia. The Russell 2000 is also showing strength, breaching critical moving averages. Special market events such as the Russell index rebalancing caused notable volatility in specific stocks, illustrating the importance of understanding structural market flows.

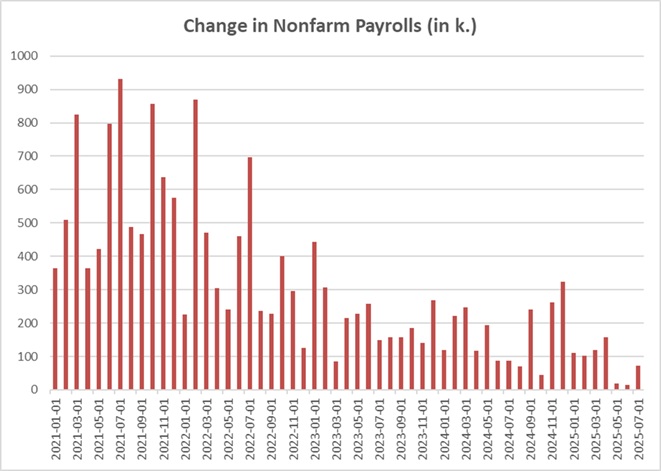

Looking ahead, the market faces several catalysts, including the July 4th US holiday (resulting in a shortened trading week), the upcoming ISM manufacturing and services reports, and the critical Non-Farm Payroll (NFP) data that could influence the Fed’s rate decisions. Institutional investors have recently increased exposure to tech stocks after earlier reductions, driving the current tech rally. The outlook remains cautiously optimistic, with seasonality trends favoring July gains and expectations for ongoing accommodative central bank policies amid some lingering uncertainties around tariffs and geopolitical risks.

Highlights

- 🔥 US stocks have rallied 3-5% since option expiry despite geopolitical tensions.

- The Iran attack was a short-lived market concern, quickly dismissed by investors.

- 💹 Central banks are shifting toward a dovish stance, increasing odds of rate cuts starting September.

- 🖥️ Tech and AI sectors lead market gains, supported by strong institutional buying.

Source: BofA

- 🛢️ Oil prices dropped due to easing Middle East tensions and ample supply outlook.

- 📉 Volatility (VIX) has decreased, signaling reduced market fear ahead of earnings.

- 📊 Key upcoming catalysts include ISM reports, NFP data, and the July 4th holiday impacting trading volume.

Key Insights

- ⚖️ Market Resilience Amid Geopolitical Risk: Despite the US-Iran conflict initially raising volatility concerns, the market quickly normalized, demonstrating its ability to absorb geopolitical shocks without derailing bullish momentum. This reaction underscores the role of clear communication from policymakers and the market’s focus on fundamentals over headline noise.

- 🏦 Shift in Central Bank Policy Expectations: The transition from expecting tighter monetary policy to a more accommodative stance reflects the market’s responsiveness to deteriorating macroeconomic data, inflation trends, and political pressures. This pivot has been a key driver for equity markets, especially in growth sectors that benefit from lower rates.

- 🌐 Currency Impact on Earnings: The significant weakening of the US dollar (10-15% year-to-date) materially benefits multinational corporations by boosting foreign revenue when converted back to dollars. Investors should monitor foreign exposure carefully as currency fluctuations can amplify earnings surprises positively or negatively.

- 💡 Tech Sector Leadership & AI Momentum: Institutional investors are re-entering tech stocks after earlier de-risking phases, driving a resurgence in AI-related companies and semiconductor stocks. This reflects confidence in sustained innovation-driven growth, even as some non-profitable tech names experience volatility.

- 🔄 Market Technicals Support Continued Upside: The breakout above key resistance levels in the S&P 500, NASDAQ, and Russell 2000 signals strong momentum. The leadership by financials (JP Morgan) and mega-cap tech (Nvidia) confirms a healthy risk-on environment, providing a technical foundation for further gains.

- ⚡ Volatility Dynamics & Dispersion Trading: The decline in implied volatility, coupled with growing interest in dispersion trades, suggests that investors expect individual stock volatility to diverge from index volatility. This strategy capitalizes on idiosyncratic earnings risks and is a sophisticated way to hedge or profit from earnings season volatility spikes.

- 🗓️ Upcoming Macro Catalysts & Seasonality: The market faces critical macro events, including ISM surveys and NFP reports, which will heavily influence Fed policy outlook. Historically, July tends to be a positive month for equities, aided by lower trading volumes and a seasonal tilt, but tariff uncertainties and geopolitical risks remain watch points.

Additional Analysis

The episode reveals a nuanced interplay between macroeconomic factors, geopolitical events, and market technicals. The market’s ability to shrug off the Iran-US tensions quickly highlights how traders prioritize sustained earnings growth and central bank policies over sporadic headline risks. The evolving Fed narrative, from tightening to easing, is central to the bullish stock market environment, especially with inflation expectations softening and real economic data showing signs of slowing momentum.

Investors should note the importance of the US dollar’s depreciation in magnifying overseas earnings, which may not be fully priced in yet. The tech sector’s dominance, particularly in AI and semiconductors, reflects structural growth themes that continue to attract institutional capital, which is critical for sustaining momentum beyond short-term trading rallies.

The technical breakout in major indices is a positive signal but also cautions about potential short-term overbought conditions, especially given the RSI and some stretched valuations in non-profitable tech stocks. The dispersion trade’s rising popularity indicates growing differentiation within the market ahead of earnings, suggesting opportunities for active stock pickers.

S&P 500

J.P. Morgan

Nvidia

Lastly, the calendar ahead is packed with pivotal data releases and a shortened trading week due to the 4th of July holiday, which tends to compress trading volumes and can increase volatility. Market participants should remain alert to tariff developments and central bank communications, which could quickly alter the current Goldilocks scenario. The overall tone is cautiously optimistic, emphasizing strategic positioning ahead of earnings and macro data while managing risks related to geopolitical and policy uncertainties.

Community and Mentoring

- Join Our Community: Our Discord community offers both free and advanced channels for in-depth discussions: https://discord.com/invite/Yf42SgAx7fhttps://buy.stripe.com/5kA3dmdVV1g4cuIaEE

- For personalized mentoring, reach out soon as slots are filling up quickly.

Have a good Trading Week!

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions