Bitcoin’s Big Drop & Market Chaos: What Traders Must Learn from Friday’s Shockwave

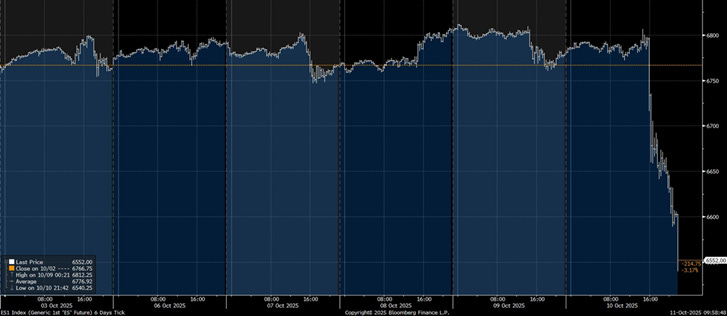

Until Friday afternoon (3:00 p.m. London time), everything seemed calm—stocks were climbing, leverage was high, and optimism was rampant. But then came the storm:

- China announced export controls on rare earth metals early Friday morning.

- Trump tweeted threats of canceling a meeting with China, triggering a broad sell-off.

- S&P 500 dropped 200 points, and NASDAQ plunged.

- Post-close, Trump announced 100% tariffs on China, intensifying the panic.

The crypto market was hit hardest:

- Bitcoin fell from $115K to $105K.

- Altcoins dropped 10–50%.

- Liquidity dried up as ETF market makers were offline.

- Over 1.5 to 2 million retail traders lost money—many leveraged 5x or more.

“Crypto is still far from being a mature, regulated asset class.”

⚠️ The Leverage Trap

Massive use of options and leverage across asset classes has created a fragile environment. When assets drop even slightly, leveraged positions get wiped out.

- Retail traders are drawn to shiny, high-risk trades.

- Risk management is often ignored—but it’s crucial.

- If you’re leveraged 10x and the asset drops 10%, you’re out.

“Risk management isn’t sexy—but it’s what keeps you in the game.”

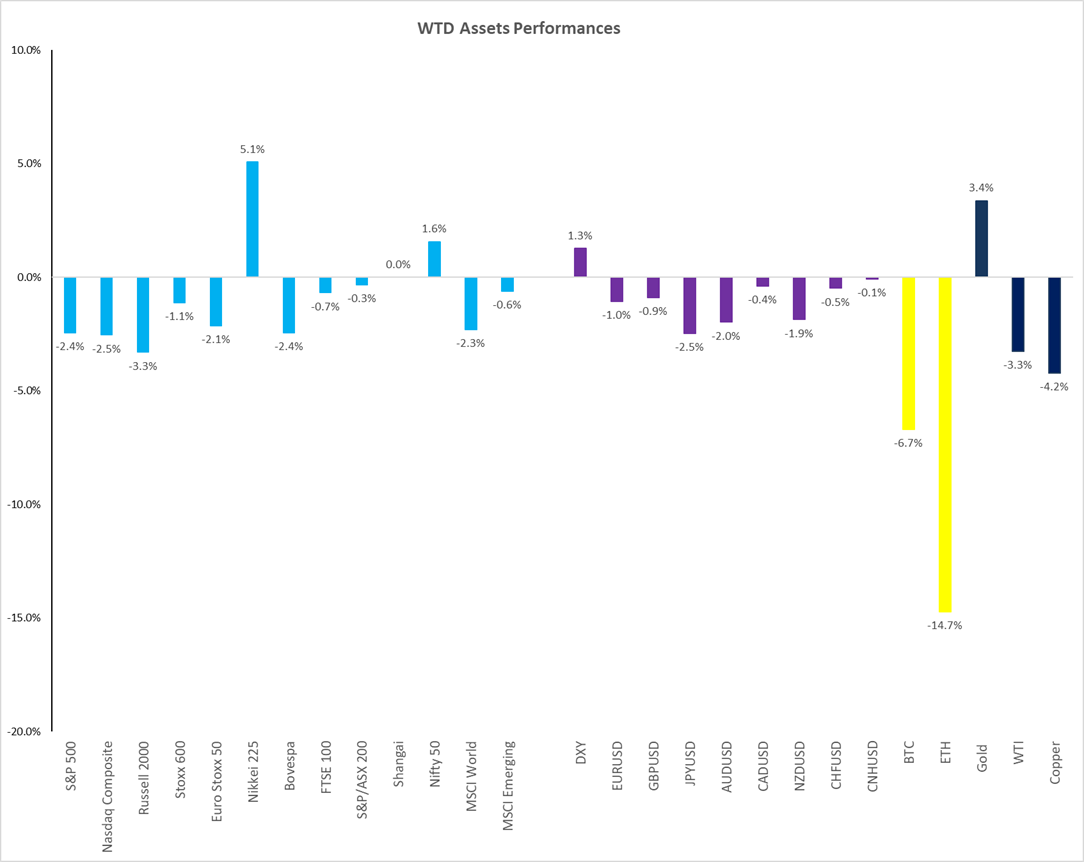

📊 Week-to-Date Performance Snapshot

Asset Classes

- Stocks: Down ~2% (except Japan, which rallied post-election).

- Crypto: Bitcoin -7%, Ethereum -15%.

- Commodities: WTI below $60, Copper weak, Gold & Silver strong.

- Currencies: USD strengthened, JPY weakened.

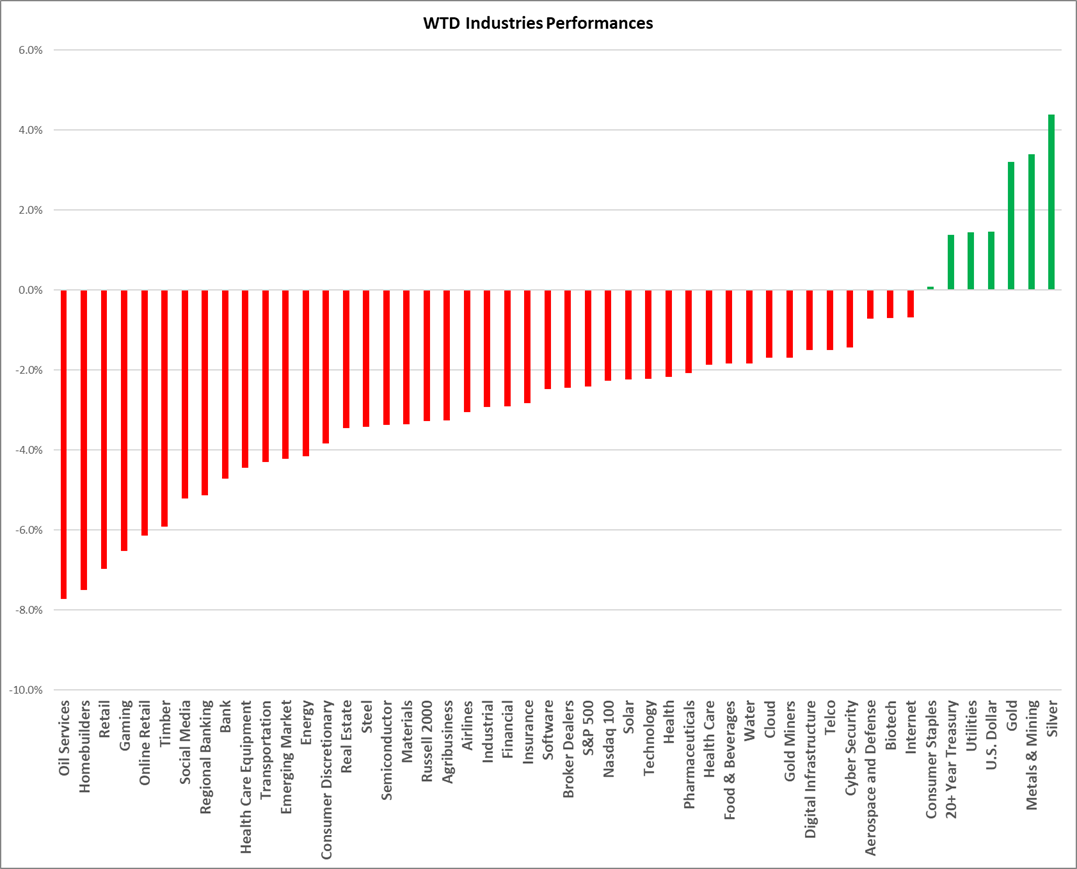

Industries

- Struggling: Oil services, home builders, retail, gaming.

- Resilient: Gold, silver, mining, utilities, treasuries.

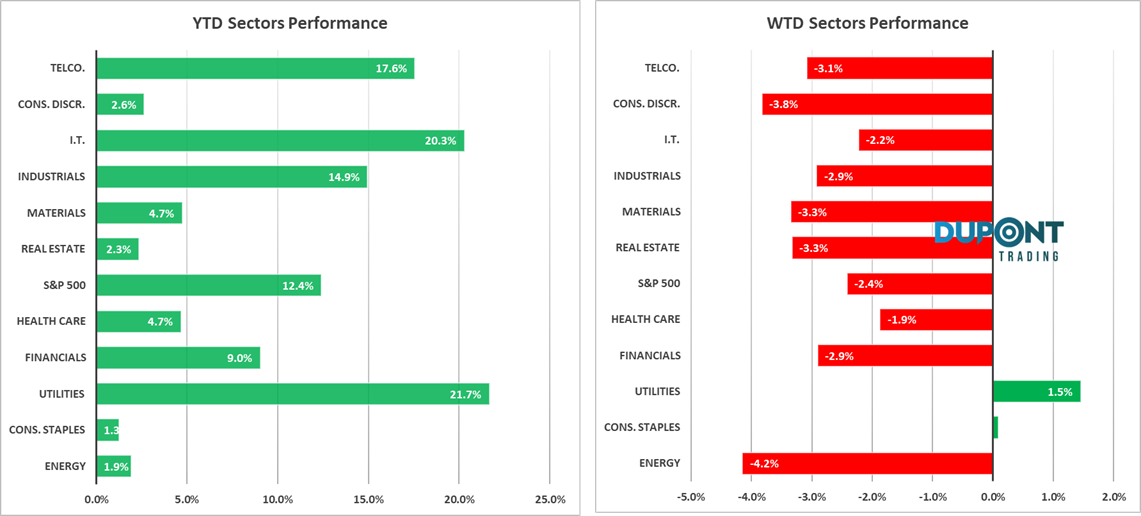

Sectors

- Only Utilities & Consumer Staples held steady.

- Tech: Still leading, down just 2.2% vs. market’s 2.4%.

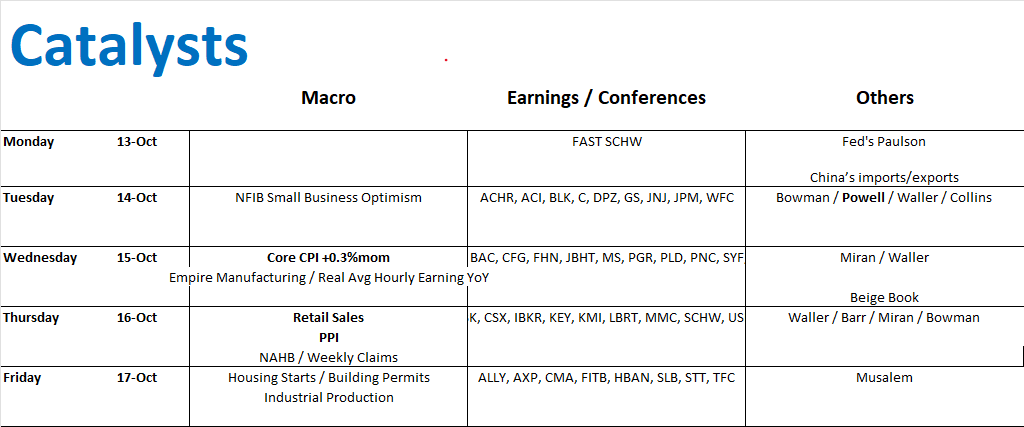

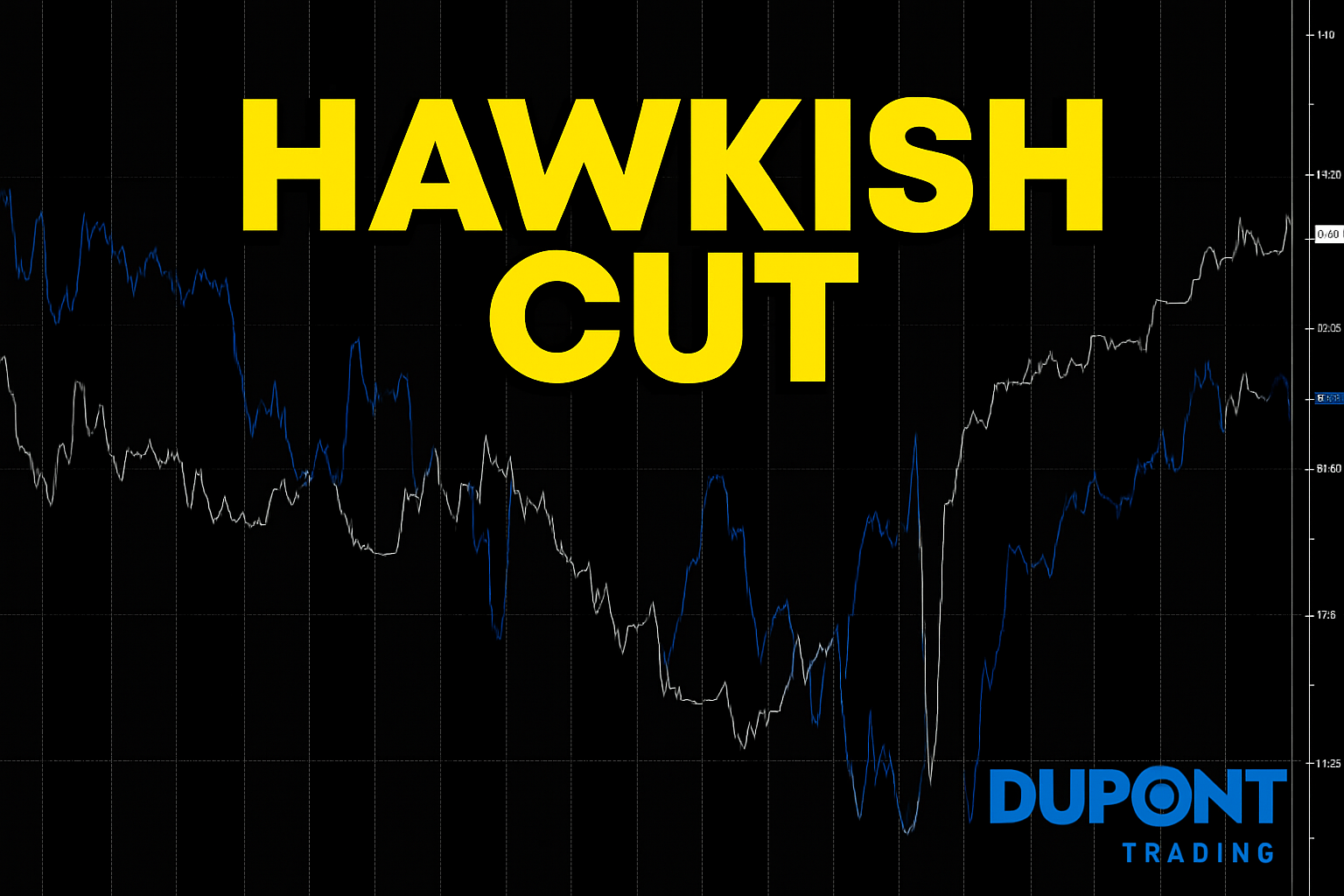

📉 Rates, Volatility & Fed Expectations

- Bond yields fell ~10 bps as investors fled to safety.

- Fed rate cuts expected: 25 bps in October and December.

- VIX spiked to 21.66%, signaling rising short-term fear.

📈 Technical Analysis Highlights

- S&P & NASDAQ: Sharp sell-offs, testing 50-day moving averages.

- WTI Crude: Below $60—pressure on producers.

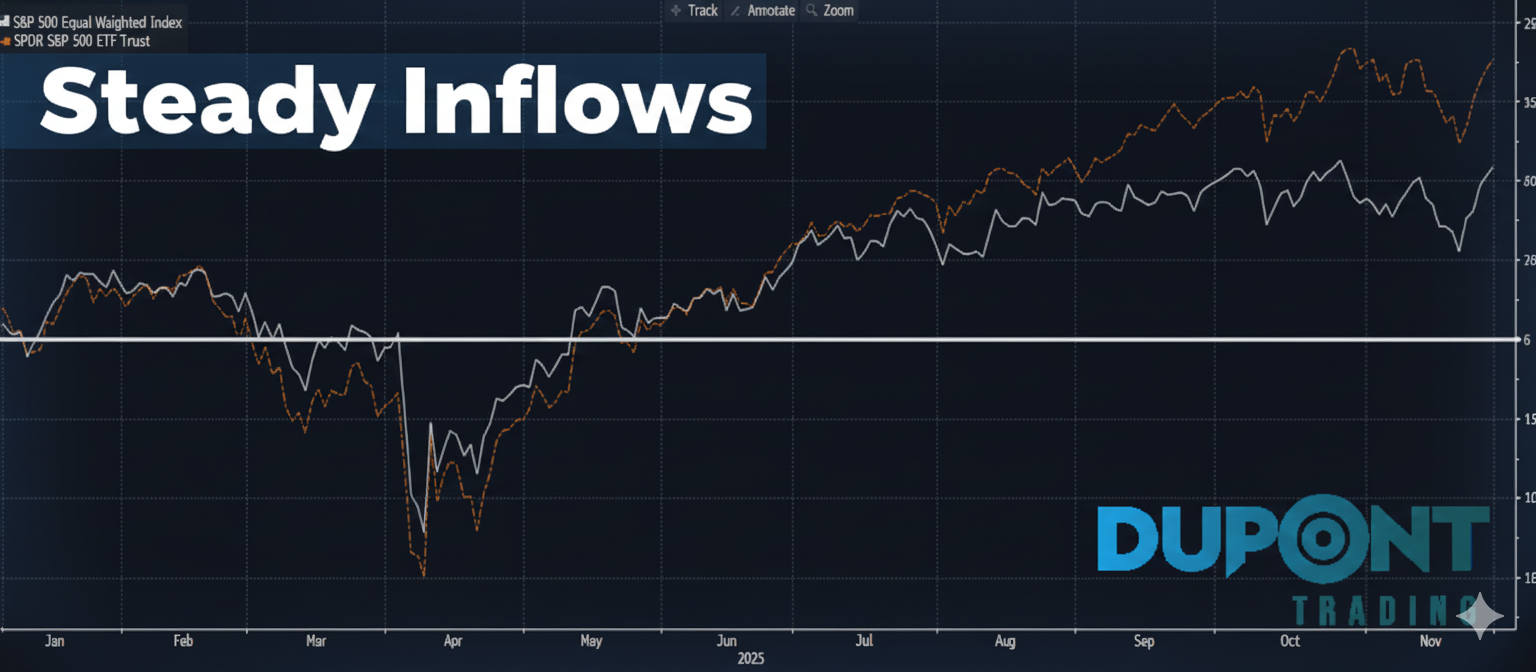

- Gold & Silver: Strong inflows, potential new highs.

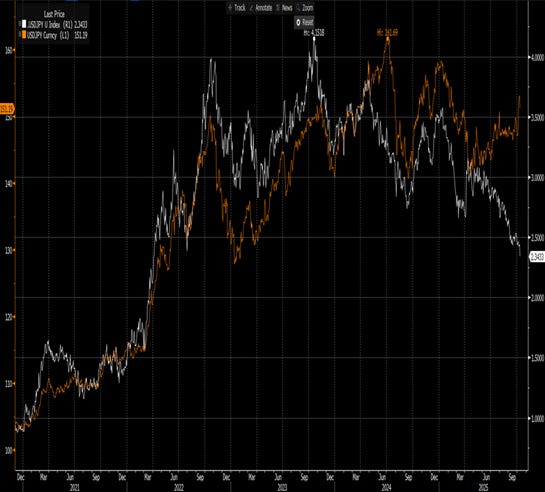

- USD/JPY: Divergence driven by dovish Japanese policy.

USDJPY (lhs) vs U.S. 10y – JP 10y (rhs)

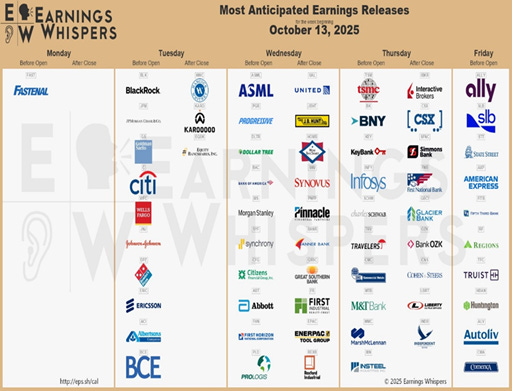

🧠 Macro & Earnings Season Preview

- Earnings kickoff: JP Morgan, Goldman Sachs, Citi.

- Volatility Watch: Last season saw realized volatility exceed implied—first time in 18 years.

- Retail flows: $100B into stocks last week—often a near-term top signal.

🧨 Catalysts to Watch

- Trump Tariffs: Expect headlines and potential softening of tone.

- China Relations: Crucial for market sentiment.

- CPI & Retail Sales: Delayed due to U.S. government shutdown.

- Earnings Season: Financials lead the way.

💬 Final Thoughts

“This week was a masterclass in why risk management matters. Leverage can amplify gains—but it can also wipe you out. If you want to learn more, join our Discord, subscribe to the 4×4 video series, or reach out for mentoring.”

If you’d like to join or explore our 30+ private trading channels for $74.99/month, now’s the time.

https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions