Day Trading vs Investing?

For Currencies, Bonds, Stocks, even Bitcoin.

http://gregoiredupont.com/2019/03/16/short-term-trading-possible-if-realistic/

Over the last 19 years, I have been looking at many strategies and different timeframes. When I did prop trading, most of the strategies were short-term: from literally 1minute to 3 months.When I was working for a hedge fund, the average holding period was longer. You seat with analysts, you do meetings with managements, CEOs, CFOs, take part in roadshows… You have different timeframes, different risk adjusted returns, concentrations…

But from the day I started in 2000 and probably because at that time volatility was much higher (dotcom bubble burst, economic recession, 9/11…) I always have been convinced that active trading will add performance to my portfolio. Therefore, it has always been part of my different mandates.

So when someone is telling me that Short-Term trading is pointless or that you will always be losing money doing it, I know that the reason is probably different: they just do not know how to trade short-term.

But there is something very true here about day trading: you need to be realistic about the expected returns, have a process, a strict risk management and a set-up that allows it.

So in that sense if you call trading short-term and investing mid to long-term, both need the same: a valid process and a strong and strict risk management.

The expected Returns

First, when you look at a possible trade, it is all about the Risk Adjusted Return or how much risk is involved in producing that return. And that is the beauty and/or the struggle for investors as Financial Markets are always changing, moving, offering different conditions and opportunities.

Secondly, even if that is not a surprise, the longer your time horizon, the higher your expected return should be. And vice versa: the shorter the timeframe, the lower the return should be.

(Looking at yield curves around the world or the levels of the 10 years bond something seems to be broken though. Like for example, these days with the U.S. 1 Month at 2.11% vs the U.S. 5Years at 1.77%.)

Since the Great Financial Crisis, Financial markets experienced a dampening of Volatility on the back of:

– Economic Recovery

– Central Banks Intervention

– Move from Active Investment into Passive Investment – rise of ETF

– Algos Trading

– Regulation reducing the number of active players (like prop traders or market makers) and the amount of capital involved in active trading

– More recently, structured products, especially from Asian Retail Investors, which are natural sellers of volatility

By definition, if you are day trading, the expected moves on any particular asset will be lower than for longer timeframes. Day trading is about trading volatility on the day and spotting assets that would be moving on the day.

Let’s now look at Volatility through numbers, facts.

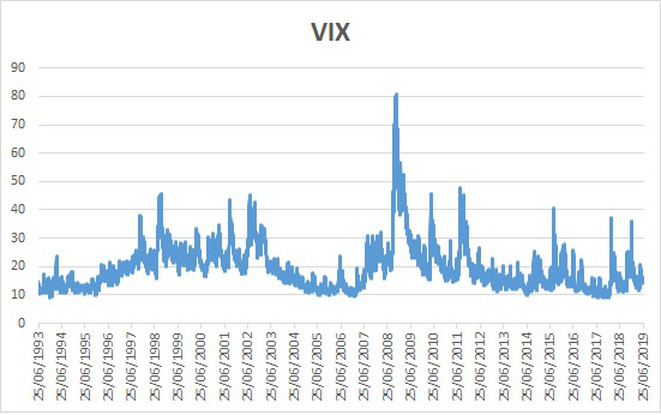

One of the indicators to look at for stocks is the Volatility Index or VIX, which calculates the implied volatility on the S&P 500 based on 30 days options.

We know that Volatility has been pretty low over the last few years. But as I discussed before, this low volatility environment already existed in the past.

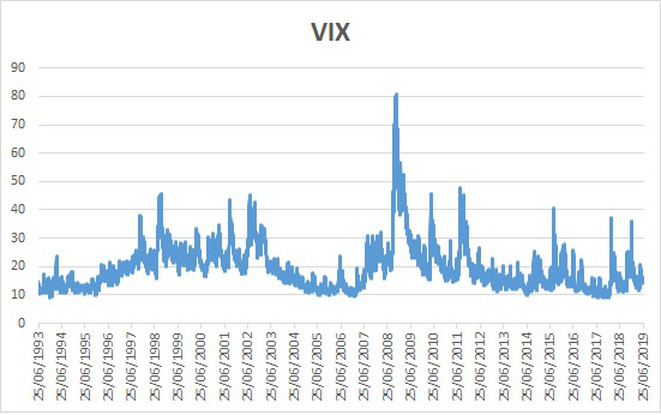

To illustrate the idea, I really like this table:

In that sense, 2005-2006 was very similar to 2016-2017 with low volatility. The only real shake-up I remember was in May 2006.

We had a recent pick-up in volatility but still we are below the historical average.

Like in 2005-2006, lower volatility means that you need to extend your timeframe. Otherwise, if you are dealing with the same short term strategies, you should be expecting lower returns and less possible trades or opportunities.

Best again is probably to go through facts.

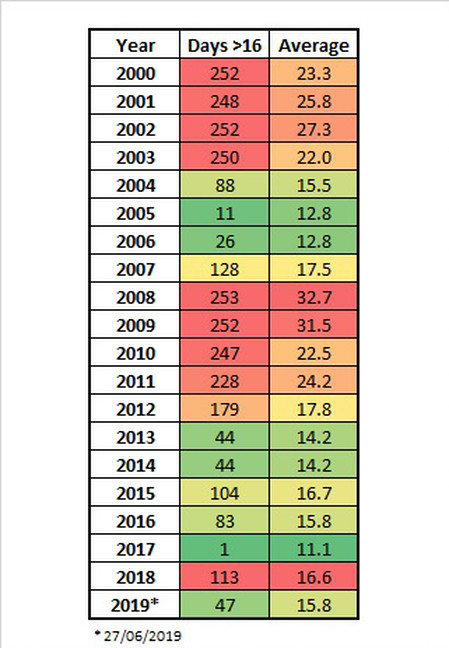

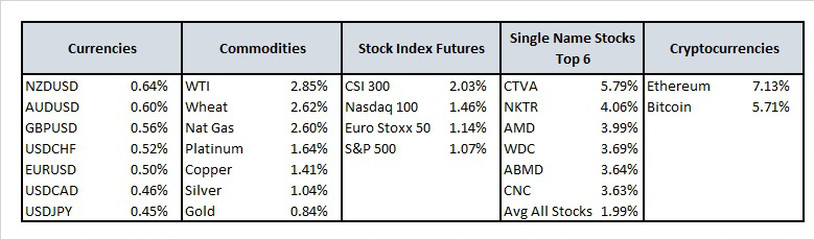

Let’s take a look at the last 60 trading days across different asset classes and assume we traded intraday and always bought at the low of the day and sold at the high. Not as accurate at the Average True Range though for Risk Management.

Average Return last 60 sessions (from 17/04/2019 to 25/06/2019) low-high:

With VIX averaging 15.16.

Looking at those data and if you were the best intraday trader in the world (by buying at the day’s low and selling at the high) your daily return would have been 0.5% on currencies, 2-3x more on stock indexes, 4x more for single stocks, x6 more for WTI, 11x more for Bitcoin.

Over those 60 trading days, 100% of the S&P 500 stocks had an average intraday move higher than the S&P Future 1.07% average move. To sum that up, the stock market offers many opportunities on single name.

For the Bitcoin follower, only one stock in the S&P 500 had an higher average intraday volatility than Bitcoin over that period.

The conclusion of this part one about expected returns is that before trading or investing, you need to assess the asset class returns (look at ATR for example). Each asset class is carrying a “market volatility” and an “asset specific volatility”. There will be correlations between asset classes that will fluctuate over time. For example, the recent Wheat volatility can be explained by the recent weather conditions in the U.S.. Based on your expectations, you could then decide which asset to favour.

But the reality is that it is not because something is moving that we will necessarily make money out of it. No matter which timeframe you are trading, you need a process for your idea generation.

In that sense, trading and investing are the same and retail traders fail at both because they have no process.

A trading strategy is not following the 5 top movers (down or up) on the day and trading them.

A trading strategy is not buying/selling a stock on forum tips.

A trading strategy is not buying a stock and yesterday’s news in the newspapers.

A trading strategy is not buying/selling on NFP numbers.

…

For both trading and investing, you need to identify the strategies that could work. For short-term trading, that would be trading the news (or the tape), earnings, ADR arbitrage, index rebalancing, …

For longer term investing, that would be top-down process, growth strategy, value strategy, asset/sector allocation…

But the common thing for trading and investing is you need to know the asset’s fundamentals. How it trades, when, how, what are the drivers…If you do not, you are mainly playing the price action and that does not work in the long run.

That means for both investing and trading risk management is always key.

Think about concentration, leverage and stop-loss.

For risk management, a positive about trading intraday stocks is you will avoid gaps. In fact, where many retail stock traders are failing is because they badly deal with gaps.

Secondly, if you daytrade stocks and as you are not facing gaps, your concentration per position could be higher than investing. Still concentration is key.

For currencies, commodities, index futures, markets would be open almost 24h from Monday to Friday. Meaning that for those assets, unless very rare situation like the EURCHF in January 2015, your risk management would be easier as you will not be facing gaps. Your stop order (order with a limit stop when you reach your stop-loss) would be executed in the market.

But risk management is essential for both.

For intraday trading, looking at the small average expected returns, running the losers is just not an option. For some of you, that might be when trading becomes investing, ie “I keep the position as it will come back in the green”, “I know I am right. I keep it.”, “This time is different. I can use a wider stop-loss”…

From the second you enter the trade, you need to have a stop-loss and stick with it.

Discipline is essential for both investing and trading: you need hard stop loss. That might sound very boring but that is the reality. Each time I went into trouble was when I decided that this time was different and my position had no stop-loss.

In the real world, when you are trading short-term, emotions can run very high and you need to be able to deal with them. That is unrealistic to say that you are a machine. Emotions will interfere. From my experience, stress is much higher when you do prop trading than when you have longer timeframe. Your mandate is for more risky assets, with a shorter time frame and more concentration.

Based on all of the above, my conviction is not that you can not make money trading short-term. It is true though that the higher the overall volatility, the more trading opportunities you will have. So traders do depend on volatility. The correlate to this point is that when volatility goes higher, an investor needs to reduce his timeframe and his exposure.

But my strongest conviction is you CAN NOT make money if you do not have a process, a strong risk management and a set up similar to professionals.

For the set up, it is much better than 10 years ago as retail trader can now have direct access to market, having cheaper cost of trading, good software tools, reliable data… But if you trade intraday for 0.5% move and you pay 0.2% of commissions, what is the point?

Here, if you try to compete with intraday strategies that imply high investment like Artificial Intelligence, close and fast access to markets, you have no chance. High-Frequency trading will destroy you.

But again what you first learn at prop trading and all over the years is that risk management is key.

In investing, you need to learn how to build a diversified portfolio and if you do that for a hedge fund, it is about dealing with overall exposure: net exposure and gross exposure.

Trading or investing, you always will have to reassess market’s conditions and position your book or your portfolio accordingly. In that sense implementing the right strategy at the right time is valid for both.

Due to the different factors explained above, Financial Markets have experienced a strong reduction in volatility and less occurrences of disruptions. My experience is that the Stock Market offers many opportunities even for short-term timeframe. If you take 3,000 stocks in the U.S., there will always be news or earnings released for at least 30 stocks. That does not mean you should not be looking at the other asset classes – opportunities will arise.

As my first boss used to say, in trading there is good volatility and bad volatility. It is about how to translate this volatility into P&L. For that as an investor or as a trader, you need to rely on three very important things: a real investment process to generate ideas, a strict and strong risk management and a very solid infrastructure that allows you to generate those ideas, execute and deal with them.

I hope it helps,

Gregoire

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions