Brokers are The House

Market Overview

Brokers and Retail Power

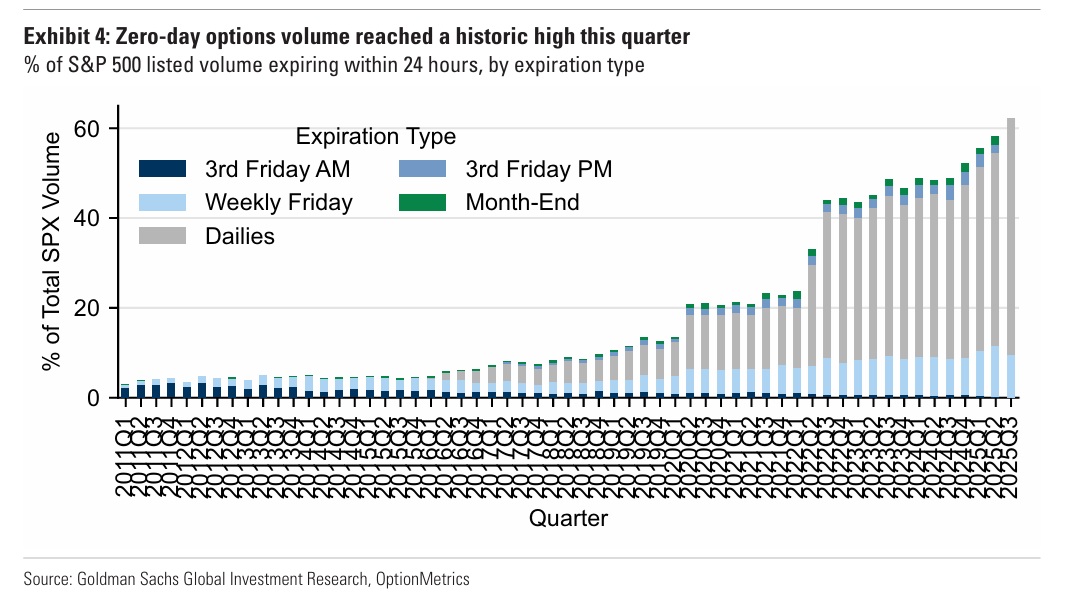

- Broker-dealer stocks have surged to new highs, driven by a boom in retail trading. Retail investors account for a significant share of market volumes, especially with over 60% of options trades now in zero day to expiry products.

- Recent crypto regulations and the introduction of new ETFs, especially in Ethereum and Bitcoin, are fueling additional volume and brokerage revenue.

- Despite sideways action in the past 10 days for major indices, both the S&P 500 and Nasdaq are up 7-8% year-to-date; Europe is showing similarly strong performance.

- Asset class performance: The dollar is down 10% for the year, Bitcoin is up 25%, gold up 27%, and copper remains strong due to new tariffs.

Sector & Industry Breakdown

Week-to-Date Sector Moves

- Winners: Aerospace & defense, software, metals, and mining stocks outperformed.

- Losers: Oil services and healthcare equipment lagged.

- Industrials are up over 15% year-to-date, reflecting market confidence in ongoing GDP growth.

- The technology sector has gained 12% year-to-date.

Market Dynamics & Sentiment

Interest Rates and Volatility

- The 10-year yield hovered between 4.3% and 4.5%.

- Inflation data (CPI, PPI) showed signs of easing, while retail sales continued to impress.

- The VIX (market volatility index) remains subdued, signaling a risk-on environment and aggressive volatility selling by institutions.

Federal Reserve Outlook

- The market expects no change at the upcoming Fed meeting in 10 days.

- Probabilities for a September rate cut are around 50%, with only a modest two possible cuts priced in by year-end.

- Fed policy has become less accommodative as economic indicators and earnings remain robust.

Technicals and Leading Stocks

Index Trends

- Both the S&P 500 and Nasdaq continue to set all-time highs, albeit in narrow trading ranges.

- The Russell index is catching up, with levels of interest flagged at 2,250 and 2,300.

Crypto Surge

- Ethereum has rallied nearly 50% in two weeks following regulatory changes and new ETF launches, pushing the broader crypto space higher.

Key Stock Performers

- Microsoft: Since its last earnings gap, the stock has steadily advanced from $425 to $510, demonstrating persistent earnings momentum.

- Roblox: Jumped from $60 to $124.50, doubling in value since its lows. Volume spikes and upgrades from major banks support this move. (log chart)

- Robinhood: Broke out at $67 and now trades around $110, rising 50–60%. Despite strong gains, some profit-taking appeared on high volume last Friday. (log chart)

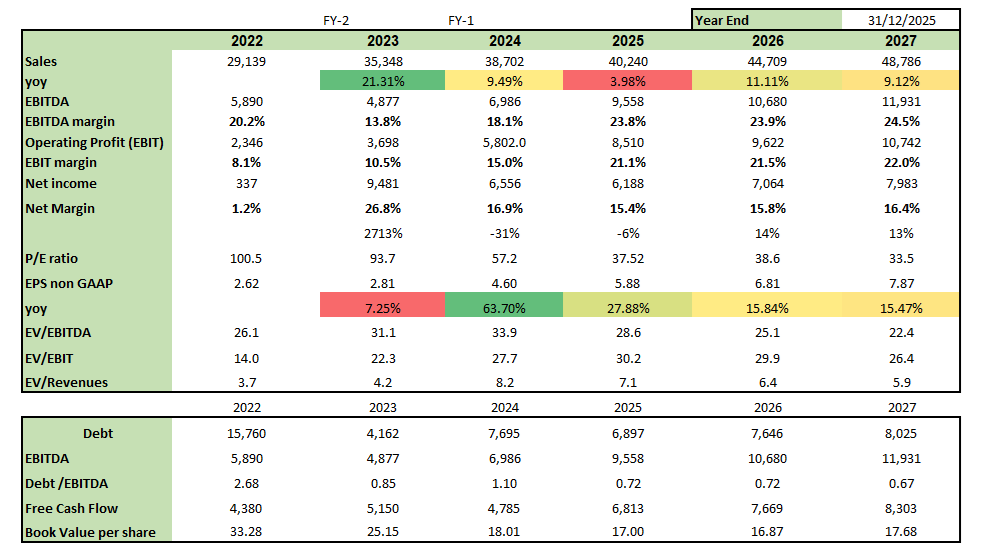

- GE and Spin-offs: GE has been rerated dramatically since its spin-off, with the forward valuation now at 33–38x 2026–2027 EPS despite little change in earnings forecasts.

GE last (lhs) vs 2026 EPSe (rhs).

GE Fundamentals.

Upcoming Catalysts

- Earnings Season: Major companies reporting in the next weeks include Coca-Cola, Intel, Tesla, and Google.

- So far, 60% of sales and 80% of EPS have beaten estimates, but stocks missing on sales or profits are being punished more than usual.

- Macro Events: ECB rate decision and flash PMIs on Thursday. Little is expected from the Fed until their next meeting due to the blackout period.

- Political Watch: Japan’s elections will impact global bond markets.

Trading Insights

- Retail traders currently drive short squeezes in non-profitable tech and heavily shorted names, propelling them over 10% in a week.

- Volatility is historically low, with implied moves for the S&P 500 now under 2% per week, and persistent downward trends.

- The market is showing some complacency heading into earnings, potentially underpricing event risk

Community & Mentoring

Interested in joining the trading community or mentoring program?

- Discord: 1 free channel, 30+ premium channels ($75/month)

- Mentoring: Limited seats for September start

Have a good Trading Week!

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions