Bitcoin Breakout

This week, Bitcoin surged past the $112,000 mark, confirming the bullish momentum flagged last week. While crypto headlines are heating up, the focus remains on cross-asset market regimes, not on chasing crypto trends. The overall market regime since April’s lows remains “risk-on,” with both Bitcoin and various retail names hitting new highs.

Key Highlights:

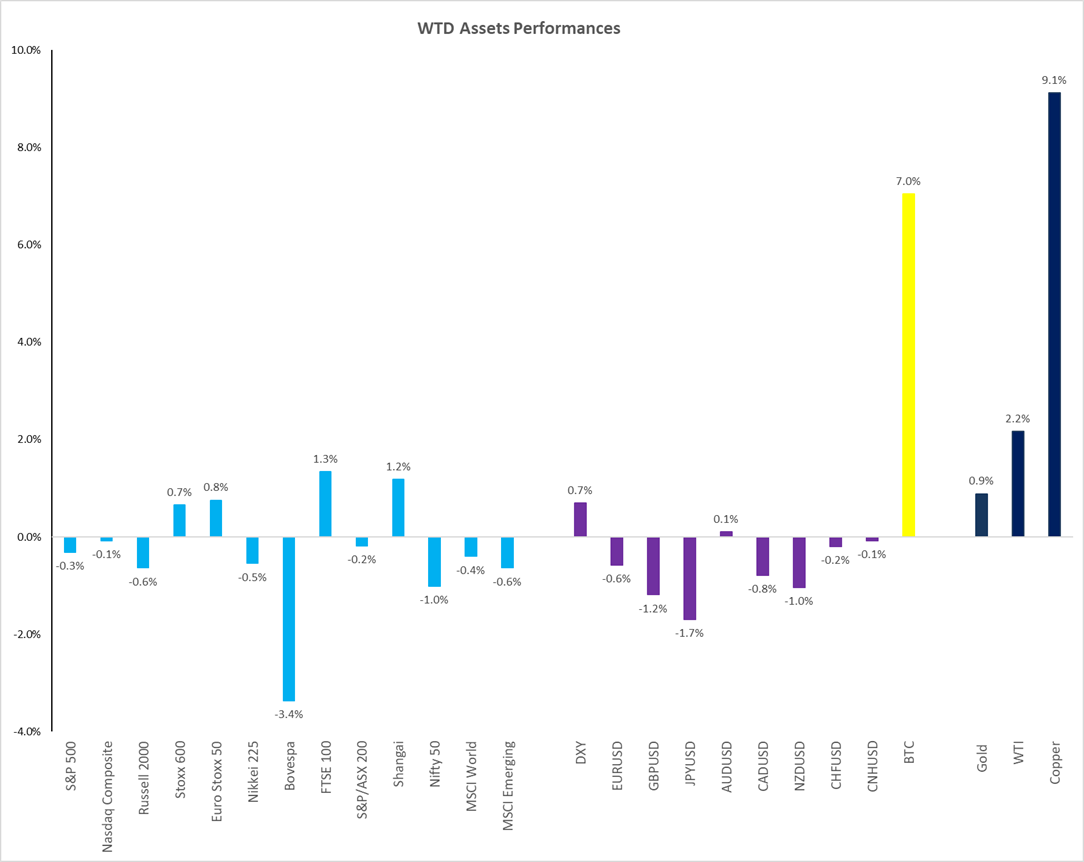

- S&P 500: Flattish performance for the week.

- Brazil: Under pressure after the U.S. imposed a 50% tariff.

- U.S. Dollar: Slight bounce after a 10% decline over six months; now at 1.17 vs. the euro.

- Bitcoin: Up 7% for the week.

- Copper: Major breakout following U.S. tariffs.

The Dispersion Trade: Winners & Losers

A major theme continues to be dispersion trading—selling index volatility and buying single-name volatility. While indices like the S&P and NASDAQ stayed flat, there was significant divergence among individual stocks:

- Software Sector: Early signs of AI-driven disruption; expect some names to face 60–80% declines in coming years. Watch ETFs like IGV for opportunities.

- Airlines: Strong performance, with sector ETF JETS up ~10% after positive earnings.

- Cyclicals: Mixed signals, but discretionary names are worth monitoring.

Sector Performance Table:

Macro & Rates Update

- 10-Year U.S. Yield: Steady at 4.4%. Despite efforts to push yields lower, rates remain sticky.

- Fed Watch: No rate cut expected at the next meeting. Odds for a September cut are around 70%, but expectations for Fed easing are fading.

- Volatility: S&P implied volatility at 16%; realized volatility much lower. VIX 9-day at 13%.

Technical Analysis Recap

- Airlines (JETS): Breakout on strong earnings and volume.

- S&P 500 / NASDAQ: Sideways trading, but both remain at all-time highs.

- Russell 2000: Outperforming S&P and NASDAQ since late June.

- Bitcoin: 7–8% move higher, confirming last week’s bullish call.

- Copper: Breakout after U.S. tariffs.

- JP Morgan: Pulled back after a breakout; earnings season starts Wednesday.

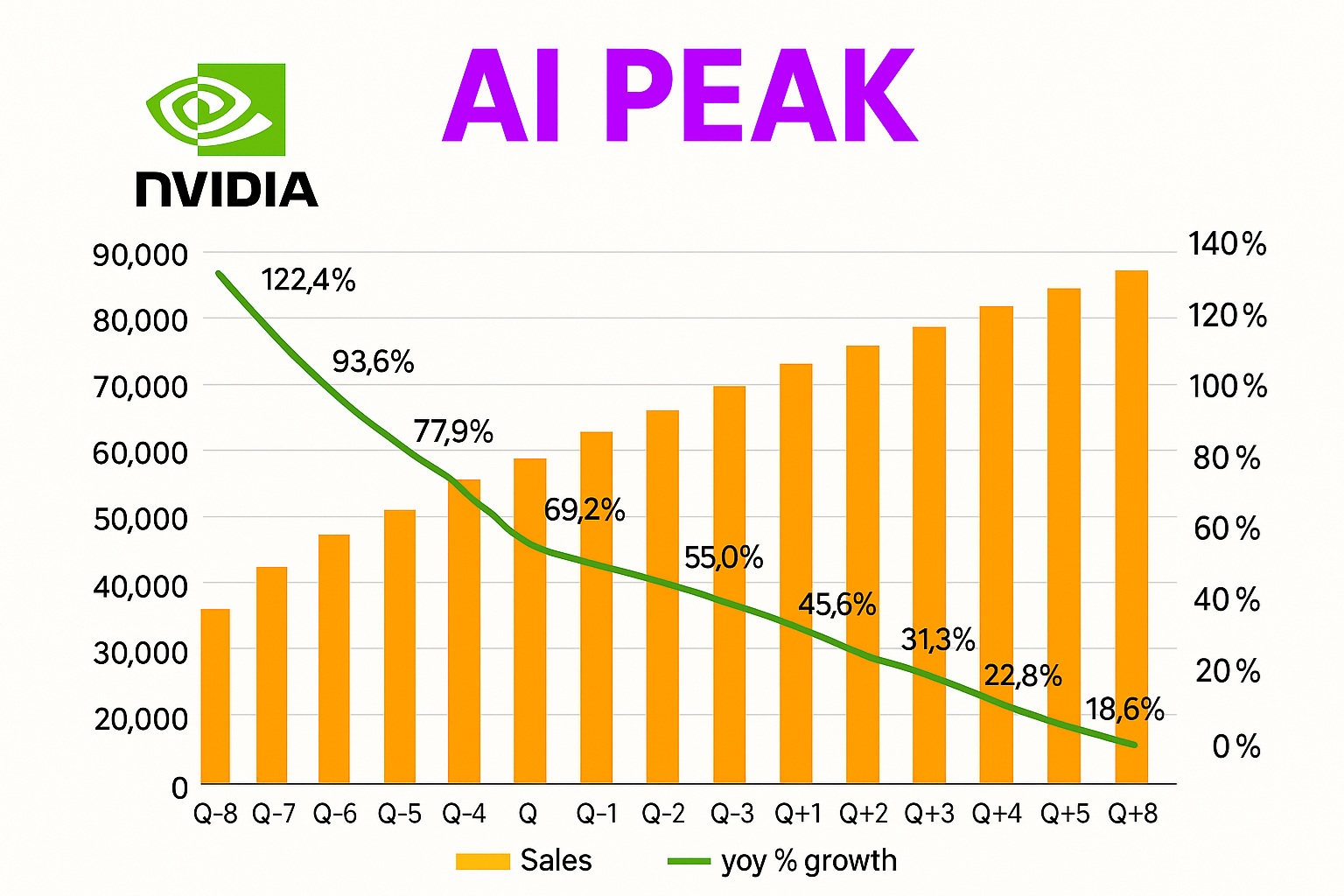

- Nvidia: Hit $4 trillion market cap midweek, with retail-driven call option activity.

Market Regime & Retail Flows

- Leveraged ETFs: Massive growth since 2020, especially among retail traders in names like Nvidia and Tesla.

Source: Nomura

- Options Activity: Retail traders heavily favor options, often resulting in losses.

- Market Breadth: Concentrated gains in a few names; overall breadth remains weak.

Upcoming Events: Macro & Earnings Calendar

- Tuesday: CPI (Inflation)

- Wednesday: PPI (Producer Prices)

- Thursday: Retail Sales

- Friday: Housing Starts, University of Michigan Confidence

- Earnings Season: Kicks off with JP Morgan, ASML, TSM, Netflix, and more.

Q2 earnings growth expectations have been lowered to 4% (from a typical 7%), setting a low bar for the season.

Strategy Corner

- Volatility Remains Compressed: Despite macro events and earnings, the market is pricing in little movement (SPY weekly straddle at ±1.3%).

- Protection Trades: With July seasonality favorable but August less so, consider S&P downside spreads with 7–10% protection over the next two months. Current risk/reward is 9:1.

Community & Mentoring

Interested in joining the trading community or mentoring program?

- Discord: 1 free channel, 30+ premium channels ($75/month)https://discord.com/invite/Yf42SgAx7f

- Mentoring: Limited seats for September start

Have a good Trading Week!

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.