Bread and Circuses

This week, we explore the macroeconomic landscape, political noise, and market momentum, all under the theme of “Bread and Circuses”—a nod to the distractions and sustenance that keep the market machine running.

🔍 Macro Recap: Same Trends, New Noise

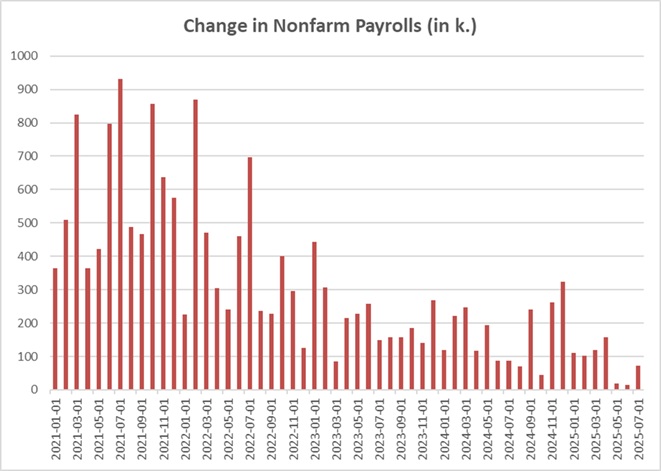

- Economic Data: ISM Manufacturing and Services, along with NFPs, showed little change. The U.S. economy continues to tread water—not booming, but not collapsing either.

- Political Drama: Elon Musk publicly distanced himself from Trump, criticizing the administration’s unsustainable deficit projections. The U.S. deficit remains at 6–7%, with debt-to-GDP ratios climbing past 120%.

📊 Market Performance: A Broadening Rally

- Equities:

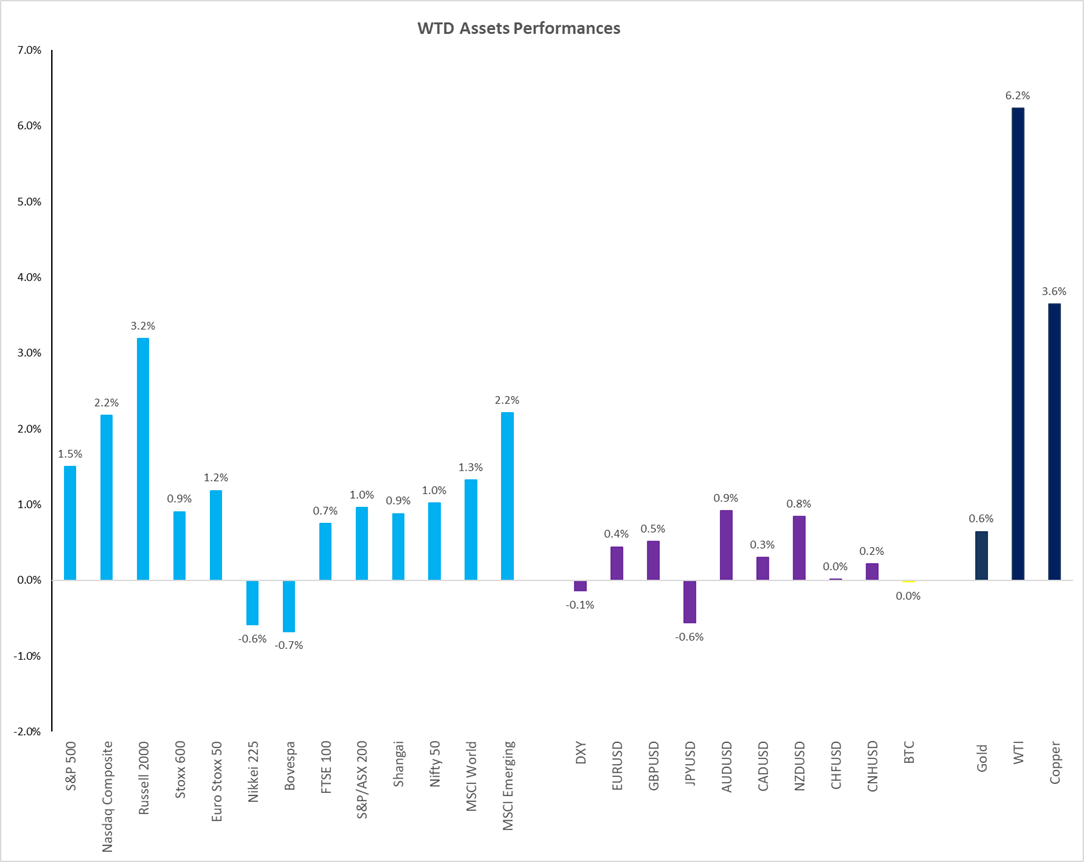

- S&P 500: +1.5% for the week

- Russell 2000: +3%, showing signs of catch-up after YTD underperformance

- NASDAQ: Near all-time highs, driven by momentum stocks

- Sectors:

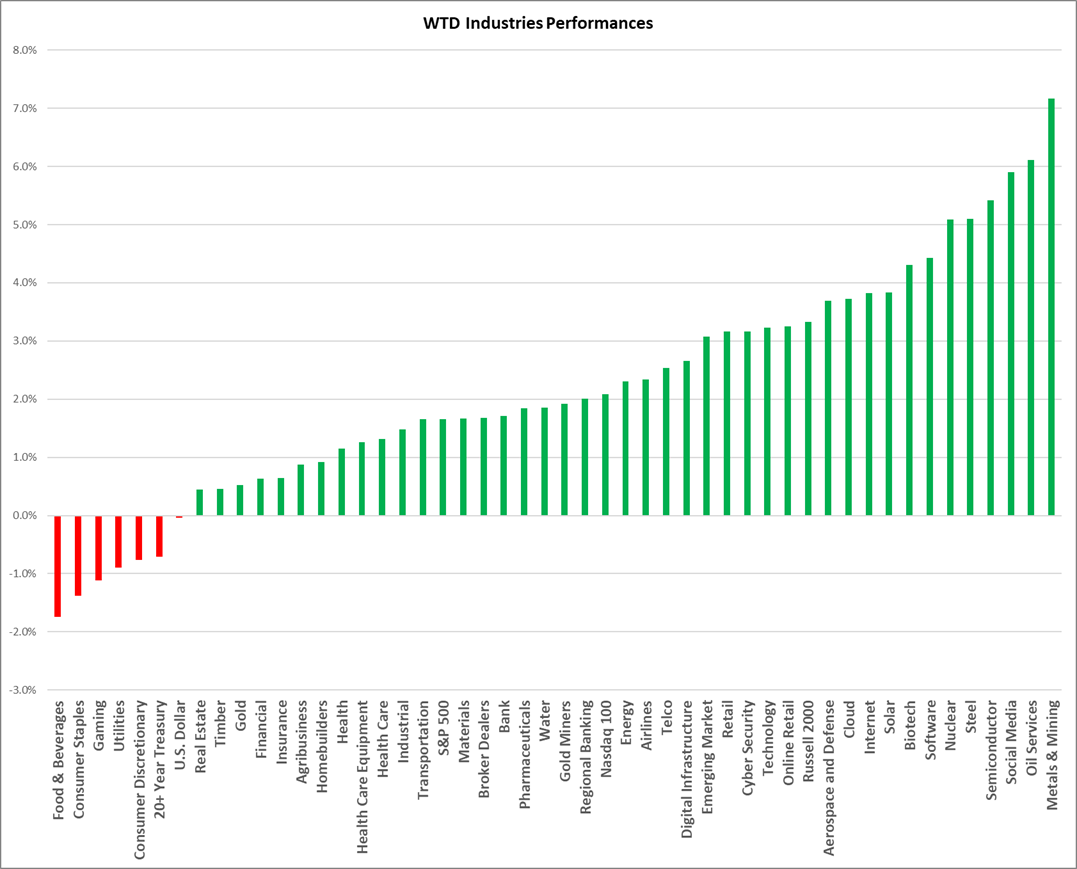

- Outperformance beyond the “Fabulous 7”

- Semiconductors and nuclear stocks surged, boosted by the Meta–Oklo deal

- Defensive sectors like utilities and staples lagged, signaling a risk-on environment

- Commodities & FX:

- WTI Crude: Rebounded to $63–$65

- USD & Bitcoin: Flat

- EUR/USD: Hovering around 1.14

📉 Rates & Volatility

- 10-Year Treasury Yield: Holding at 4.5%, reflecting “okay-ish” macro data

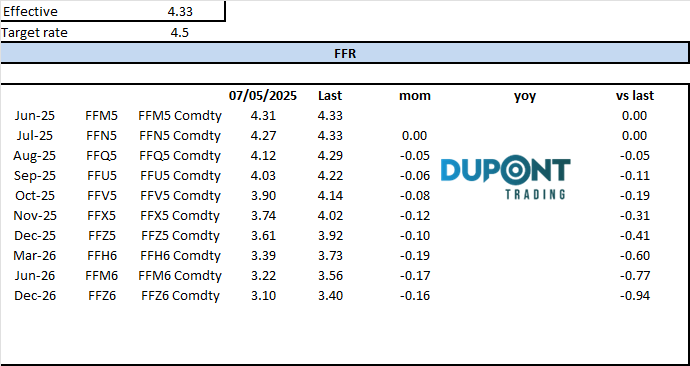

- Fed Expectations: Fewer than two rate cuts expected by December

- VIX: Below 17%, indicating low volatility and continued bullish sentiment

📈 Technicals: Near All-Time Highs

- S&P 500: Broke out from the 5900–5905 range, now just 3% from all-time highs

- NASDAQ: Strong momentum, mirroring S&P

- Russell 2000: Testing key resistance at 2130 (futures) / 2110 (cash)

- Fabulous 7: Nvidia and other momentum names continue to lead

🧠 Macro Insights

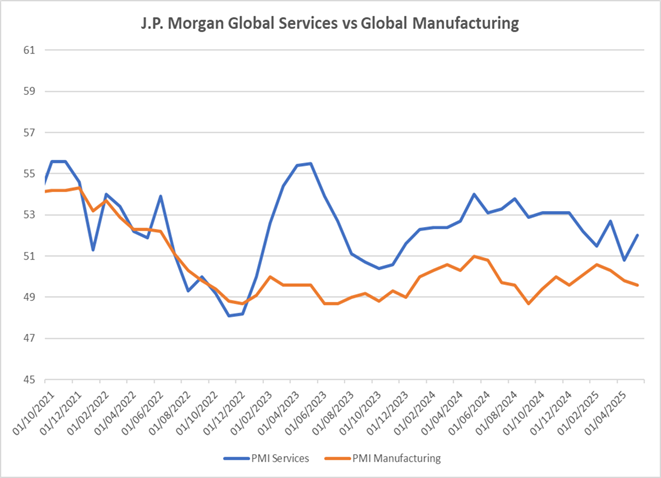

- ISM Trends: Manufacturing remains flat; services are softening

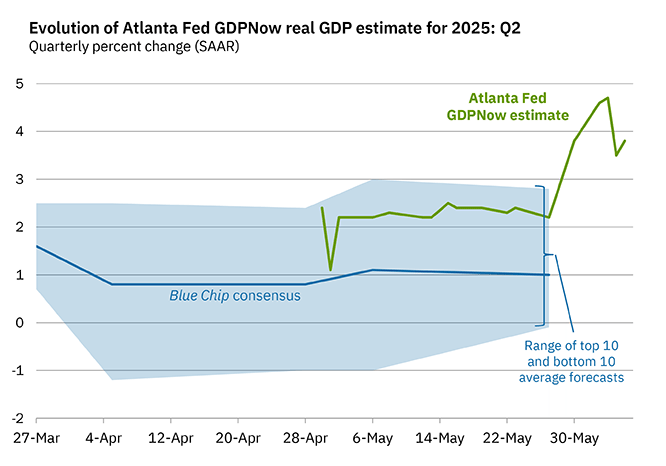

- GDP Outlook: Q1 was negative, but Q2 could see 3–4% growth

- Tariffs: Potential inflationary impact expected to show up in summer data

- Volatility Correlation: Strong inverse relationship between VIX and S&P continues

🔮 What’s Ahead: Key Catalysts

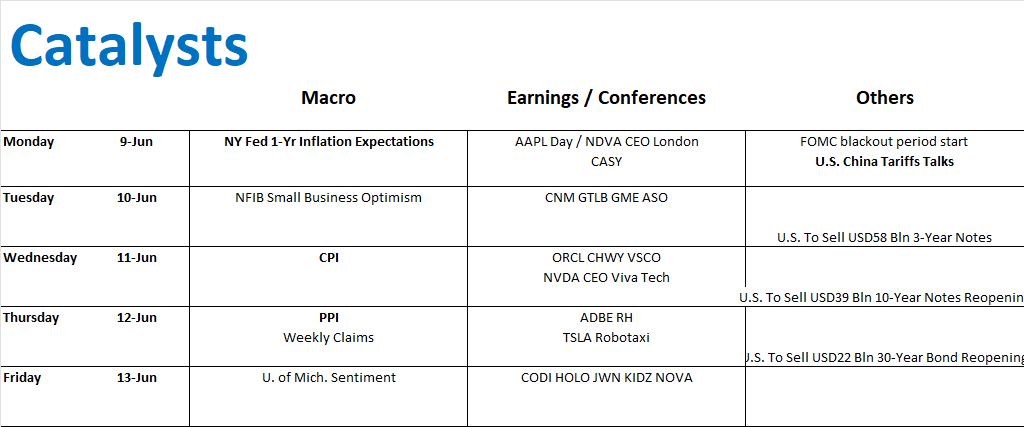

- Inflation Data:

- Monday: NY Fed 1-Year Inflation Expectations

- Wednesday: CPI

- Thursday: PPI

- Earnings & Events:

- Oracle, Adobe report

- Nvidia CEO presentations in London and Paris

- Apple Day (Monday)

- Tesla RoboTaxi Day (Thursday)

- FOMC: In blackout period ahead of next week’s meeting—no rate change expected

- U.S. China Tariffs talk in London.

- Bond Auctions: Watch for market reactions Tuesday–Thursday

📌 Final Thoughts

- Russell vs. S&P: Catch-up trade in motion, signaling broader market strength

- Seasonality: June is typically flat, but July often favors small caps and momentum

- Volatility: One-week implied vol at ±1.5%—a shift toward longer holding periods

Community and Mentoring

- Join Our Community: Our Discord community offers both free and advanced channels for in-depth discussions: https://discord.com/invite/Yf42SgAx7fhttps://buy.stripe.com/5kA3dmdVV1g4cuIaEE

- For personalized mentoring, reach out soon as slots are filling up quickly.

Have a good Trading Week!

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Until next week—trade smart, stay disciplined, and follow your plan.

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions