Big Tech, China & Market Momentum – Oct, 26 2025

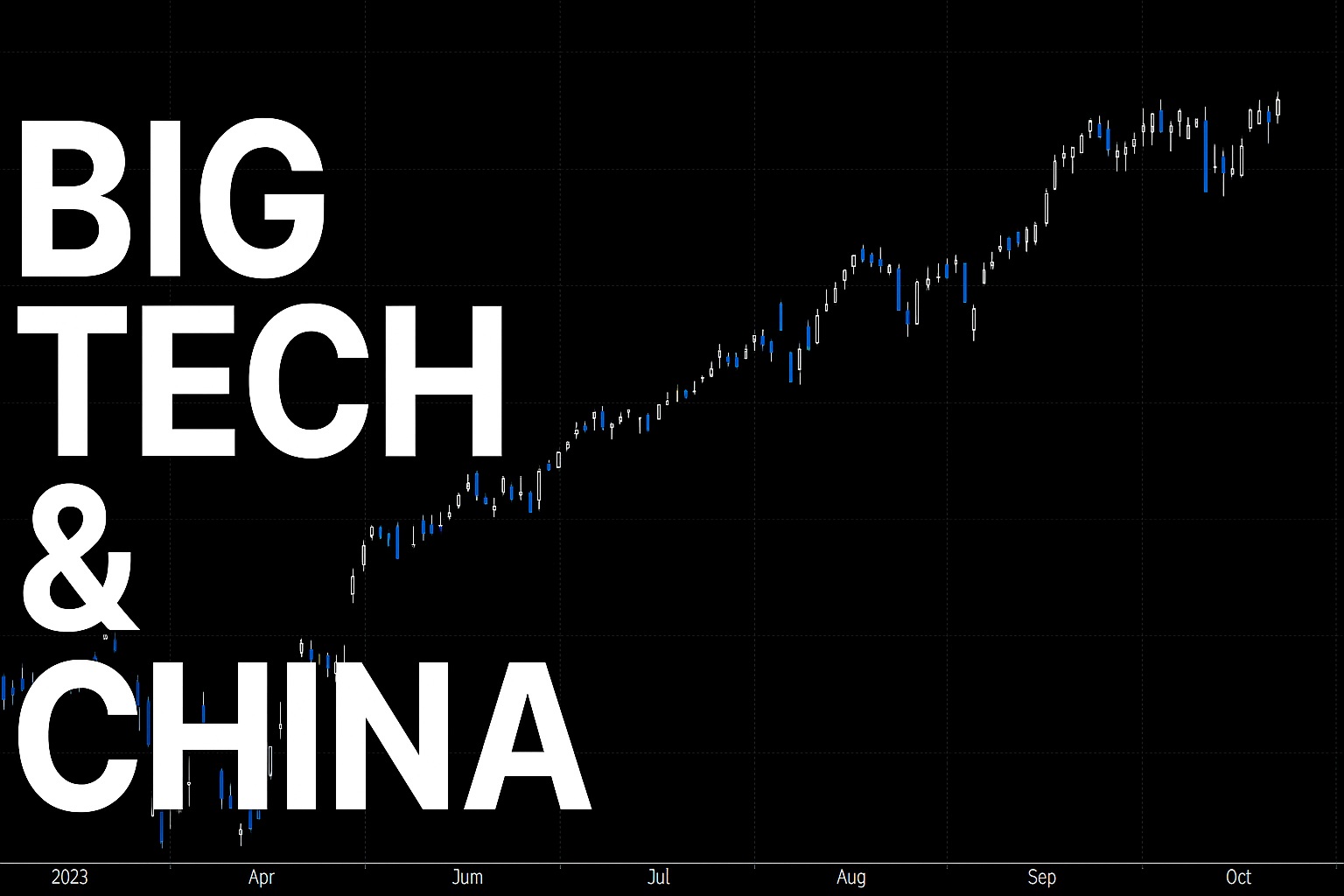

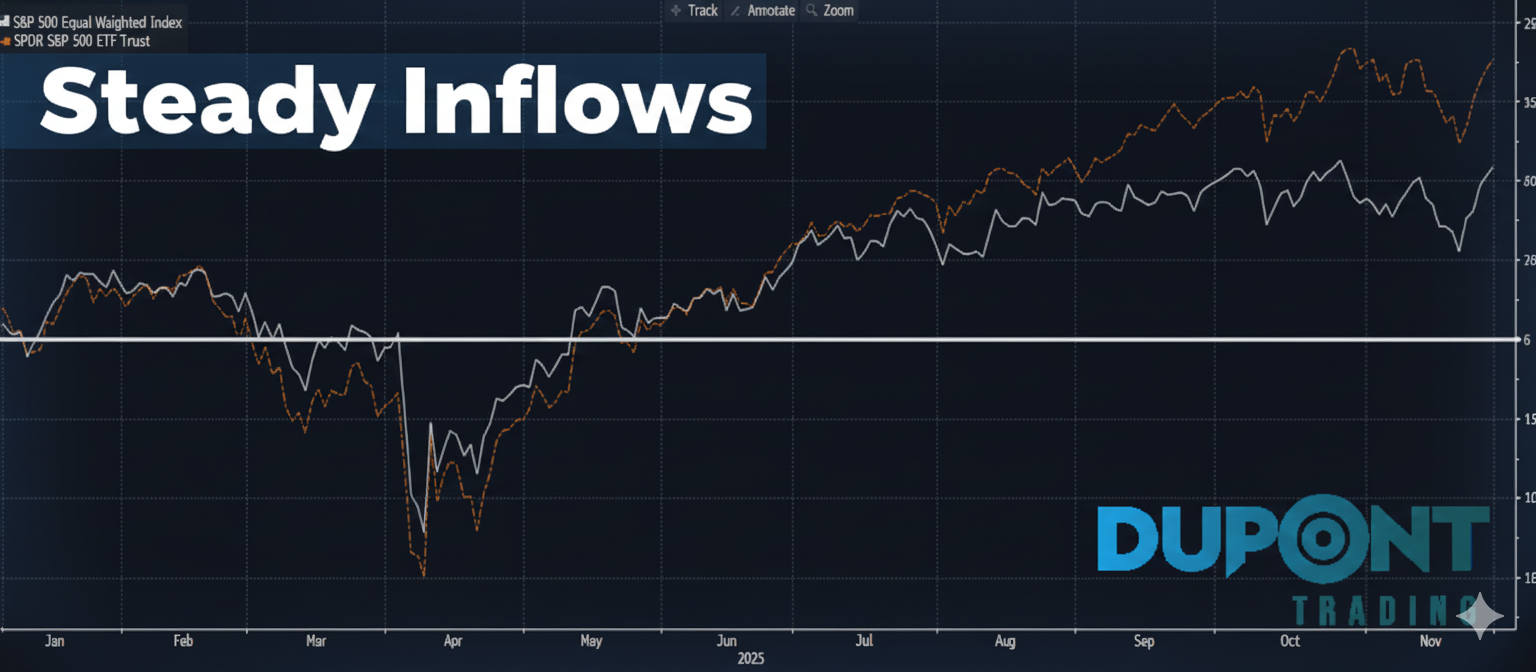

Despite some volatility earlier in the year, big tech stocks (the “Fabulous 7”) have been driving the market to new highs, supported by significant retail call buying and passive ETF investments. The S&P 500 and NASDAQ have both shown strong gains recently, while other asset classes like gold and silver faced sell-offs after a strong prior run, indicating potential market turning points.

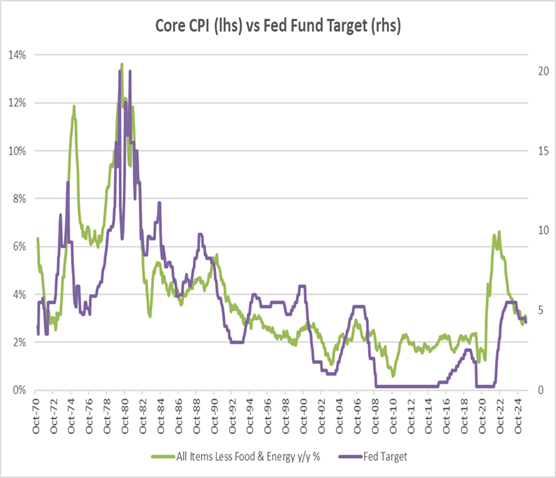

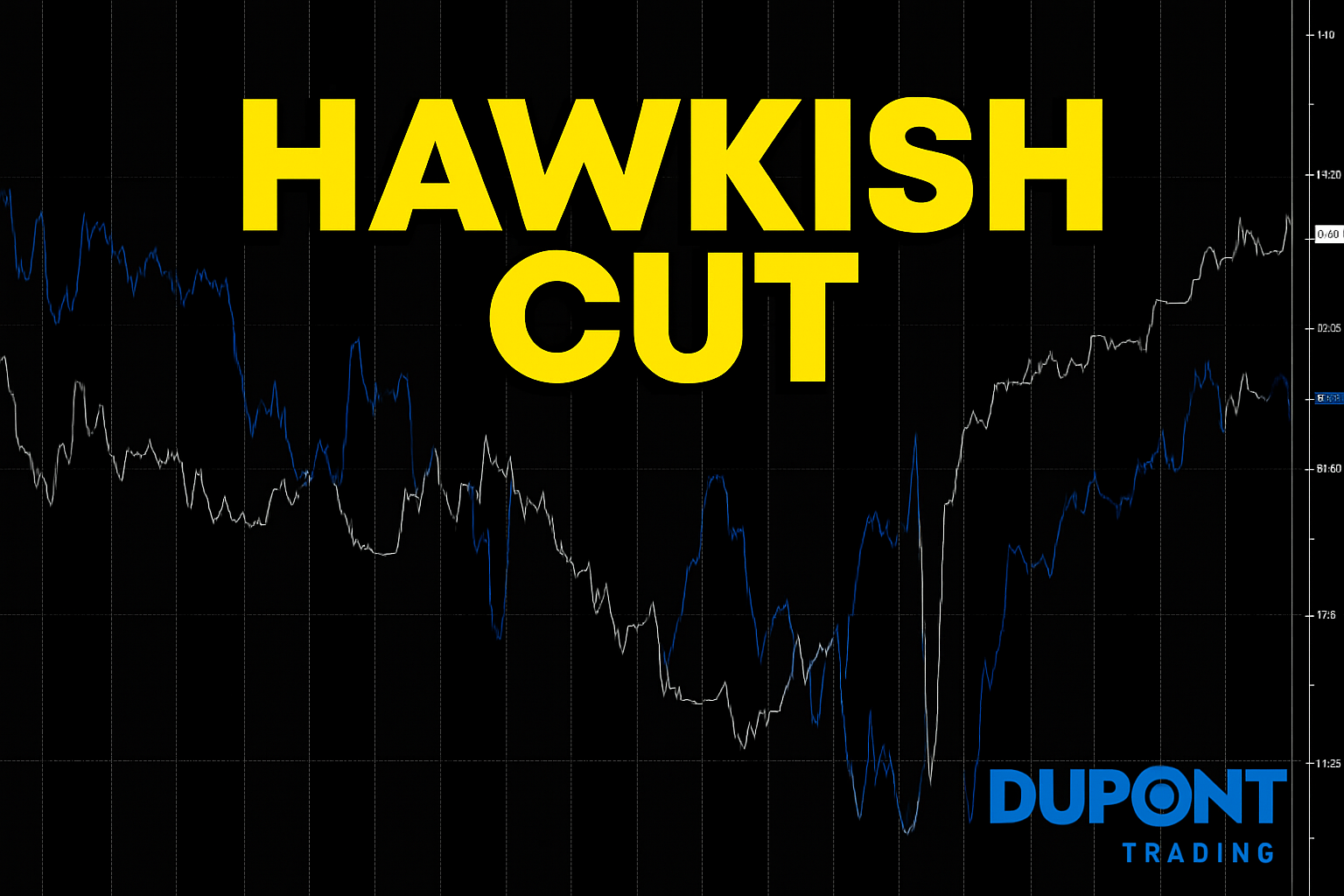

The macroeconomic landscape remains critical with the Federal Reserve expected to cut interest rates by 25 basis points this week and potentially again in December, signaling a dovish stance that boosts stock market sentiment. Inflation remains elevated at around 3%, higher than the Fed’s traditional 2% target, but market expectations have adjusted to this “new normal,” which supports ongoing asset price appreciation.

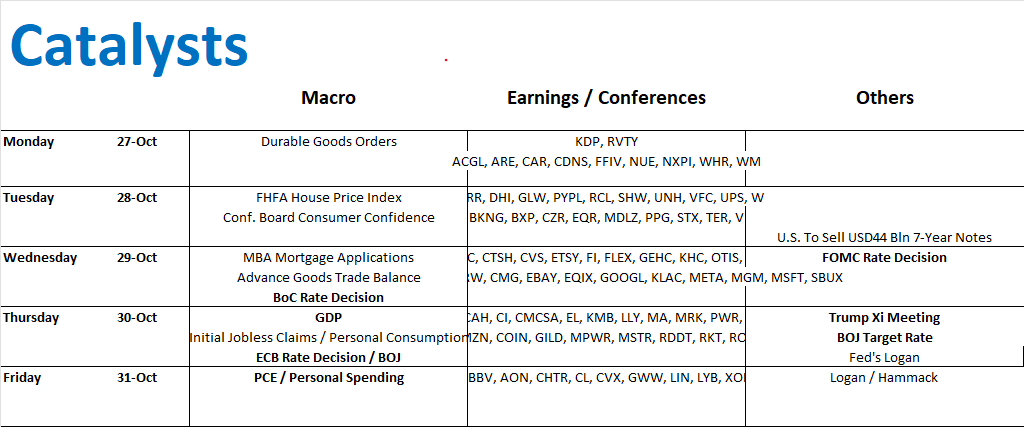

Key upcoming catalysts include a busy earnings week featuring major tech companies such as Microsoft, Meta, Apple, Amazon, and Google, as well as important central bank meetings from the Fed, ECB, Bank of Japan, and Bank of Canada. Additionally, there is anticipation around a potential US-China trade deal, which could influence market direction.

Volatility has recently compressed from a spike in the VIX, indicating more stable market conditions and providing opportunities for volatility sellers. Sector performance favors risk-on assets, with technology and industrial sectors leading gains while defensive sectors like utilities and consumer staples lag behind. The presenter also touches on market breadth, noting that despite some talk of broadening, market gains are still concentrated in a few key stocks and sectors.

Overall, the outlook is cautiously optimistic with positive earnings results so far and favorable seasonal trends pointing to a potential year-end rally.

🔥 Market Highlights

- Big Tech Breakout: The “Fabulous 7” tech giants are leading the charge, with major indices like the S&P and NASDAQ hitting new highs. Passive ETF flows and short-term call options are fueling the rally.

Bloomberg Magnificent 7 Total Return Index

- Earnings Season Kicks Off: Strong earnings are coming in, with 85% of S&P companies beating expectations. EPS and sales surprises are averaging 6–7.6% above estimates.

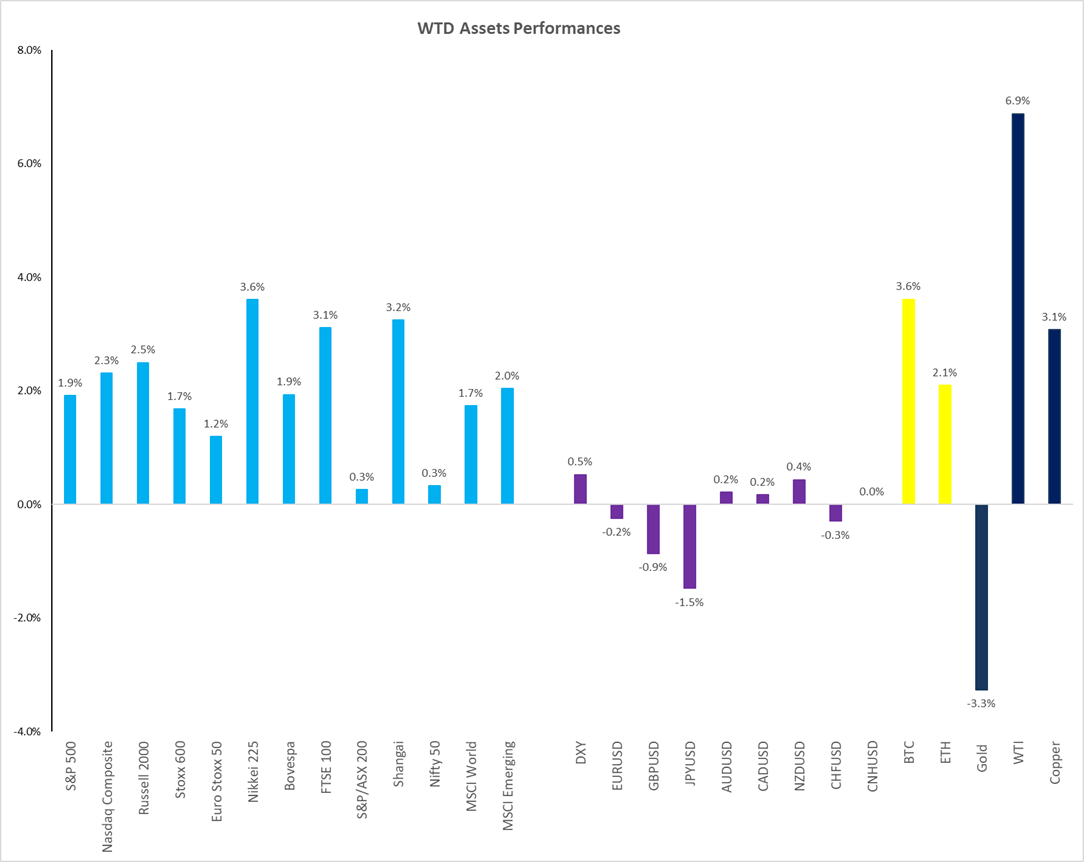

- Risk-On Sentiment: Utilities and consumer staples lagged, while tech and high-beta sectors surged. The S&P gained ~2%, and tech rose ~3%.

- Volatility Drops: The VIX fell from 25% back to 16%, signaling a return to calmer markets and supporting bullish momentum.

🪙 Crypto & Commodities

- Crypto Climbs: Ethereum and Bitcoin performed well in the risk-on environment.

- Gold Sell-Off: After peaking, gold and silver dropped over 5% early in the week, confirming a potential top flagged last episode.

- Oil Strength: WTI crude rose 7% amid geopolitical pressure on Russian exports.

📊 Macro & Rates

- Fed Outlook: A 25 bps rate cut is expected at the upcoming FOMC meeting, with another likely in December. Lower inflation perceptions are helping equities.

- CPI Update: Core CPI came in at 0.23% MoM vs. 0.3% expected. YoY remains at 3%, suggesting the “new normal” may be above the Fed’s 2% target.

🧭 What’s Ahead

🏛️ Central Banks:

- FOMC (Wednesday)

- ECB, Bank of Japan, Bank of Canada also in focus

💻 Big Tech Earnings:

- Wednesday: Meta, Microsoft, Alphabet

- Thursday: Amazon, Apple

- Tesla reported last week; Nvidia is coming soon.

🌍 Geopolitics:

- US-China Talks: High-level meetings in Malaysia could lead to a major deal. Markets are pricing in a “blue sky” scenario.

📅 Seasonality:

- Historical trends suggest a 3–5% S&P rally from now through year-end, supported by strong earnings and dovish central banks.

S&P 500 Seasonality – Source: GS.

If you’re serious about trading, consider joining the 4×4 video series https://duponttrading.com/4×4-course/ , mentoring sessions, or the Discord trading community.

If you’d like to join or explore our 30+ private trading channels for $74.99/month, now’s the time.

https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions