Big, Beautiful US Market

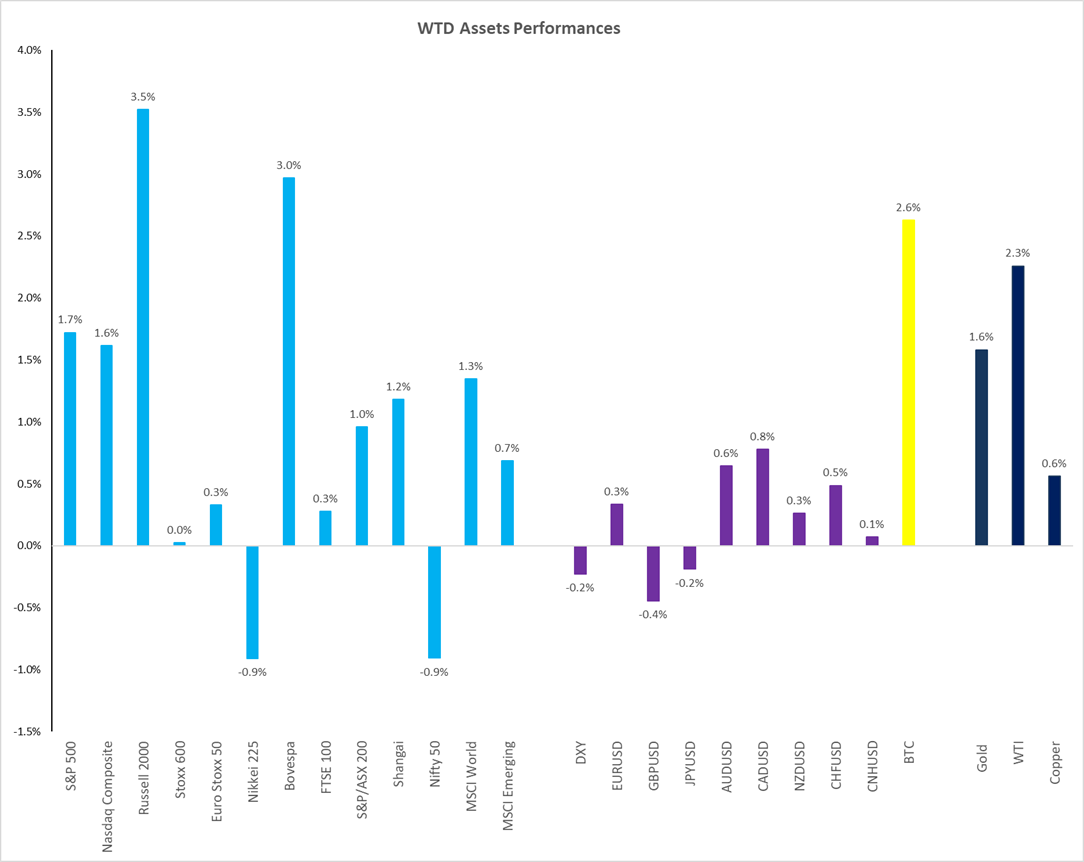

Despite a shortened trading week due to the July 4th holiday, US markets delivered strong performance, driven by a major bill passed in Congress. This legislation is expected to significantly boost GDP and earnings growth over the next four years. While it doesn’t address the growing US deficit—currently running at 6–7%—markets are choosing to focus on the short-term positives.

- S&P 500 & NASDAQ: Up ~1.6–1.7% for the week

- Russell 2000: Outperforming, thanks to its domestic focus and benefits from the new bill

- Banks: Leading the charge, with JP Morgan hitting new highs

🏦 Sector Highlights: Growth & Cyclicals Shine

- Top Performers: Regional banks, software, airlines, and materials (up 4%)

- Underperformers: Defensive sectors like telcos, utilities, and consumer staples

- JP Morgan: Continues to lead, supported by strong stress test results and regulatory tailwinds

📊 Macro & Market Dynamics

- US 10-Year Yield: Holding steady at 4.35%

- Fed Outlook:

- July rate cut odds: ~10%

- September cut odds: ~80%, pending CPI data mid-month

- Volatility:

- VIX at 17.5% (30-day), 12.8% (short-term)

- Low volume and seasonality keeping volatility in check

🔍 Technical Trends & Price Action

- S&P Futures: One-way traffic since the breakout

- Russell 2000: Strong move after breaking 2130 level

- Momentum Stocks: Brief reversal, likely due to pre-earnings profit-taking

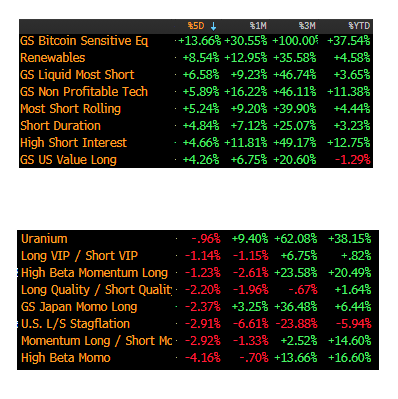

- “Dodgy” Stocks: High short interest and non-profitable techs seeing strong gains

🪙 Crypto Corner: Calm Before the Storm?

- Bitcoin: Trading sideways between $100K–$110K with low volatility

- Catalyst Ahead: July 22 deadline for the US Crypto Reserve Fund could spark major moves

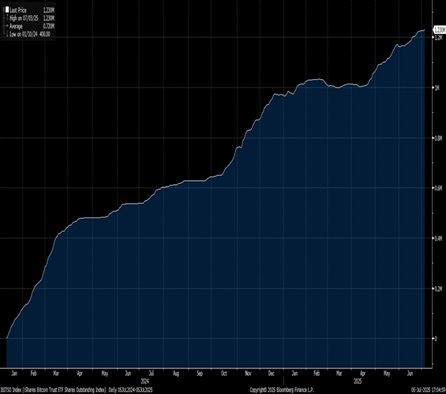

- IBIT ETF: Steady inflows as institutional exposure to Bitcoin increases

IBIT number of shares

🧠 Macro Watch: Fiscal Dominance in Focus

Governments globally are shifting bond issuance to short-term T-bills to manage deficits. While this reduces short-term costs, it raises long-term risks. The US, Europe, and Japan are all “kicking the can down the road,” enjoying growth now while deferring tough fiscal decisions.

📅 What’s Ahead

- Tariff Deadline: Tuesday – binary outcome, hard to price

- Bond Supply: More short-term issuance expected

- Earnings Season: Starts July 15 with JP Morgan

- CPI Data: Also due mid-July – a key macro trigger

💡 Final Thoughts

Markets remain in a bullish regime, supported by strong earnings, growth expectations, and low volatility. But under the surface, fiscal imbalances and shifting bond dynamics suggest caution is warranted in the long run.

Community and Mentoring

- Join Our Community: Our Discord community offers both free and advanced channels for in-depth discussions: https://discord.com/invite/Yf42SgAx7f

- For personalized mentoring, reach out soon as slots are filling up quickly.

Have a good Trading Week!

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

J. (United Kingdom)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions