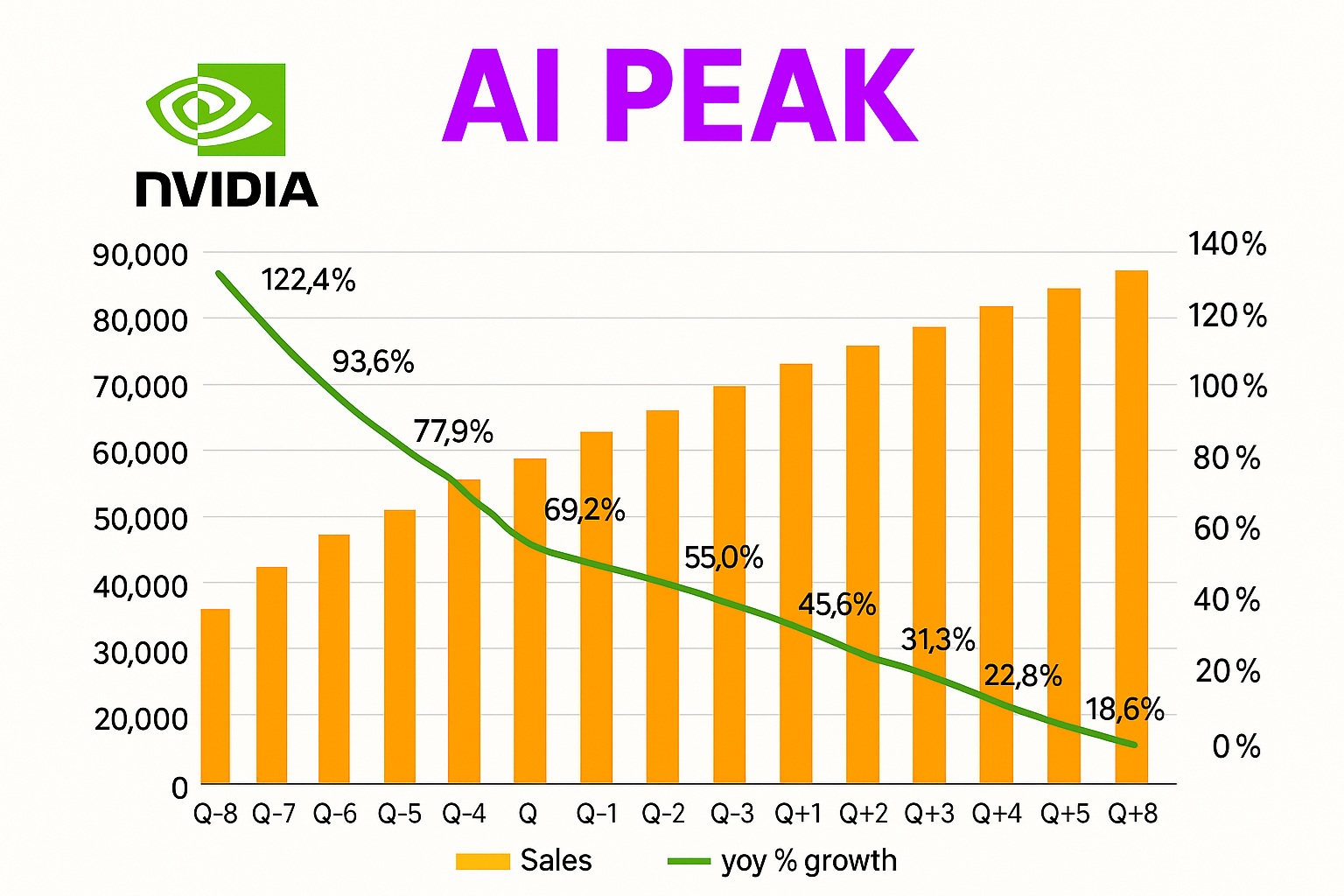

AI Peak

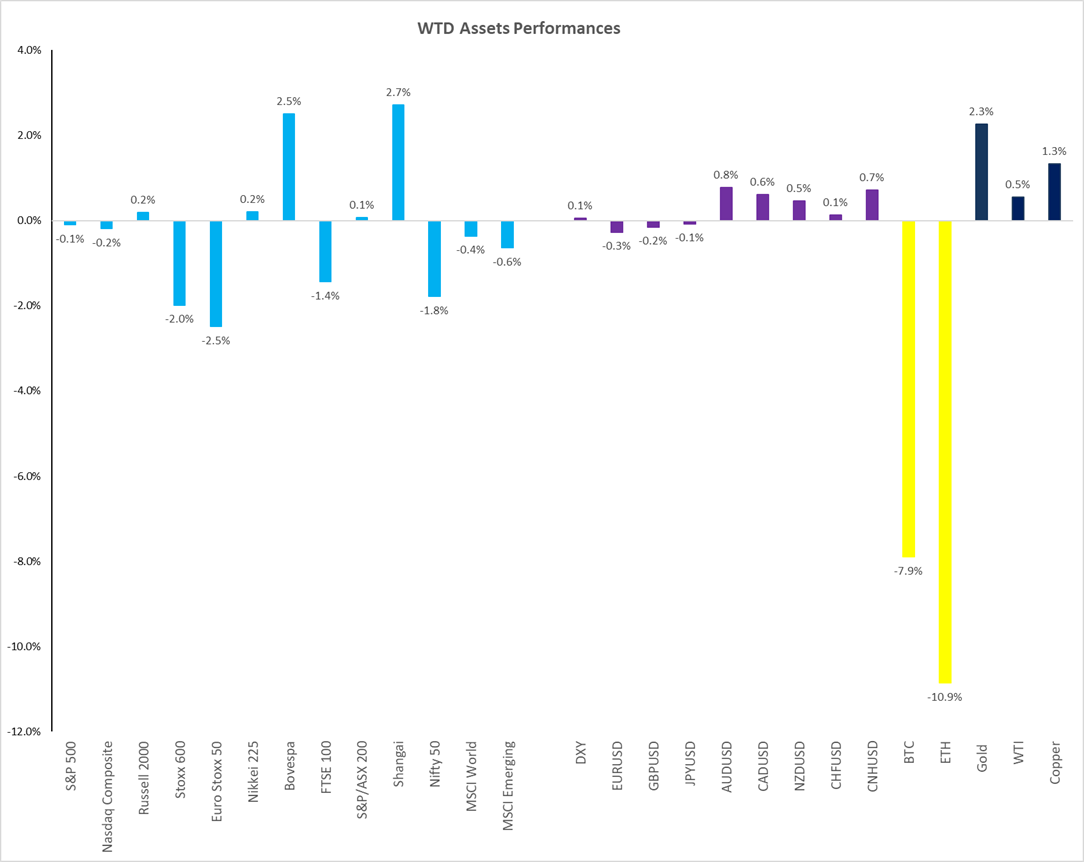

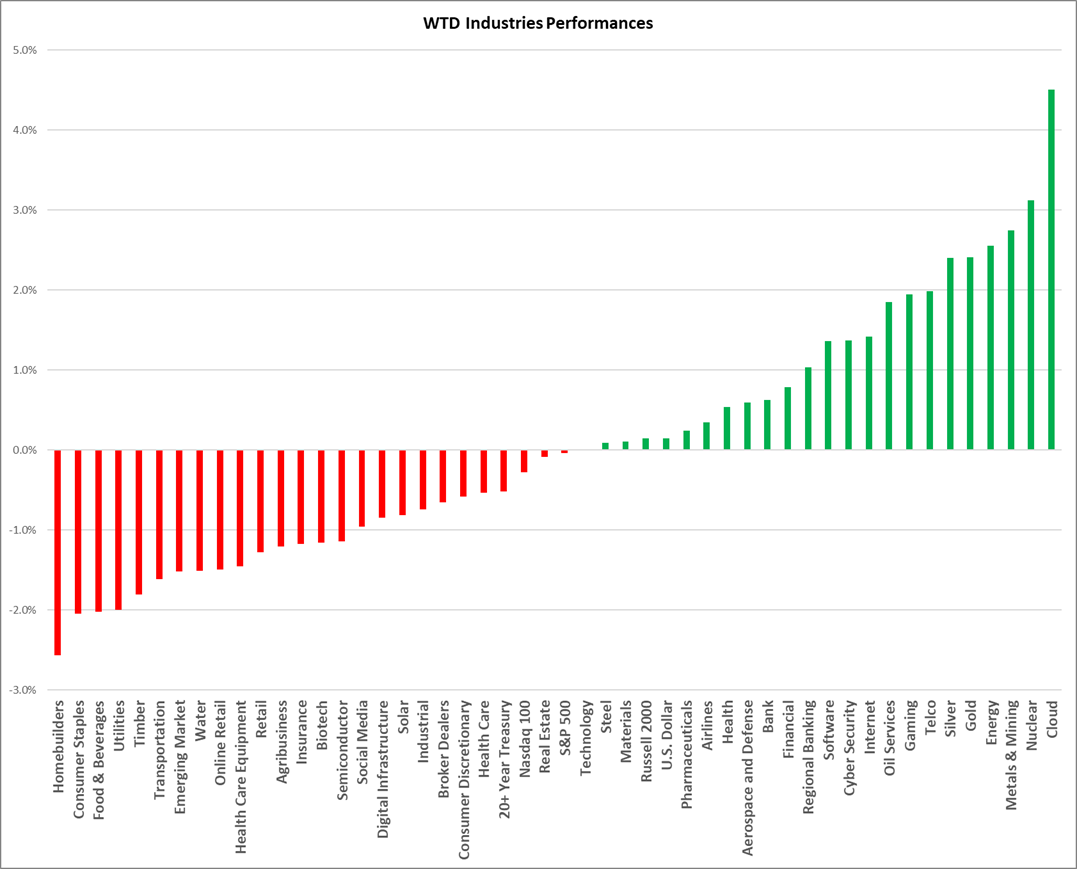

This edition provides a comprehensive market update at the end of August, highlighting key themes for September, including seasonality, macroeconomic factors, and geopolitical risks, particularly in Europe. The discussion centers on the recent Nvidia earnings as a proxy for the AI-driven growth infrastructure sector, revealing strong sales growth but notable deceleration and lack of future upgrades. The market experienced a mixed week, with flat performance in major U.S. indices and pressure on European markets due to social unrest in France. Defensive sectors faced headwinds, while energy and financials showed relative strength, though banking multiples face long-term skepticism due to economic uncertainties.

Yields on long-dated bonds rose globally, impacting rate-sensitive sectors like homebuilders and utilities. The Federal Reserve is widely expected to cut rates in September, reflecting a more dovish stance after recent inflation data showed persistent pressures. Volatility spiked towards the end of the month, driven by a rotation out of high-growth tech stocks like Nvidia and Dell.

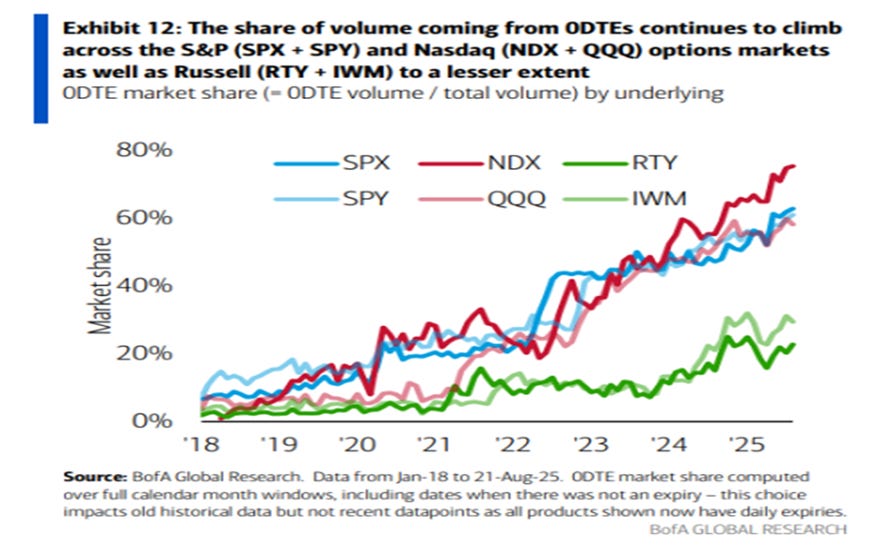

Currency and commodity markets showed some divergence: the Euro is under pressure due to European uncertainties, cryptocurrencies like Bitcoin and Ethereum declined, but gold exhibited a potential breakout after a consolidation phase. The episode also covers the peculiar rise of zero-day-to-expiry options trading, reflecting increased speculative activity. Looking ahead, key economic data including ISM manufacturing and services PMI, and labor market reports will be critical in shaping Fed policy and market direction. The French political landscape remains a risk factor with strikes potentially disrupting economic activity and increasing bond yield spreads versus Germany.

The episode concludes with a reminder of upcoming earnings and industry conferences, ongoing tariff legal challenges, and offers details about the host’s trading community and mentoring programs.

Highlights

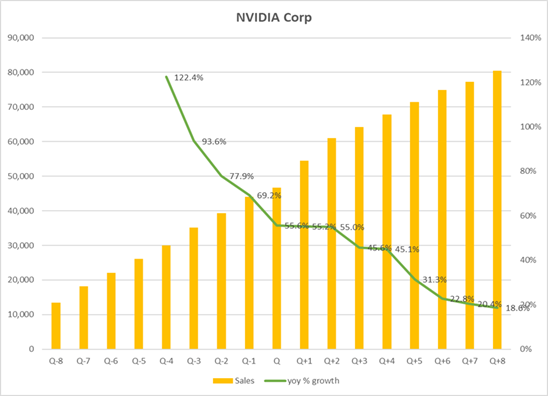

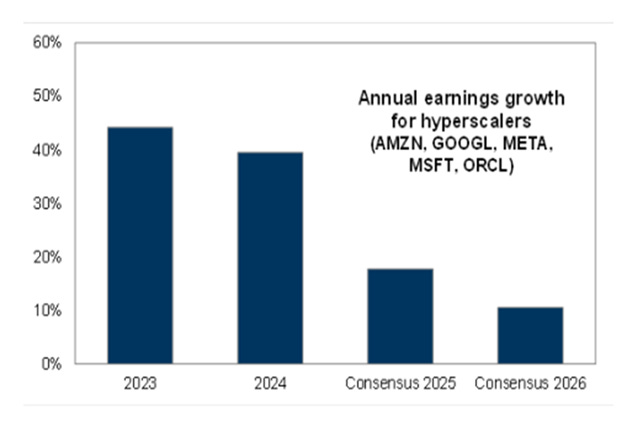

- 📈 Nvidia’s sales growth remains strong but is decelerating, signaling a shift from AI infrastructure growth to AI implementation.

- 🇫🇷 European markets face pressure amid French social unrest and potential strikes, impacting both equities and bond yields.

- 💹 Major U.S. indices were flat for the week with increased market volatility linked to rotation out of growth tech stocks.

- 🏦 Financials, especially banks, showed strength but face long-term challenges if economic growth slows.

- 🏠 Rising long-term yields pressured rate-sensitive sectors like homebuilders and utilities.

- 🪙 Cryptocurrencies declined sharply, whereas gold is showing signs of a significant breakout.

- 📊 Increased trading volume in zero-day-to-expiry options highlights growing retail and speculative activity.

Key Insights

- 📉 Deceleration in AI Growth Stocks: Nvidia’s recent earnings demonstrated an impressive expansion in sales from $10 billion to an expected $80 billion in two years. However, the growth rate is slowing from 120%+ to under 20%. This deceleration and lack of analyst upgrades suggest the AI infrastructure boom is maturing, shifting investor focus to companies that will implement AI technologies rather than build the infrastructure. This signals a transition phase in the technology sector, requiring investors to adapt their strategies accordingly.

- 🇪🇺 European Market Vulnerability Amid French Unrest: France’s long-standing pattern of social strikes is resurfacing this September, threatening to disrupt economic activity and increase uncertainty. The pressure on French government bonds (OATs) versus German bunds indicates rising risk premia, which weighs on both fixed income and equity markets in Europe. This instability ahead of the 2027 presidential election may lead to prolonged volatility and outflows from French equities, particularly financials like BNP and Société Générale.

- 📉 Flat U.S. Equity Markets and Sector Rotation: Despite strong earnings from some large-cap tech names, the S&P 500, NASDAQ, and Russell 2000 were flat for the week, reflecting a cautious market stance. Defensive sectors such as utilities and consumer staples underperformed, while energy and financials were among the few winners. The rotation highlights investors’ concerns about slowing growth and margin compression, particularly in tech and consumer discretionary sectors.

- 📈 Impact of Rising Long-Term Yields: The increase in 30-year yields in the US, Europe, and Japan is pressuring rate-sensitive sectors like homebuilders and utilities, which typically rely on low borrowing costs. This upward move in yields is partially driven by political pressures on the Federal Reserve and global inflation dynamics, suggesting that bond market risk premiums are rising. This environment challenges sectors dependent on cheap capital and signals a cautious economic outlook.

- 💰 Gold as a Safe-Haven Asset: While cryptocurrencies such as Bitcoin and Ethereum fell by 8-10% during the week, gold showed signs of a breakout after consolidating for several months. Gold’s performance underscores its enduring role as a traditional safe-haven asset amid global uncertainty and inflation concerns. Investors may increasingly turn to gold as a portfolio hedge as volatility and risk premiums rise.

- 📉 Fed’s Shift Toward a More Dovish Policy: Market expectations are pricing an 80-90% chance of a Fed rate cut in September, a significant shift since the July FOMC meeting. Inflation, measured by the Personal Consumption Expenditures (PCE) index, remains elevated at 2.9%, above the Fed’s 2% target. However, the Fed appears to accept a higher “new normal” inflation level around 3%, indicating a more flexible approach. This dovish tilt aims to support economic growth but may also fuel further market volatility as investors digest mixed signals.

- 🕒 Rise of Zero-Day-to-Expire Options Trading: The episode highlights a striking increase in the volume of zero-day-to-expiry options, particularly on the NASDAQ, accounting for 70-80% of options volume. This trend reflects heightened speculative trading and short-term positioning by retail investors and hedge funds alike. While these instruments offer opportunities for quick gains, they also increase market volatility and risk, underscoring the need for disciplined risk management.

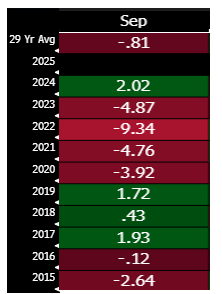

- 🔮 Seasonality and Upcoming Macroeconomic Catalysts: September historically shows poor seasonality for the S&P 500, averaging an 80 basis points decline over 29 years, with the last decade marked predominantly by negative returns. Key upcoming data releases including ISM manufacturing and services PMI, ADP employment, and Nonfarm Payrolls will be critical in shaping market sentiment and Fed policy. Weak job creation may push the Fed toward easing, while stronger data could stall rate cuts, making September a pivotal month for markets.

- 🏢 Market Expectation of AI Phase Transition: The episode stresses the market’s evolving narrative from AI infrastructure leaders like Nvidia to companies focused on AI applications and software development. As the initial surge in hyperscaler earnings growth slows, investors must identify firms that will capitalize on AI integration, creating new products and services. This phase demands more selective investment approaches as competitive pressures and margin squeezes increase in the software sector.

Source: Goldman Sachs

- 🇺🇸 Political Influence on Fed Independence and Market Perception: The Trump administration’s attempts to influence Fed leadership, such as efforts to replace board member Cook, have unsettled markets. Investors globally interpret Fed independence as crucial for stability; any perceived political interference increases risk premiums on long-dated bonds, raising borrowing costs and dampening investor confidence. This dynamic adds a layer of political risk to an already complex macroeconomic environment.

- 🔄 Market Rotation and Volatility Dynamics: The sell-off in major tech names like Nvidia, Dell, and Marvel Technology during the week triggered a rotation away from high-growth stocks, reflecting concerns over margin compression and slowing growth. This shift, combined with end-of-month rebalancing and seasonality effects, led to increased volatility, emphasizing the market’s cautious stance as investors adjust portfolios ahead of potentially choppier September trading.

📚 Back-to-School Learning

Our 4×4 educational video series is available, plus limited spaces in the mentoring program for the next 3–6 months (especially US & Asia time zones).

If you’d like to join or explore our 30+ private trading channels, now’s the time.

https://discord.com/invite/Yf42SgAx7f

https://buy.stripe.com/5kA3dmdVV1g4cuIaEE

For any questions or to join our mentoring sessions, email us at

Greg📩 Contact: greg@duponttrading.com

Have a good Trading Week!

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

S. (Malaysia)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions